The three-letter word that sparked a massive rally in stocks and bonds

It turns out the war on inflation may finally be over. The Federal Reserve kept interest rates steady for a third consecutive meeting and officials now expect to see three interest rate cuts in 2024.

The Russell 2000, the benchmark gauge for small-cap US equities, rallied 3.5% to its highest close since August 9. This was more than double the 1.37% gain in the broader S&P 500 Index. Despite its outperformance of large-cap peers, the Russell 2000 is still 26% away from the all-time high it hit in November 2021.

The broad-based US rally has pushed the S&P 500 and Nasdaq 100 within 3% of all-time highs. The blue-chip Dow Jones Industrial Average has already cleared its January 2022 to close above 37,000 points for the first time on record.

The Fed’s Key Takeaways

#1 – Powell said the FOMC added the word ‘any’ in front of ‘additional policy firming’ as an “acknowledgment that we are likely at or near the peak rate for this cycle.”

#2 – The Fed’s forecasts expect three 25 basis point cuts next year to 4.6%, which was more than what economists expected. By end-2025, policymakers expect the Fed Funds rate to sit at just 3.6%.

#3 – Eight out of nineteen officials see the policy rate above the 2024 median of 4.6%. Five officials see 100 bps worth of rate cuts next year. When the last "Dot Plot" - or Summary of Economic Projections - was released in September, not one official was expecting rate cuts.

#4 – The Fed expects to see inflation at 2.4% in 2024 and return to the 2.0% target by 2026. “We anticipate that the process of getting inflation all the way to 2% will take some time. The median projection in the SEP is 2.8% this year, falls to 2.4% next year, and reaches 2% in 2026,” said Powell.

#5 – The Fed expects to see a soft landing for the US economy as the labour market comes into better balance, progress is made on inflation and growth moderates. Powell emphasised this view in the post-meeting press conference, arguing "I think you can say that there's little basis for thinking that the economy is in a recession now. I think there's always a probability that there will be a recession in the next year and it's a meaningful probability, no matter what the economy's doing."

