The most-tipped small caps for 2021

It has become a lauded tradition here within the great halls of Livewire Markets to each year celebrate the investment aptitude and foresight of you, our valuable readers, recording in survey-form your outlook and stock picks for the year ahead.

While functional crystal balls are hard to come by, your stock picks from previous years have performed intriguingly, almost suspiciously well. The top ten tipped small-cap stocks from 2019 gained 43% for the year, while your tips for 2020 lifted 6.8%.

Crunching your votes is far from a laughing matter, even more so when we receive picks from nearly 5200 of you. It's a tough, tiresome job, but somebody has to do it.

So, we put our interns to the test, working them day and night without respite throughout the Christmas and New Years period to analyse, scrutinise, and painstakingly dissect the numbers*, and finally, the results are in.

Among the lucky 10 are a fintech, a bookmaker, and a rare earth excavator; all members of the S&P/ASX Small Ordinaries Index, the benchmark consisting of the 200 companies within the S&P/ASX300 - but those that haven't made it, yet, to the top 100.

The chosen few received around 10% of your votes and boast market caps ranging from $524 million to $4.1 billion. The best performing stock in this list rose more than 158% during tumultuous 2020, while the group combined has whipsawed more than 2605% from the March lows.

But before you throw all caution to the wind - a word to the wise: This list of ideas is not a "set and forget" portfolio, and much of the returns seen in previous years were buoyed by one or two outperforming stocks - while others underperformed or even fell deeply in the red.

That said, here are the lucky 10, as voted by you, with commentary from some of Livewire's expert contributing fund managers.

*NB No interns were hurt in the making of this wire. They are recovering nicely.

Please note: The stocks mentioned as holdings in this article are current as of the recording date of the respective podcasts and may no longer be current.

Small caps, at a glance

- This year's most-tipped small cap didn't even make it to the top 10 list last year.

- Five of the 10 tipped stocks were in negative territory last year, with two stocks down over 60%. The five that were up, however, lifted around 50%, 158%, 74%, 107% and 7%.

- Four stocks fell from your top-tipped small-cap list from 2020: Appen (ASX:APX) - now in the S&P/ASX100, Nearmap (ASX:NEA) - receiving 9 votes this year, Nanosonics (ASX:NAN) - receiving 31 votes, and Audinate Group (ASX:AD8) - receiving 14 votes.

%20copy.jpg)

