The shift to private debt: Why investors are eyeing non-sponsored lending

At a Glance:

● Global merger and acquisition (M&A) activity declined in 2023, driving a shift towards private debt, particularly non-sponsored lending, which can offer high yields, diversification, and attractive returns.

● While there is often a perception that non-sponsored lending is riskier, experienced private credit lenders can negotiate stronger agreements and obtain better prices, improving the loan's security.

● With the expected growth of non-sponsored lending, an experienced lender becomes essential to conduct more proactive due diligence to reduce risks and maximise returns.

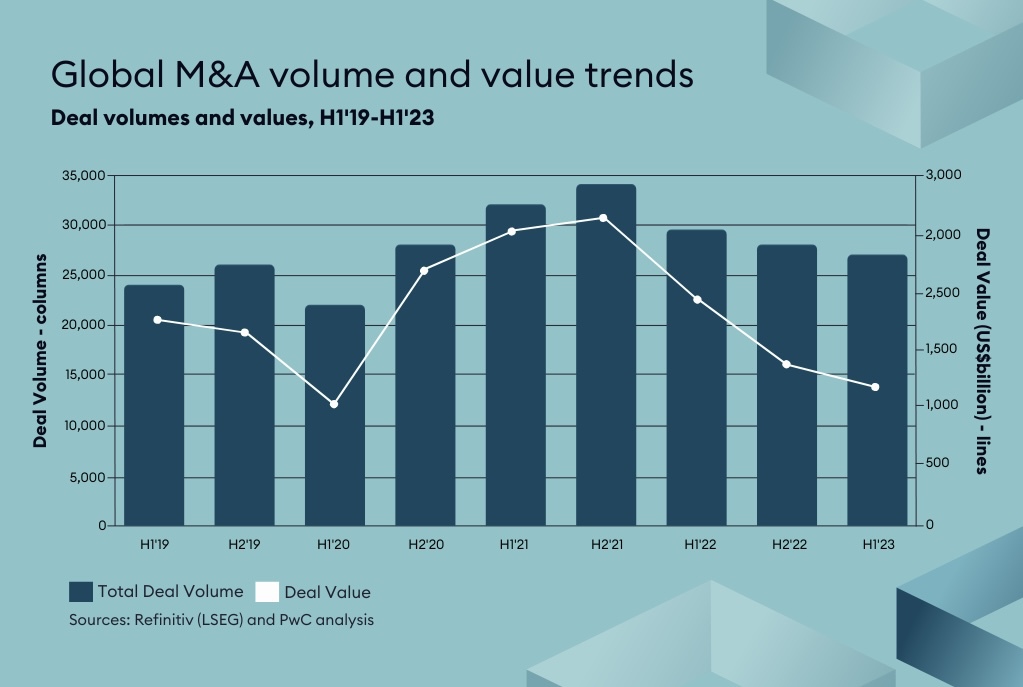

In the first half of 2023, global merger and acquisition (M&A) activity experienced a sharp decline, due to rising interest rates and economic uncertainty.

Research conducted by PwC revealed a contraction of global M&A volumes by 9% and a decrease in values by 39% compared to the first half of 2022. Remarkably, deals exceeding US$1bn declined by 56% since 2021.

With lower M&A activity, financial institutions have shifted their focus to other lending opportunities, especially private debt, to maintain their loan volumes.

Private credit reached $1.4 trillion in global assets under management by the close of 2022, standing on par with U.S. high yield bonds, and is projected to reach $2.3 trillion by 2027.

The appeal of private credit lies in its combination of high yields, potential for portfolio diversification, and a level of protection against inflation due to the variable nature of these loans.

Before pivoting to

this asset class, investors should get familiar with the differences and

benefits of the two main types of private credit available: sponsored and

non-sponsored.

Key differences between sponsored and non-sponsored lending

The primary distinction between sponsored and non-sponsored lending lies in the involvement and influence of a financial sponsor. This involvement impacts various aspects such as risk perception, borrower profile, and management dynamics.

Sponsored lending

Sponsored lending refers to loans provided to companies that are backed by a private equity sponsor or financial sponsor. These sponsors provide capital, expertise, and support to the borrower, often influencing the management and strategic direction of the loan.

Stronger sponsors may be able to negotiate

better terms, including a lower cost of debt. But the presence of an equity

sponsor does not guarantee absolute credit protection.

The level of protection is often correlated with the financial strength and credibility of the sponsor.

Origination

● Sourcing: Often through relationships with private equity firms and financial sponsors.

● Assessment: Sponsor's knowledge and insights into the business facilitate due diligence.

● Borrower profile: Typically mid-size to larger companies where the sponsor seeks influence.

Execution

● Structure: Loan structure often influenced by the sponsor's strategy and requirements.

● Covenants: Standard covenants, reflecting the sponsor's involvement.

