The role of sentiment in iron-ore stocks

In a previous wire, we asked the question: "Where is iron-ore headed from here?".

We suggested a clearing price around $100 USD/ton. The futures price hit that level last Friday, and has been testing levels around $90 USD/ton. These are marks that represent the reversal of the market to mid 2020 levels, before the October rally kicked off the bull market.

Our attention should now turn to the stocks themselves: "Where are the stocks of iron ore producers headed? Lately, down, down and then down some more.

This is natural in a sharp retreat for commodity prices. However, BHP Group is not only an iron ore miner. It has metallurgical coal, copper, nickel and oil and gas. Our concern must also be for the valuation of the underlying business, which is discounted future cashflow. That is a judgement on the range and value of future realized prices over time.

Valuations of stocks reflect more than spot values, or indeed the futures curve. They represent an estimation of the likely fair value of continued operations over some years.

So much, so obvious. Value investors are famous for saying "Now is the time to buy, when all is misery and carnage." This is the thrust of the old exhortation, attributed to Nathan Rothschild, that one should: "Buy when there is blood in the streets." That is sage investment advice on the vagaries of human psychology, so long as there is not more blood tomorrow.

Flip back to this moment in time, and we can record that the first sign of some pause in the present sell-off happened yesterday. Pauses in a general bear trend are not that unusual and not themselves indicative of an end to a down draft. The issue is investor sentiment.

Investors have a number of well known psychological bugbears. One is to sell their winners too early. The other is to let their losses run. A third is "Get-Evenitis", which is the desire to sell any losing position when it recovers the break-even level. This is called "The Disposition Effect".

Fortunately, there is a technical indicator which directly measures this effect.

The indicator is the "cost of entry" for investors in their current stock holdings. That is intuitive, since that historical price represents the break-even point for each individual investor.

If the price is above what you paid you are likely sitting happy with a paper profit.

If the price is below what you paid you are likely unhappy with a paper loss.

If the price is exactly at the level you paid for the stock, what you do next likely depends from what direction the price came to reach your breakeven. If it came from above, then you are likely as not holding a former winner, and open to buy more. If it came from below, then you are certainly holding a prior loser, and, likely as not, eager to sell out and "get out even".

Most investors I speak to about this just nod sagely and quietly say: "Yup, been there."

What is probably not widely known is that you can estimate that number from market data.

This discovery was made independently by Bing Han and Mark Grinblatt at UCLA, who are two finance professors that were researching "The Disposition Effect and Momentum", and myself, working at Credit Suisse First Boston, on estimating tax-loss selling effects. Once I had found the appropriate formula, I wrote a series of research notes, emphasizing the trading angle.

The first was titled "Market Average Profit and Loss", which described the formula. This was applied to a trading set-up in a particular stock in "CSFB Profit and Loss Monitor". Later I extended the idea to market index studies in "Reading the Mind of the Market".

While I have used this method for nearly twenty years, it is not widely known in markets.

If readers are interested, I am happy to assemble a webinar on the topic. I have done so in the past for the Market Technicians Association in the USA, and the Australian Professional Technical Analysts (APTA) association in Sydney.

If you are keen to learn more, just call out your interest level in the comment section below.

The math involved is described at the above sources. For this article, we will cut to the chase and simply state that it is an Exponential Moving Average (EMA), but with a window length that depends on the rate of turnover in the stock. In simple terms, the memory of prices is short when the turnover is high, and long when the turnover is low.

Please feel free to skip over the next slide, where I explain the math. Later, I will show some simple charts, explain what they are, and how to interpret them.

