The outlook for Australian property

Zero policy rates in Australia and offshore are likely to provide more impetus to rising asset prices, than rising consumer prices, in the year ahead. While we have closed our underweight to Aussie sovereign bonds in the wake of a rise in yields, we still favour returns in equity over fixed income. Other than equities, we believe property (residential and non-residential, listed and unlisted) is likely to be an increasing beneficiary of low rates. This month, we take a look at the outlook for property markets.

Bond yields rise and equity markets pause…

It’s been a strong start to the year for risk assets, with domestic and offshore equities rising 4-5% from the year’s start, buoyed by easing geo-political tension, an accelerating vaccine rollout, and additional policy stimulus across the globe. However, since mid-last month, markets have tracked sideways, as a weight of positive news increased concern that a rise in inflation (and ultimately tighter policy) may be coming sooner than expected.

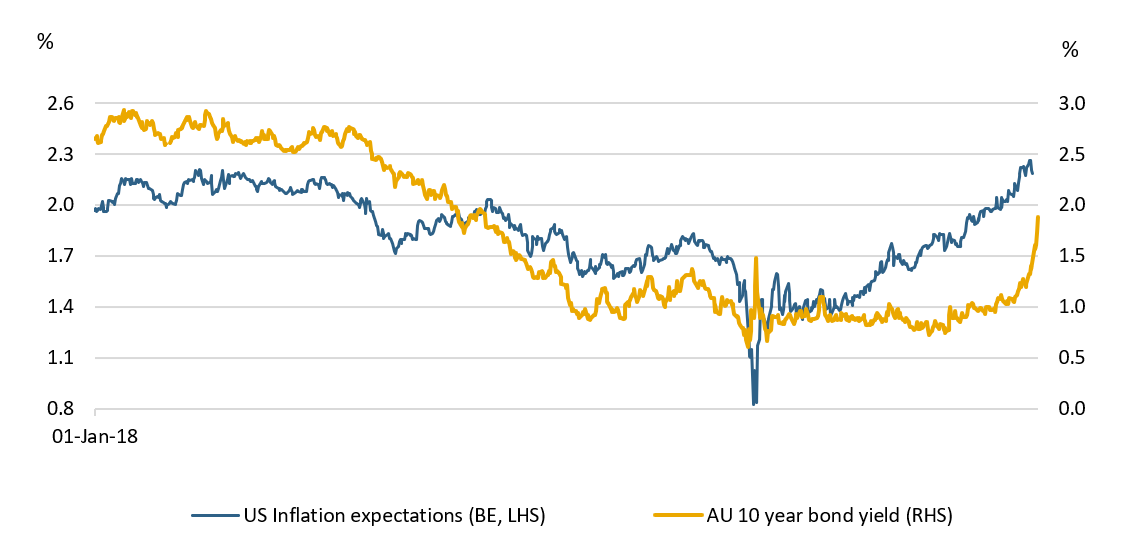

This has been most clearly reflected in a significant rise in bond yields (chart overleaf), with Aussie 10-year government yields rising to over 1.9% from 1.0% at the start of the year. This is despite the Reserve Bank of Australia’s (RBA) dovish surprise at the start of February, where it announced further bond buying of AUD 100 billion and pledged to keep rates near zero until 2024.

“With Australian 10-year yields rising even more quickly than in the US, the Reserve Bank of Australia has already run up the white flag of surrender and resumed bond purchases this week”.

Albert Edwards, Global Strategy, Societe Generale

With yields rising faster than inflation, higher real rates have the potential to weigh on the growth outlook. Of course, as we flagged in our 2021 outlook, and again in last month’s letter, periods of volatility are likely to feature this year. Interestingly, below the surface, the rotation from growth to value in the equity market continues apace. Adding to the concern in bond markets, investors are increasingly aware of a likely spike in headline inflation in March and April (driven mostly by the base effects of last year’s zero oil prices).

We remain cautiously optimistic about the year ahead, continuing to favour returns in equity over fixed income. Over coming months, we expect central banks to argue strongly that any near-term pick-up in inflation is temporary (and we have closed our domestic sovereign bond underweight in the wake of the recent sharp rise in yields). The opportunity to add risk is likely to appear as central banks increasingly try to manage bond yields lower, and an absence of structural inflation keeps real rates supportive for economies.

Zero policy rates are only likely to be threatened when unemployment falls below its pre-COVID levels and inflation targets are achieved for some time (given central banks are actively seeking to ‘get behind’ the inflation curve).

Bond yields have spiked higher as inflation expectations have risen

Source: Crestone, Factset.

Ironically, near-zero rates are more likely to drive higher asset prices than higher consumer prices in year ahead. This reflects why we are happy to remain overweight equities relative to fixed income (though we have trimmed our domestic equity overweight in favour of the UK this month). Another asset, other than equities, likely to benefit from near-zero rates is property.

