The US$115 billion question: Will Meta and Microsoft's huge spending on AI be worth it?

Many investors believe that artificial intelligence (AI) will improve the world. But bullish or not, there is one question that AI aficionados cannot afford to ignore: how much will it cost? This week, that cost question was front and centre for the major US tech earnings results.

Alphabet (NASDAQ: GOOGL), the parent company of Google, has already flagged that its AI expenditure costs will remain elevated. Although it reported a 35% increase in cloud revenues last quarter, CAPEX (capital expenditure) rose by more than 60%, to over US$13 billion. CEO Sundar Pichai has already flagged that this figure will likely be similar for Q4.

But unlike Alphabet, two other Magnificent Seven names have increased their CAPEX forecasts for fiscal 2025. At a time when margins are being watched more closely than ever, any significant increase in costs will likely weigh on investor sentiment. And as anyone who's closely watched markets over the last few years could tell you, one miss in an otherwise perfect set of numbers can still cost a company any expectations for a post-earnings share price appreciation.

Livewire is running coverage of the US earnings season over the next week or so as the numbers come in and the washout begins. We are starting with Plato Investment Management's Dr David Allen and his analysis of the Meta (NASDAQ: META) and Microsoft (NASDAQ: MSFT) results.

Meta Platforms

- Q3 revenue +19% year-over-year to US$40,589 million (BEAT)

- Costs +14% year-over-year to US$23,239 million

- Net income +35% year-over-year to US$15,688 million (BEAT)

- EPS of US$6.03/share BEAT expectations by 15%

- Margins of 42.7% BEAT expectations by 9.5%

The commentary below was provided by Dr David Allen, Plato Investment Management.

Meta, the owner of Facebook and Instagram reported on Thursday, and fell 4%.

There was something for the Meta bulls and bears in Thursday’s results. The former cheered the 20% year-over-year advertising revenue growth, a 1% beat on the top line, a margin of 42.7%, which was 9.5% above consensus, and a GAAP EPS [earnings per share] that was 15% above consensus.

