The Match Out: Spirited fightback despite bank weakness, NAB hurt by ‘intense’ competition

The market opened sharply lower this morning before a spirited ~50pt fightback that saw 75% of the main board actually finish up on the day. Banks dominated following a weaker than expected 1H23 result from NAB (ASX: NAB) which threw the cat amongst the pigeons, weakness in the big 4 taking 44pts off the ASX200 ahead of ANZ (ASX: ANZ) & Macquarie (ASX: MQG) reporting tomorrow, while Westpac (ASX: WBC) is out on Monday.

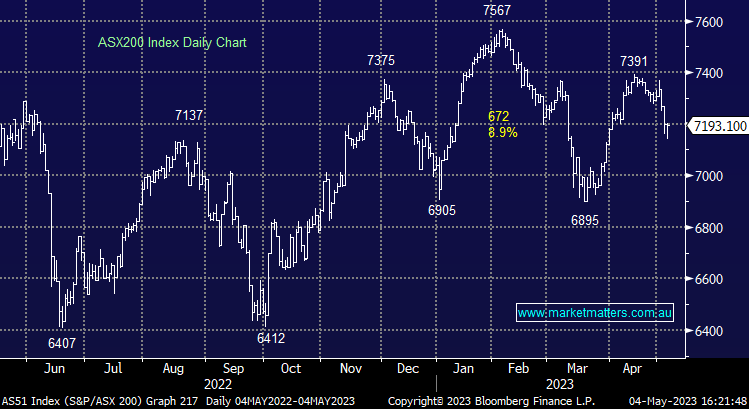

- The ASX 200 finished down -4pts/ -0.06% at 7193

- The property sector was best on ground (+1.98%) while Materials (+1.24%) & IT (+1.24%) were also strong.

- Financials (-2.52%) the clear drag while some profit taking filtered through the Consumer Staples (-0.05%)

- ANZ -2.37% was the relative outperformer in the sector while NAB was hit -6.41%, Com Bank (CBA) -2.57% & Westpac -4.11% rounded out a tough day.

- NAB was down -8.2% at the lows this morning, the most since March 2020 - Competition is hitting margins which are past their peak – we cover the NAB result below.

- The Macquarie conference wrapped up today with a couple of late landmines, Super Retail (ASX: SUL) -7.14% pushed through a trading update late yesterday before presenting today. They said the macro environment remains challenging and inflation continues to bite.

- St Barbara (ASX: SBM) +7.03% announced Silver Lake (ASX: SLR) -2.02% has also entered the fray with a higher offer for their Leonora assets. Silver Lake’s deal looks to be a ~10% improvement on the original offer from Genesis (GMD) -4.8% after break fees are paid. Two buyers are always better than 1.

- The broader gold sector was solid, although Evolution Mining (ASX: EVN) was a standout putting on +7.2%.

- Jumbo Interactive (ASX: JIN) +5.15% Rallied on positive cost controls.

- Ramsay Healthcare (ASX: RHC) -2.23% down again as Goldman cut it to a SELL and $54 price target.

- They also took the knife to Mineral Resources (ASX: MIN), saying SELL and $53 price target. On a brighter note, they upgraded BHP (ASX: BHP) to BUY

- AGL Energy (ASX: AGL) +3.15% is now knocking on the door of 12-month highs at $8.85 – looks good.

- James Gerrish & Harry Watt cover Portfolio Performance for April, along with the NAB result in todays video update - Here

- Iron Ore was flat in Asia today while Fortescue (ASX: FMG) +1.45% & RIO (ASX: RIO) +1.26% traded higher

- Gold was up overnight to ~US$2040 before sideways in Asia

- Asian stocks were mostly higher as China came back online, Hong Kong +0.97%, Japan -1.37% while China was up +0.81%

- US Futures are flat

ASX 200

Portfolio Performance for April

Against the ASX 200 which advanced 1.85% in April, the Market Matters Portfolios generally performed well, with the Flagship Growth Portfolio +3.33%, the Active Income Portfolio +1.88%, Emerging Companies +2.33% & International Equities +4.33%. Portfolio Managers James Gerrish & Watt Watt discuss performance, along with the 1H result from NAB.

