Sometimes the safest thing to do is nothing

Morphic Asset Management

As most of you will have noticed, global share markets have been very turbulent, and sharply down this month. Our view is that this does NOT mark the end of the bull market we have seen since we launched the Morphic Global Opportunities Fund in 2012. In consequence, we remain fully invested and have increased our holdings in selected over-sold stocks.

Figure 1 – Global markets in Australian dollars (NDUEACWF in AUD) for last 12 months

Source: Bloomberg, Team Analysis

Our confidence springs from three factors:

- Strength in the underlying global economy

- Low contagion risk to the financial system or the real economy

- Technical elements to the sell-off

Global Economic Strength

Concluding our recent half-yearly report to our investors, published in mid-January, we said:

when the real economy (as opposed to the financial economy that markets operate in) gets momentum, that momentum is hard to break – like a supertanker.

Risks? A recession in 2018 remains unlikely. If we were to nominate a risk, it is that the financial economy fails to adjust in an orderly manner to reflect the changed (stronger) real economy.

This could cause a bond market rout as investors get excessively concerned about inflation, which contaminates other assets. But we see this as unlikely at this stage – and it would probably be a mistake to position for it before late 2018.

Since then, economic data from most major economies has surprised positively. In the US, for example on Friday, December employment data was much better than expected and yesterday the broadest measure of business confidence, the so-called Non-Manufacturing Purchasing Manager Index, reached its highest level in a decade. Similarly strong signals of a sustainable growth pick-up can be seen in Japan, Europe, and most major emerging markets.

Although corporate earnings don’t always go hand in hand with economic trends, in 2018 we are seeing a simultaneous pick-up in earnings projections for the year ahead after 2017 that generally proved better than expected.

The risk of all this, as we alluded to in our half-yearly report was that global bond markets would over-estimate inflation pressures. A bond sell-off, which is reflected in sustained higher yields, can force a repricing of equities, as investors push down their view as to ‘fair market’ price-earnings multiples.

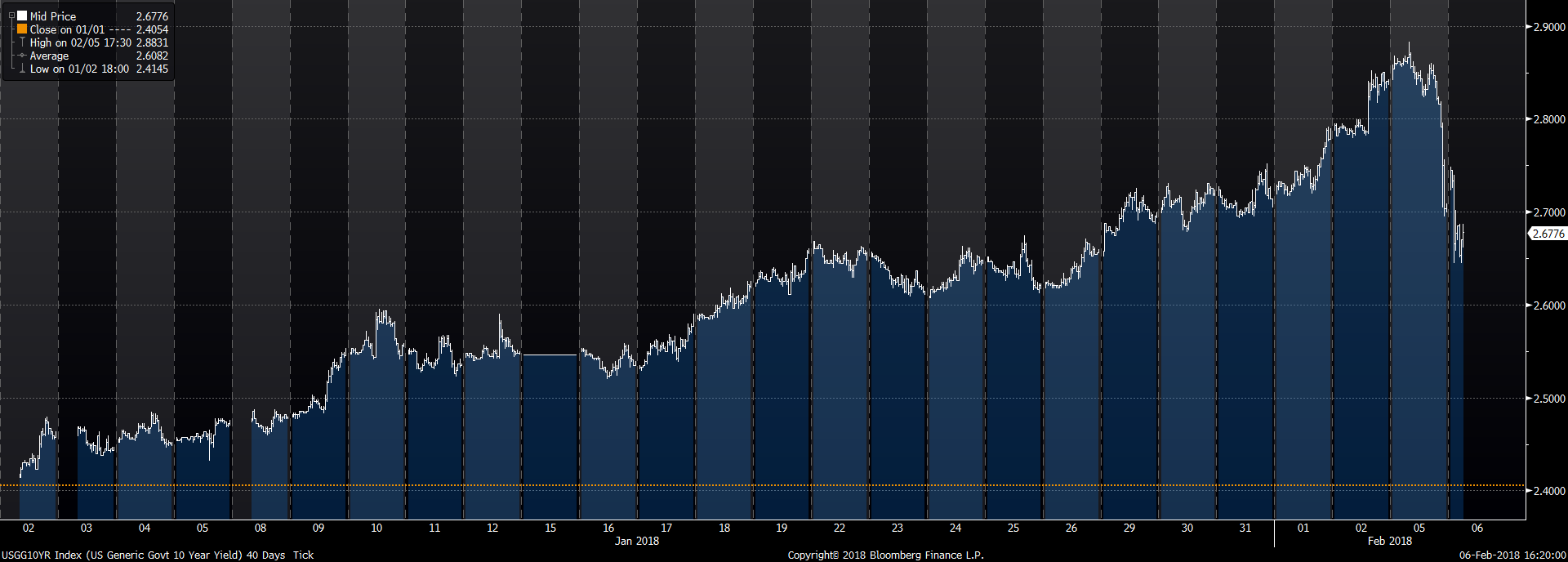

The key word here is ‘sustained’. In our view, the market is already (and correctly) having second thoughts about inflation risks. US 10 year treasury bonds where the yield peaked at just under 2.88% on Friday, from 2.43% on January 1 are now back to 2.69%.

Figure 2 – US 10 year treasury yields, Year to Date

Source: Bloomberg, Team Analysis

Low Contagion Risk

Most investors are hyper-aware of the most recent market sell-off. In this context, it is not unnatural for people to worry about a repeat of the global financial crisis of 2007-2009.

