There are 9 upcoming Australian IPOs looking to raise a combined $693 million. Here's the list

In times of easy money, new companies typically flock to the stock exchange. In more uncertain times with monetary tightening, unsurprisingly, many companies hold back. That should tell you what to expect when it comes to upcoming listings on the ASX, let alone globally. After all, we’ve watched:

- the official cash rate jump 12 times in just over a year,

- markets crash into the red at the end of 2022 and,

- signals of a recession come in hard and fast, despite an early-2023 recovery.

How times have changed

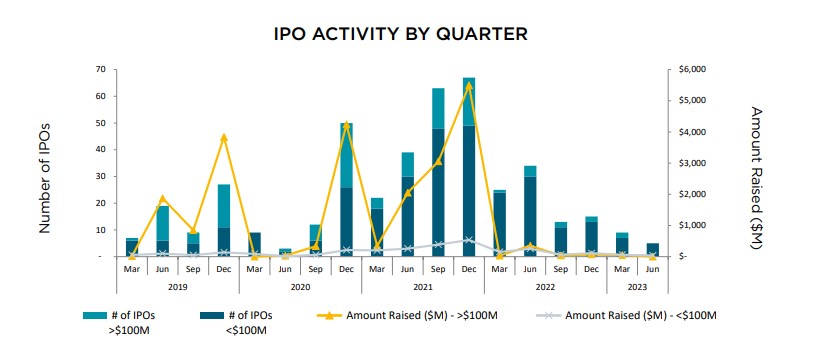

Only two years ago, there were record numbers of IPOs. In fact, there were over 1000 in the US. Locally, we had around 191 IPOs. The volume dipped dramatically in 2022 and the number this year is looking smaller again.

According to HLB Mann Judd’s IPO Watch Australia Mid-Year Report July 2023, there were only 14 listings in the first half of 2023, compared to 59 in the same period last year, with $150 million raised compared to $790 million last year. At this stage, there are only nine upcoming floats for the remainder of the year, seeking to raise $693 million.

What’s happening in Australian IPO markets?

“Underlying factors impacting the IPO market include a significant degree of uncertainty across global markets, weaker indicators, and a slowdown in the world economy due to tighter monetary conditions. The outlook for the remainder of 2023 is expected to be challenging with tight capital markets,” says Marcus Ohm, partner, corporate and audit services, HLB Mann Judd.

Ohm notes that any improvements in the inflation print or interest rates will be critical to the success of IPOs in the second half of 2023.

The market headwinds have not only placed pressure on capital raising but have also meant companies have struggled performance-wise post-listing according to Ohm.

The bulk of listings across the year have been focused on materials, with companies based in WA comprising the majority of these. Lithium and gold have both been a feature given the role of the former in the green transition and the latter as a safe-haven metal in challenging times. While there have been a few large-cap additions, most IPOs have been in the small-cap space.

New listings in 2023 so far

There have been 20 new listings to 1 August 2023 on the ASX. The below chart shows these companies, along with one-year returns (noting that obviously none of these companies has been listed for a year yet, and one was only listed this week).

Company |

ASX ticker |

Market cap |

1-year return |

Abacus Storage King |

ASK |

$1.77bn |

-7.80% |

Australian Critical Minerals |

ACM |

$5.65m |

-5.00% |

Acusensus Ltd |

ACEDB |

$17.66m |

0 |

ACDC Metals |

ADC |

$3.74m |

-60.00% |

Augustus Minerals |

AUG |

$17.33m |

7.50% |

Chilwa Minerals |

CHW |

$8.26m |

-10.00% |

Dynamic Metals |

DYM |

$8.23m |

17.50% |

DY6 Metals |

DY6 |

$7.52m |

-2.50% |

Evergreen Lithium |

EG1 |

$16.31m |

16.00% |

Gold Hydrogen Ltd |

GHY |

$16.79m |

-41.00% |

High-Tech Metals Ltd |

HTM |

$4.44m |

-10.00% |

Iltani Resources |

ILT |

$11.07m |

32.50% |

Leeuwin Metals |

LM1 |

$15.23m |

36.00% |

Light and Wonder Inc |

LNW |

$554.96m |

16.24% |

NGX Ltd |

NGX |

$19.48m |

7.50% |

Patagonia Lithium |

PL3 |

$8.58m |

-20.45% |

Peet Limited |

PPC |

$584.46m |

22.17% |

Redox Ltd |

RDX |

$1.32bn |

-1.57% |

SQX Resources Ltd |

SQX |

$3.50m |

-30.00% |

VHM Ltd |

VHM |

$91.92m |

-55.56% |

Source: ASX, Market Index, 2 August 2023

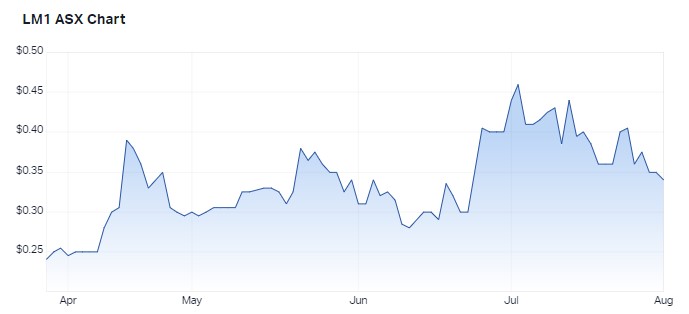

The top performer was Leeuwin Metals (ASX: LM1), which listed on 29 March 2023 and has returned 36% since then. Leeuwin Metals is a mineral explorer committed to securing critical metals vital for the advancement of electric vehicles and renewable energy. It has projects in Canada and Western Australia that are highly prospective for Nickel, Copper, PGF and lithium.

