The US dollar is soaring – So which ASX stocks stand to benefit?

The US Dollar Index has surged 6.3% since late September, completing an impressive eight-week rally – the longest since September 2023. Over the same time period, the Australian Dollar has dipped by a similar magnitude and is hovering near a seven-month low.

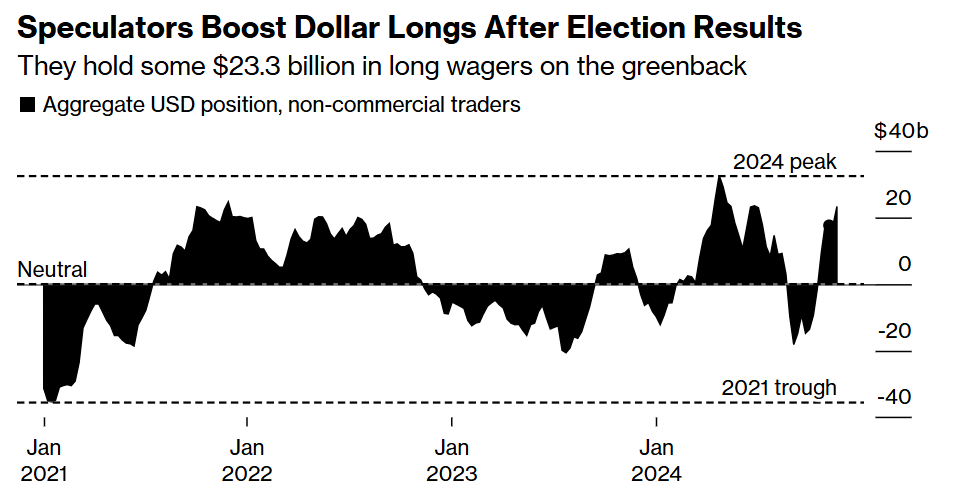

Bloomberg reports that speculative traders have ramped up their dollar-positive bets to the most bullish level since late June, signalling confidence in further gains.

As the US Dollar continues to trend higher, you might start to think – Which ASX-listed companies stand to benefit?

Sector Winners and Losers

- Beta: Measure of a stock's volatility relative to the market (or, in this case, relative to the Australian dollar). A beta of one or more suggests the stock is aggressive and its price movements are more volatile than the Aussie.

- T-Stat: A high T-stat suggests that the movements between the Aussie and cyclical sectors are unlikely to be due to chance. A low T-Stat suggests that the difference could be attributed to random variations or other factors.

|

Sector

|

Cyclical or Defensive

|

Avg Beta

|

Avg T-Stat

|

|---|---|---|---|

|

Materials

|

Cyclical

|

0.6

|

1.2

|

|

Energy

|

Cyclical

|

0.5

|

0.8

|

|

Financials

|

Cyclical

|

0.1

|

0.5

|

|

Industrials

|

Cyclical

|

0.2

|

0.1

|

|

Communications

|

Defensive

|

0.1

|

0.1

|

|

Discretionary

|

Cyclical

|

0.1

|

0.1

|

|

Technology

|

Cyclical

|

0.2

|

-0.1

|

|

Utilities

|

Defensive

|

-0.1

|

-0.8

|

|

Real Estate

|

Defensive

|

-0.1

|

-1.0

|

|

Staples

|

Defensive

|

-0.4

|

-1.4

|

|

Health Care

|

Defensive

|

-0.3

|

-1.5

|

Source: Citi Research December 2023

The data shows that cyclical sectors have historically outperformed in a falling US dollar environment.

|

Ticker

|

Company

|

Sector

|

Beta

|

T-Stat

|

|---|---|---|---|---|

|

Fortescue

|

Materials

|

1.4

|

4.1

|

|

|

BHP Group

|

Materials

|

0.5

|

2.5

|

|

|

Rio Tinto

|

Materials

|

0.5

|

2.4

|

|

|

Mineral Resources

|

Materials

|

0.8

|

2.2

|

|

|

Commonwealth Bank

|

Financials

|

0.2

|

2

|

|

|

Santos

|

Energy

|

0.5

|

1.8

|

|

|

Westpac

|

Financials

|

0.2

|

1.7

|

|

|

Seek Limited

|

Communication Services

|

1.7

|

|

|

|

Bluescope Steel

|

Materials

|

0.5

|

1

|

Source: Citi Research December 2023

|

Ticker

|

Company

|

Sector

|

Beta

|

T-Stat

|

|---|---|---|---|---|

|

Brambles

|

Industrials

|

-0.6

|

-3.9

|

|

|

CSL

|

Health Care

|

-0.5

|

-3.5

|

|

|

APA Group

|

Utilities

|

-0.5

|

-3.3

|

|

|

Transurban Group .

|

Industrials

|

-0.3

|

-2.8

|

|

|

Telstra Group

|

Communication Services

|

-0.4

|

-2.8

|

|

|

ASX

|

Financials

|

-0.4

|

-2.8

|

|

|

Woolworths Group

|

Consumer Staples

|

-0.4

|

-2.6

|

|

|

Sonic Healthcare

|

Health Care

|

-0.4

|

-2.6

|

|

|

James Hardie Industries

|

Materials

|

-0.6

|

-2.5

|

|

|

Cochlear

|

Health Care

|

-0.4

|

-2.4

|

|

|

Aristocrat Leisure

|

Consumer Discretionary

|

-0.4

|

-1.9

|

|

|

Computershare

|

Industrials

|

-0.3

|

-1.7

|

Source: Citi Research December 2023

Stocks by US Dollar Exposure

For instance, Aristocrat Leisure says a single US cent change in the AUD/USD exchange rate could translate to an estimated $24 million impact on the Group's net profit after tax for the year ending 30 September 2024. This isn't a game-changer but may present a small incremental change to earnings.

|

Company

|

Foreign (%)

|

Americas (%)

|

|---|---|---|

|

Life360

|

98%

|

92%

|

|

Propel Funeral Partners

|

94%

|

91%

|

|

Orora

|

55%

|

77%

|

|

Aristocrat Leisure

|

84%

|

77%

|

|

James Hardie Industries

|

87%

|

68%

|

|

Resmed Inc.

|

39%

|

65%

|

|

Fisher & Paykel

|

99%

|

59%

|

|

Computershare

|

85%

|

57%

|

|

Ansell

|

95%

|

56%

|

|

Reliance Worldwide

|

89%

|

55%

|

|

CSL

|

92%

|

53%

|

|

Reece

|

89%

|

52%

|

|

Breville Group

|

80%

|

50%

|

Source: Morgan Stanley 2024

|

Company

|

Region

|

Exposure %

|

|---|---|---|

|

Block

|

USA

|

93%

|

|

Austal

|

USA

|

85%

|

|

James Hardie

|

USA

|

81%

|

|

Aristocrat Leisure

|

North America

|

79%

|

|

Polynovo

|

USA

|

77%

|

|

Reliance Worldwide

|

Americas

|

71%

|

|

Computershare

|

USA

|

69%

|

|

Light & Wonder

|

USA

|

67%

|

|

Bluescope Steel

|

NatAM

|

62%

|

|

Cochlear

|

Americas

|

59%

|

|

Brambles

|

Americas

|

56%

|

|

Breville Group

|

Americas

|

55%

|

Source: Macquarie Research November 2024

This article first appeared on Market Index on Wednesday 27 November 2024.

2 topics