The rise of sustainable investing

Global X ETFs

There has been an increasing

demand from socially and environmentally conscious investors for

sustainable investment options. One of the big areas to focus on is renewable energy and battery technology.

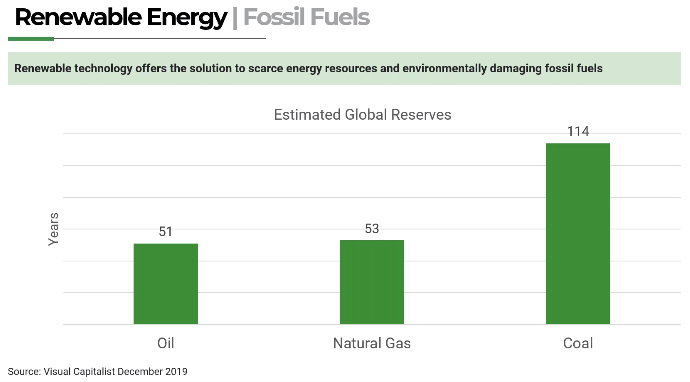

So why do we need renewable energy? I'm sure we're all aware of the negative environmental impacts of burning fossil fuels. But if these environmental impacts weren't already enough of a reason for global governments to make a shift away from fossil fuels, the fact that these resources are finite certainly is. There's only around 50 years' worth of oil and natural gas reserves left in the world, and 114 years worth of coal reserves.

The scarcity of fossil fuels, combined with these negative environmental impacts, and the declining costs of renewable power is displacing coal, oil, and gas. So, what are the sustainable solutions to fossil fuels? Renewable energy is the answer here, and this includes the likes of wind and solar energy.

We're already seeing a use of wind and solar farms around the world, and we can expect this to continue to increase as their capacity and reliability really starts to grow. Just to give you an example, looking at wind energy, by 2025, a single 300 metre diameter wind turbine could produce enough energy to power a small town. So, you can imagine how much energy an entire wind farm could generate.

Now, solar energy is also increasingly used and this can be used both within individual households and on a much larger scale.

And this is why solar will account for 50% of the growth in renewable capacity by 2023.

But wind and solar energy can be unreliable. So, what do you do when it's not windy and it's not sunny? Well, this is where battery holds the key.

Batteries create reliability to renewable energy sources, and in the future, it won't just be your phone that's powered by batteries, but our cars, our homes, and our cities too.

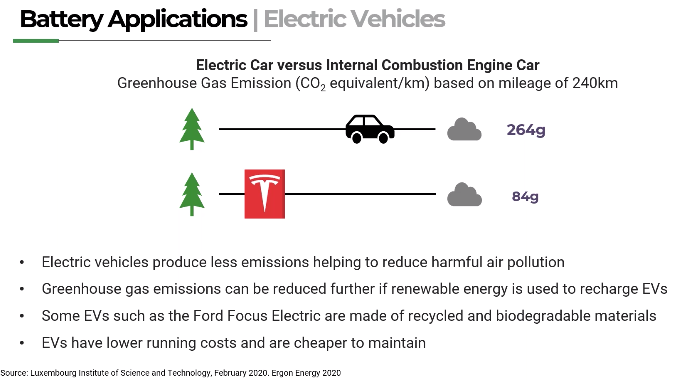

And batteries really have a wide range of applications. Where we are now, battery is being used primarily to power the likes of our phones, our laptops, and our iPads. But we're starting to see more and more electric vehicles on the road. Primarily just in cars, but, we will start to see this transition to things like buses, and larger vehicles, too. Tesla's recent release of their cyber truck is an example of the shift into new areas away from the traditional battery technology uses.

There are a number of factors driving the demand for electric vehicles and with them the demand for batteries.

- Technology - Battery technology keeps improving, with new types and better capacities hitting the market each year. Speeds are also rising. A lot of the reasons that investors previously didn't use electric vehicles such as those long charging speeds are diminishing, so that's why we're starting to see the demanding creeks.

- Policy - Global policymakers are also pushing the auto market towards lower emissions, so 13 countries and 31 regions and cities have already announced plans to phase out internal combustion engines.

- Economics - By the mid 2020s, electric vehicles will reach upfront price parity with internal combustion vehicles across most segments.

- Manufacturers - Automakers are increasingly investing in electric and hybrid vehicles to meet both their long-term climate commitments and their near-term policy requirements as well.

- Lithium-ion prices - And the final factor, which is particularly important, is the falling lithium-ion prices. Now, lithium-ion battery prices fell 87% between 2010 and 2019. And new technologies will continue to push these prices lower.

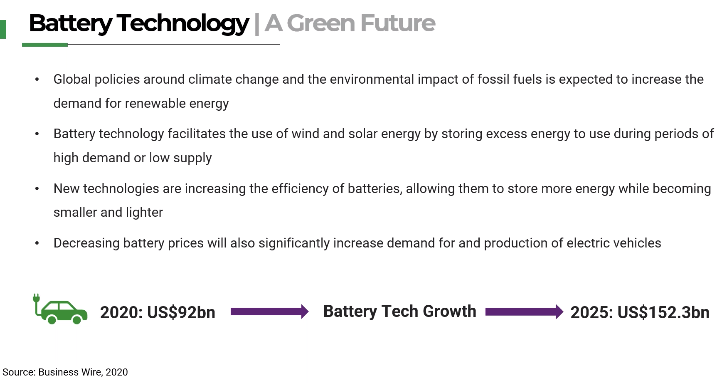

Over the next five years, the battery technology market is set to increase from US$92 billion today, to over US$150 billion by 2025.

There are a number of ways investors can gain exposure to the battery technology market, but one of the most simple and efficient ways of gaining exposure to this theme is through a battery technology ETF, such as the ETFS Battery Tech & Lithium ETF (ASX:ACDC). Rather than having to find and select the individual companies with exposure to battery technology, ACDC allows investors to access a basket of companies which are all linked to the battery technology supply chain, either with direct battery technology investments or through lithium producers as well.

Access to a range of opportunities

Find out how to get exposure to the energy storage and production megatrend, including companies involved in the supply chain and production for battery technology and lithium mining by clicking the 'CONTACT' button below.

2 topics

1 stock mentioned

Expertise