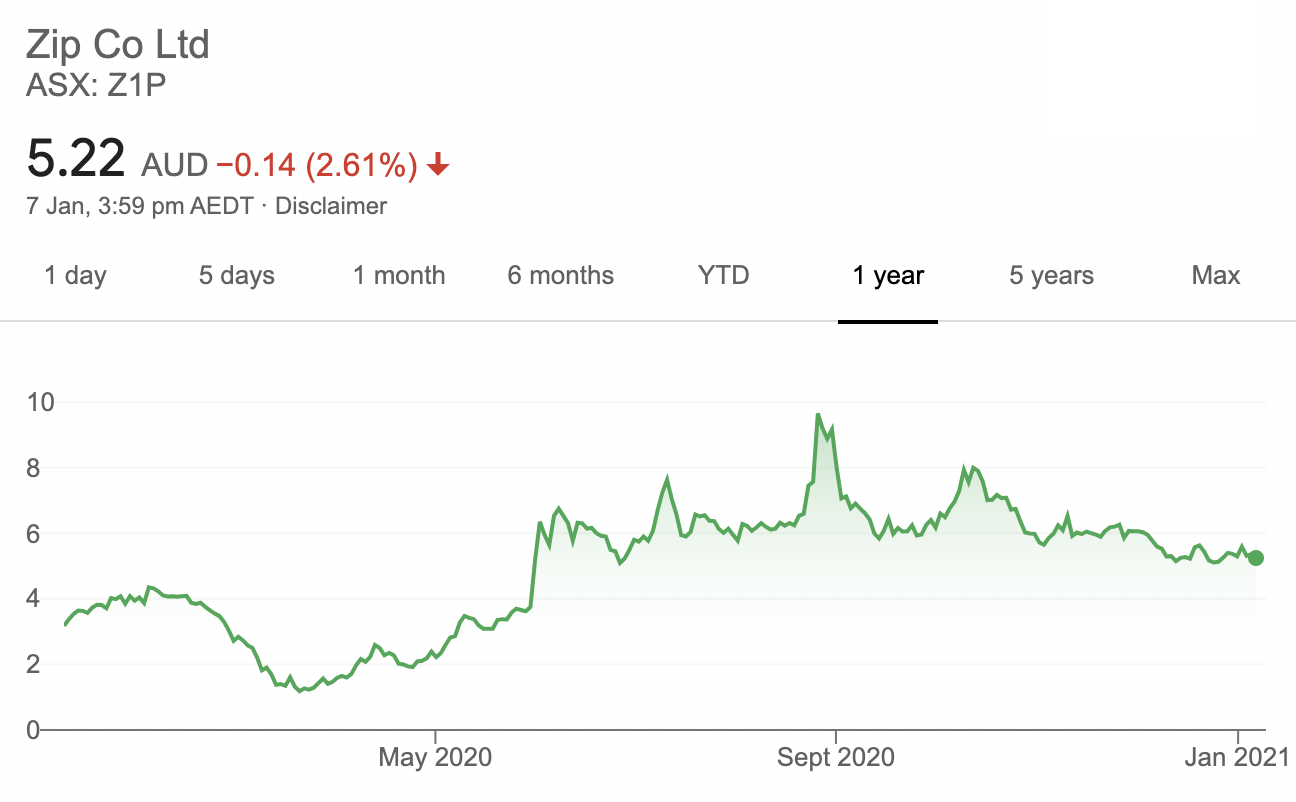

The #1 most-tipped small cap: Zip Co (ASX:Z1P)

- Percentage of votes in the top 10: 19.2%

- Market Cap: $2.9 billion

- Share price: $5.54 (Market close, 8 January 2021)

Zip Co (ASX:Z1P) took out the top gong as your most-tipped small cap for the year ahead with 93 votes, and with plenty good reason too. The buy-now-pay-later contender has seen its share price rise just short of 50% during CY20, while it has soared around 428% since its low in March.

Z1P has made a few major strategic moves of late, having acquired QuadPay in June for $400 million to take on Afterpay in the US, partnering with Facebook in December to help SMEs pay for advertising, and as recently as this week, partnering with digital payment service provider AsiaPay to allow its service to be accepted throughout Asia.

Z1P is currently trading at a significant discount to its major competitor in the market, Afterpay, which has returned around 1348% since the March low in 2020 and is currently trading at $116 (8 Jan, 2021).

Shaw and Partners' James Gerrish named Z1P as his pick of the buy-now-pay-later bunch in a wire published on 7 October 2020. He was impressed by the company's rapid accumulation of new customers. The portfolio manager is bullish on the company's growth, with an initial target 25-30% higher.

The #2 most-tipped small cap: EML Payments (ASX:EML)

- Percentage of votes in the top 10: 11%

-

Market Cap: $1.37 billion

- Share price: $3.81 (Market close, 8 January 2021)

Having topped your 2020 small-caps list, EML Payments (ASX:EML) has been dethroned this year, claiming second place with 53 tips. The gift and prepaid-card provider was badly burnt during the pandemic sell-off in March, with its share price falling 79%. EML went on to make a miraculous recovery, having rebounded by more than 217% from its low. For the calendar year, EML was still in the red -9.72% but has since recovered its losses, lifting 1.8%.

Dominic Rose of Montgomery Lucent Investment Management is confident the company's share price will continue to lift as businesses reopen, with the firm recently increasing its exposure to the business within its small companies fund.

"The recent encouraging vaccine news materially increases confidence in a solid earnings recovery in FY22," he said.

"Market estimates are for EBITDA to rebound 40 per cent in FY22 to $74 million, still well below pre-COVID expectations of $95-100 million."

First Sentier Investors' Dushko Bajic on 22 December 2020 also tipped EML as his pick for the reopening trade, arguing he believes "they will be a big beneficiary of foot traffic returning more broadly in the economy".

