The power of niche companies (showcasing 2 ASX small-cap success stories)

In the dynamic and highly competitive world of business, mastering a niche can be a powerful pathway to greater success and growth. Companies such as Audinate (ASX: AD8) and PWR Advanced Cooling (ASX: PWH), offer a blueprint for how focused expertise in a specific market segment can pave the way for broader market penetration and diversified growth. In the following, we explore the journey of these companies from niche specialists to industry leaders, delving into the strategic importance of niche domination and the investment potential as a catalyst for long-term growth.

Mastering a niche is not just a strategy; it's the cornerstone of enduring business success. Focusing intently on a specific market segment, coupled with innovative growth strategies and unwavering commitment to quality, has consistently led to remarkable business triumphs.

Companies such as Audinate Limited and PWR Holdings demonstrate how a deep, concentrated focus on a niche market is a potent foundation that can be used as a launchpad for expansive growth.

Audinate stands as a beacon of how to effectively conquer market challenges and capitalise on emerging opportunities within a niche, better capturing more significant value from their customers. In contrast, PWR Holdings' journey is a testament to using niche expertise as a stepping stone to diversify into new markets and sectors.

Investing in businesses that have not only dominated their niches but also successfully branched out presents an extremely compelling investment proposition. The key lies in recognising the untapped market potential and substantial growth prospects inherent in niche-focused strategies.

Yet, many investors frequently miss out on these opportunities by underestimating the full potential of Total Addressable Market (TAM) and the strategic advantages of niche supremacy.

In a world where broad diversification is often prized, the power of a concentrated portfolio comprising well-executed niche businesses is underestimated. For investors, identifying these investments assists in achieving sustainable and long-term investment success.

Audinate: Mastering AV Networking

Audinate has evolved into a global AV networking leader, demonstrating the transformative power of technology in AV markets. Founded by Aiden Williams, the company has significantly reshaped the AV industry through its innovative approach.

The company’s breakthrough technology, Dante, marked a major advancement in synchronised audio over networks, revolutionising digital AV networking. Dante distinguished itself by delivering exceptional synchronisation and low latency in audio transmission over a standard ethernet network, profoundly influencing the industry.

Dante's introduction was a turning point in audio networking, simplifying complex configurations while improving reliability and sound quality. Its capability to transmit numerous uncompressed audio channels via Ethernet networks distinguished it as a revolutionary technology, propelling Audinate to rapid growth and industry prominence.