The Market’s Reaction

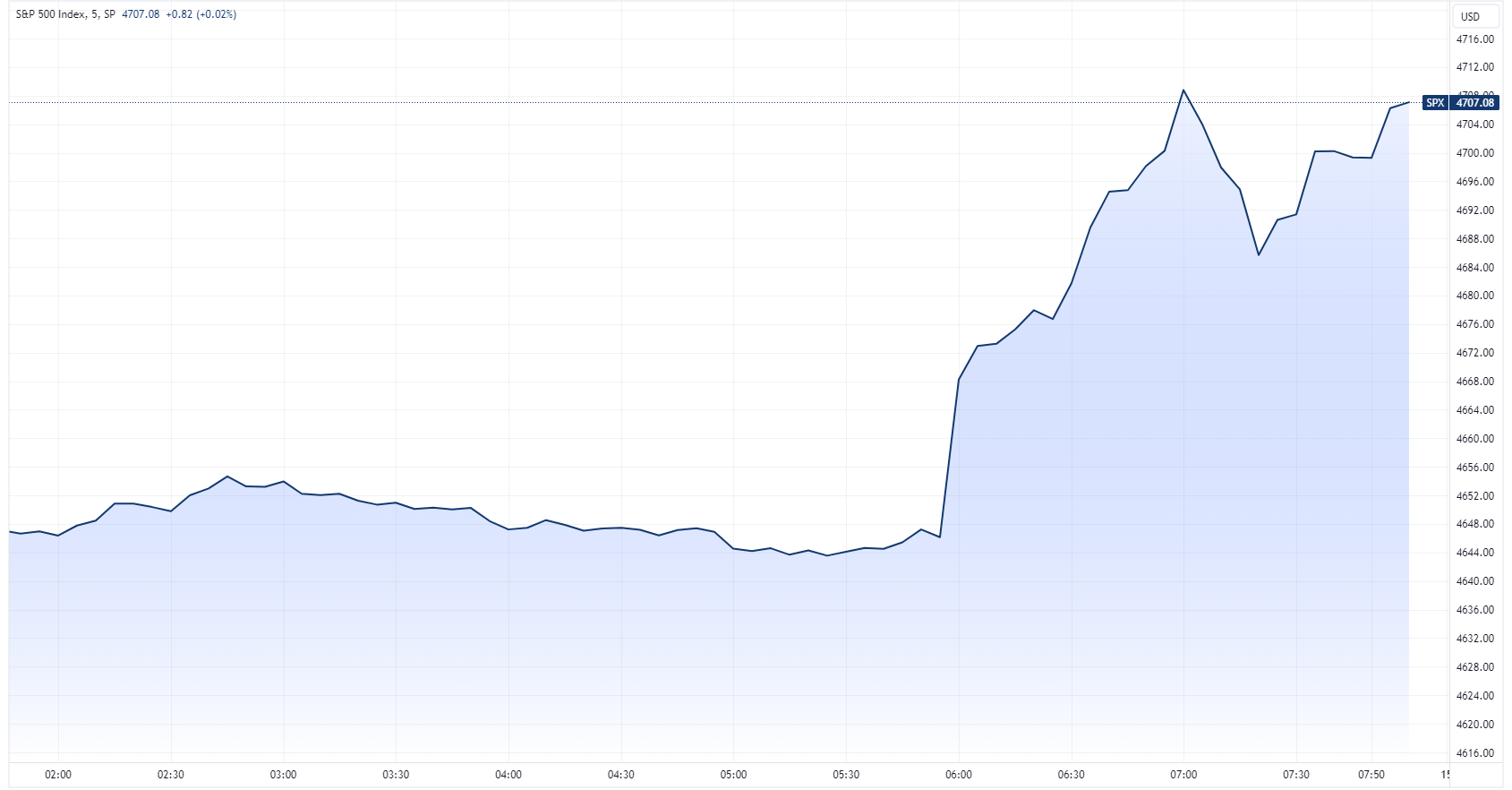

The S&P 500 rallied around 1.35% between the Fed’s rate decision and press conference (6:00 am to 7:00 am AEDT).

Over the same timeframe, the Russell 2000 rallied around 3.6%.

The US 10-year Treasury Yield tumbled 15 bps to 4.02%. Between the Fed's last meeting and today's meeting, the yield on the benchmark bond has fallen by nearly 100 basis points - or one full percentage point.

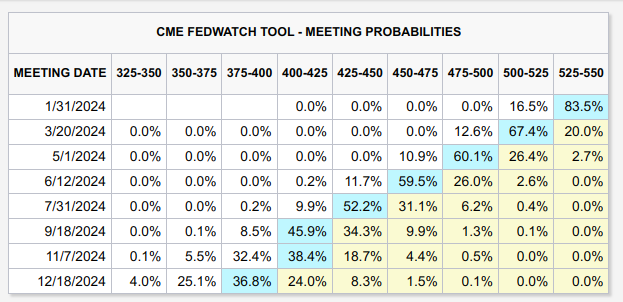

Fed fund futures are now pricing in six rate cuts in 2024 after the Fed’s dovish economic projections and press conference – That’s 150 bps of rate cuts expected to begin in March.

The ASX 200 is up around 1.5% in the first thirty minutes, on pace for its highest close since 2 August. While the Small Ords is up 2.3% to a three-and-a-half month high.

From a sector perspective, growth and yield-sensitive sectors are topping the leaderboards. As of 10:30 am AEDT: Technology (+2.8%), Real Estate (+2.7%) and Materials (+2.4%) are tracking well ahead of benchmarks while Staples (+0.5%), Financials (+0.6%) and Energy (+0.8%) lag.

Where to From Here?

