The next generation of lithium batteries

Lithium-ion (Li-ion) batteries have become a staple of modern technology over the last 20 years. But like all technologies, it will eventually be replaced by something superior. One of the technologies vying to be the successor is lithium-sulphur (Li-S). Don’t be fooled by the similar name – it’s very different to Li-ion, both in a technical and a practical sense. On the technical front, Li-ion batteries use a lithium salt and base metals such as cobalt, nickel, and manganese. Li-S batteries on the other hand, use lithium metal, but contain no base metals. On the practical front, Li-S batteries will be half the weight, and several times more energy-dense than an equivalent Li-ion battery.

“These new lithium and sulphur batteries have a much higher energy density, are lighter, and also safer than the current lithium ion batteries,” said Professor Ian Chen from Deakin University.

One of the biggest challenges for Li-S batteries has been avoiding degradation over multiple charge cycles, with the batteries degrading to the point of failure very quickly. However, a partnership between Deakin University and the ASX-listed PPK Group has recently made a breakthrough which could help put these batteries in your phone (or electric car) sooner.

Li-S Energy – the joint venture between Deakin and PPK Group – have found that using the nanomaterial, Boron Nitride Nanotubes (BNNT) can improve the performance of Li-S batteries – retaining high energy capacity over hundreds of cycles.

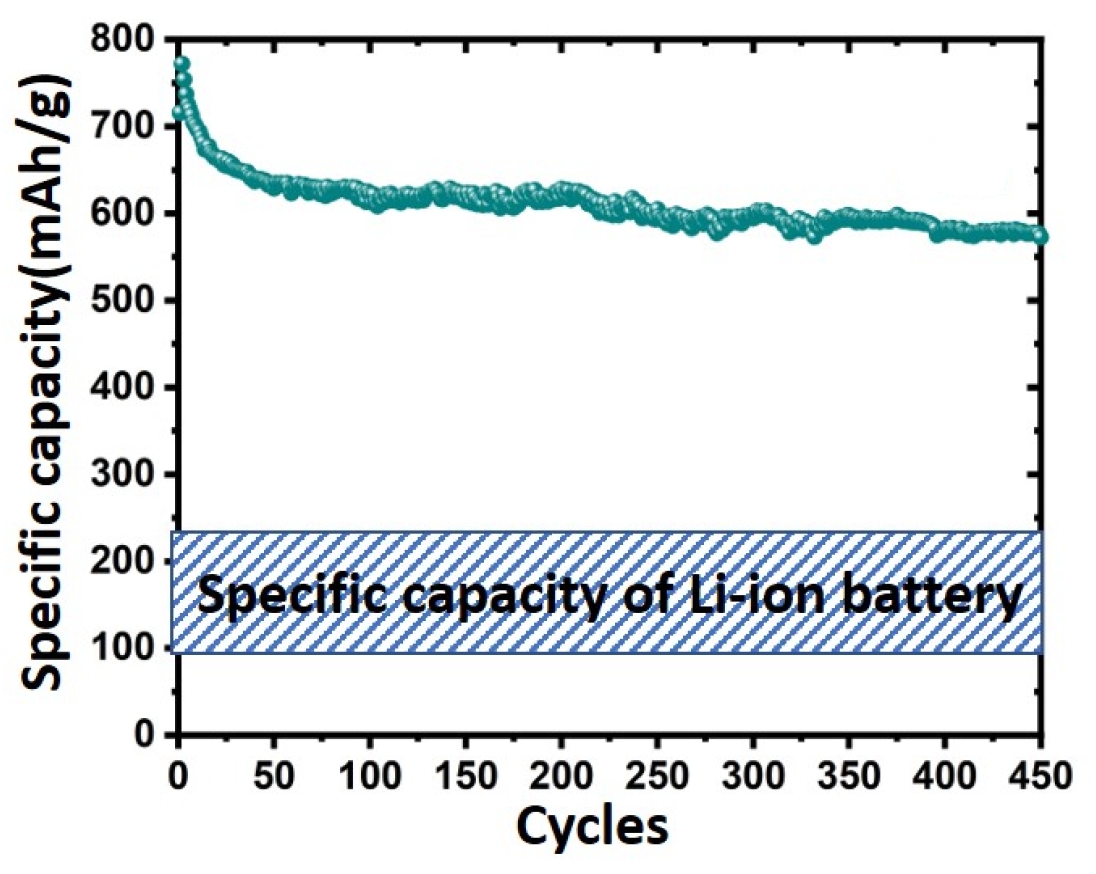

Li-S battery test results after 450 continuous cycles. Specific capacity has been maintained at greater than 550mAh/g which is in the region of 3 times the specific capacity of current Li-ion batteries.

"Current lithium ion batteries have energy density around 200 or 300 watt hour per kilogram. For lithium sulphur batteries it can achieve 500 watt hour per kilogram. That means with the same energy that lithium sulphur battery will be half the weight." - Dr Baozhi Yu, Deakin University.

