The top performing ASX small and mid-caps over the last 12 months (and 6 you should watch)

Unsurprisingly, mining companies dominated the list of top gainers in FY23, with gold a key player. Gold is a traditional safe-haven asset in inflationary times. Despite prices struggling in late 2022, it staged a recovery in the first six months of 2023.

Non-mining companies on the list ranged from services and tech-related, while online fashion even made an appearance. No small feat in a time where cost of living pressures should have seen consumers trading down (though numbers until recently for consumer spending remained high).

In this wire, I’ll look at the performance figures of ASX300 companies collated by Market Index and focus on those classified as small or mid-cap companies. You can find out about the top performing large-caps in this wire by my colleague Glenn Freeman. I also spoke with FNArena's editor and founder Rudi Filapek-Vandyck for his views on the list and where he's watching in the coming year.

The table below shows the 10 ASX small and mid-caps that delivered the highest returns in FY2023 (based on the ASX300).

|

Code |

Company |

Price |

High |

Low |

Volume |

Market cap |

1-year share price return (%) |

|

Cettire Ltd |

$2.76 |

$2.83 |

$2.65 |

661,594 |

$1.1B |

481.05% |

|

|

Latin Resources Ltd |

$0.24 |

$0.26 |

$0.23 |

18,480,169 |

$625M |

256.62% |

|

|

Alpha Hpa Ltd |

$1.13 |

$1.17 |

$1.11 |

442,964 |

$969M |

179.01% |

|

|

Weebit Nano Ltd |

$6.15 |

$6.92 |

$6.07 |

1,280,664 |

$1.2B |

170.93% |

|

|

LIFE360 Inc |

$7.05 |

$7.13 |

$6.89 |

290,855 |

$1.4B |

128.16% |

|

|

Resolute Mining Ltd |

$0.41 |

$0.42 |

$0.40 |

2,980,811 |

$878M |

104.61% |

|

|

Mader Group Ltd |

$4.93 |

$4.97 |

$4.81 |

18,888 |

$986M |

89.62% |

|

|

Mcmillan Shakespeare Ltd |

$17.53 |

$17.57 |

$17.30 |

102,803 |

$1.2B |

79.06% |

|

|

Bellevue Gold Ltd |

$1.25 |

$1.26 |

$1.23 |

1,057,361 |

$1.4B |

78.57% |

|

|

Emerald Resources NL |

$2.03 |

$2.08 |

$2.02 |

627,554 |

$1.2B |

77.29% |

The top 5 gainers for FY23

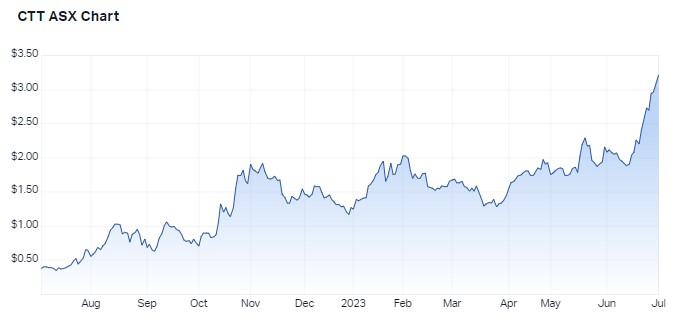

1. Cettire Ltd (ASX: CTT)

Cettire is a global online retailer offering a large selection of in-demand personal luxury goods via cettire.com. It has access to more than 2,500 luxury brands and more than 400,000 items of clothing, shoes, bags and accessories. The US is its strongest market.

In Cettire’s report for the year to end of April 2023, it announced an increase of 122% in sales revenue and adjusted earnings before tax, depreciation and amortisation of $7 million. It has seen significant growth in its active customer base and is focusing on expansion in to emerging markets and new geographies like China.

While most anticipated that retail, particularly on the luxury end would struggle in FY23 due to cost of living challenges, this has not been the case for Cettire.

According to Claire Aitchison, Independent Investment Research, Cettire is benefitting from global expansion and a localisation strategy, with the introduction of local languages and improved local targeting.

“The Company should continue to see strong demand in the financial year, as luxury demand is relatively robust, especially in China, where the site has a significant footprint,” says Aitchison.

She also anticipates Cettire will reaps the rewards of an agreement signed late last year with luxury attire brand Zegna.

The firm is rated a BUY, according to Market Index’s Broker Consensus widget, where it is rated with 4 Buys and 1 Sell, as of 1 June 2023.