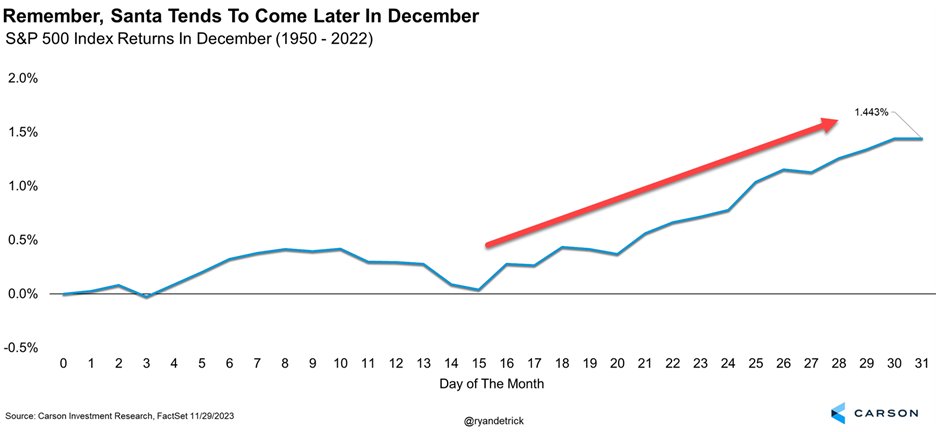

For seasonality watchers – The first half of December has historically been a choppy period for the S&P 500. It is only in the second half of the month that Santa comes to town, according to Carson Investment Research.

From a sentiment and positioning perspective, things are getting a little overextended.

- S&P 500 is currently the most overbought since September 2020

- ASX 200 is currently the most overbought since November 2020

- US Investor Intelligence survey notes bulls increased to 55.6% in the week-ended December 12 – This marks the third consecutive week in caution territory, a streak not seen since the market’s prior high in late July

- Bank of America notes that Commodity Trading Advisors have built up sizeable long positions in the S&P 500 and Nasdaq, that now appear more stretched

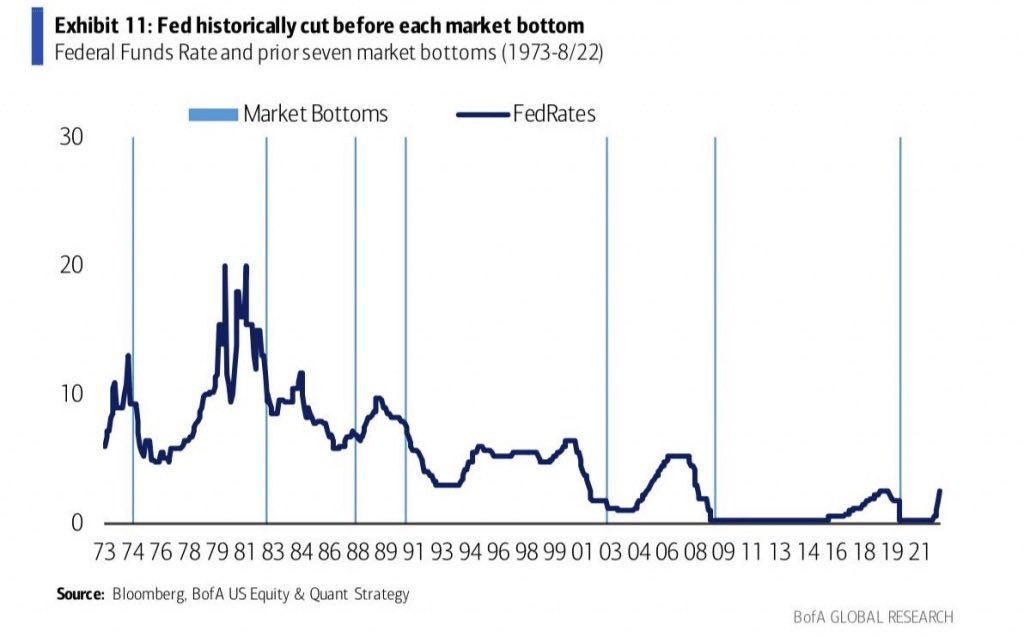

Historically speaking, the first Fed cut takes place before the market bottoms. This has occurred in all prior seven market bottoms between 1973 and 2022. The playbook calls for a waiting time of a little under six months, with a drop of around 20%.

Will this time be any different?

3 topics