The real reason why stocks rallied in July - and whether it can last

Inflation is the buzzword of our present time in the markets - and with good reason. After years of central banks suggesting that price rises would be transitory and limited in nature, the rising cost of borrowing and living is heading north. In turn, asset prices are heading in opposite directions. Equities and property prices are lower, while the bond market is looking attractive for the first time in many years. In fact, the Australian 10-year note is now attracting a 3.1% yield. The last time we saw that happen was in 2015.

But could we - even the money printers - have seen this coming?

There is no doubt that inflation's surge caught out more than a few investors. The question now is when those price rises will begin to ease and, after that, when will interest rates begin to cool down? It is here that we find the crux of this wire: interest rate expectations.

In this wire, we'll discuss the following (with the help of Market Economics' Stephen Koukoulas, City Index's Tony Sycamore and PIMCO's Adam Bowe):

- What interest rate expectations are

- Why have they changed so dramatically, so quickly?

- What impact do they have on the markets?

- Where do we go from here?

But before we can do any of that, we have to introduce you to the most important chart for this story - the ASX OIS curve.

One of the most important charts around

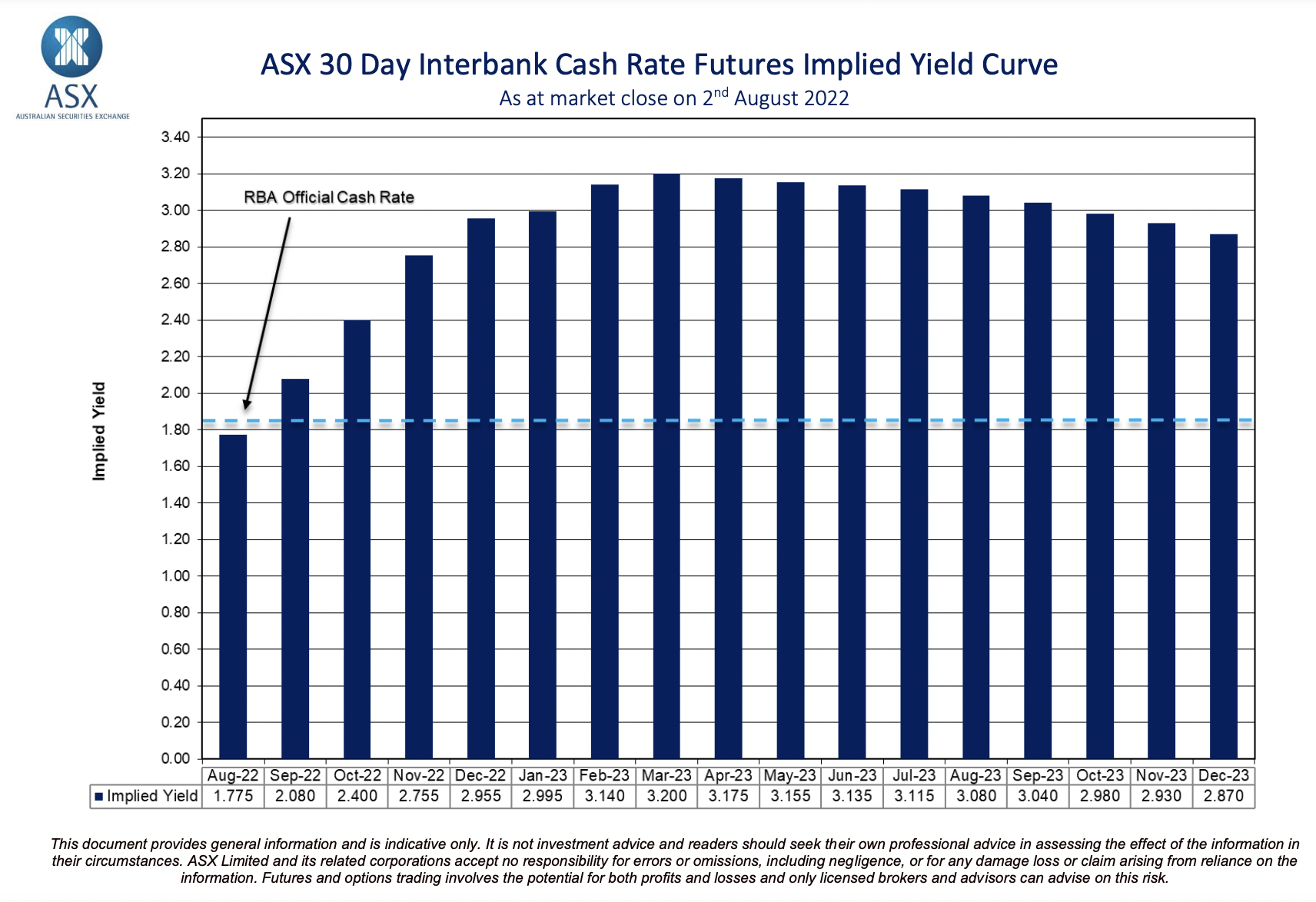

This is the ASX OIS curve. OIS stands for "overnight indexed swap". In Australia, the "overnight" rate is what the rest of us call the cash rate - or indeed, the starting point for the eventual interest rate you pay on your mortgage or earn on your savings account.

