The secrets to long-term compounding with Robert Millner

Washington H. Soul Pattinson (ASX: SOL) is the closest investment vehicle that Australia has to Warren Buffett’s Berkshire Hathaway and is best known for its 20-year streak of growing dividends.

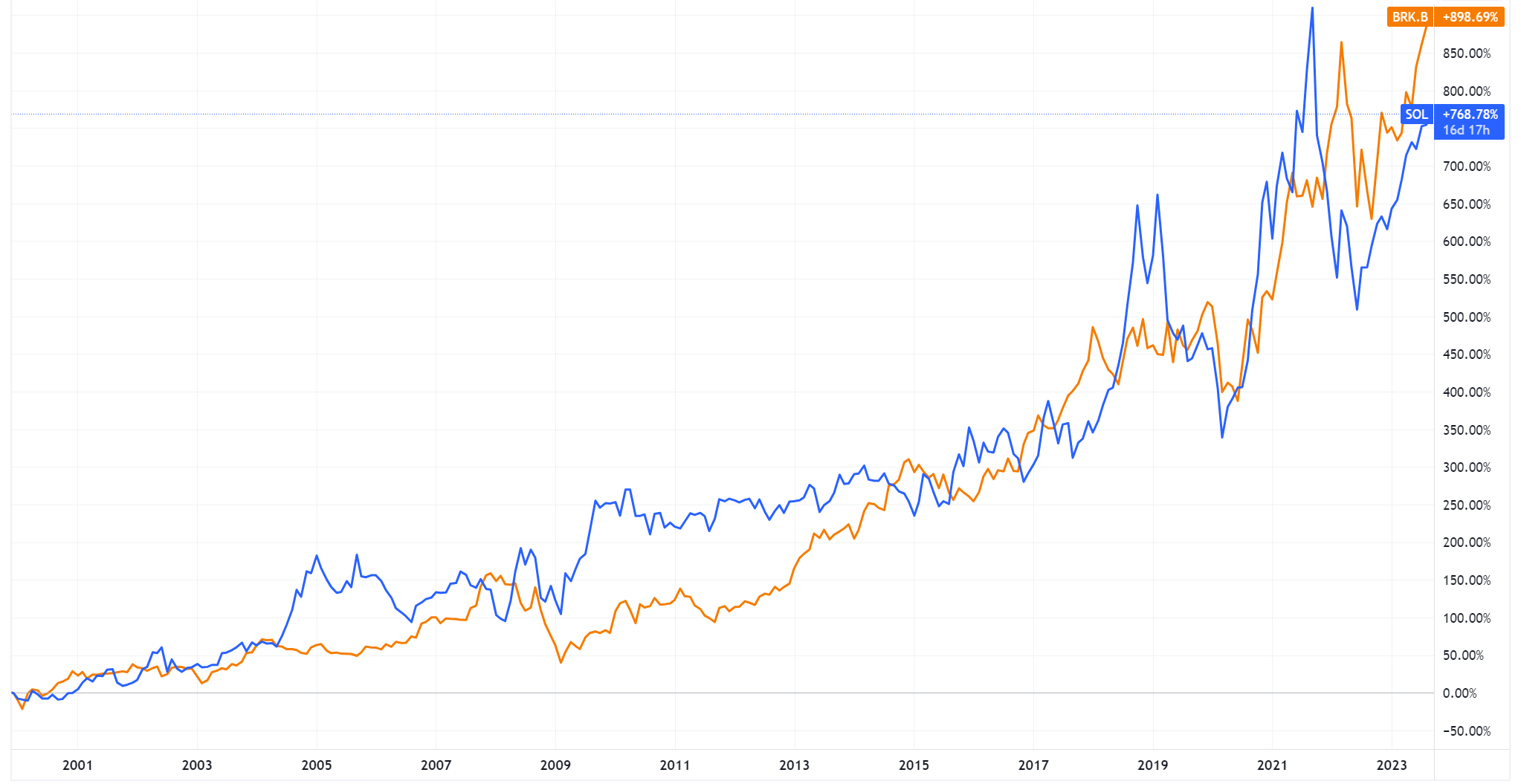

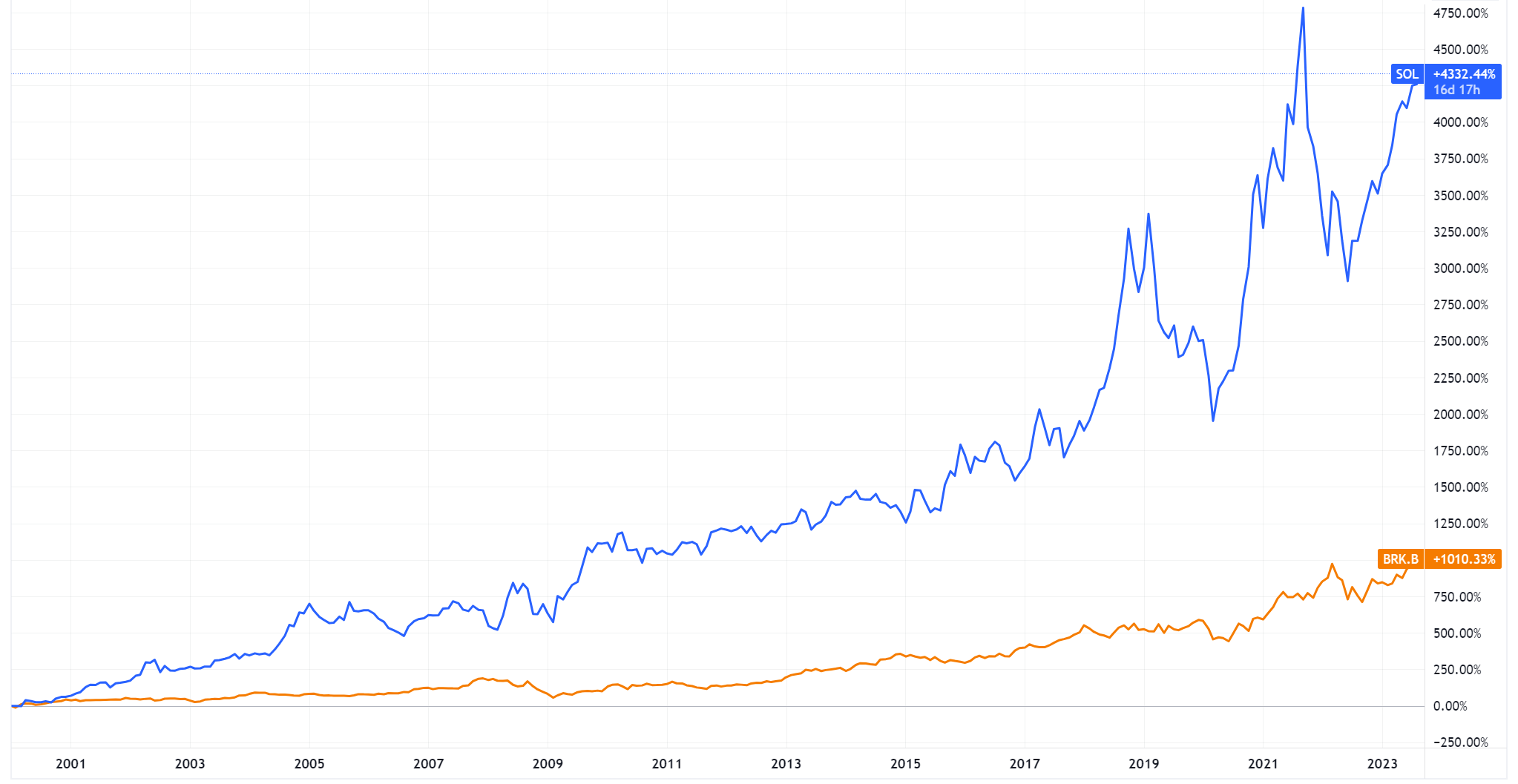

Since 2000, the performance between the two conglomerates has been neck-and-neck.