● Pricing: Standard pricing in line with the market, reflecting the sponsor's negotiation power.

Performance

● Risk Management: Perceived as lower risk due to sponsor's involvement, expertise, and support.

● Returns: Standard returns aligned with market expectations and sponsor's influence.

● Recovery: Sponsor's vested interest may assist in recovery and problem-solving if issues arise.

Example

A manufacturing

company is seeking to expand its operations and requires additional financing.

A private equity firm sponsors the loan, providing not only capital but also

strategic guidance, management expertise, and industry connections. The lender,

knowing that the private equity firm has a vested interest in the success of

the company, feels more comfortable providing the loan.

Non-sponsored lending

Non-sponsored lending involves loans to companies that are not backed by any private equity or financial sponsor.

Non-sponsored lending is particularly prevalent in the small-to-lower-middle market, where strong equity sponsors are less common and banks may have reduced appetite for lending. While there is often a perception that this type of financing is riskier, this may not necessarily be the case.

Experienced private credit lenders with robust sourcing capabilities can negotiate stronger agreements and obtain better prices, improving the loan's security.

To account for the

added complexity and illiquidity premium, returns on non-sponsored debt are

typically higher compared to sponsored debt.

Origination

● Sourcing: Directly through the market or relationships with companies. Experienced private credit lenders should have robust sourcing capabilities to identify suitable borrowers.

● Assessment: Lenders rely on their own due diligence, possibly with a deeper focus since there's no sponsor oversight.

● Borrower profile: Often small to medium businesses, as well as specialised opportunities.

Execution

● Structure: Loans can be highly tailored by experienced lenders to align with the borrower's unique needs.

● Covenants: Stronger covenants are possible, especially when crafted by experienced private credit lenders.

● Pricing: Better pricing may be achieved since fewer lenders are positioned to compete for a business.

Performance

● Risk Management: Risk perception varies; experienced private credit lenders can mitigate risks through tailored covenants and strong relationships.

● Returns: Potential for additional returns through better pricing and unique loan structures.

● Recovery: Direct relationship with the borrower and a strong understanding of the business may assist in recovery.

Example

A medium-sized technology business is seeking a loan to develop a new product. An experienced private credit lender, with industry expertise, negotiates directly with the company, crafting a loan with specific agreements that align with their business model. The lender's knowledge and strong working relationship with the borrower help mitigate the risk usually associated with non-sponsored lending.

Summary - Sponsored vs Non-sponsored Lending

Is non-sponsored lending riskier?

While it is often easier to work with a sponsor like a private equity firm, this does not necessarily mean that sponsored deals are superior. The question of risk in non-sponsored lending often stems from a hesitancy to deal directly with a company.

“This is a myth we want to debunk. Our experience in dealing directly with borrowers ensures good working relationships, should any problems arise.” says Christian Brehm, CEO of FC Capital.

The non-sponsor market may require more hands-on credit analysis and a more proactive due diligence process, but this extra effort can be rewarded with more attractive risk-based pricing levels due to the inherently less competitive nature of the non-sponsor market.

The higher prices and

yields have recently shifted the interest of middle market investors from

sponsored to non-sponsored deals. However, due to the complexity of the

origination process and the execution, it’s fundamental to lean on experienced

private credit lenders with robust sourcing capabilities and industry expertise

who can manage and even reduce the associated risks.

Why you need non-sponsored lending in your portfolio

Although often overlooked, non-sponsored lending can be an invaluable addition to a portfolio for a variety of reasons.

Enhanced opportunities and returns

Non-sponsored lending allows to capture the widest range of opportunities and potentially boost your returns. By diversifying across sponsored and non-sponsored lending, firms are not limited to just one type of lending. This approach ensures consistent capital deployment, and potentially higher rewards.

Growing demand for private credit

The continued growth in private credit demand is drawing more investors to the asset class. Flexibility in sourcing both sponsored and non-sponsored deals can be an antidote against competition in a crowded market.

Attractive features of non-sponsored lending

● Less competition: Since non-sponsored deals often require more effort to source and execute, there's less competition, potentially leading to higher returns.

● Early exclusivity: Lenders often get more time for due diligence and negotiation, allowing them to structure more beneficial deals.

● Strong yield protection: Non-sponsored deals generally include robust yield protection and up-front fees, mitigating risk for lenders.

Takeaways

The appetite for private debt is on the rise. A survey by Goldman Sachs Asset Management shows that 40 per cent of insurance company CIOs and CFOs plan to increase their allocations to private corporate debt over the next year.

Within the category, the non-sponsored market is only around one-tenth the size of the sponsored market, indicating substantial room for growth.

As investors increasingly turn their attention to this asset class, they should consider that, while it often appears easier to go down the sponsored route, non-sponsored lending can be as secured when managed by an experienced lender — while offering greater returns.

5 topics