You should also know that this swap rate is actively traded during the day by people with a lot of money (and for that matter, guts). This fact will become more important as our story develops.

There are three things to watch on this graph:

- The actual RBA cash rate (that's the light blue dotted line)

- The implied yield table at the bottom of the chart, and

- The actual shape of the bars on the chart (this is the actual curve, in the "OIS curve" term)

At the moment, the traders are betting that the RBA's interest rate hiking cycle will peak in March next year. You can see this represented because 3.2% is the highest figure currently in the "implied yield" table. You can also see this represented in the shape of the curve (it peaks in March 2023 and then flattens at the end of next year.)

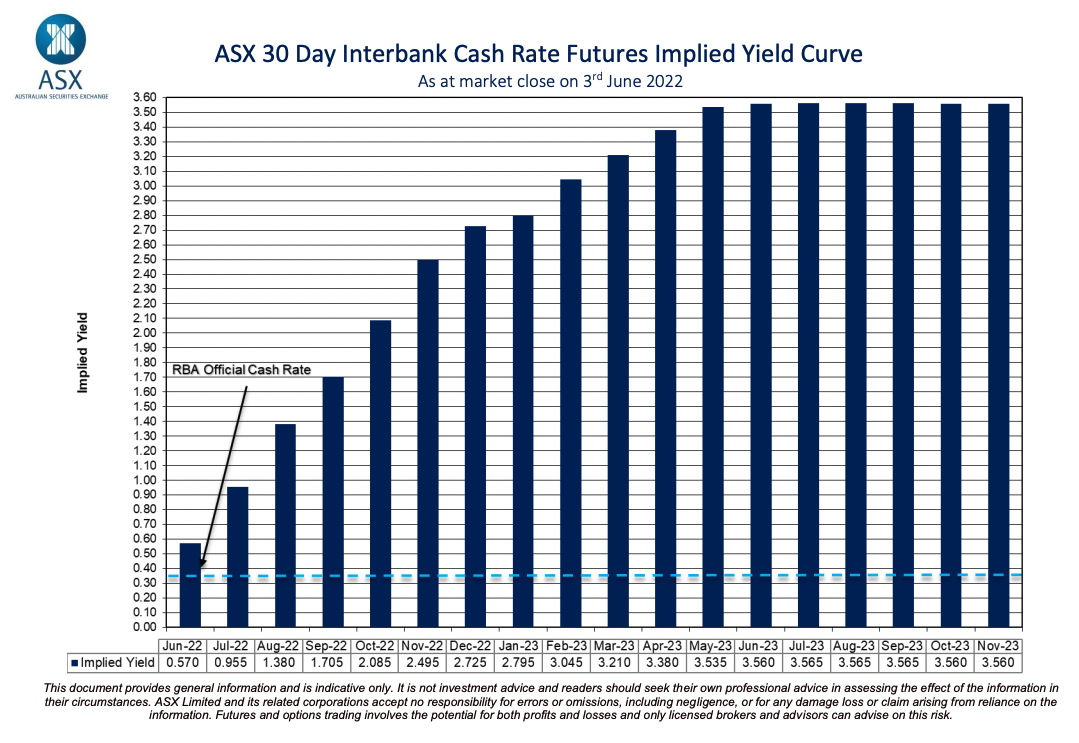

But it was not always like this. The next chart is the same instrument just two months ago (June 3rd market close, to be precise). Look closely at the change in the curve between now and then.

Why so dramatic?

Well, dear reader, this is the subject of our wire from here on in. The changes have been incredibly dramatic as traders alter their expectations for where they think interest rates will be at certain points in the not-too-distant future. The root cause of these changes, according to Tony Sycamore from City Index, stems from the changing face of data.

Interest rate expectations have repriced lower over the past six weeks, as various leading indicators (global PMIs, consumer confidence) show that the global economy is slowing.

In addition to the data, central banks continue to hike interest rates aggressively even as geopolitical issues continue to bubble in the background (Ukraine, China, etc.)

Finally, the price of crude oil has come down. Crude oil is considered to be a direct bet on the global supply and demand situation.

If we are going into a global recession based on a surging cost of living, people may not be heading out on long drives again (or not be able to afford to).