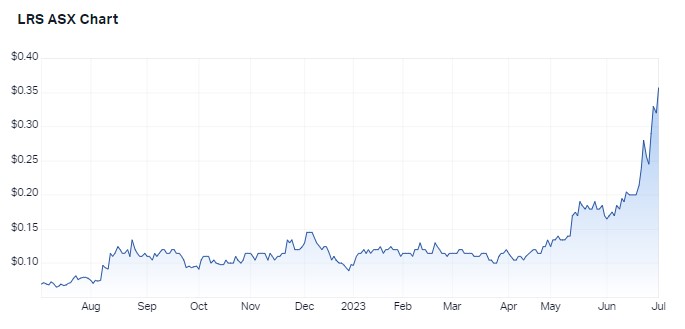

2. Latin Resources (ASX: LRS)

Latin Resources is an Australian-based mineral exploration company with several mineral resource projects in Latin America and Australia. In Latin America, the Company's focus is on its two Lithium projects. One is in the state of Minas Gerais, Brazil and the other, the Catamarca Lithium Project is in Argentina. The Australian projects include the Cloud Nine Halloysite Project near Merredin, WA.

Latin Resources’ share prices recently surged to a five-year high after it announced multiple spodumene-rich pegmatites in a drilling program at its Salinas Lithium Project in Brazil, opening up what the company believes could be a new corridor.

Henry Jennings, senior market analyst and media commentator for Marcus Today, recently pointed to Latin Resources as a stock to watch in FY24.

“[Latin Resources and Leo Lithium] look very cheap when you can see the trajectory of those two. And if we’re talking about FY24 stock returns in a year’s time, I wouldn’t be surprised to see either of them replacing Liontown as the winners of the year,” he says.

The firm is rated a STRONG BUY, according to Market Index’s Broker Consensus widget, where it is rated with 6 Buys and 1 HOLD, as of 1 June 2023.

3. Alpha HPA (ASX: A4N)

Alpha HPA Limited (A4N) is involved in proceeding the commercialisation of its proprietary solvent extraction and refining technology to produce High Purity Alumina (HPA) for sale into the lithium-ion battery and LED battery markets. The Company intends to materialise its technology through the delivery of its HPA First Project within the Gladstone State Development Area in Queensland, Australia.

Todd Warren from Tribeca nominated this as a stock he’d hold for the next five years in an April BUY HOLD SELL episode.

"They've actually just commenced producing high-purity alumina, which is a precursor material used both in batteries but also in sapphire glass, LCD, lighting, etc. And that's going to be a big thematic in the decarbonisation space.

These guys have some funding from the government as well, albeit not to the tune of Iluka, but building their first-stage facility up in Gladstone, now in production. They've delivered on their promises to date, and there's a lot of news flow between now and the end of the year in regard to their next stage - the big expansion. And so far, they've ticked all the right boxes. It's run a fair way since we talked about this stock, but we still like it," he said.

The firm is rated a STRONG BUY, according to Market Index’s Broker Consensus widget, where it is rated with 4 Buys and 1 HOLD, as of 1 June 2023.

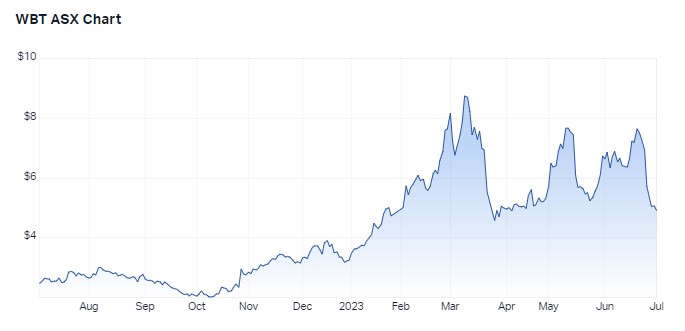

4. Weebit Nano (ASX: WBT)

Weebit Nano Ltd. is a developer of advanced semiconductor memory technology. The company's Resistive RAM (ReRAM) addresses the need for higher performance and lower power memory solutions in a range of new electronic products such as Internet of Things (IoT) devices, smartphones, robotics, autonomous vehicles, 5G communications and artificial intelligence.

It was added to the ASX300 on March 20 2023.

The company was forced to suspend trading last week on Tuesday after the resignation of Fred Bart meant that the company no longer had the minimum requirement of two Australian directors. It resumed trade on Thursday 29 June after appointing an interim replacement.

The company is unprofitable at this stage but could benefit from the boom in AI.

Dr David Allen of Plato Asset Management recently noted that Weebit Nano raises red flags for him and currently holds a short position on the company.

Market Index’s Broker Consensus widget notes that there is currently no major broker coverage of the company.