The #3 most-tipped small cap: PointsBet Holdings (ASX:PBH)

- Percentage of votes in the top 10: 10.3%

- Market Cap: $2.5 billion

- Share price: $12.00 (Market close, 8 January 2021)

PointsBet Holdings (ASX:PBH) takes out the bronze in your small-cap tips for 2021, having received 50 votes from Livewire readers. The online bookmaker returned a nice 158% during 2020, having rebounded around 1076.5% from its low of $1.02 in March to trade at $12.

2020 was a big year for PBH, with the bookmaker announcing a partnership with NBCUniversal in August. The deal saw PointsBet gain access to the media company's 184 million-strong sports-loving audience, with investors lapping up the news to send PBH's share price soaring 87% to a high of $13.

Montgomery's Gary Rollo backed PBH in September, arguing that gross gaming revenue is estimated to grow to $20 billion over the next five years.

"We've seen from the European experience that market leaders can capture 30% - 40% as profits, that's a $6 - $8bn profit pool. That doesn't come along every day."

Meantime, Bell Potter on 6 January 2021 named Pointsbet as one of its picks for the year ahead this week, noting PBH’s Australian operations should remain EBITDA positive in FY21. The stockbroker also reported that PBH had recently completed a $353 million equity raising, providing it with the funding to execute its target of generating US$1 billion in annual revenue by 2025.

The #4 most-tipped small cap: Lynas Rare Earths (ASX:LYC)

- Percentage of votes in the top 10: 9.9%

- Market Cap: $4.06 billion

- Share price: $4.60 (Market close, 8 January 2021)

In fourth place is a new addition to your top-tipped small-caps list, Lynas Rare Earths (ASX:LYC), claiming 48 nods for 2021. For those not in the know, LYC is the largest producer of rare earth oxides outside of China, and the second-largest in the world.

The Australian miner manufactures essential products used in green technologies, like electric vehicles and wind turbines, making it a worthy play in the renewable energy transition.

LYC saw its share price soar nearly 351% since its low at a $1.02 in the sell-off, returning a nice 73.8% in the calendar year. But will it continue to run in 2021? First Sentier's Dawn Kanelleas and Frame Funds Management's Hue Frame believe so.

Also the #4 most-tipped small cap: Polynovo (ASX:PNV)

- Percentage of votes in the top 10: 9.9%

- Market Cap: $2.24 billion

- Share price: $3.53 (Market close, 8 January 2021)

Polynovo (ASX:PNV) comes in at equal fourth place and is another new addition to the top-tipped small-caps list in 2021. The burn and wound treatment developer also received 48 tips for the year ahead, after its share price soared more than 107% during 2020.

Frazis Capital's Michael Frazis says PNV's polymer solution is improving the existing standard-of-care for serious burns, with further applications in both cosmetic surgery and the, ahem, hernia market.

Meantime, First Sentier's Dawn Kanelleas on 16 December 2020 revealed the investment manager had a position in the biotech in its small-cap portfolio, noting that while "technology can often be misconstrued as just being software... it’s much more than that".

The #6 most-tipped small cap: Paradigm Biopharmaceuticals (ASX:PAR)

- Percentage of votes in the top 10: 9.2%

- Market Cap: $552 million

- Share price: $2.41 (Market close, 8 January 2021)

Back for another year is Paradigm Pharmaceutical (ASX: PAR), taking out your sixth spot for 2021. Despite Paradigm coming in third last in 2020’s most-tipped stocks, it seems investors believe there is still plenty room for improvement for this healthcare company.

Down more than 22% in 2020, Scott Williams of Fiftyone Capital is optimistic that the company could be gearing up to become the next CSL.

"Our view is that Paradigm could be the next big Australian biotechnology success story - think CSL type success."

And clearly, you agree, with Paradigm receiving 9% of your votes among this year's top ten. We think its safe to say that we will all be watching to see what happens to this exciting company in 2021.

The #7 most-tipped small cap: Avita Medical (ASX:AVH)

- Percentage of votes in the top 10: 7.8%

- Market Cap: $524 million

- Share price: $4.98 (Market close, 8 January 2021)

After a colossal collapse in 2020, Avita Medical (ASX:AVH) has been picked by our readers as one to watch in the recovery. After co-listing on the NASDAQ in June 2020, the company - which specialises in the production of spray-on-skin - is looking to make its comeback after falling over 61% in CY20.

