The “unprecedented potential” of these assets (and 2 long-term investments)

Beyond stock exchanges and bond markets, investing is more than buying and trading shares and fixed income assets. Much more, as demonstrated by the phenomenal growth in demand for Alternatives.

Ahead of their presentations at the upcoming Pinnacle Investment Summit 2024, we recently spoke with two professional investors focused on different parts of this rapidly growing space:

- Justin England, Managing Director of private equity asset manager Five V Capital, and

- Vicki Rigg, Managing Director of unlisted infrastructure investment manager Palisade Investment Partners.

The pair provided views on why their respective asset classes are attractive right now and explained some of the key things potential investors need to understand. They also described what they must see in potential investments before adding them to their portfolio, and each discussed a long-term holding.

Unpacking the appeal of Private Equity

England said the appeal is two-fold: the outperformance of PE versus the public market, and the larger number of opportunities among the unlisted space, which is, “many times larger than public companies, no matter which country you are in.”

England also noted several features of the PE asset class that traditionally discouraged many high-net-worth and wholesale investors – including long lockup periods, high minimum investment amounts and demanding administrative requirements – are now being overcome. He said these burdens are lessened in funds such as his, which have “democratised” investor access by implementing “practical things like dropping the minimums and making limited redemption liquidity available for investors.”

What is unlisted infrastructure (and why should you care)?

Palisade Investment Partners focuses on mid-market unlisted infrastructure which allows Palisade to source attractive investment opportunities (often on a bilateral basis) and create greater value for investors through active asset management alongside aligned management teams.

Rigg cited the current macro environment coupled with industry and government catalysts are creating a highly attractive investment opportunity in unlisted infrastructure.

“Over the next three to five years, we expect unprecedented levels of attractive investment opportunities to be available within the Australian mid-market infrastructure space,” she said.

“Private capital from financial investors such as Palisade will very likely be required to play an ongoing role in partnering with government and corporates to alleviate balance sheet pressure as a result of sustained higher interest rates.”

Rising demand for infrastructure development – and the funding sources that make this possible – will also be driven by tailwinds such as the:

- transition to a low carbon economy,

- exponential growth in data, and

- greater emphasis on supply chain resilience and energy security.

What investors need to know about Alternatives

Within PE, Five V Capital’s England said it’s crucial for investors to understand the wide variation that exists across the asset class. He noted asset managers are often key to successful PE investments, often partnering with company management teams to help grow their businesses and eventually sell them for a profit.

“This process is challenging, so investors should seek private equity managers who have a proven track record of performance,” England said.

“Not all private equity is the same. Just like in public markets – you have different strategies. It is important to understand the underlying investments that your private equity manager is going into, and how they practically add value.”

In the unlisted infrastructure space, Palisade’s Rigg said investors need to understand that the underlying assets are, in many cases, critical to the efficient functioning of modern society.

“This essential nature means that infrastructure is often thought of as a defensive asset class, providing downside protection through market cycles whilst delivering sustainable, inflation-linked cashflows,” she said.

The must-have investment attributes

Five V Capital only partners with companies that have already turned a profit. For them, such companies typically demonstrate a profit of between $5 million and $30 million, with enterprise values of between $50 million and $300 million.

“They are leaders in a niche and have many growth opportunities that can be unlocked with our support and capital,” said Five V’s England.

Within the unlisted infrastructure space, Rigg notes Palisade’s definition of “infrastructure” is broad and continues to evolve but says her team’s philosophy remains unchanged since it launched 16 years ago.

“In addition to being considered essential, infrastructure assets fundamentally need to be tangible, with strong market positions and high barriers to entry,” she said.

One stand-out investment (and why Palisade owns it)

The transport and broader logistics sectors have long been areas of interest to Palisade. Rigg highlighted regional airports as examples of “classic infrastructure characteristics such as long-term sustainable cashflows and defensiveness.”