But once the performance is adjusted for dividends, you come to realise the power of consistent and growing payouts.

Speaking at Livewire Live, Robert Millner shared his lessons on the art of long-term compounding and how he’s positioned for the near term. This wire will recap the key nuggets below.

.png)

#1 Patience is a virtue

WHSP is sitting on a “very large nest egg” of cash. In fact, it's almost $650 million as of the beginning of 2023, nearly double the $345 million in the bank at the end of FY20.

But they’re not in a rush for more exposure or acquisitions. In fact, that $650 million is happily earning about 5% pa at the moment, says Millner.

The “attractive opportunities” have yet to come but “we’re quietly confident that we can start to see some bargain hunting coming in the next few months or early in the new year.”

The latest M&A deal saw WHSP merge with one of Australia’s oldest listed investment houses (Milton) back in October 2021. The move created a $10.8 billion company and further diversified WHSP across multiple asset classes including private markets, direct credit and real assets.

#2 Investing in the energy transition can wait

Millner is not in a rush to gain exposure in the renewable energy space.

“If you receive approval for a copper mine, that’ll take at least 5-7 years to enter production,” said Millner.

And that’ll be 5-7 years of no cash flow and in this day and age, plenty of upside risks to CAPEX.

He admitted that “we will want to go down that renewable cycle in some way” but reiterated that “these things take time.”

At least for now, WHSP retains relatively minor exposures to the renewables thematic via:

- Copper: Aeris Resources (ASX: AIS)

- Nickel and copper: BHP (ASX: BHP)

- Uranium: Boss Energy (ASX: BOE) and Paladin Energy (ASX: PDN)

#3 Australia’s energy crisis

Millner is extremely frustrated about Australia’s ability to produce cheap energy and yet sky-high electricity prices.

For context, Australian electricity prices are up 15.7% on the year in July, accelerating from a 10.2% rise in June.

If we exclude the impacts of rebates from the Energy Bill Relief Fund – which offered eligible household rebates ranging from $40 to $250 in July – electricity prices would have recorded a monthly increase of 19.2%.

But the road to renewables is a bumpy one. A future-facing energy source like the Snowy 2.0 project in New South Wales is incredibly expensive. Costs at that project have ballooned from $2.0 billion in March 2017 to $12 billion, as of the end of August 2023.

The headlines get more extreme in Germany, where energy giant RWE has been dismantling wind farms to make way for expansions of open-pit coal mines.

When asked how he could gain further conviction to invest in renewables, Millner called for more investment and development in areas like battery storage, solar and wind, as well as decisive policy on alternative sources like nuclear.

#4 The portfolio heavy hitters

In the first half of FY23, WHSP delivered 38.4% net profit growth to $475.7 million and raised its interim dividend by 24.1% to 36 cents per share.

