The RBA did not consider a cut at its June meeting - but it did consider a hike

A quick glance at the data the RBA eyes most closely suggests the soft landing is still in sight. The unemployment rate is at 4% and the Australian economy is still creating jobs. The most recent monthly inflation indicator reading was 3.6%, labour productivity is not improving, and the cost of hiring (through wage inflation) is continuing to moderate. And while the headline figure is not 2-3%, the disinflation trend is (for the moment) intact.

But on the flip side, the central bank may find that it has a big growth problem. Q1 GDP came in at just +0.1% quarter-on-quarter. That is dangerously close to fulfilling one-half of the traditional definition of a recession. In addition, retail sales grew just 0.1% month-on-month at the end of May.

Given consumer spending drives approximately 50% of the Australian economy, this is a major signal that interest rate hikes are having a big impact on us all.

It's already acknowledged that the RBA will likely be the last major central bank to start cutting interest rates - but now the question has to be asked, will its first cut be too little too late? In this wire, we'll analyse the latest RBA decision - its fifth consecutive hold - and try to answer some pressing questions.

Four key takeaways

1) "Inflation remains above target and is proving persistent."

You know it's a thorny issue when the RBA changes the first heading of its statement. Six weeks ago, the first heading was: "Inflation remains high and is falling more gradually than expected." This month, it's "inflation remains above target and is proving persistent." Does this mean the RBA is even more worried about inflation than we are giving them credit for?

2) "While recent data have been mixed, they have reinforced the need to remain vigilant to upside risks to inflation. The path of interest rates that will best ensure that inflation returns to target in a reasonable timeframe remains uncertain and the Board is not ruling anything in or out."

Speaking of this, there were substantial changes made to the final paragraph of the statement - even if the now-famous phrase "not ruling anything in or out" remains.

The sentence we've highlighted reinforces just how much the RBA needs to keep its neutral tone and its optionality bias. Having said that, they also added an extra half-sentence at the very end of the last paragraph, saying that the Bank "will do what is necessary to achieve that outcome" [returning inflation to target].

It emphasises how resolute the RBA is to defeating inflation - but perhaps also how worried it is about even the slightest additional upside inflation surprise.

3) "Recent budget outcomes may also have an impact on demand, although federal and state energy rebates will temporarily reduce headline inflation."

Governor Michele Bullock has already said that the rebates could shave off as much as 0.5% from headline inflation in the short term.

"It is helping people who clearly are hurting at the moment. But I don’t think it’s material in terms of our forecast for inflation," she said during her recent testimony to the House of Representatives Economics Committee.

If that's right, then the RBA will see inflation come tantalisingly close to its target band. The only problem is that rebates don't stick around forever - and the underlying inflation trend doesn't change just because a one-off rebate is implemented.

Further, as CEDA has pointed out, the government has far more levers than the RBA does in dampening inflation over the long run.

4) "Conditions in the labour market eased further over the past month but remain tighter than is consistent with sustained full employment and inflation at target."

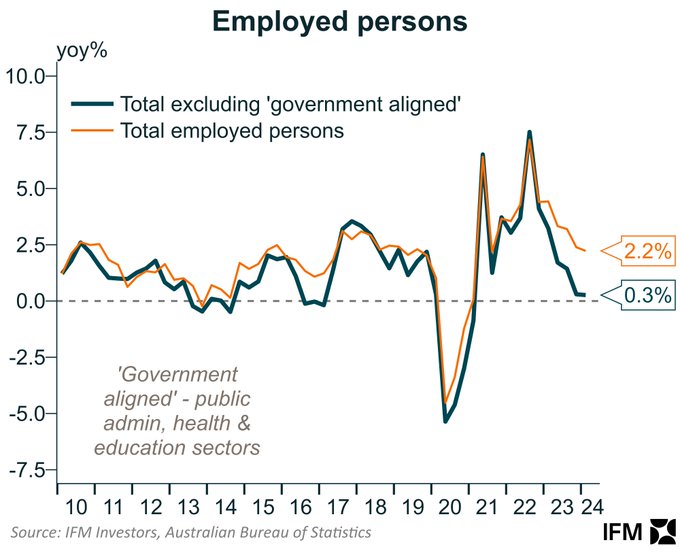

Past wires from our contributors have discussed how sluggish productivity growth is not good for inflation. And while the headline unemployment rate is rising, the real story may be that no one (apart from the public service) is actually doing the hiring - as IFM Investors Chief Economist Alex Joiner's chart shows:

Livewire asks the Governor

Once again, Livewire was part of the press consortium quizzing the RBA Governor. Even before we asked the Governor our question, she had this to say:

"We still think we're on the narrow path [to a soft landing]. It does appear to be getting a bit narrower. We need a lot to go our way if we are going to bring inflation down to our 2% target range."

Can you say nervous?

For our part, Sara Allen was our representative and asked this question:

"There are increasing signs of global recession risks like weaker US growth figures. Are you concerned about a domestic recession?"

This is how the Governor responded:

"Interestingly, I think the world economy has probably troughed now. We think it won't go down further. The point of the narrow path is to try to avoid a recession here and that's still our aim. The aim is to bring inflation down and to try to maintain as many of the employment gains as we can and keep employment growing to the extent we can. That's not a recession and that's not what we're aiming for. I would say that that's not what we're going to see but as has been brought up by others, there are some risks on the downside so we need to be alert to them and if they are materialising, that's when we have to think about whether we need to loosen monetary policy."

3 topics

1 contributor mentioned