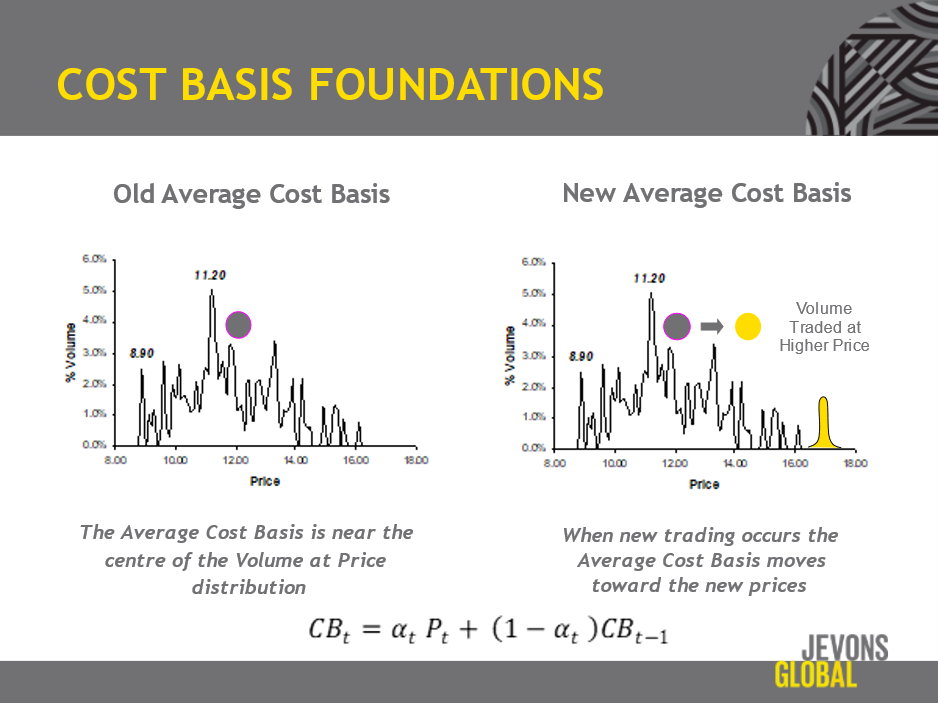

The formula is at the bottom of the above slide. In words, we estimate the cost basis by first imagining that we actually knew at what price every share outstanding had been bought. That is represented by a distribution of different prices in different weights at the left. If you knew that distribution, then the update rule for new trading is simple. On the right, we imagine a new trading session whose prices of trade are marked in yellow.

The update rule rests on a simple assumption. If all shares currently held were equally likely to be among those sold, then we simply haircut the previous distribution by the percentage of shares traded and roll in that amount of new shares to the right.

You can work out all the math to this and show that the outcomes are not very sensitive to the assumptions made, as the "old" shares soon fall out of the distribution over time. The present cost basis is dominated by most recently traded shares and the memory is lost at a rate that is higher when the market turns over faster. That is all pretty intuitive.

Finally, to kick off the calculation, you can go all the way back to the Initial Public Offering (IPO) date, or use the rule of thumb to take 10% less than the traded price ten years ago.

Involved explanation, but the key is to estimate the average cost of entry for investors.

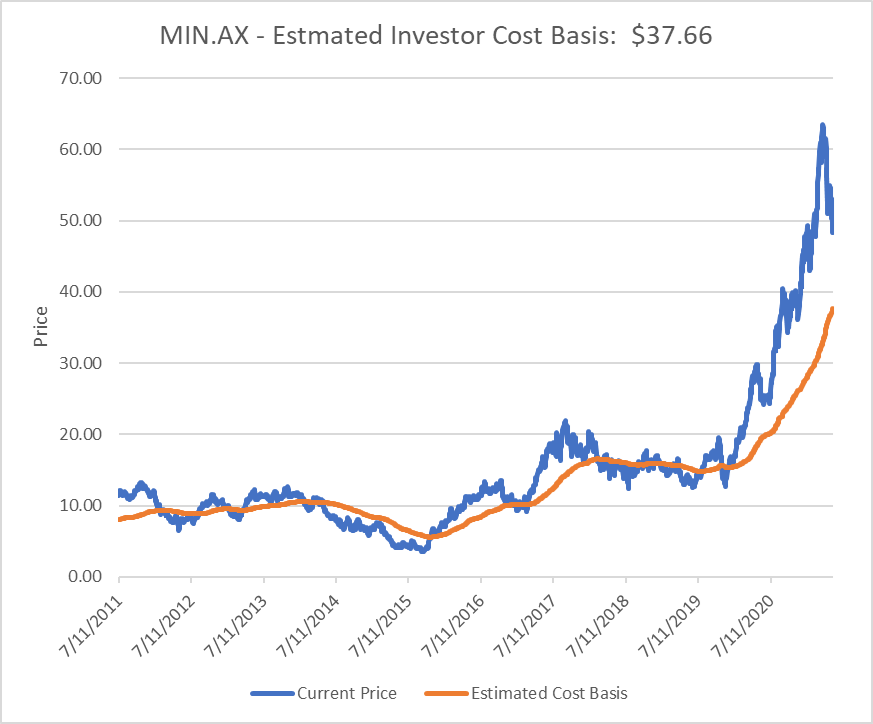

Now, we are there, let us look at it as of market close Tuesday 21st September 2021.

