The Match Out: Recession fears send the market lower, OZL green lights new project. Go the Swans!

The rout in the ASX resumed today after yesterday’s holiday. Weakness in risk assets came on the back of rate hikes from the US Fed (+75bps) and the BOE (+50bps), while the FOMC Chairman also warned of a recession. Today the market was concerned with a hit to earnings expectations and the higher discount rate that comes with a hawkish Fed. Materials held up in the face of the selling as iron ore found some support thanks to improving construction activity in China and the hope for further stimulus here.

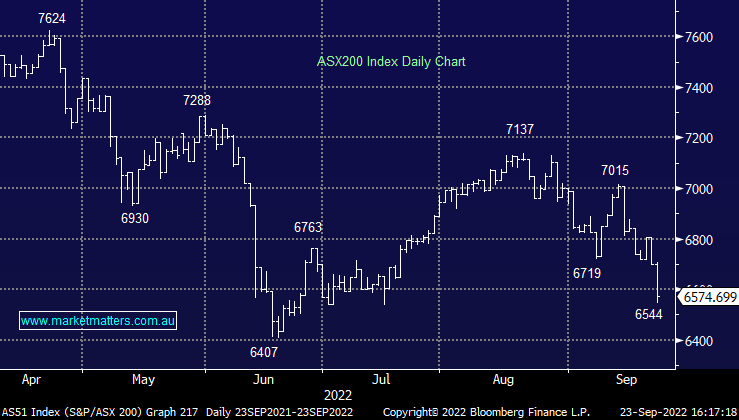

- The ASX 200 finished down -125pts/ -1.87% at 6574

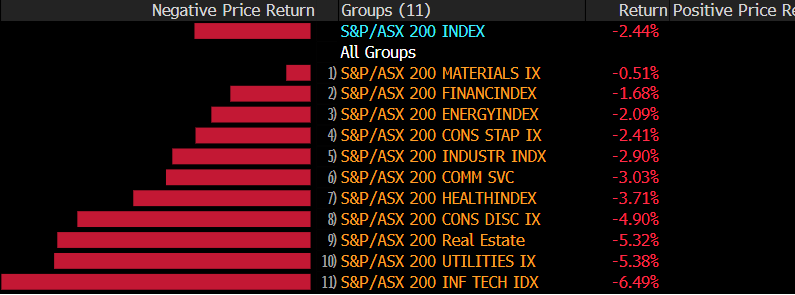

- Materials (-0.49%) were by far the best sector to be today, though still in the red to the end of the week.

- No surprises that the two sectors most concerned with a recession and higher rates were the hardest hit today. Consumer Discretionary and Tech both fell -4.44%.

- The index struggled for the second consecutive week, falling -164pts/-2.44% today, a similar move to what was experienced last week.

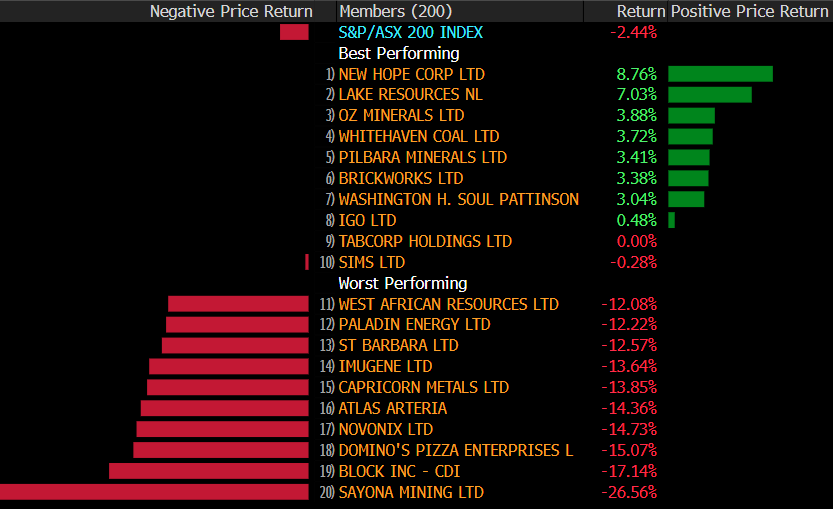

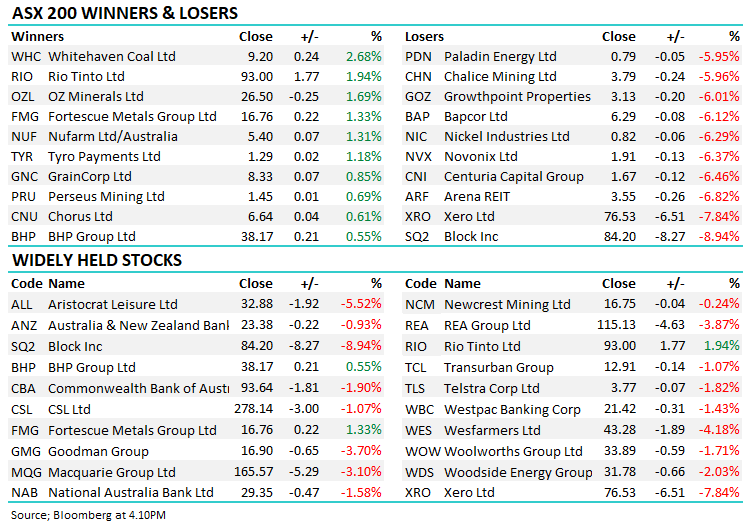

- Oz Minerals (ASX: OZL) +1.69%, the copper miner rallied today after announcing approval for the final investment decision at West Musgrave was successful. The $1.7b nickel & copper development has all the key approvals and licences in place to progress now. No update on the bid from BHP yet.

- Link (ASX: LNK) halt, didn’t trade today as they await news on the Dye & Durham bid with a court battle in the UK potentially skittling the deal.

- Coal stocks held up in the face of the selling. News that a major Canadian producer is limiting production creating further tightness in supply.

- Iron Ore was ~2% higher in Asia today, with the big three miners all in the green.

- Gold was flat today, currently trading around US$1672. Gold stocks were mostly lower despite the precious metal holding up

- Asian stocks were weaker today, Japan’s Nikkei holding up the best, though still falling -0.58%, Hong Kong down -0.80%

- US Futures are mixed. S&P500 flat, Dow Futures around -0.15% and the Nasdaq futures -0.1%

ASX200 Chart

Sectors this week

Stocks this week

Broker Moves

- Bendigo & Adelaide Raised to Reduce at CLSA; PT A$8.60

- Link Administration Cut to Equal-Weight at Morgan Stanley

Major Movers Today

Have a great night

The Market Matters Team

Make informed investment decisions

At Market Matters, we write a straight-talking, concise, twice daily note about our experiences, the stocks we like, the stocks we don’t, the themes that you should be across and the risks as we see them. Click here for your free trial.

The Match Out will be available each day after the market close. Follow my profile to be notified when the latest report is live.

1 topic

2 stocks mentioned