The Match Out: Stocks rally to end month and quarter, ASX puts on 1.88%, all sectors up as we enter a bullish seasonal period

The market ended a soft month of September with a bang today, rallying around 1.9% with broad-based buying right across the board and a very bullish close to finish on the daily and weekly highs, smashing back up through 7300 in the process.

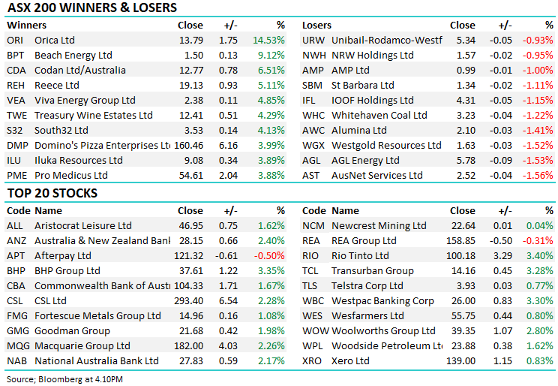

- The ASX 200 added +135pts /+1.88% to 7,332 today

- Staples, Materials and Healthcare all rallied more than 2% as all sectors finished up on the day.

- While Healthcare bounced back +2.2% from recent weakness, technology stocks underperformed, gaining just 0.61% as rising bond yields continue to weigh

- For the month of September, the ASX 200 finished down -2.59%, today's move sugar-coating a weak period for local stocks.

- At a sector level, a +14.9% gain from the Energy sector was the standout while on the other side of the ledger, Materials lost -11.36% largely due to the rout in Iron Ore.

- Five stocks in the ASX 200 added more than 20% for the month, namely Beach Energy (ASX: BPT) +38% on higher crude prices + a more bullish update, AusNet (ASX: AST) +31% on a takeover, Flight Centre (ASX: FLT) +27% because we’re about to open up, Whitehaven Coal (ASX: WHC) +22% due to surging Coal prices and Woodside (ASX: WPL) +21% on higher Crude - which was very oversold.

- The 5 worst stocks for the month dropped 18% or more, the weakest of those being Fortescue (ASX: FMG) -26%, although it did trade ex-dividend, Iress (ASX; IRE) -20% as suitor walked, Regis Resources (ASX: RRL) -19% as Gold fell, Magellan (ASX: MFG) -19% as we all questioned their high fee model when performance has been weak plus outflows have ticked up, and Bluescope (ASX: BSL) fell 18% on profit taking…we actually like BSL into weakness here.

- Today also marks the end of Q1 of FY22, the ASX 200 is up +0.92% FY22 to date (excluding dividends) – from a quick glance across our domestic portfolio’s we’ve done significantly more with a particularly strong month in September from a relative perspective – more detail on this in the coming days.

- Iron Ore was in focus today with Iron Ore Futures +5% into our close–up more at one stage - BHP bounced +3.35%, RIO +3.4% however Fortescue (FMG) +1.08% lagged following a very sad fatality at Soloman where operations have stopped.

- Better than expected Chinese data one aspect to this move however we also had a meeting chaired by central bank Governor Yi Gang, telling financial institutions to cooperate with governments “to jointly maintain the steady and healthy development of the real estate market and safeguard the legitimate rights and interests of housing consumers.” Developer stocks rallied in HK and China as a result and that flowed through to our local miners

- Zip Co (ASX: Z1P) +1.29% announced a good deal with Microsoft (MSFT US) today – we own both stocks

- Gold was up around $2 in Asia after having a weak session overnight, trading around $US1728 at our close

- Iron Ore Futures +5.4% at out close as mentioned above

- We outpaced Asian markets with Japan down about 0.3%, China up +0.65% while Hong Kong fell -0.27%.

- US

Futures are trading up, all around +0.50%

ASX 200 chart

Weekly Video Update

In this week’s video update, James and Harry discuss the strength in the Energy sector, portfolio positioning against a backdrop of rising rates and key stock picks as we end the September funk. As always, please subscribe to the Market Matters YouTube Channel and remember to ‘like’ the video (if you do)...this will give us an added incentive to continue producing these weekly updates.

Zip Co (ASX: Z1P) $7.06

Z1P +1.29%: Announced a new deal with Microsoft (MSFT US) today – a stock we hold in our International Equities Portfolio - to integrate into the Microsoft Edge browser. This is another incremental positive for customer acquisition into November/Christmas period. While the Product is not in the Microsoft store, it will utilise payment details in the browser for any merchant online meaning Z1P will appear alongside Visa, Mastercard and AMEX and importantly, it is the only BNPL to be integrated into Edge browser globally. Edge has 600m installs across the World and the USA is the largest market for the group. Whilst MSFT doesn’t disclose payment volumes, it’s safe to say it’s big and will help Z1P add to its existing ~5m US customers that are doing annualised volumes of ~$3.2b.

MM remains bullish Z1Pm

Zip Co (Z1P)

Broker moves

- Codan Raised to Buy at Moelis & Company; PT A$17.12

- Cochlear Cut to Underweight at Morgan Stanley; PT A$196

- Orica Raised to Buy at Jefferies; PT A$14

- BetMakers Technology Rated New Hold at Jefferies; PT A$1.20

- Orica Raised to Add at Morgans Financial Limited; PT A$13.70

- SmartGroup Cut to Hold at Morgans Financial Limited; PT A$10.35

- SmartGroup Cut to Neutral at Credit Suisse; PT A$10.35

- Genmin Rated New Speculative Buy at Bell Potter

Major movers today

Make informed investment decisions

At Market Matters, we write a straight-talking, concise, twice daily note about our experiences, the stocks we like, the stocks we don’t, the themes that you should be across and the risks as we see them. Click here for your free trial.

The Match Out will be available each day after the market close. Follow my profile to be notified when the latest report is live.

3 topics