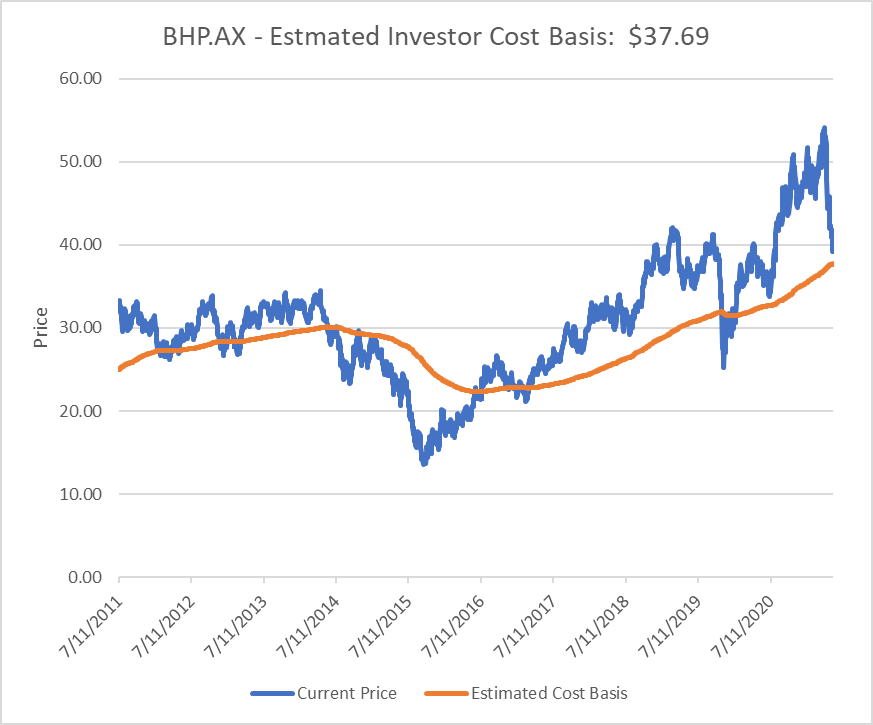

First, let us start with BHP Group (ASX: BHP). I estimate the average investor cost basis to be around $37.69. Note that the orange line acts as technical support in bull markets, and as an overhead resistance level in bear markets. On current broker estimates, BHP is below 8x on a forward price-to-earnings basis. Those numbers may move up a little, towards 10x, as brokers factor in lower iron ore prices, but BHP also has oil and gas, nickel, copper and metallurgical coal. In this market, we think that level will act as support to investors who own the stock now, redeploying dividend payments to buy more.

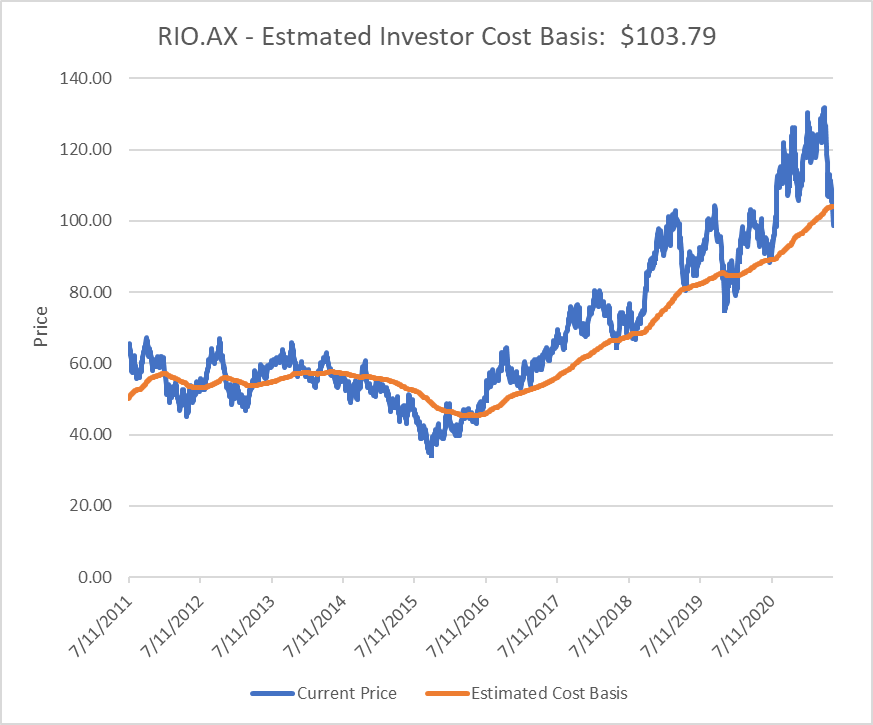

Next, let us look at Rio Tinto Ltd (ASX: RIO). Current cost basis is around $103.79. Since the stock punched through that level, we should anticipate some possible congestion as some weaker hands sell the anticipated rally. For those who are students of the limit order book, it can be helpful to watch where the limit orders are coming in around that mark. You can be forewarned of resistance if selling volume piles up ahead of the stock around cost basis.