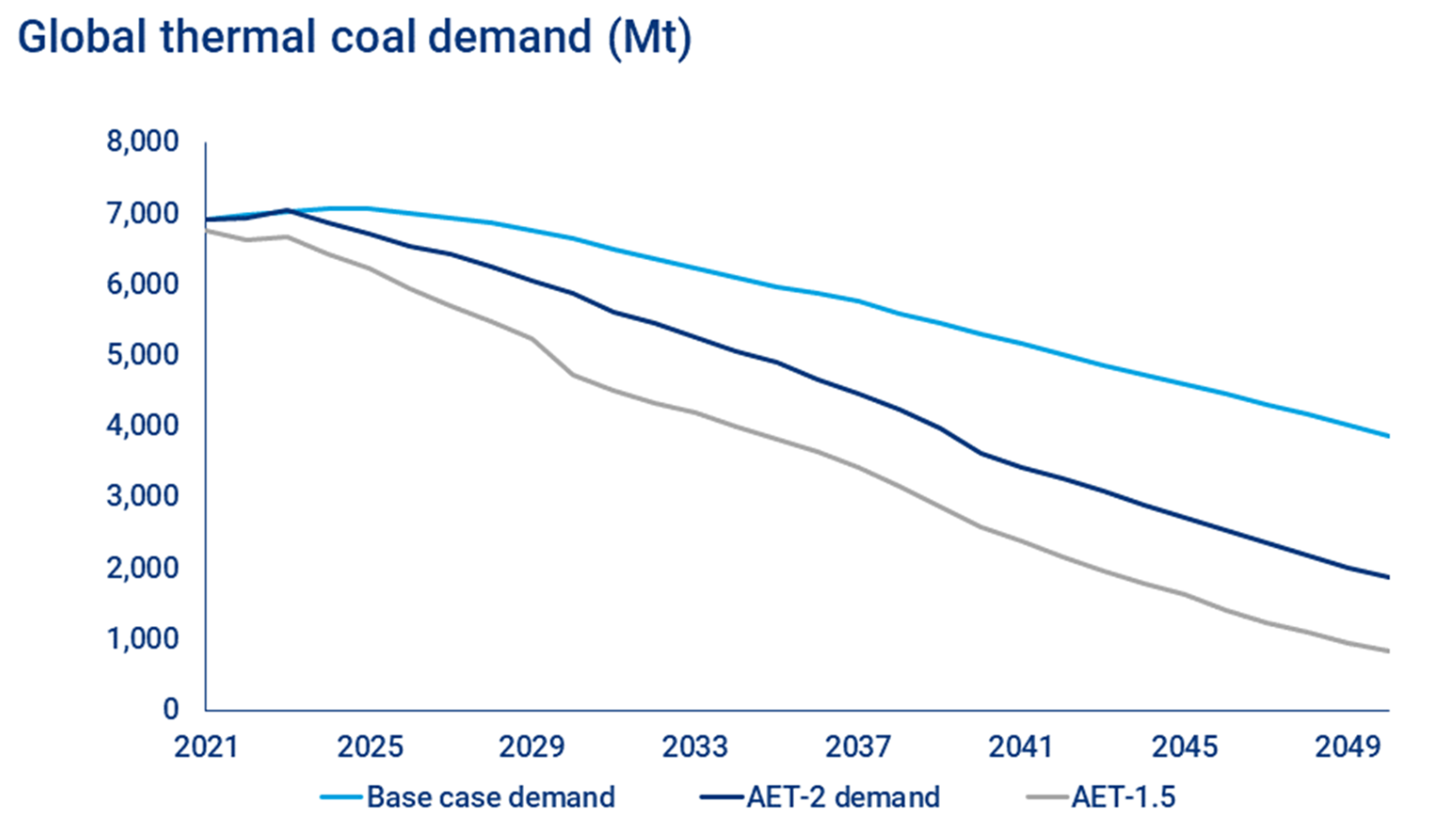

The majority of its earnings growth came from its $4.8 billion strategic portfolio, which delivered “very strong returns from New Hope (ASX: NHC) due to high prices for thermal coal.” The portfolio delivered a total return of 25.8% over 2022.

When commenting on the state of play for coal, Millner said “Australia has the most efficient and cleanest coal in the world.” He referenced data points from Wood Mackenzie, which reiterate the still-solid demand for global coal through to at least 2030.

“This year could see peak global demand for thermal coal as China’s economy recovers and coal plant retirements are getting a short reprieve in developed economies - as the world grapples with energy shortages and supply chain issues,” Wood Mackenzie said in a report.

Watch the full session here

3 topics

6 stocks mentioned