A key feature of that event was the way a doubling in interest rates over four years led to the unwinding of excess valuation in a single asset, US housing, exposing systematic weakness in global financial institutions. This caused a collapse in credit availability feeding back into the real economy, before opening up secondary fissures such as the European peripheral debt crisis.

Today banks globally are much better capitalised. Strict limits on the kinds of risk they can take also create a powerful ring-fence against this kind of negative feedback loops. Reflecting this, global liquidity remains ample.

Unique Technical Aspects to this sell-off

The steadiness of the bull market has pushed a small set of investors into dangerous assets. In our half-yearly report, we referred to the crazy bubble surrounding crypto-currencies like Bitcoin. Since then Bitcoin has halved.

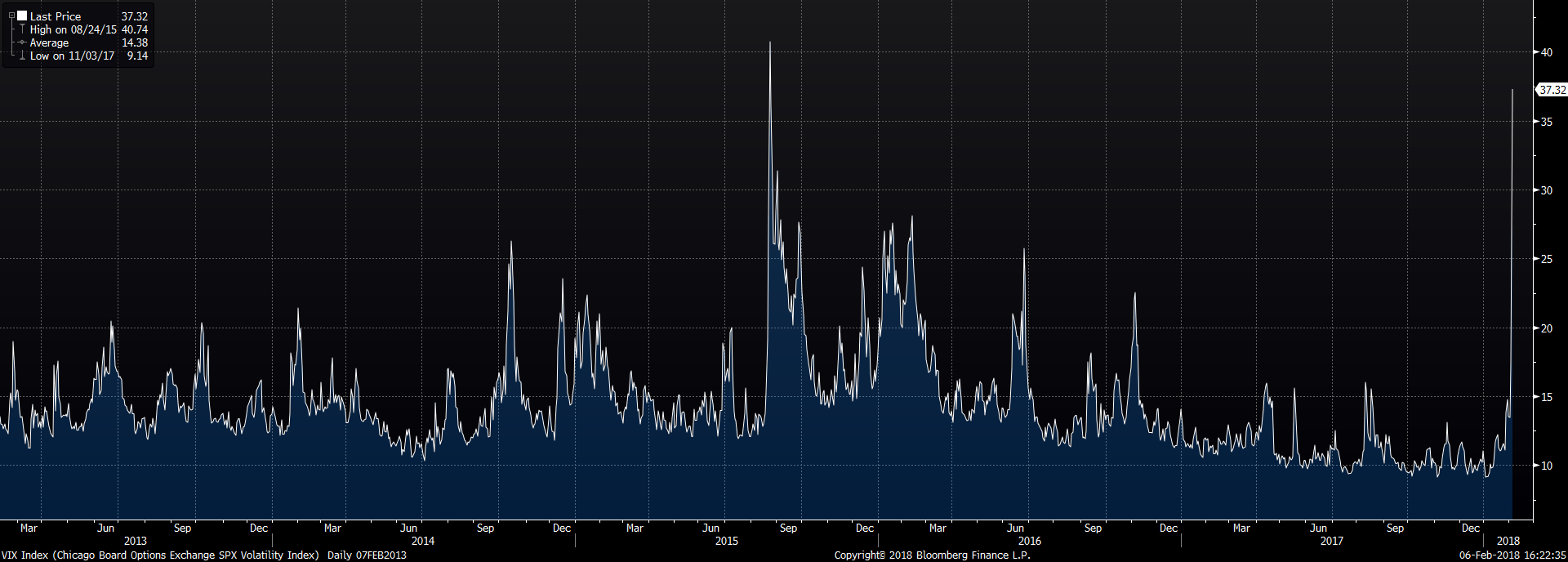

A less remarked upon high-risk activity was investors betting that market volatility would stay low, and consistently prove lower at the end of each month than feared at its beginning. As money poured into complex funds that replicate this and similar strategies, the markets ability to absorb a change of sentiment has proven very limited.

This has resulted in a much greater surge in the so-called Volatility, or VIX index, (also known, more poetically as the “fear” index) that can be justified by underlying market movements.

Figure 3 – VIX Index over the last five years

Source: Bloomberg, Team Analysis

We believe the limited liquidity of these fairly obscure markets will result in a ‘cleansing’ of this kind of activity from the system. As volatility returns to more normal levels, as it nearly always does, stock market stability and recovery will follow.

Conclusion

Sometimes the hardest – but the safest – thing to do is nothing. Until we lose faith in the points above, we are not going to engage in panic liquidation – as some of the complex funds we refer to above are doing.

When the dust settles, as long as global financial institutions stay robust, the prospects of impacts on the fundamental economy are limited. Not only will stocks bounce back, but we expect them to go to new highs, supported by the strong economic and earnings background. A less skittish bond market, may settle at higher levels, but not so high as to unravel global growth, corporate earnings or investor views as to fair value.

For further insights from the team at Morphic Asset Management, please visit our website

3 topics

Jack co-founded Morphic Asset Management in 2012. As a stock picker Jack has invested in a variety of markets and sectors, but developed in-depth knowledge of markets in Asia-Pacific region as well as global finance and resources sectors.

Expertise

Jack co-founded Morphic Asset Management in 2012. As a stock picker Jack has invested in a variety of markets and sectors, but developed in-depth knowledge of markets in Asia-Pacific region as well as global finance and resources sectors.