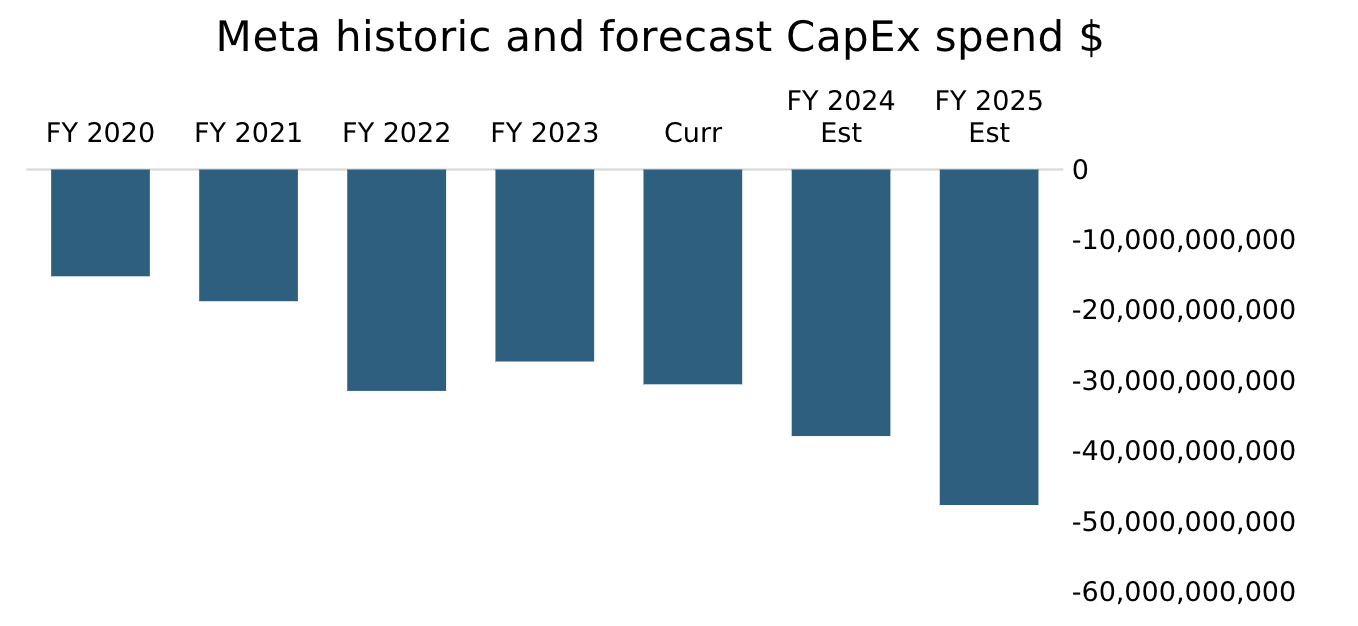

The bears will fret over the guidance for “significant acceleration” in CAPEX as Meta leans into AI infrastructure spending. As seen below, the forecast CAPEX spending is colossal, predicted to be almost $50 billion in the 2025 fiscal year. It remains to be seen the extent to which Meta can monetise their leadership in this space. That said, Meta AI now has more than 500 million MAUs [monthly active users]. Bears will also note the company is signalling that it will be less focused on earnings during this build-out.

Meta has released its Llama LLM [large language-generated AI models] for broad use. Within Meta, these models are driving productivity gains. At Plato, we use the models for analysing the sentiment of tens of thousands of earnings calls and broker research notes and have found them to perform remarkably well (near human level).

We currently have a BUY on Meta. The company’s almost impenetrable competitive moat continues to drive network effects. Plato ranks Meta as the 509th most attractive stock of 3145 US stocks and the 17th most attractive of the 135 stocks in its sector.

Microsoft

- Earnings per share of US$3.30, on revenue of US$65.59 billion (both BEAT analyst expectations)

- Margins +14% year-over-year to 46.7%

- Cloud revenues +20% to US$24.1 billion, guidance of +18% to +20% for the year

- Azure cloud infrastructure business sales +34%, guidance of +31% to +32% for the coming quarter (weaker than market expectations)

The commentary below was provided by Dr David Allen, Plato Investment Management.

Microsoft, reported quarterly earnings, falling 6%, the most in two years.

Again, there was something in the results for the bulls and the bears. Bulls will focus on the 16% first-quarter revenue growth to US$65.6 billion and EPS of US$3.30, beating expectations. The Bears will focus on the slower-than-expected Azure ramp and accelerating CAPEX. The disappointing cloud outlook was supply-driven with a slower-than-hoped-for roll-out for the Azure platform capacity.

Why is this so important? Well, the Intelligent Cloud segment that Azure falls under makes up US$105.4 billion of Microsoft’s revenue. This represents 43% of revenue, exceeding the revenue of their dominant Office products.

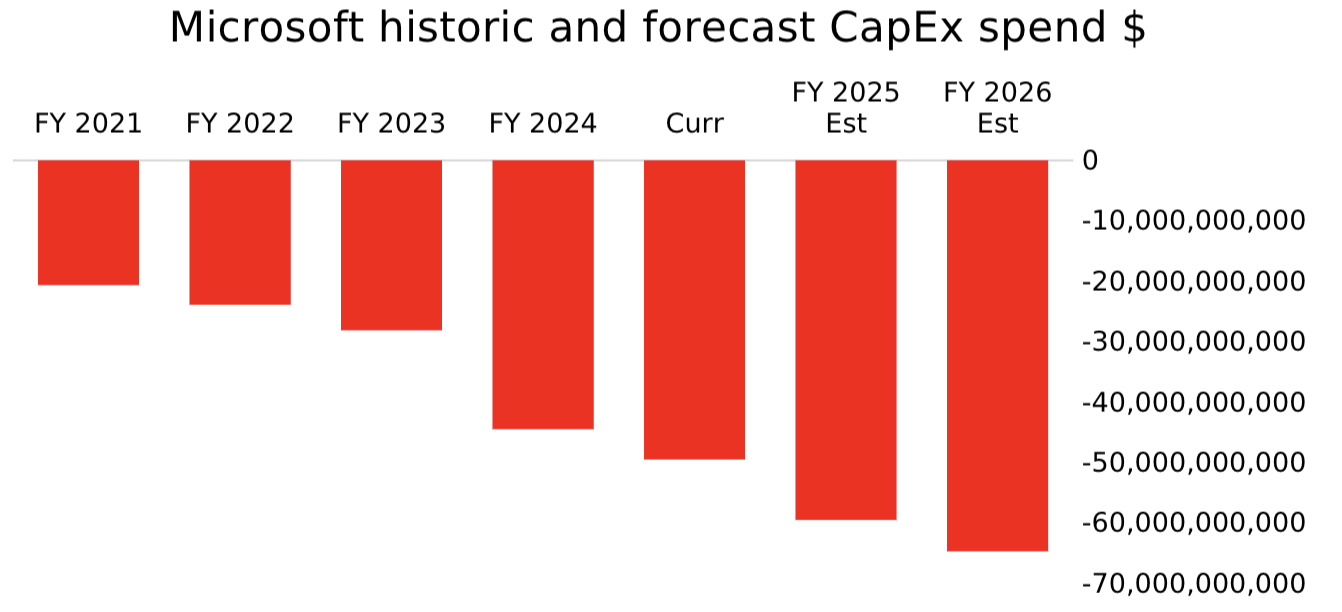

If you were frightened by the acceleration of Meta's CAPEX, the picture for Microsoft is arguably even more sobering, projected to reach US$65 billion in 2026.