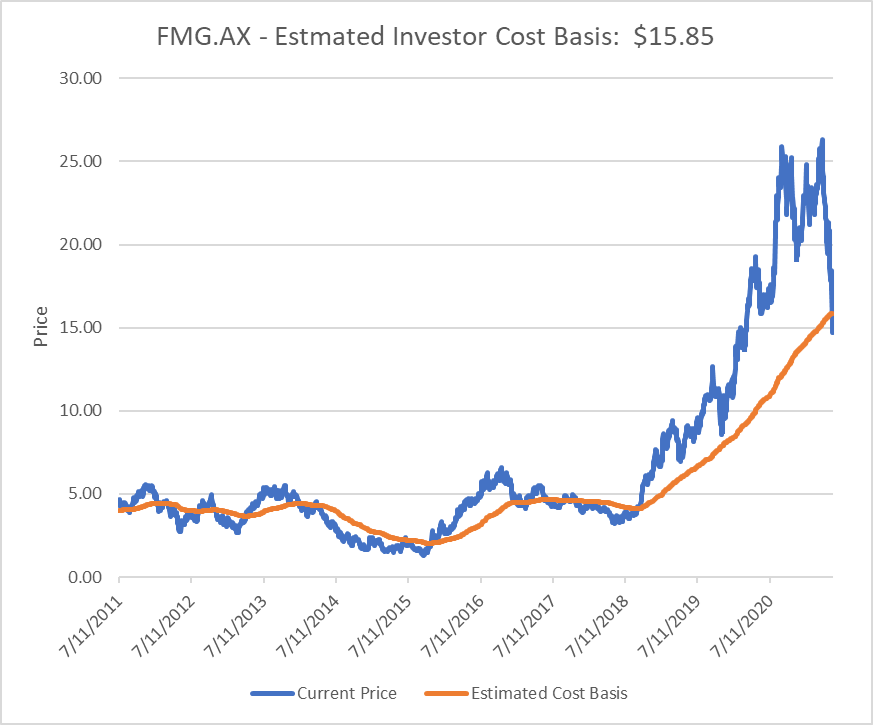

The story is similar with Fortescue Metals Group (ASX: FMG). This stock has much greater inherent leverage to swings in iron ore prices and so punched through support. Knowing which stocks are more sensitive to fundamentals can help traders discern sentiment for the wider complex of iron ore names. Shrewd traders are more active in these sensitives on both the long and the short side. Expect a much more dynamic order book with orders coming in around current levels. A large break to the upside, on sustained trading volume could be interpreted as a positive bullish sign for the complex as a whole.

Mineral Resources (ASX: MIN) is the odd one out here on the sentiment side. It remains very strongly in profit for investors. That is a two-edged sword. On the one hand, there is more unrealized profit to take if we are heading into a bear market. On the other hand, the investor support is likely to be pretty strong if we clear these headwinds on Chinese real estate, and the coming US Debt Ceiling Limit negotiations. You can always wait to figure out the answers to those questions. We should have a pretty good idea by mid October.

The foregoing offers an introduction to how Jevons Global thinks about market sentiment. In our view, the active investor needs to consider a range of factors from the macro signals, the valuation signals, and the technical market signals.

Right now, the iron ore complex is in the midst of a very significant correction. Looking forward, it is necessary to weigh risks against a deeper and longer slowdown in China, or the alternate viewpoint that we are experiencing an early cycle inventory correction.

In our view, it is more likely a sharp inventory correction in an early stage bull market for wider commodities. The drivers of this trend are the usual suspects in China, but now broadened by the prospect of a fundamental shift in Western economics towards fiscal stimulus.

As always in markets, we will not know until we know, but we hope the above discussion of technical indicators, that speak to investor sentiment, has been helpful.

Do reach out in the comments section, and click follow if you would like to learn more.

(Image Credit: Order Book Photo by Austin Distel on Unsplash)

Never miss an insight

Enjoy this wire? Hit the ‘like’ button to let us know. Stay up to date with my content by hitting the ‘follow’ button below and you’ll be notified every time I post a wire. Not already a Livewire member? Sign up today to get free access to investment ideas and strategies from Australia’s leading investors.

5 topics

4 stocks mentioned