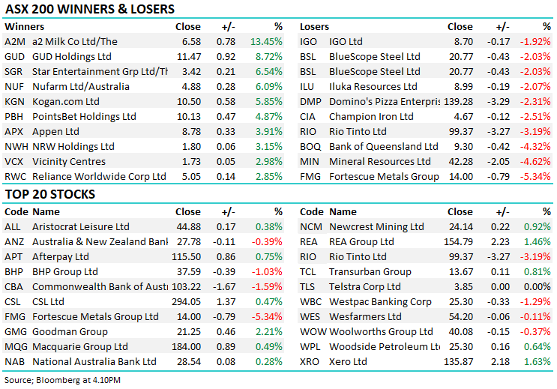

The Match Out: Stocks drift lower for the third session in a row, real estate rallies, A2 Milk soars 13%

It was another session that closed in the red for the ASX, the third straight decline, but again it was more about the influence of the sectors that fell. Given financials and materials – which account for around 40% of the market – ended down, it was actually positive to see the market off only 8 points. This implies that a greater volume of stocks finished the session in the green. As we’ve been writing in recent notes, the market is taking a plethora of bad news largely in its stride. And a market that holds up in the face of negative news flow generally has underlying strength.

- The ASX 200 fell -8pts /-0.11% to 7,272 today.

- Real estate stocks were strong (+1.54%) while weakness in Iron Ore weighed on the materials.

- Westpac’s consumer confidence survey was out today, showing Australian consumers who intend to get vaccinated are far more optimistic than those who don’t intend to have a jab. The overall consumer sentiment index slid 1.5% from last month to 104.6, a result of lockdowns in Sydney and Melbourne.

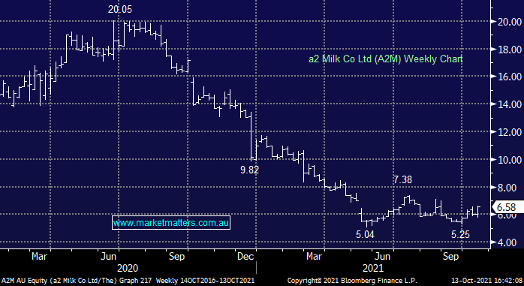

- A2 Milk (ASX: A2M) +13.45% today on a positive read from formula company Bubs Australia (ASX: BUB) sighting resurging strength in the daigou channel – more on this below.

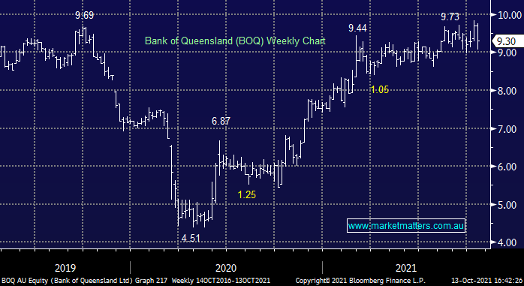

- Bank of Queensland (ASX: BOQ) -4.32% following their FY21 result, rising costs the main issue.

- Uranium stocks rallied today with Paladin (ASX: PDN) +18% on higher yellowcake prices. Interestingly, Uranium-related ETFs attracted more than $1 billion so far this year with the Global X Uranium ETF that we covered in the AM note today taking up about half of the total. We remain bullish and long PDN.

- Pointsbet Holdings (ASX: PBH) +4.87% rallies after securing an exclusive partnership with Curling Canada.

- GUD Holdings (ASX: GUD) +8.72% today on a broker upgrade.

- In this week’s Market Matters Video Update, I try my best to explain our thinking between value versus growth, not with the clarity that I had hoped for, but you may find it useful – Click here to view

- Gold was up around US$8.00 in Asia today to US$1,762.

- Iron Ore Futures were down -4.5% in Asia.

- Asian markets were all higher today – China +1.3%, Hong Kong +0.23% and Japan +0.42%.

- US Futures are trading down around 0.20%.

ASX 200 chart

A2 Milk (ASX: A2M) $6.58

A2M 13.45%: The stock caught a bid today, thanks to a strong sales read through from Bubs (ASX: BUB). The infant formula company saw sales almost double in the first quarter with a strong 156% jump in sales to China compared to the first quarter of 2021. Sales into daigou channels were particularly strong, a market that has troubled A2 Milk recently, in a sign the Australian milk products are regaining traction with the Chinese consumer. Bubs noted that COVID challenges were largely behind them and supply chains were starting to open up again. A2 Milk was the strongest performer in the ASX200 on the back of the news.

MM remains bullish and long A2M.

A2 Milk (ASX: A2M)

Bank of QLD (ASX: BOQ) $9.30

BOQ +0.08%: Shares in the regional lender fell today, despite the company producing cash earnings for FY21 that were 3% above consensus at $412 million, while its final dividend of 22 cents a share brought its fiscal year payout ratio to the lower end of its target 60-70% range. But the obvious cost pressures gaining more than expected was key to today’s result, with these putting downward pressure on net interest margins (NIM) which are now expected to decline by between 5 and 7 basis points. BOQ management says expenses will grow by 3% on an underlying basis to support business growth, which was unexpected by the market. In MM’s view, this is yet another result that tells us regional banks must consider consolidation in some form to improve scale and reduce the costs burden of increasing regulation and technology requirements. MM does not own BOQ.

MM believes BOQ will at some point complete a beneficial merger with Bendigo Bank (ASX: BEN) or Suncorp (ASX: SUN).

Bank of QLD (ASX: BOQ)

Broker moves

- Zip Co. Cut to Neutral at Citi; PT A$7.40

- Cooper Energy Cut to Neutral at Jarden Securities

- GUD Holdings Raised to Overweight at JPMorgan; PT A$12.25

- Openn Negotiation Rated New Speculative Buy at Euroz

- Fortescue Raised to Neutral at Evans & Partners Pty Ltd

Major movers today

Make informed investment decisions

At Market Matters, we write a straight-talking, concise, twice daily note about our experiences, the stocks we like, the stocks we don’t, the themes that you should be across and the risks as we see them. Click here for your free trial.

The Match Out will be available each day after the market close. Follow my profile to be notified when the latest report is live.

3 topics

6 stocks mentioned