The real estate business that’s been a better investment than buying a house in Sydney

The headline numbers may not excite but despite one of the fastest rate hiking cycles in decades REA Group (ASX: REA) has reported a commendable result that was bang in line with consensus.

The group managed to scratch out 1% revenue growth with earnings per share down 9%, despite cycling an incredibly strong listings environment in FY22. The balance sheet is bulletproof with net debt at $59 million.

The outlook for new property listings is rapidly improving. In May, new listings returned to growth for the first time in 16 months. Post the end of the financial year, July listings in Sydney and Melbourne grew 9%. This is unexpectedly strong and is important as these markets have the greatest housing density but also because these markets typically lead the country.

The CEO advised he sees "healthy growth in 2024" which will be aided by a 13% price rise pushed through

in September.

.jpg)

But first, some background

We have owned the stock for over 10 years. At the time, the company was constantly labelled as expensive and had very little institutional ownership. We were attracted by its ROE, dominant standing in a duopoly Australian market, very strong balance sheet, and long-term tailwinds for the underlying market it operated in. Plus, management has been very impressive.

What you need to know off the back of REA's result

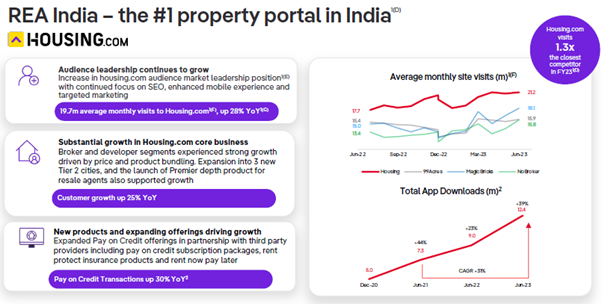

The standout result (and an increasingly interesting component) was Housing.com, REA’s India operation. Revenue growth was up 46% YoY with the platform reporting 1.3 times more average monthly visits than their nearest competitor, making them the No.1 property portal for home buyers in the country. I think it’s fair to say that REA’s investments offshore have been a mixed bag and we have questioned the logic in the past. But this investment, now 78% owned and on the path to breaking even in what is a massive, technology-savvy market has a lot of blue-sky potential.

The key disappointment was probably Move.Inc which struggled in what is likely a pretty unusual US market environment. Despite posting over US$600 million in revenue the group still reported a small loss.

There are both headwinds and tailwinds for REA

Sydney and Melbourne-based listings are increasing according to REA’s July reports, and these two major cities generally lead a rise in listings nationally. Price increases from September 2022 and an increase in listings should provide revenue growth for the year ahead. Management is using flat listings volumes for the coming year which feels conservative.

The biggest risk for REA in the near term is a surprise inflation uptick and a resumption of rate rises in this cycle. Changing rates lead to uncertainty and as we have seen over the past 12 months, fewer people are transacting on property.

We have a hold on the stock off the back of that result

We are holding the stock. The share price has bounced hard off its 2022 lows and now looks about fairly valued versus its historical multiple on a forward EV / EBITDA of 23 times. After a torrid few years of listings, with the housing market swinging around all over the place, we believe conditions should calm with strong long-term fundamentals continuing to attract. If you are selling your house somewhere in Australia and not using REA there are now 6.8 million Australians looking to buy who don’t know its for sale.

With 1.5 million people set to move to Australia over the coming five years, it is inevitable we will have significantly more dwellings around the country and ever-increasing numbers buying and selling.

Catch all of our August 2023 Reporting Season coverage

The Livewire Team and our contributors are providing coverage of a selection of stocks this reporting season. You can access other reporting season content by clicking here.

3 topics

1 stock mentioned