The outlook for domestic residential property

According to CBA, “the Australian housing market is on the cusp of a boom”. Recent months have seen clear signs of an acceleration:

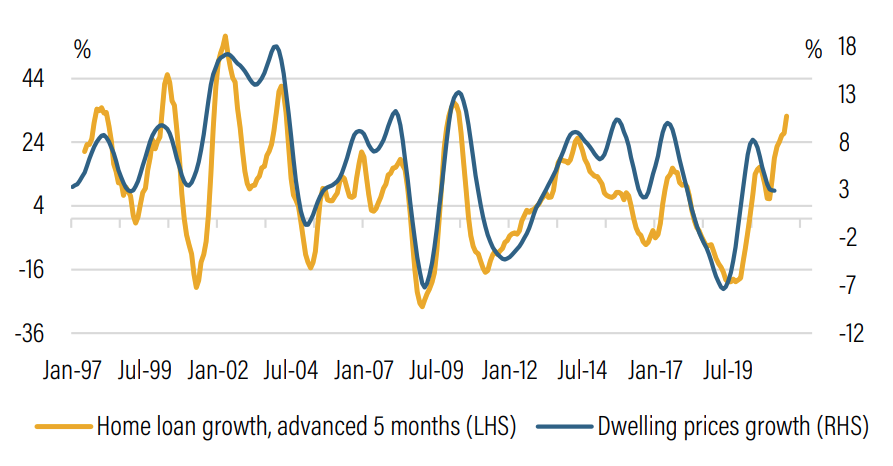

- New lending (a key driver of price growth) has risen significantly, up by 59% since its May 2020 trough (to be 30% higher than a year ago).

- Dwelling prices are rising in most capital cities, up by 3% annually in January 2021, with February on track for a further, around 2%, gain.

- New home sales have also accelerated sharply in late 2020, rising more than 36% above year-ago levels.

- Auction clearance rates have also now risen to levels consistent with double-digit house price gains.

Key drivers of the rapidly improving housing outlook include, not surprisingly, near-zero policy rates, record low mortgage rates, and the unfolding strong rebound in Australia’s jobs market.

Low borrowing rates impact the outlook through multiple channels. The sharp rise in new lending has, to date, largely been driven by owner-occupiers, who are most likely upgrading their homes, given each million dollars of leverage costs less than AUD 20,000 to service per year (and likely redirected from other spending, such as overseas travel).

With the borrowing rate less than the rental yield, this is also now starting to encourage investors back into the market. And the low cost to service a mortgage is likely supporting the transition of first home buyers from renting to owning. Government policy around less restrictive lending standards, as well as the Government’s recent HomeBuilder grants policy (winding down by end-March 2021), are all supporting housing demand in 2021.

Despite the collapse in migration, this is supporting demand for new homes, with building approvals recently surging, leading UBS to lift its construction forecasts from 180,000 to 230,000 for 2021, only a little shy of the 250,000 during the 2015-18 housing boom. This has the potential to add significantly to economic growth via demand for materials and household goods.

Housing price forecasts are also on the rise, with CBA raising its price outlook to 14% over the next two years. UBS expects 5-10% growth this year but flags the potential for double-digit gains.

For well-known reasons, expectations for houses are more buoyant than for multi-story apartments, while ‘working-from-home’ (WFH) trends are likely to support property prices outside the inner cities.

Risks to the outlook centre on the return of macro-prudential lending rules in late 2021/early 2022 to slow the pace of credit growth. A renewed pandemic lockdown or inflation surprise (and higher policy rates) would also dent the outlook. Further ahead, a lack of migration (if it continues) could lead to oversupply of rental and newly-constructed properties in 2022 or 2023.

The rapid growth in loans points to double-digit house prices

Source: Crestone, ABS, UBS, Core Logic.

How to gain exposure - Listed exposure can be gained via a range of home builders, as well as building material companies. Disability accommodation and social housing provide an attractive and unique opportunity in the unlisted residential market. They offer long-term, stable, and high-yielding assets, backed in part by the Australian Government through the National Disability Insurance Scheme.

The outlook for commercial property sectors

Industrial/logistics are our preferred long-term exposures

COVID-19 halved transaction volumes in the commercial property sector in 2020, particularly over Q2 and Q3. But as lockdowns eased, demand for high-quality industrial and logistics property became apparent, with a number of transactions underscoring the resilience of the sector.

COVID-19 has accelerated pre-existing trends in e-commerce and has served to highlight the need for companies to have logistics and distribution capabilities that match this trajectory.

The difficulty with listed industrial assets is one of pricing, and though industrial/logistics remains a clear beneficiary with long-term structural tailwinds, UBS sees this as already reflected in listed prices.

How to gain exposure - There is a selection of industrial property companies with balance sheets that have ample scope to deploy capital in an accretive manner. There is also a range of funds that offer exposure to unlisted commercial property assets. Those with the flexibility to skew capital toward industrial and logistic assets rather than retail assets are likely to outperform in the period ahead.