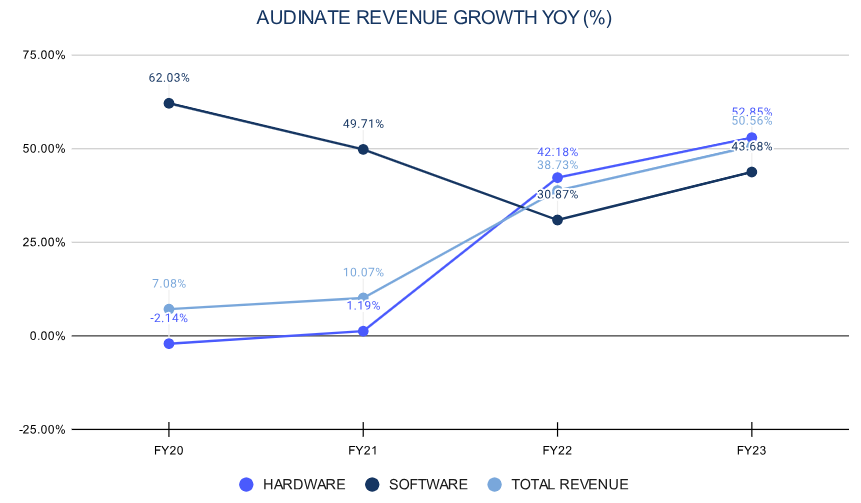

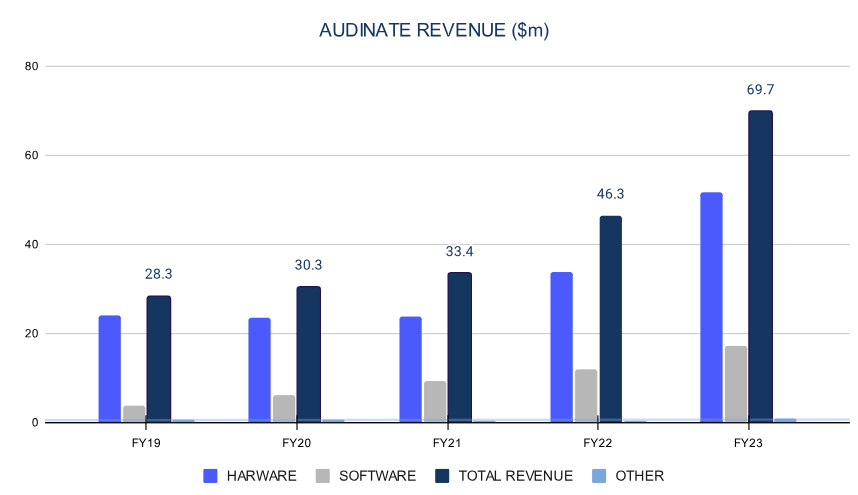

Financially, Audinate has shown remarkable resilience and progress. Their most recent results saw the company post $69.7 million in revenue and a net income of $10.6 million, reflecting their effective market penetration, innovative products, and strategic business operations.

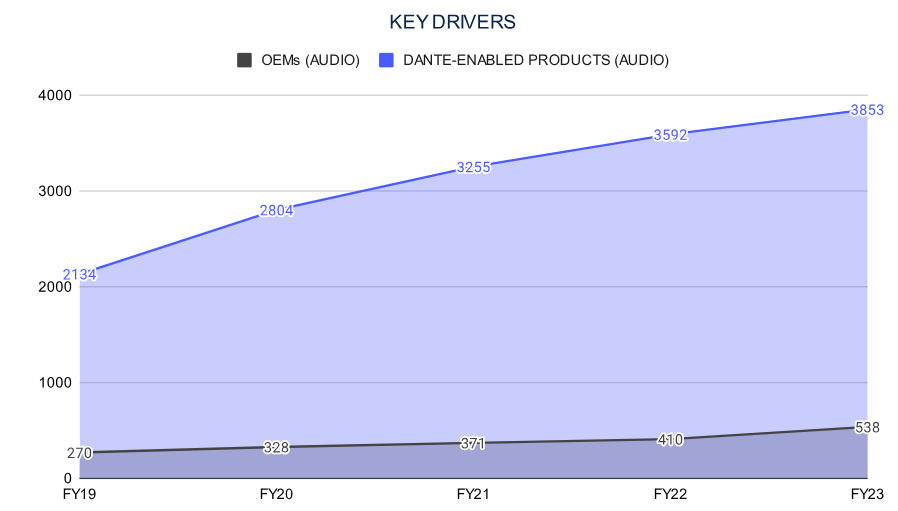

In the last five years, the company has grown from 438 to 538 OEMs, while their Dante-enabled products have grown from 1,639 to 3,853 by 2023. While still in its infancy, their video products have started to grow strongly, with the company rapidly expanding several OEMs now incorporating Dante into their video products.

Despite not being a first-mover, Audinate has become the de facto standard in the Audio segment. Beyond this, Audinate broadened its expertise with Dante AV by integrating audio and video networking. This expansion diversified the company's portfolio and secured its position as a leader in the comprehensive audio-video networking domain.

Audinate's story illustrates the power of innovation in achieving remarkable success. The company’s journey underscores how solid foundations in a specific field, like audio networking, complemented by ventures into new areas like video, can support ongoing growth.

PWR: Redefining cooling solutions

Founded in 1997 by Kees and Paul Weel, PWR quickly identified a niche in the automotive cooling market, focusing on high-quality, performance-driven aluminium cooling products. The company distinguished itself by specialising in lightweight, performance-oriented products, carving a unique position in the market.

PWR's success stemmed from offering custom cooling solutions, notably characterised by their exceptional performance. Their flexible manufacturing capabilities allowed them to design and adapt products to meet specific requirements, especially in compact spaces, setting them apart in the industry.