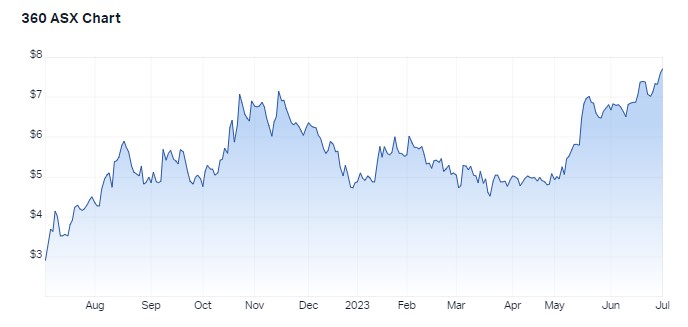

5. Life360 (ASX: 360)

Life360 operates a location-tracking platform for families. The company's core offering, the Life360 mobile app, is a market-leading app for families, with features that range from communications to driving safety and location sharing. Life360 is based in San Francisco and had 42 million monthly active users (MAU) as of June 2022, located in more than 150 countries.

Like most tech companies, it has had a tough few years but has offered strong performance in the start of 2023. In fact, it announced on 16 May, it had reached profitability with EBITDA of US$500k for the first quarter of 2023, ahead of expectations. It had significant growth by 66% in its subscription revenue for Core Life360 and its annualised monthly revenue was up 44%.

Sam Koch from Wilson Asset Management recently nominated Life360 as a BUY.

“The investment thesis is being progressively de-risked over the next couple of quarters as they continue to add subs ahead of market expectations, whilst putting through a 50% price increase. That really demonstrates the pricing power of this business.

Going forward, you've got the integration of the Tile acquisition, which will really help to accelerate subs growth as well because you've got that bundling with the two products together. As it approaches EBITDA and operating cash flow breakeven this year, we think that's a key catalyst to see it continue to rerate,” he says.

The firm is rated a STRONG BUY, according to Market Index’s Broker Consensus widget, where it is rated with 7 Buys and 1 HOLD, as of 1 June 2023.

A view from the expert: Rudi Filapek-Vandyck

On the surface, a list of top gainers in the small and mid-cap world sounds like excellent hunting grounds, but Filapek-Vandyck cautions that, as with many things in life, there's more to the story.

"It's an extremely polarised market. For every outperforming small cap you can find, there's probably 2-3 that have gone the other way. Some of the companies on this list are unprofitable and would have been smashed in 2022 so the gains look exceptional compared to 2022 prices," he says.

%20(1).png)

Companies like Cettire and Weebit Nano made the bulk of their gains in June and Filapek-Vandyck is concerned this doesn't reflect company fundamentals.

"There's a reek of June manipulation for Cettire," he says, referencing the fact that many fund managers will put extra money into stocks ahead of the end of the financial year.

He notes he would never invest in any of the top-gaining companies on this list, with the exception of Life360.

"It's an American company that has listed on the ASX. The technology is probably on its way to becoming profitable in the next few years."

The outlook for small and mid-caps in Australia

Filapek-Vandyck believes the volatility we've seen to date will only continue.

"We are now moving into tougher economic conditions. Rate hikes in Australia, Europe and the US are really now starting to hit. Smaller companies are more vulnerable in this environment. Some of them have cheap valuations but are they cheap enough based on the risks?" he says.

He suggests that some of the better performers will be in the mid-cap world, outside the ASX50.

When it comes to the list of top gainers for FY23, he's not convinced they'll see a second year of top performance.

"When it comes to smaller companies, history tells me they typically have trouble sustaining performance for two-three years in succession."

Where Filapek-Vandyck is watching (or holding) instead

Filapek-Vandyck holds the following companies and has a high conviction in their prospects.

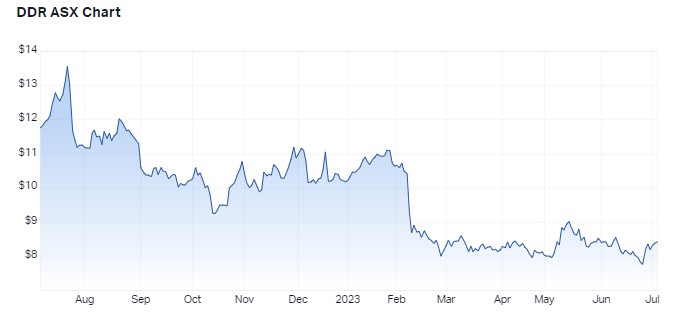

1. Dicker Data (ASX: DDR)Dicker Data is a technology, hardware, software and cloud distributor.

"It was sold down quite heavily last year and as a consequence is today offering a high yield. I have a lot of confidence it will continue to perform in the years ahead," Filapek-Vandyck says.