Retail to face headwinds from the transition to online

At the other end of the spectrum, the headwinds that were already confronting the retail sector have been accelerated by COVID-19. Not only has the significant fall in foot traffic impacted occupancy costs and forced significant store closures, but a number of assets that were slated for sale have been pulled and are likely to see downward pricing pressure. According to property advisory group, Property Advisory Research, the value of retail property across Australia could fall by as much as 30%, based on the assumption that 20% of tenants’ current sales will transition to online. The combination of customer demand for online offerings and significant investment of retailers in their omni-channel offering is cannibalising a portion of their bricks and mortar sales and is most likely structural in nature. For retail, short-term optimism around relaxation of mobility restrictions does not ease concerns regarding the acceleration of online spend.

Another accelerating thematic is decarbonisation as commercial and office tenants move toward carbon-neutral buildings. Specifically, solar as a source of renewable energy has provided ample investment opportunity.

“Sydney ranked in sixth place globally for cross- border investment activity in Q4 2020 and was the only city in the Asia-Pacific region within the top 10 destinations for global capital flows”.

Leonie Wilkinson, Senior Vice President, Portfolio Management, Real Estate, Brookfield

Exposure to unlisted property, in particular, can help stabilise cashflows through the cycle and provide a hedge to higher inflation.

High-quality, well-located offices are increasingly important

If industrial and logistics assets are the preferred long-term exposures and traditional retail is widely considered to be the most vulnerable, the office sector, arguably, sits somewhere in the middle. As the WFH theme plays out, the importance of high-quality, well-located offices will become increasingly important, while obsolescence may also accelerate (combined with other considerations, such as sustainability requirements). This could offer opportunities to real estate investment trusts (REITs) with development capabilities. Ironically, it is the disconnect between COVID-19 realities and listed share prices that might make this the most attractive opportunity. Indeed, UBS rates the office sector as its number one exposure in the listed equity space, given its relative resilience of income, better balance sheets and an over-reaction of share prices to the WFH thematic.

Gaining diversified exposure across sectors

As well as providing a more diversified, listed exposure across sectors, global REITs (GREITs) can also take advantage of structural mis-pricings globally. While GREITs underperformed broader equity and bond markets in 2020, many property types have been resilient, particularly those with exposure to data centres and logistics that have benefited from the move to digitisation and e-commerce.

A number offshore real asset funds are also taking advantage of opportunities in US logistics and multi-family residential assets, while some domestic funds are focused on office assets with stable banking, insurance and government tenants. This is indicative of our preference for quality across listed and unlisted markets.

Demand from overseas investors expected to remain strong

Although the longer-term impact of COVID-19, once populations are inoculated, remains subject to debate, the very low cost of capital is not. Offshore investors will continue to be attracted to Australian commercial property assets, given the attractive yields on offer. A recent survey from commercial real estate firm, Jones Lang LaSalle, suggests that half the investors surveyed plan to increase their exposure to Australia. Australia is seen as a relative COVID safe haven, with comparatively favourable demographic drivers and a stable regulatory and political environment that sits on the doorstep to Asia Pacific.

Australia is more attractive than other developed markets.

At a country level, Australia remains relatively attractive with quantitative easing (QE) and the resultant low bond yields (even after their recent rise) likely to benefit domestic real estate. Furthermore, Australian listed property returns are lagging the global index year-to-date.

Within unlisted property, pricing remains above previous cyclical peaks in many countries. However, the property yield spread to local government bonds (or funding costs) is wider than, or in line with, historical averages. Put another way, absolute pricing of unlisted property remains elevated—but relative to bond yields and funding costs, that pricing seems to be supported. The historical average spread between property yields (cap rates) and 10-year government bond yields has averaged around 200 basis points (bps) for Australia. However, the current spread between property yields and bond yields, at around 450bps, is much wider than this historical average. In fact, at 250bps above average, Australia stands out as particularly attractive on this measure vis-à-vis other major developed markets. Interestingly, according to UBS, bond yield movements are half the reason why property cap rates move, and this relationship takes 18 months to be priced into values.

For listed property, as with equity markets more generally, the dividend yield of the S&P/ASX 200 A-REIT index, at 4.7%, remains attractive relative to the 10-year bond yield at 1.9%.

Building more resilient portfolios

Exposure to unlisted property, in particular, can help stabilise cashflows through the cycle and provide positive sensitivity (or hedge) to higher inflation. Investors should ensure they have an appropriate allocation to core real estate to smooth economic volatility—such investments embody high-quality tenants and long-term rental agreements. Not only does core real estate have a low correlation to traditional markets, but it typically has a low correlation to different global regions. Looking ahead, there is likely to be a range of long-term, as well as post-virus, return drivers across the unlisted real estate sector.

Learn what Crestone can do for your portfolio

With access to an unrivalled network of strategic partners and specialist investment managers, Crestone Wealth Management offer one of the most comprehensive and global product and service offerings in Australian wealth management. Click 'contact' below to find out more.

2 topics

1 contributor mentioned