AVH was declared the worst-performing reader’s pick in 2020. But despite this disappointing performance, Bell Potter analyst John Hester believes the stock has a long runway for growth ahead of it.

“We think the reason the stock price has fallen so much is primarily because of COVID – the fundamentals of the company are 100% in place.”

Will a vaccine boost this stock to recovery in 2021, or are we bound for groundhog day?

Also the #7 most-tipped small cap: Flight Centre (ASX:FLT)

- Percentage of votes in the top 10: 7.8%

- Market Cap: $3.02 billion

- Share price: $15.66 (Market close, 8 January 2021)

Talk about a recovery play - Flight Centre (ASX:FLT) had a truly horrific year in 2020, with more than 400 of the travel retailer's 740 Australian stores shuttering their doors since the onset of the pandemic. Despite its share price suffering a 60% fall and reporting a staggering $662 million loss in FY20, Livewire readers have selected Flight Centre for the eighth-position in this illustrious list with just under 8% of the votes.

Momentum is clearly building for FLT, with its share price rebounding almost 76% since it suspended trading in March, a vaccine around the corner, a trans-Tasman bubble on the cards and a slither of normality on the horizon. Could these factors see Flight Centre soar in 2021 and beyond?

The #9 most-tipped small cap: Electro Optic Systems Holdings (ASX:EOS)

- Percentage of votes in the top 10: 7.4%

- Market Cap: $838 million

- Share price: $5.67 (Market close, 8 January 2021)

For the second year in a row, Electro Optic Systems (ASX:EOS) has made it onto the list of Livewire reader’s most-tipped small caps. Down over 21% in 2020, it was the second-worst performer from your pick's last year.

EOS will be looking to impress the market in 2021, having made a $10 million acquisition in the middle of the pandemic. Henry Jennings of Marcus Today is one of Livewire’s biggest EOS fans and claims COVID-19 was a mere bump in the road for the company and is convinced it will be able to perform in the near future.

“EOS is a home-grown success story and has been very good at penetrating overseas markets, especially in the Middle East and the US. It is a great success story, and it's a good way to get exposure to that growing defence sector.”

The #10 most-tipped small cap: Mesoblast (ASX:MSB)

- Percentage of votes in the top 10: 7.2%

- Market Cap: $1.5 billion

- Share price: $2.24 (Market close, 8 January 2021)

Back for another year, Livewire readers selected Mesoblast (ASX:MSB) as number 10 on their most-tipped small-caps list. The Aussie-based regenerative medicine company has a market cap of $1.3 billion and is responsible for 7.2% of the votes in this survey.

After disappointing investors for most of the decade, 2019 saw Mesoblast skyrocket, with its share price soaring 79.3% in only twelve months. It’s been another successful but volatile year for the biotech company in 2020, with investors who stuck around for the ride rewarded with a 7% return. It will be interesting to see how the healthcare star performs this year – is a repeat of 2019 on the cards or will COVID really get the best of MSB?

Conclusion

2021 looks promising, with central banks assuring nervous investors that interest rates will remain low, a vaccine being distributed and international flights being reinstated as soon as June. But this time last year, the world had hardly heard of the coronavirus, nor had we truly appreciated its potential to spread. The truth is, something that could turn the world and our lives upside down may not have even been discovered yet.

To keep you in the know, Livewire will be bringing you an update on your most tipped small caps every quarter so you can track their progress. Here's hoping for a more positive year with fewer obstacles thrown our way.

Disclaimer

Once again, this is to be taken as a list of stock ideas, and not as a portfolio. Whilst the last two years have generated quite the performance, I'd caution against expecting this to happen again!

Liked this wire? My colleague James Marlay has published the ten most tipped large caps for 2021, which you can read here. Also, give Glenn Freeman a follow, who for the first time, will be revealing the top ten most tipped global stocks for 2021.

2 topics

10 stocks mentioned

11 contributors mentioned