The Match Out: US inflation miss lights up equities, Gold stocks a key beneficiary

Inflation, at least in the US, is quickly coming under control leading to a strong rally on the local market today. The broad-based rally saw more than 90% of the ASX200 closer higher today, led by a strong rally in Real Estate on a day when all sectors closed up. China trade data also printed today with both imports and exports falling more than expected with a lower trade surplus adding to the view that China will ramp up its stimulus efforts.

- The ASX 200 finished up +111pts/ +1.56% at 7246

- The Real Estate sector (+3.23%) was the best on ground with Tech (+2.27%), Consumer Discretionary (+2.22%) and Materials (+2.11%) the other three adding more than 2%

- Utilities (+0.66%) was the underperformer despite still posting a strong gain.

- China Exports fell -12.4% YoY vs -10% expected, while imports dropped -6.8% vs expectations around -4%. The bad news was mostly taken as a positive given the pressure on China to fire up the economy through stimulus.

- Netwealth (ASX: NWL) +5.24% hit 1-year highs following strong Funds Under Administration update, adding $4.4b in Q4 taking the total over $70b.

- Global Lithium (ASX: GL1) -5.17% announced significant rare earth element discoveries at their Manna site in WA. A positive update but a typical buy the rumour sell the fact result for shares today. The market will want the company to focus on its lithium exploration at this stage.

- Lotus (ASX: LOT) +11.11% announced plans to merge with A-Cap (ASX: ACB) to create a significant uranium player with a focus on African deposits.

- Viva Energy (ASX: VEA) +0.34% said fuel sales in the first half are expected to climb to 7.6ML, but refining margins will nearly halve from $US19.90/bbl to $US10.80/bbl.

- St Barbara (ASX: SBM) +3.77% hit 260koz of gold production last year, largely on the back of a better 4Q from Leonora, an asset they no longer own.

- Iron Ore was up 1.5% in Asia, with Rio Tinto (ASX: RIO) seeing the best of the move, up +3.03%.

- Gold was flat in Asia today, but has put on ~$US35/oz over the last 24 hours thanks to the falling bond yields. Gold equities happily joined in with the rally, Evolution (ASX: EVN) a key gainer, up +7.33%.

- Asian stocks also rallied, the Nikkei (+1.5%), China (+1.23%) and Hang Seng (+2.47%) all posting strong gains.

- US Futures are pointing to positive starts to tonight’s session. S&P futures +0.25% and Nasdaq Futures +0.43%.

ASX 200 Intraday and Daily

FY23 Performance Update

FY23 was a strong year for markets and we’re pleased to say, the Market Matters Portfolios captured this strength. In this week’s video update we discuss the performance of the Market Matters Portfolios and our positioning for what comes next in FY24.

&feature=youtu.be&ab_channel=MarketMatters

Broker Moves

- Pacific Smiles Raised to Overweight at Wilsons; PT A$1.55

- Transurban Raised to Buy at Citi; PT A$16.20

- Imdex Cut to Neutral at Citi; PT A$2

- PWR Holdings Raised to Positive at Evans & Partners Pty Ltd

- Altium Cut to Sector Perform at RBC; PT A$40

- Mesoblast Cut to Speculative Buy at Bell Potter; PT A$2

- KMD Brands Cut to Reduce at CLSA; PT NZ$0.97

- Aristocrat Raised to Buy at CLSA; PT A$44.90

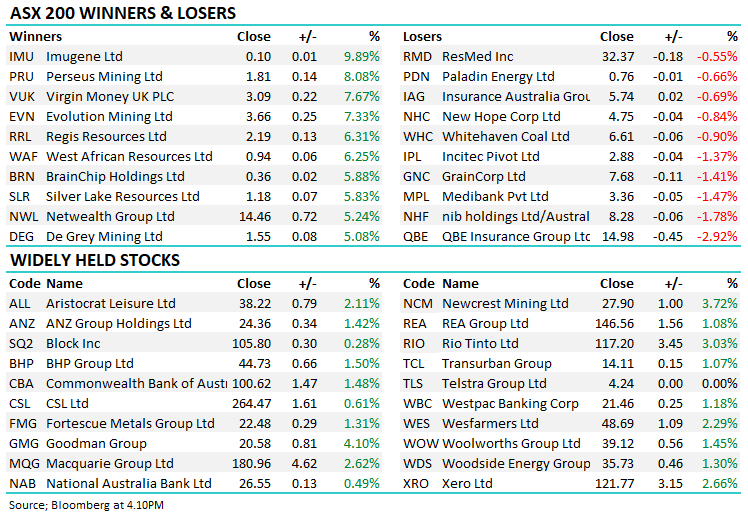

Major Movers Today

Make informed investment decisions

At Market Matters, we write a straight-talking, concise, twice daily note about our experiences, the stocks we like, the stocks we don’t, the themes that you should be across and the risks as we see them. Click here for your free trial.

The Match Out will be available each day after the market close. Follow my profile to be notified when the latest report is live.

2 topics

8 stocks mentioned