&ab_channel=MarketMatters

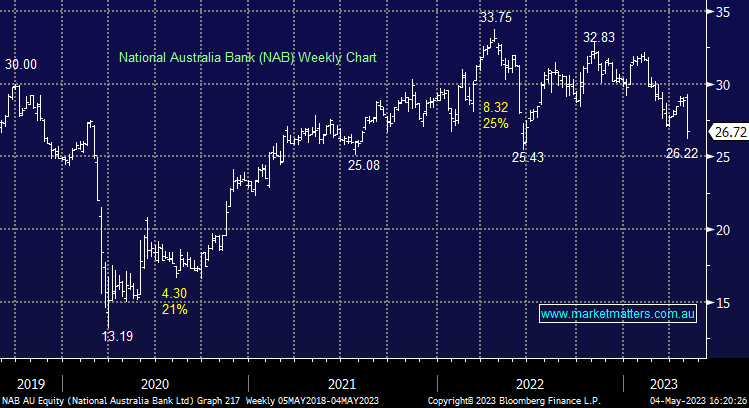

National Australia Bank (NAB) $26.72

NAB -6.41%: While we thought the stock would trade lower, we were surprised at the level of weakness given the composition of the underlying 1H23 result that was a record in terms of earnings, but showed a soft underbelly in terms of margins which will likely impact the 2H.

1H23 Cash earnings of $4.07 billion were up 17% however that compared to $4.18 billion expected (-2.6% miss) thanks to a NIM of 1.77% versus 1.83% expected. Cash Diluted EPS from continuing operations was 124.3c/share while the Interim dividend of 83cps fully franked was below the 86cps expected (some were even higher).

While margins are expanding (+0.14%) due to higher interest rates, some of the benefit is being eroded by competition for mortgages and deposits, importantly, it seems margins peaked in December at 1.79% and have tracked lower since, with the 2Q exit margin at 1.76%.

As CEO Ross McEwan said today, “It’s very difficult in the mortgage market at the moment, very, very competitive, margins getting knocked around there.” Asset quality and capital levels remain very strong, NAB saying that 90-day arrears reduced by 0.9% to just 0.66% driven by improvement in home lending, although they did say arrears in their business lending had increased. Expect earnings downgrades to flow here, with the 2H more challenging than the first, declining margins and an uptick in delinquencies a poor combo!

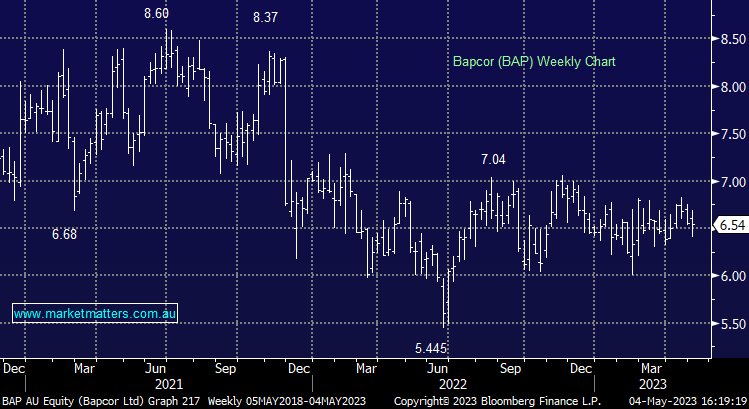

Bapcor (BAP) $6.54

BAP +0.62%: it was the vehicle parts business’ turn to front the market at the Macquarie Conference today with the presentation largely a ‘staying the course’ affair. The company reiterated the FY guidance from earlier in the year, looking for a slight improvement in the second half. They talked to the continued de-stocking of inventory, robust Trade & Wholesale markets and a swift rebound in the NZ business following the natural disasters.

Bapcor did note a slowdown in retail which has weighed on margins in that segment, but improved performance elsewhere has offset the impact. The medium-term outlook remains supportive as they look to reduce the underlying cost base while positioning themselves to benefit from the shift to EVs. We like Bapcor, with today’s update showing all is on track and in line with expectations.