Its recent drilling program at William Lake in Canada indicated a significant scale of nickel sulphide mineralisation, while it also announced the potential for major rare earth elements, along with lithium at its Western Australian Gascoyne Lithium-REE Project.

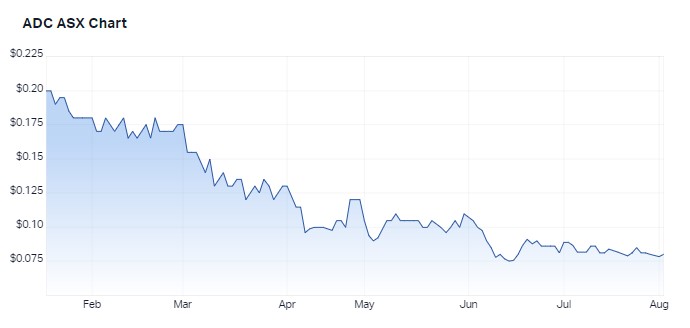

The worst performer was ACDC Metals (ASX: ADC), which was listed on 17 January and has fallen 60%. ACDC Metals is an integrated mineral exploration and rare earth technology company incorporated with the aim of undertaking mineral exploration and resource development, focusing on heavy mineral sands projects in Victoria. It aims to produce heavy mineral sands products and rare earth elements.

It announced an "exceptionally high-value" mineral assemblage at its Goschen Central project in June.

Redox (ASX: RDX) has been the biggest IPO listing of the year, raising more than $400 million in its float.

The 9 upcoming floats on the ASX

“With a combination of unfavourable macroeconomic factors and poor investor sentiment, we anticipate a challenging third quarter ahead for IPOs,” said Ohm.

|

Company |

ASX ticker |

Issue price |

Tentative listing date |

|

Ashby Mining Ltd |

AMG |

$0.20 |

16 August |

|

Cleo Diagnostics |

COV |

$0.20 |

11 August |

|

CurveBeam AI Ltd |

CVB |

$0.48 |

23 August |

|

Dragonfly Biosciences Ltd |

DRF |

$0.20 |

TBC |

|

Great Divide Mining Ltd |

GDM |

$0.20 |

TBC |

|

James Bay Minerals Ltd |

JBY |

$0.20 |

7 September |

|

Mining Green Metals Ltd |

MG1 |

$0.20 |

4 August |

|

Western Australia |

WER |

$0.20 |

TBC |

|

XLR8 Metals Ltd |

XL8 |

$0.20 |

TBC |

Source: ASX, 2 August 2023

Ashby Mining (ASX: AMG) – an aspiring Australian mineral resources company developing a gold production business in Northern Queensland. Key investors are Collins St Asset Management, Nebari Gold Fund, Rivi Opportunity Fund LLP and Trans Asia Private Capital. You can find out more about the offering here.

Cleo Diagnostics (ASX: COV) – a medical technology company that is aiming to bring to market a blood test capable of early ovarian cancer detection. You can find out more about the offer here.

CurveBeam AI Ltd (ASX: CVB) – develops, manufactures and sells a range of specialised medical imaging (CT) scanners and supporting clinical assessment software aids to support the clinical assessment and management of musculoskeletal health conditions. Its existing investors include Tenmile, Ilwella, Firetrail, SG Hiscock, Frazis Capital, Karst Peak Capital and Acorn. You can find out more about the offer here.

Dragonfly Biosciences (ASX: DRF) – a leading cannabidiol brand in the UK, supplying premium CBD products to national retail chains and international markets. The company has decided to focus on Australia after legislation changes meaning that low-dose CBD is classified as a pharmacist-only medicine, rather than prescription medicine. You can find out more about the offer here.

Great Divide Mining Ltd (ASX: GDM) – a Queensland-based and focused mineral explorer targeting gold and technology metals within renowned mineral provinces. It has four key project sites. You can find out more about the offer here.

James Bay Minerals Ltd (ASX: JBY) – a lithium miner with key project Troilus in Canada. Its project is in early-stage exploration, but lithium spodumene-bearing pegmatites have been identified on close-neighbouring projects operated by Vision Lithium, Sayona Mining and Winsome. You can find out more about the offer here.

Mining Green Metals Ltd (ASX: MG1) - a mining exploration and development company with a suite of green metal projects (either owned or optioned) including Lithium, PGEs, Nickel, Vanadium and Uranium in the mining jurisdictions of Western Australia. Mining Green Metals has an option agreement with Australian Vanadium to buy its Coates (nickel, base metals, gold and platinum group elements) and Nowthanna Hill (uranium) Projects in WA. You can find out more about the offer here.

Western Australia Energy Resources Ltd (ASX: WER) – aims to evaluate and secure investment possibilities in the resources industry and uncover economically significant mineral reserves. It is intending to use capital raising to explore the Jimberlana Nickel project. You can find out more about the offer here.

XLR8 Metals Ltd (ASX: XL8) – a

minerals exploration company with a portfolio of quality nickel projects in Sweden

and Tanzania, this firm intends to embed itself into the EV supply chain in Europe. You

can find out more about the offer here.

Have you invested, or do you plan to invest, in any Australian IPOs this year? Let us know in the comments.

3 topics

11 stocks mentioned