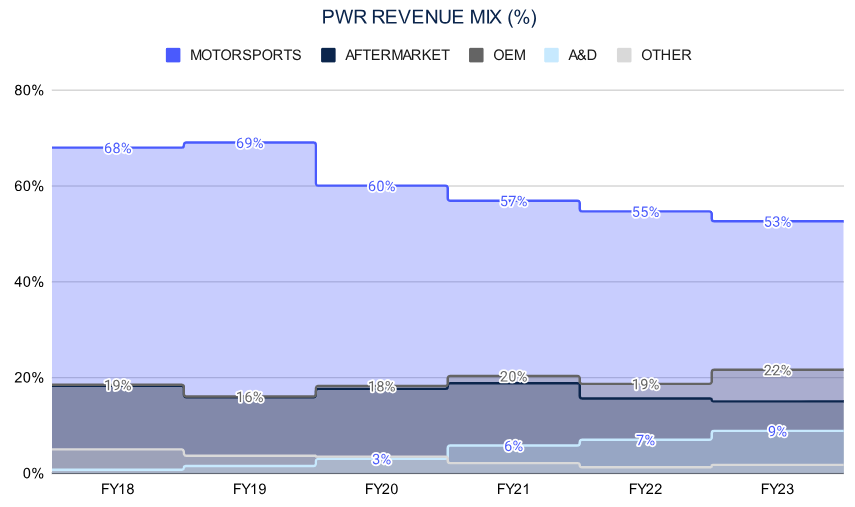

The company's growth story is marked by strategic diversification. Initially centred on motorsports (in particular Formula 1), PWR expanded into programs servicing OEM, Aerospace and Defence (A&D) customers by adapting their technologies to meet the complex demands of these varied sectors.

Financially, PWR has demonstrated significant growth and profitability, with reported revenues of $118.3 million and a net income of $21.8 million. This financial health reflects their ability to scale effectively across diverse markets.

PWR's global expansion has been a key element of its success. Notably, the acquisition of US-based C&R in 2015 (now PWR North America) marked a major step in strengthening their presence in the American market, including access to military sectors. This strategic move enhanced PWR's market share, diversified its product line, and broadened its customer base, positioning it well for continued growth.

Over the past five years, the company has grown its A&D revenues to ~9% of its revenue base, while maintaining 10-15% top line growth in both its Motorsport and OEM segments.

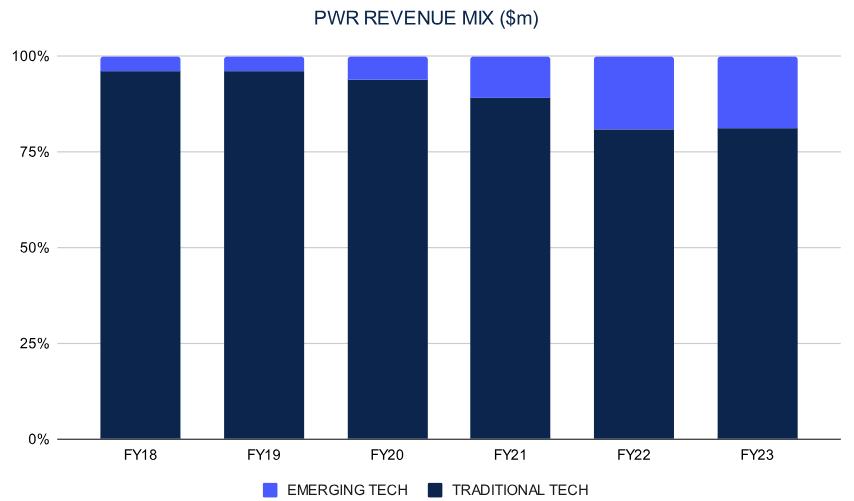

The strategic vision and commitment to innovation by Kees Wheel and PWR's leadership have been crucial in navigating market changes and technological advancements, solidifying PWR's status as a leader in high-performance cooling solutions. Since 2018, they have grown their emerging technologies segment by over 60%, to ~20% of their total revenues - a significant extension of their core customer base.

PWR's transformation from a specialised provider into a global leader in advanced cooling technology is a testament to the effectiveness of strategic diversification and innovation-led growth. PWR is well-placed to capitalise on emerging markets, particularly with the rise of electric vehicles and renewable energy.

Niche domination as a path to expansion

Companies such as these demonstrate the ability to not only dominate a niche but also expand beyond it, presenting attractive investment options over the long term. However, it's common for investors to overlook the extensive potential of TAM and the strategic benefits of niche dominance, leading to premature underestimation or undervaluation of investment opportunities.

Niche dominance is a key indicator of a company's potential for significant growth, and more often than not cannot be fully appreciated ahead of time.