If all goes well, scaling up production appears achievable. Dr Chen says that fabrication processes for Li-S batteries is quite similar to existing Li-ion fabrication, which would allow battery makers to re-tool existing facilities, making commercialisation easier.

"Currently, most Li-S pouch cells can run a couple of hundred cycles and we have improved it to several hundred, we then need it to be over a thousand," said Professor Chen.

Li-S technology is not new

Don’t make the mistake of thinking that this is a newly-discovered and poorly understood technology. Li-S batteries have been around for some time. As Roger Montgomery, Chief Investment Officer at Montgomery Investment Management pointed out:

“12 years ago, in 2008, these batteries were used on the Zephyr 6 – the then longest and highest-altitude unmanned solar-powered flight.”

But long paths through development and commercialisation are the norm with such technologies. Indeed, Li-ion batteries were proposed in 1973, developed through the 70s and 80s, and the first commercial versions hit the market in the early 90s. However, it was not until the mid-00s that Li-ion batteries truly dominated the market.

“There is hope that Li-S batteries may succeed Li-ion cells because of their higher energy density and reduced cost thanks to the use of sulphur. Of course, there are still issues to get it to commercial scale, which Lithium-Ion has already achieved,” said Montgomery.

Competing technologies

But Li-S is not the only game in town of course. New Li-ion technologies are also being developed that could end up being more attractive to battery manufacturers. One such technology is the NCM 811 cathode chemistry, which uses higher portions of nickel than current Li-ion batteries.

“There is also a push by battery makers toward cathodes with higher nickel content. NCM 811 cathodes, for which lithium hydroxide is better suited, are eight parts nickel, one part cobalt and one part manganese, and they too have a higher energy density, a longer lifespan and provide a better driving range when used in EVs,” said Montgomery.

Montgomery described the battle as being akin to Betamax versus VHS (or maybe HD-DVD versus Blu-ray, for our younger audience).

“Back in the 80’s it was Betamax that had the better technology for viewing movies but VHS won out because it gained traction with producers and distributors. Whether the best battery technology wins may depend on what technologies the biggest manufacturers invest their substantial capital in first,” he told us.

Resource intensity

A key problem for any new battery technology is ensuring stable supply of the required commodities. Lithium itself is not a scarce resource, averaging 20mg per kilogram of the Earth’s crust, making it the 25th most abundant element. Though lithium production will need to be scaled up in the years and decades ahead, regardless of the dominant technology. Recent successes in finding large economic deposits suggest that this is more a problem of capital, time, and desire though. With enough time and motivation, new mines will be brought online to meet demand.

However, Li-S batteries require lithium metal, not lithium hydroxide or carbonate. Hard rock deposits, such as those found in Western Australia, produce lithium hydroxide as a saleable product, whereas brine deposits, such as those found in South America, produce lithium carbonate. Neither, however, produces lithium metal. Lithium metal is produced from lithium chloride (and potassium chloride) and requires temperatures of 450 degrees Celsius.

Supply of sulphur is unlikely to be a concern, however. Sulphur is the 16th-most abundant element on the planet, and we produce around 70mt per annum already.

For Li-ion batteries cobalt offers the biggest challenges. Cobalt is a very rare metal and faces significant supply chain problems. Much of the world’s supply comes from the Democratic Republic of Congo, and is produced by ‘artisanal miners’, who are often children, in terrible conditions. Understandably, not many electric car or smartphone producers want to be involved with this. Economic deposits have been difficult to find elsewhere.

“Li-ion and Li-S are totally different. In Li-ion batteries there is no lithium metal, it’s just the lithium ion and the lithium oxide, or salt inside. But in Li-S with only two main materials are lithium metal and sulphur. There are no other metals. I think that is one of the advantages of the Li-S because only sulphur is involved inside the Li-S battery,” said Dr Baozhi Yu.

What it all means for investors (and consumers)

While this technology is unlikely to have a major impact at a company level in the immediate term, it’s important to consider it in the context of long-term demand for resources. If Li-S does become the dominant technology rather than NCM 811, then long-term forecasts of nickel and cobalt demand may need to be adjusted. While the 48% owner of this technology (ASX:PPK) is a listed company, it should be noted that it’s a loss-making small cap, with other operations of more significance to their P&L statement than any revenues that may or may not come from Li-S battery technology.

Electric car makers may end up being the big beneficiary, as range anxiety reduces and people outside cities become more comfortable with electric car ownership.

“In any case, consumers will be the winners. You may be better off shorting the legacy ICE technologies that Lithium will relegate to the history books,” Montgomery said.

Australia’s 100 top-rated funds

Livewire’s Top-Rated Fund Series gives subscribers exclusive access to data and insights that will help them make more informed decisions.

Click here to view the dedicated website, which includes:

- The full list of Australia’s 100 top-rated funds.

- Detailed fund profile pages, with data powered by Morningstar.

- Exclusive interviews with expert researchers from Lonsec, Morningstar and Zenith.

- Videos and articles featuring 16 top-rated fund managers.

1 stock mentioned