The RBA’s window to hike interest rates

Jamieson Coote Bonds

The Reserve Bank of Australia’s (RBA) balance sheet tightening in 2023 may frame its window to hike rates, since it gives a natural pause to see the effect of quantitative tightening (QT).

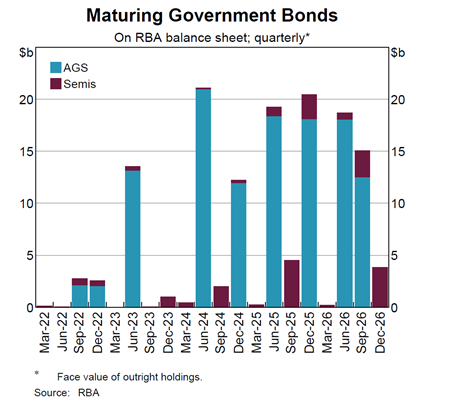

The chart of the RBA’s maturing government bonds on the RBA balance sheet, published on 2 February 2022 in Governor Lowe’s Year Ahead speech, shows the maturity of 2.5 billion government bonds in September 2022 and a little over 2 billion in December 2022 vs. a 644 billion balance sheet size. We can discuss the effect of stock vs flow to death, but we do not think 2022 maturities should affect rates markets that much vs. other macroeconomic factors. The big balance sheet shrinkage will occur in the middle of 2023, when over 20 billion of the RBA’s bond holding will mature and over 80 billion of Term Funding Facility (TFF) is to be repaid, for a total of 100 billion of QT.

The RBA can decide to re-invest to smooth out the lumpy maturity profile or to control the speed of balance sheet tightening, but TFF repayment still dominates over the next few years.

Where this natural QT timeline should matter is twofold:

1. The tactical window in which the RBA can hike rates.

Governor Lowe alluded during his Q&A on 2 February, that if he waits longer, then he would have to hike rates at a faster pace. So, there are two choices of hiking styles here. Either the RBA begins the first hike early and hikes at a slower pace, such as a 25 basis point hike per quarter, or it waits for the first hike rather late in 2022, and then hikes at a faster pace, such as a 25 basis point hike at each meeting. JCB believes that it is very natural to pause the hiking cycle in the second quarter of 2023 to see the effect of QT from TFF repayment and bond maturity. It also gives the RBA time to assess the effect of rate hikes so far and the sustainability of inflation.

If the RBA waits for the wage price index to be released on 23 February and 18 May, together with other wage-related data, it can hike rates as early as June 2022. Rate hikes of 15 or 35 basis points in June, then 25 basis points each in September, December, and a March 2023 hike will get the official cash rate to 1-1.25% by March 2023. If however the RBA waits until August 2022, then hikes at each meeting after that, then it can get the official cash rate to 1.50-1.75% by March next year.

In either case, the RBA has a chance to get the official cash rate to 1.25% over the next 12 months, then a natural pause − not only to see the QT effect, but also to see how the economy responds to the 1.25% official cash rate, which is the neutral interest rate that Westpac and CBA published last year as a rate to get monetary policy back to neutral. This could bring household debt service (principal plus interest) as % of income, back to the high levels seen in 2015-2017.

JCB prefers the first hike earlier at the slower pace. There is no reason that the official cash rate should be at zero in the current economic environment. An earlier start could give more flexibility later on. It can help to generate lower volatility in the bond market and bring the market pricing closer to where the RBA thinks bond markets should price sooner.

The second faster style may generate higher volatility later in the year (late 2022 or early 2023). JCB believes June 2022 is possible because the RBA will get the CPI data in late April and wage data in February and May.

2. Banks’ Exchange Settlement Accounts (ESA) balance will fall naturally by the middle of 2023.

ESA has replaced Australian Commonwealth Government Bonds (ACGB) and Semis in the banks’ High Quality Liquid Assets (HQLA) holdings. So, the banks’ balance sheets will have to replenish them sometime in 2022 and early 2023. We think this will coincide beautifully with the possible peak in yields and is very supportive of ACGB/semis in general.

If the investment strategy of 2021 had been to underweight duration, then sometime this year will be a fantastic opportunity to replenish the underweight or go overweight duration in ACGB and semis.

Jamieson Coote Bonds (JCB) is a specialist investment manager of domestic and global high grade bonds including a global absolute return strategy. Stay up to date with our latest insights by following us on LinkedIn, or visit our website for more information.

3 topics

Kate oversees a range of investment strategies for JCB clients and is based in Singapore. She is a career fixed income portfolio manager, and specialises in High Grade Bond portfolio management across all major global regions.

Expertise

Kate oversees a range of investment strategies for JCB clients and is based in Singapore. She is a career fixed income portfolio manager, and specialises in High Grade Bond portfolio management across all major global regions.