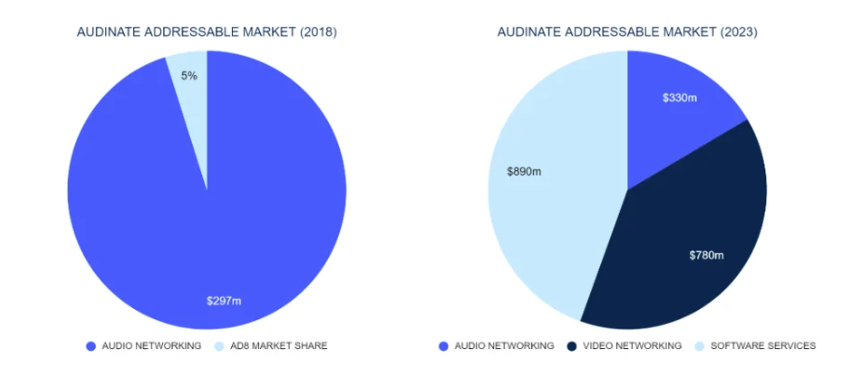

Take Audinate, for instance. At its IPO, its TAM seemed confined to professional audio networking. However, its Dante technology, enabling synchronised, low-latency audio over networks, had broader applications in the industry where the video is a natural extension to their offering, and the ability to own and control the AV experience, which was initially overlooked.

Similarly, PWR initially targeted the high-performance automotive cooling market, with many analysts highlighting the maturation of their opportunity within the F1 motorsports segment. Yet, their expertise allowed them to venture into aerospace, defense, and other industries, significantly enlarging their TAM.

These examples illustrate how companies can surpass initial TAM expectations through innovation and market adaptation. Dismissing these companies based on initial TAM assessments risks overlooking their capacity for market penetration and innovation.

Crucial to this expansion is visionary leadership, often found in founder-led companies. Such leaders possess the vision and execution skills to extend beyond initial market boundaries, exemplifying the impact of enduring, high-growth strategies. Quality management teams can identify and seize new opportunities, illustrating the transformative impact of effective management on market expansion.

This narrative teaches investors and analysts a crucial lesson: small markets can grow substantially, and niche dominance can lead to significant market expansion. Companies with strong, visionary leadership, even if seemingly expensive in the short term, can offer substantial long-term gains. Audinate and PWR are a testament to this, showcasing the immense potential of businesses that strategically grow beyond their initial niches.

Quality-Growth approach in practice

Audinate and PWR exemplify the quality-growth approach, where a firm’s commitment to excellence in a niche lays the groundwork for sustained growth. By maintaining a focus on high-quality products and services, these companies have established strong foundations that support long-term growth.

For investors, understanding the dynamics of niche domination is crucial. Companies that excel in a niche market often possess unique capabilities that give them a competitive edge. This specialisation can lead to higher profit margins and a more dedicated customer base. However, the real investment potential lies in their dynamic capability to scale these advantages into broader markets.

A key aspect of their success is the ability to reinvest profits effectively. Both companies have demonstrated a knack for channelling their earnings back into their businesses, fueling innovation, and expanding their market reach. This reinvestment strategy not only fortifies their current market position but also provides the resources needed to explore new opportunities.

While niche domination can be a powerful strategy, it also carries risks. Market dynamics can change rapidly, and what is a lucrative niche today might become a saturated or obsolete market tomorrow. Identifying which companies continuously innovate and adapt to stay ahead is key. Moreover, expanding beyond a niche requires careful strategic planning to avoid overextension or dilution of core competencies.

The power of niches

The success stories of Audinate and PWR exemplify the immense potential of excelling in niche markets. Their paths demonstrate how mastering a niche, coupled with focused innovation and strategic growth, can be a powerful driver for widespread business success in today's competitive marketplace.

Starting in specialised market segments, these companies' pursuit of growth through innovation has not only built deep expertise and brand recognition but also fostered dedicated customer bases. Importantly, they also recognised the value in extending beyond their initial market confines, showcasing the importance of adaptability and strategic foresight in expanding into new market segments and products - a dynamic capability.

Dominating a niche is a strategy that can pave the way for broad growth and enduring success. The journeys of Audinate and PWR highlight the power of niche market mastery and its strategic use as a springboard to explore and conquer new business territories. These case studies offer a blueprint for success, blending deep expertise with strategic growth, and a continuous commitment to quality and innovation.

4 topics

2 stocks mentioned