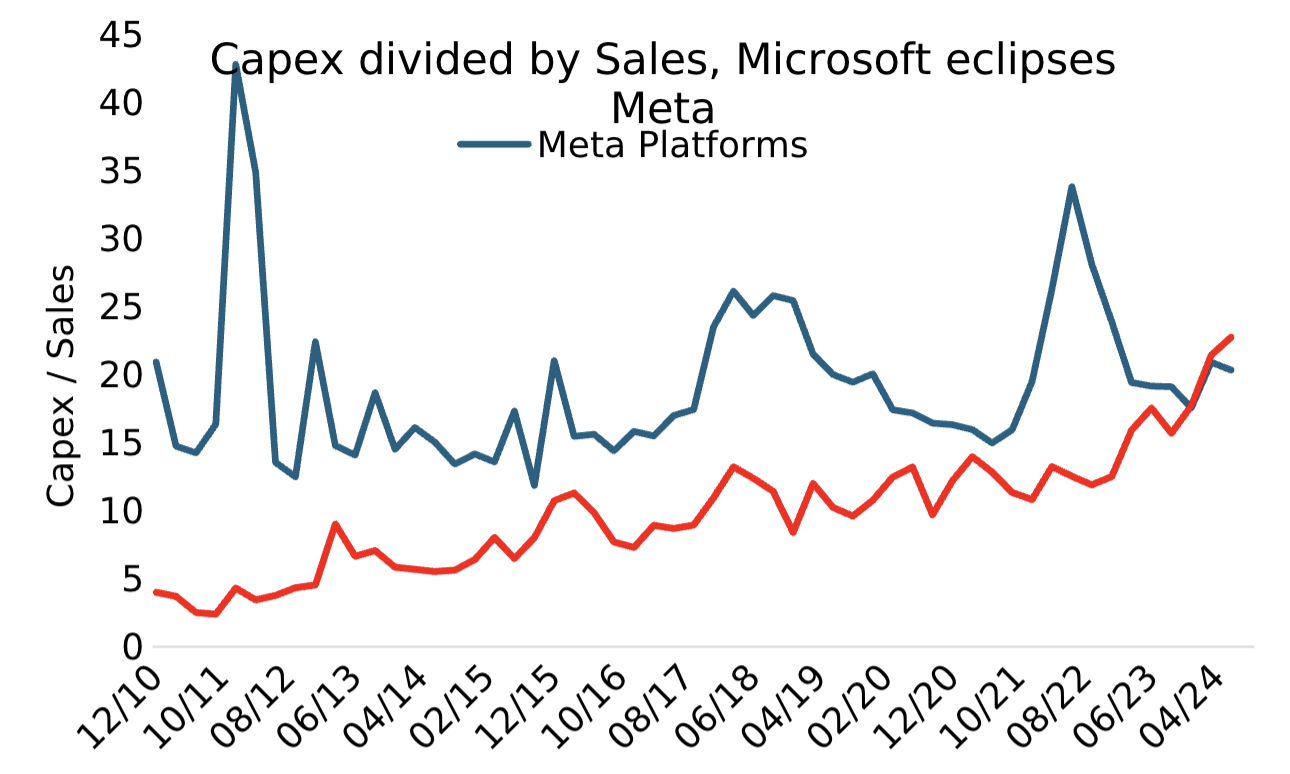

Casting this in historical terms, Microsoft’s CAPEX as a proportion of revenue has never before exceeded Meta’s. As shown below, Meta has now lost this dubious crown.

The market can be cruel in the short term and punish large-cap ex-ramps (as Meta found out in their ill-fated adventures into the metaverse). We don’t see sentiment turning around for Microsoft in the short term.

We currently have a SELL on Microsoft. Not because we doubt the long-term prospects of the company, but simply because sentiment is so dire in the short term. Plato ranks Microsoft the 2184th most attractive stock of 3145 US stocks, and the 287th most attractive of the 384 stocks in its sector.

US earnings season coverage continues next week with a complete wrap of the Big Bank earnings as well as the rest of the Magnificent Seven.

3 topics

3 stocks mentioned

1 contributor mentioned