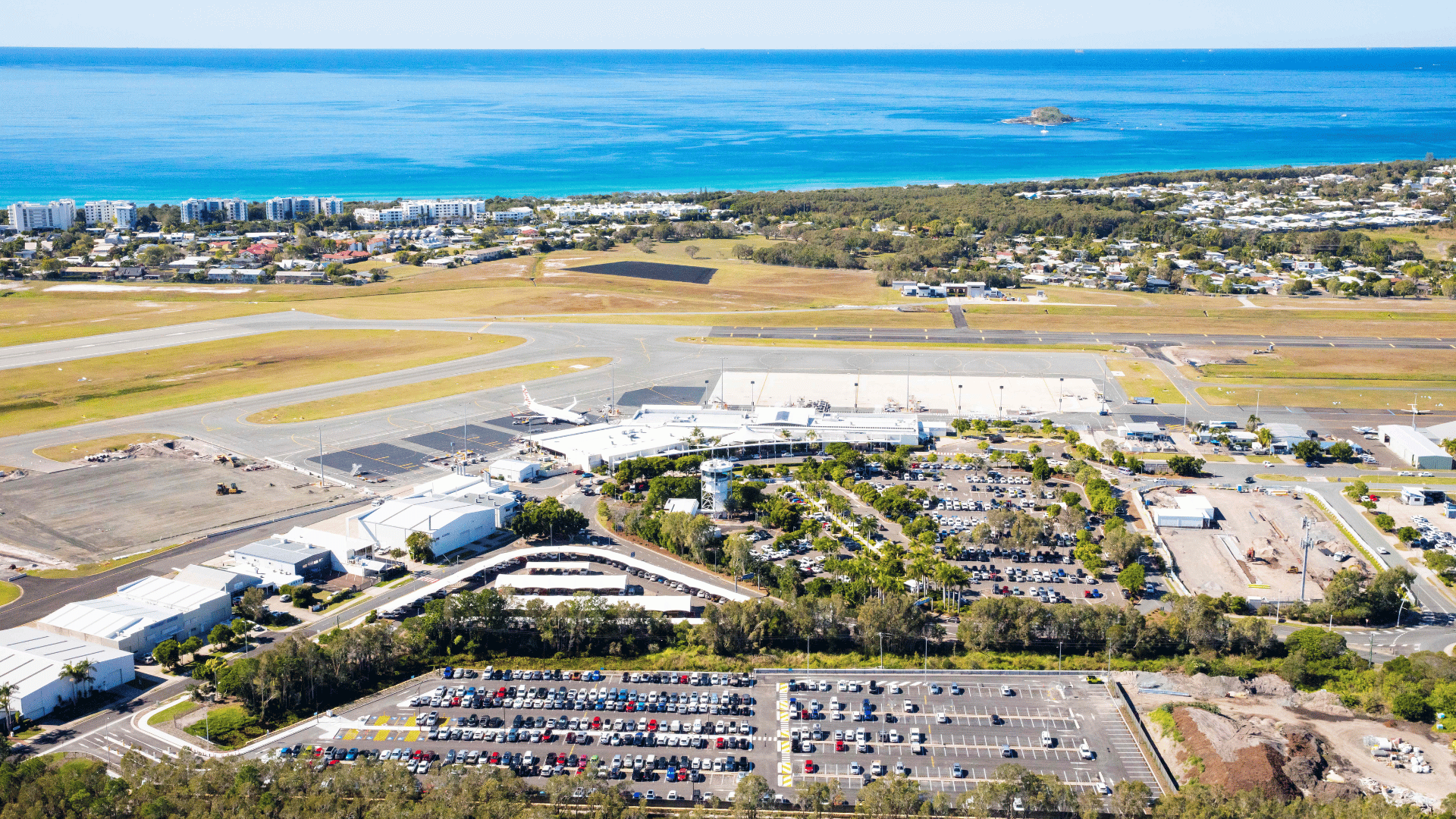

One such asset is Sunshine Coast Airport, which Palisade acquired from the local council in 2017. Australia’s fastest growing airport, it has a catchment area of around 400,000 people within one of the nation’s largest regional economies.

This is one of more than 25 individual assets in Palisade’s Diversified Infrastructure Fund, “and is an example of why we have delivered investors a total net return over 10 years to 31 March 2024 of 9.8% p.a, including yield of 5.5% p.a.”

“Initiatives under Palisade management have included driving outperformance across the aviation route network – supported by the construction of a new 2.45km runway to allow for greater sized aircraft – and non-aviation income such as property development and car parking, and recruiting an exceptional management team,” Rigg said.

She also noted continued strong growth in passenger numbers has driven significant expansion of the terminal, an ongoing program that is currently in the early stages.

A long-held Five V investment

In the PE space, England singled out sustainable packaging manufacturer BioPak, which is a leader in producing “everything from coffee cups to burrito wrappers for the food and beverage industry.”

England also emphasised BioPak is founder-led, under CEO Gary Smith, who he described as “an exceptional partner.”

“We are helping Gary and the team grow via M&A and overseas expansion so they can capture the full opportunity in front of them.”

Attend the 2024 Pinnacle Investment Summit

If you’re a financial adviser or qualify as a wholesale investor, you can hear more from Justin England and Vicki Rigg at the 2024 Pinnacle Investment Summit in Sydney on Wednesday July 24 and also receive CPD points for your attendance. Register to attend and see full event details here

You can also register to attend the Summit in other major cities across the country here.

5 topics

2 funds mentioned