The Match Out: Stocks down, ASX now ~8% below July highs

Another sell-off today with the ASX hitting the lowest close in 11-months, although the selling is fairly anaemic in nature and on very light holidays volumes, but still, the direction of least resistance has clearly been down since the ASX 200 peaked at the end of July at 7472, now down ~600pts/8% from that milestone, back at the very bottom of its 12-month trading range.

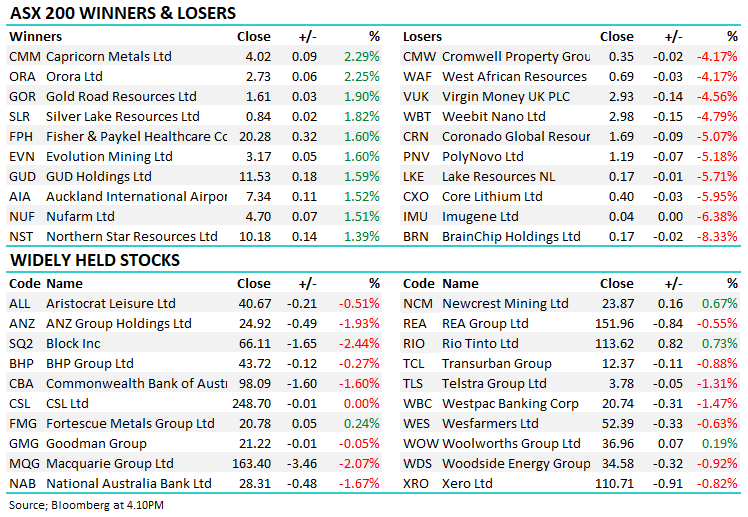

- The ASX 200 finished down -53pts/ -0.77% to 6890 with a lack of interest right across the market.

- The Utilities sector was best on ground (+0.34%) and the only sector to make gains, while Staples (-0.14%) and Healthcare (-0.20%) did better than the soft market.

- Financials (-1.54%), Communications (-1.10%) and Energy (-1.06%) the weakest links

- Bond yields continued to rise sharply overnight on stronger US data, the JOLTs Job Openings jumped to 9.61m up ~700k in the month and a reversal of the trend after 3 month’s of declines, keeping the door ajar for another rate hike, the market now pricing a 50/50 probability at the November meeting.

- We have US ISM Services PMI out tonight which is expected to contract to 53.6 from 54.5, though a higher than expected print wouldn’t surprise given the recent trend of data coming in hotter than tipped.

- Orora (ASX: ORA) +2.25% ticked another box in their acquisition of European high end bottle manufacturer Saverglass with the French works council signing off. They expect the deal to be completed this quarter – we like ORA but have remained patient while this deal plays out.

- TPG Telecom (ASX: TPG) -2.23% are still in discussions with Vocus (ASX: VOC) for the sale of TPG’s Enterprise, Government and Wholesale business and fixed infrastructure. The deal had expired, but both parties still appear keen to see something happen.

- Banks were hit today, ANZ the worst of them off -1.93%, CBA (ASX: CBA) -1.6%, NAB (ASX: NAB) -1.67% & WBC (ASX: WBC) 1.47% - we wrote a quick piece on the banks this morning (here) providing our take & current portfolio positioning in the sector.

- Qantas (ASX: QAN) -1.79% chalked up a new cycle low below $5 and is now down almost 30% from its recent high – not a pretty picture for QAN as Chairman Richard Goyder tracks around the country meeting investors.

- Mineral Resources (ASX: MIN) -1.28% down after finalising a $US1.1bn debt offer.

- Lithium stocks more generally were down but look like they’re finding a base, Pilbara (ASX: PLS) ~$4 is looking interesting to us, the same for IGO (ASX: IGO) ~$12.

- Takeover target Liontown Resources (ASX: LTR) +0.7% edged higher as Gina increased her stake +2% to 14.7%

- Cattle prices hit a new 9-year low as farmers continue to de-stock ahead of a likely dry spell, the Ag stocks remains a hard place to invest, Elders (ASX: ELD) -0.72% to $5.51, a new 4-year low today. We took a loss on ELD in August at $6.47, which feels better today!

- Not much happening on the Iron Ore market with China still closed for Golden Week, Fortescue (ASX: FMG) +0.24% was a rare winner.

- Gold has been on the nose thanks to $US strength, the Dollar Index staying supported above 107 with gold now at US$1818/oz.

- A few bargain hunters around in Gold stocks following their Canadian peers higher, Evolution (ASX: EVN) +1.6% & Northern Star (ASX: NST) +1.39%.

- Asian stocks were lower, Hong Kong off -1.38% & Japan fell -2.24%.

- US Futures are lower, down around -0.5%.

ASX 200 chart - intraday

.png)

ASX 200 chart - weekly

.png)

Quarterly Letter for Financial Advisers

We write a complimentary letter used by the growing number of Financial Advisers subscribing to our service, simply to help them better communicate with their clients. Over the years we’ve found that communicating directly, regularly and in an engaging way goes a long way to building trusted and enduring relationships, whatever the market conditions are dishing up. It’s this level of communication, transparency and engagement that we have built our business on, and we’re now offering that to other financial professionals. So, get on the front foot and engage regularly, whether that’s utilising the new Market Matters White labelled Quarterly or not!

If you’re Financial Adviser and would like to register for a complimentary 12 month trial, click here.

Broker moves

- AMA Group Raised to Buy at Canaccord; PT 14 Australian cents

- Bank of Queensland Cut to Underweight at JPMorgan; PT A$5.30

- IPH Raised to Buy at Goldman; PT A$8.75

Major movers today

.png)

Enjoy the night

The Market Matters Team

Make informed investment decisions

At Market Matters, we write a straight-talking, concise, twice daily note about our experiences, the stocks we like, the stocks we don’t, the themes that you should be across and the risks as we see them. Click here for your free trial.

The Match Out will be available each day after the market close. Follow my profile to be notified when the latest report is live

1 topic

15 stocks mentioned