These fears have been accompanied by moves from the OPEC+ cartel to increase production. As a result, the price of WTI crude oil futures has decreased by 25% since its highs in mid-June.

In fact, we're now looking at a sub-$90 oil price. That's great news for motorists, and in turn, the rampant pace of inflation. All this is further depressing expectations.

The same can also be said for a range of other agricultural and hard commodities - including lumber where futures prices have cratered in recent months.

For Stephen Koukoulas of Market Economics, it's not just about the rate hikes but the timing of those rate hikes (what the professionals call "the cycle"). While consumers may still be paranoid about future rate hikes, the indicators are slowly showing we may be near a turning point in inflation.

We're about halfway through the tightening cycle. Markets are forward-looking and the interest rate hikes are working.

Central banks are getting closer to achieving their objectives. If they achieve their objectives earlier (by the end of calendar 2022, instead of calendar 2023), then that by definition means they don't have to hike as much.

What does this do for the Reserve Bank?

When the Reserve Bank hiked its key interest rate by another 50 basis points earlier this week, it marked the fourth monthly increase in a row. It also brought the cumulative hiking total for this year to 175 basis points. As households and investors alike are now learning, these moves are quite steep and the anticipation of more hikes is directly changing consumer expectations as well.

If you can't afford the extra $100 on your repayments, the announcement effect is just as important as the cash flow effect.

Stephen has long been on the record, arguing the Reserve Bank started hiking interest rates and withdrawing its pandemic stimulus measures way too late. In fact, it was so late that rates traders (i.e. the people who control the ASX OIS curve we alluded to earlier) began not to believe them after a while.

Now, Stephen says, the monetary authority has had to acknowledge the power of the traders.

The RBA has acknowledged that they will and are paying more attention to the futures market when they set interest rates.

They don't want to shock the market ... they can influence market expectations as well as look at market expectations to see what the market is telling us about the outlook for inflation.

Adam Bowe at PIMCO says the Reserve Bank should be the much larger force on interest rate expectations through tools like forward guidance. But the last two years have proven to be very different.

They have had some communication challenges over the last six to 12 months. And they're going through a phase of rebuilding that policy tool's effectiveness.

Now, the outlook is far more uncertain and the path for monetary policy is looking muddier. After a period of saying interest rates would not likely rise until 2024, the RBA has replaced its medium-term thinking with simple guidance that rate hikes are necessary but will likely be uneven in nature. Adam says that creating this flexibility will be vital.

They have to give themselves some optionality - and the RBA did that earlier this week. They said that rates will move higher but not on a pre-set path, giving them some optionality to go a little quicker or slower depending on how the environment turns out.

How does the curve affect my investments?

Put simply, changing rate expectations were the biggest reason that global equity markets (including Australia) experienced such a massive rally in July.

But be warned - as Tony points out - we've seen this story play out before:

The accompanying retracement in yields has supported the sharp rally in stock markets, providing the latest example of where bad news becomes good news.

While we are open-minded that the rally may extend another 2-3% higher, we would be cautious about chasing the rally into the above headwinds. Furthermore, we do not expect equity markets to make new highs until midway through 2023.

Despite being an economist, Stephen also looks closely at the public markets. He says a terminal (endgame) rate of 3%+ instead of 4%+ has the power to change the narrative. But, of course, before you can go to the conversation on rate cuts, you still have to overcome the rate hikes.

That sentiment effect can be quite potent... even if a 3% cash rate is another 100 basis points away and multiples on your mortgage.

July's market moves were also volatile in the US. The stateside 10-year yield collapsed from a peak of 3.1% to finish the month at just 2.64%. From here on in, Adam argues that investors' investment strategy will come down to where "neutral" is.

The way I think about policy is to start off with where neutral is. We look at places like Australia and a lot of the developed markets, we think neutral is at 2.5% plus or minus. We use that as our longer-term secular anchor.

If you think in terms of the RBA, the last time we saw a 4%+ policy rate was during the hiking cycle after the GFC. The reality is since that time, the banks have widened out their lending margins to the cash rate. China is growing at roughly a third of the pace, and household balance sheets have levered up by 25%.

In short, this time is very different. A 4% cash rate is seen by most professionals as restrictive. But even a 3% cash rate has a serious impact on first home owners who until now have never seen an interest rate increase. Most importantly, if this is the stress of 2022, one can only imagine what the challenges will be like for households and investors in 2023.

Never miss an insight

If you're not an existing Livewire subscriber you can sign up to get free access to investment ideas and strategies from Australia's leading investors.

I'll be in charge of asking the questions to Australia's best strategists, economists, and fixed income fund managers. If you have questions of your own, flick us an email: content@livewiremarkets.com

3 topics

2 contributors mentioned