2. Steadfast Group (ASX: SDF)

Steadfast is the largest insurance broker group in Australia.

"I've done well out of it since purchasing it and used share price weaknesses to add to my position," he says.

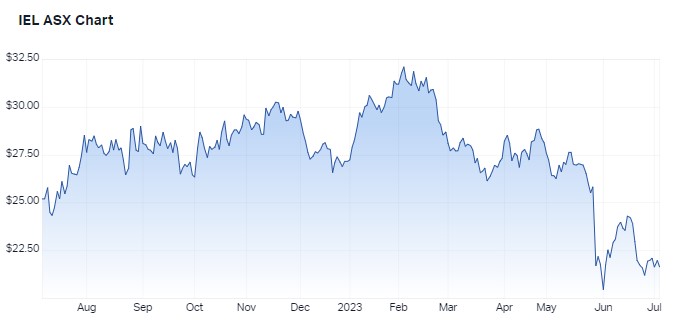

3. IDP Education (ASX: IEL)

IDP Education is an international organisation offering student placements in developed countries, including in Australia.

"I bought more when it was sold down. I think the market has been very harsh and there's a lot of shorts on it. That can go either way, prices could stay low for longer. I'm hoping that good news will come out at some point and prices will go up a lot."

Filapek-Vandyck has the following companies on his watchlist and doesn't hold them yet.

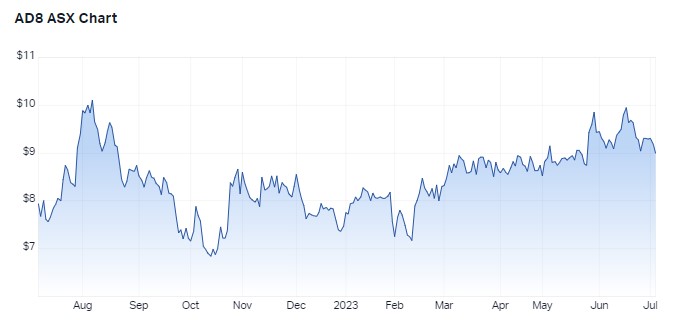

4. Audinate Group (ASX: AD8)Audinate is the leading provider of professional AV technologies worldwide.

"It's not profitable yet but it's getting there. I think it could be a future success story for the ASX. I'll be watching the August reporting season as I suspect it will be very volatile."

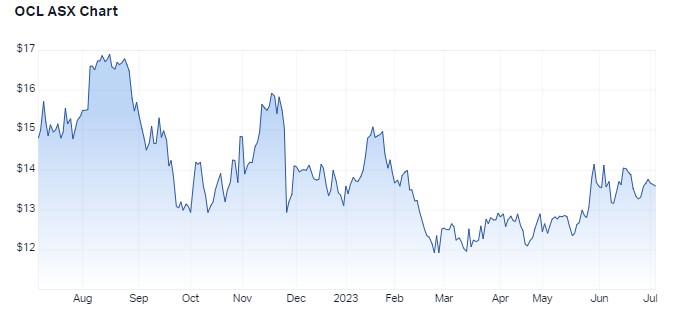

5. Objective Corporation (ASX: OCL)

Objective is a software provider focused on government and regulated industries.

"I'm a big fan of TechnologyOne (ASX: TNE). The stock has been one of the best performers on the stock exchange over the past two decades. I see similar characteristics in Objective, which I tend to describe as mini-TechnologyOne. I think Objective has strong potential."

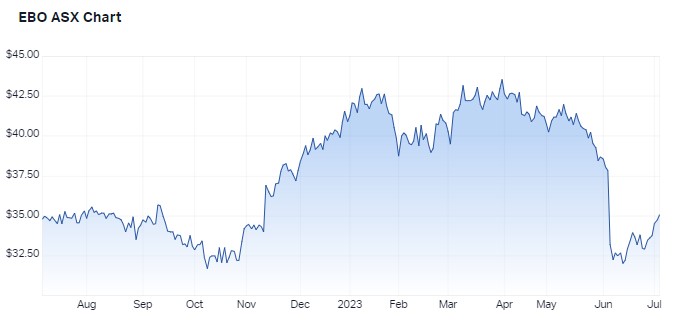

6. EBOS Group (ASX: EBO)

EBOS is the largest and most diversified Australasian marketer, wholesaler and distributor of healthcare, medical and pharmaceutical products.

"They'll be on the 'do not touch' list for many for a while because they are going to lose a big contract in 2025. They are a very good operator and I think they deserve the benefit of the doubt that they can come out stronger down the track."

Where are you watching in FY24? Let us know in the comments.

1 topic

12 stocks mentioned

6 contributors mentioned