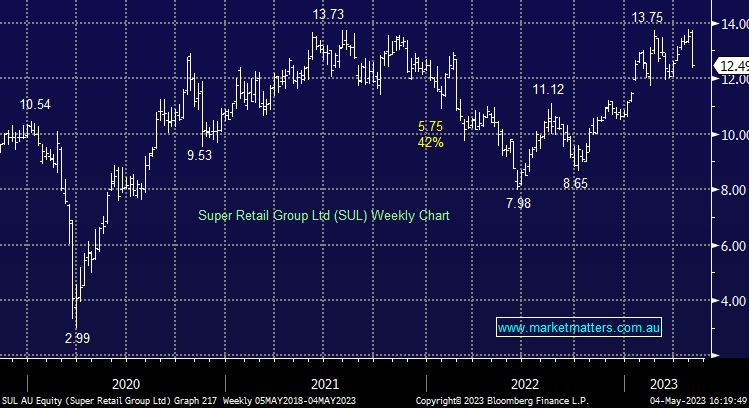

Super Retail Group (SUL) $12.49

SUL -7.14%: the retailer slipped to 5-week lows today following a trading update last night ahead of their Macquarie Conference presentation. Sales growth was strong, though it has moderated across most brands since the previous update ~10 weeks ago. Like-for-like group sales for the first 43 weeks was +9%, where that number was +10% at the prior update with Super Cheap, Rebel and Macpac all showing moderating growth while BCF was marginally higher.

In addition, the company said 2H margins were tracking marginally below 1H with labour, energy and rent costs higher, though freight has moderated. Super Retail is facing a consumer market with a number of cost headwinds, while they also noted peers have been heavily discounting to gain market share, particularly impacting the BCF brand.

Broker Moves

- Super Retail Cut to Underweight at Jarden Securities; PT A$12.10

- Amcor GDRs Raised to Neutral at Jarden Securities; PT A$15.45

- Ramsay Health Cut to Market-Weight at Wilsons; PT A$65.88

- PolyNovo Cut to Underweight at Wilsons; PT 89 Australian cents

- Nanosonics Cut to Hold at Morgans Financial Limited; PT A$5.24

- PWR Holdings Rated New Underperform at Barclay Pearce Capital

- De Grey Mining Rated New Overweight at Barrenjoey; PT A$2

- oOh!media Cut to Neutral at Goldman; PT A$1.30

- Ramsay Health Cut to Sell at Goldman; PT A$54

- Ramsay Health Raised to Accumulate at CLSA; PT A$67

- Amcor GDRs Raised to Hold at Jefferies; PT A$14

- Amcor GDRs Raised to Overweight at JPMorgan; PT A$16.30

- BHP Raised to Buy at Goldman

- Flight Centre Cut to Underperform at Jefferies; PT A$18

- Flight Centre Raised to Add at Morgans Financial Limited

- Mineral Resources Cut to Sell at Goldman; PT A$53

- Develop Global Ltd Rated New Buy at Bell Potter; PT A$4.20

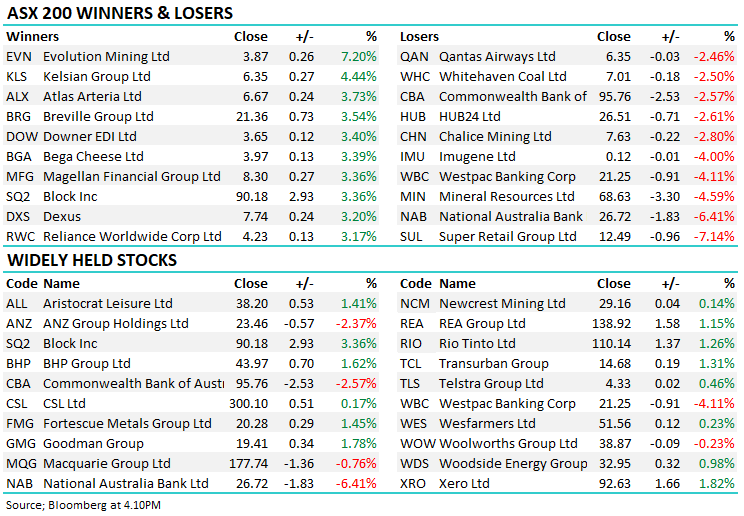

Major Movers Today

Make informed investment decisions

At Market Matters, we write a straight-talking, concise, twice daily note about our experiences, the stocks we like, the stocks we don’t, the themes that you should be across and the risks as we see them. Click here for your free trial.

The Match Out will be available each day after the market close. Follow my profile to be notified when the latest report is live.

2 topics

15 stocks mentioned