The Match Out: Stocks bounce 4.5% in November as interest rates peak

The trend for the week was broken today with the market down early before rallying ~60 points as it squeezed up into month end with an MSCI Index rebalance thrown into the mix as well – the market is starting to get that ‘Christmas squeeze’ vibe about it, the ASX 200 up 4.52% for the month of November, recouping a large proportion of the declines from the September / October, the net result is a total return of -1.4% for the tumultuous period.

- The ASX 200 finished up +51pts/+0.74% at 7087

- The Industrial sector was best on ground (+1.43%) while IT (+1.29%) & Financials (+1.24%) outpaced the market's gain.

- Utilities (-0.95%) and Energy (-0.26%) the only two sectors to finish lower.

- Utilities weighed down by Origin (ASX: ORG) -1.9% after they rejected Brookfields revised offer while AGL Energy (ASX: AGL) lost -2.68% capping off a tough month.

- Activity in China’s manufacturing and services sectors shrank in November, which fuels expectations for more stimulus.

- All the major banks we up. Commonwealth Bank (ASX: CBA) +1.29% the best of them as loan growth kicked back in.

- Uranium was on the nose, Paladin (ASX: PDN) -2.99% followed weakness overnight – couldn’t see much out on this so suspect ETF flows perhaps, they have a big bearing on the stocks.

- Iress (ASX: IRE) +14.87% rallied on an upgrade to guidance – more on this below

- Healthcare stocks a standout during November (+11%) after a tough year – Resmed (ASX: RMD) +2.27% today looking a lot better, now up ~15% from the lows. Ramsay (ASX: RHC) the one getting left behind.

- Ditto for Property stocks as recent investor surveys show more appetite to wade back in to Real-Estate – Centuria Capital (ASX: CNI) +28% for the month.

- The BNPL stocks in the US have really started to rock and roll – Block (SQ2), the old Afterpay was up +58% for the month!

- Iron Ore was marginally higher in Asia, +0.34% at $US134.70

- Gold edged was flat during our time zone today, trading at US$2044 at our close.

- Asian stocks were solid, Hong Kong +0.40%, Japan +0.40% while China added 0.34%.

- US Futures are up around 0.20%.

- Snowflake (SNOW US) reported quarterly results after the bell overnight, guiding to revenue growth of 30% (~$721m), which was ahead of expectations. More on this tomorrow – we hold in the International Equities Portfolio, with the stock +7% after hours. 32 buys, 14 holds and 1 sell from analysts.

ASX 200 index

IRESS (IRE) $7.03

IRE +14.87%: the market data platform upgraded guidance today which saw the stock hit 3-month highs. After a poor 1H result in August on slowing revenue growth and higher costs, the company went back to the drawing board with strategies to improve performance. Early signs show a vast improvement in the business as a result with Revenue expected to grow 2.6% in the 2H, costs falling on lower headcount and customer sentiment improving. Given the early success of the turnaround, IRESS upgraded FY23 EBITDA guidance by 4.5% to $123-158m, ~15% above consensus, and FY24 guidance was upgraded by 8.5% to $135-145m.

Sectors in November (Source: Bloomberg)

Stocks in November (Source: Bloomberg)

Broker moves

- CBO AU: Cobram Estate Rated New Buy at Shaw and Partners; PT A$1.75

- CLG AU: Close The Loop Reinstated Buy at Shaw and Partners

- CXO AU: Core Lithium Cut to Sell at Citi; PT 29 Australian cents

- IKE NZ: ikeGPS Group Cut to Speculative Hold at Bell Potter; PT NZ$0.68

- MRM AU: MMA Offshore Reinstated Buy at Shaw and Partners; PT A$2.30

- TPW AU: Temple & Webster Cut to Neutral at Citi; PT A$7.40

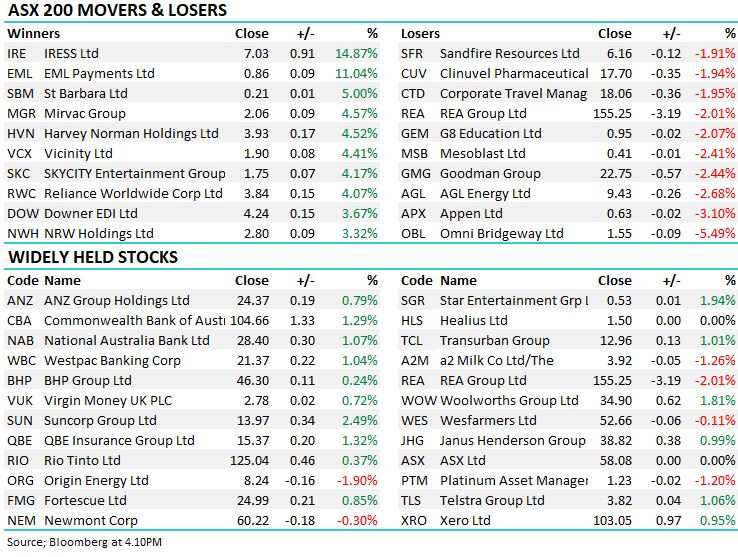

Major movers today

Enjoy the night,

The Market Matters team.

2 topics

8 stocks mentioned