Thinking long term? Try these Big Ideas

Like the proverbial frog allowing itself to boil as its slowly heated up, it’s easy to miss the pace of innovation when you’re watching it in real time. In 2007 or 2008, smartphones seemed like a frivolous toy, and few predicted the monumental impact that they’ve had on our lives. Today, many other great innovations are being developed though working out which will stay the course is, for most of us, a real headscratcher. But Ark Investment Management have built a reputation for identifying these key trends, and their CEO, Catherine Wood, is sought globally for her insights as to how they might play out.

Each year, Ark releases a special report called Ark’s Big Ideas, which have become required reading for growth investors and futurists alike. With the Big Ideas for 2021 recently released, I thought I’d pull out some of the key themes and quotes. You can access the full report at the bottom of this article.

Rather than try to cover the entire 112-page report with 15 topics, instead I’ll focus on a few stand-out topics.

Reinventing the data centre

Most Australian investors are probably already familiar with NextDC (NXT), but they’re far from the only data centre operator in the country. In fact, other well known ASX-listed companies such as Telstra (TLS) and Vocus Communications (VOC) are also among the top data centre operators in the country. But if these operators are to keep up with developing trends, they’ll need to step up their game.

PC-derived processors, such as those produced by Intel, currently provide the lion’s share of the processing power in most data centres. But ARK sees new processing technologies, such as ARM, RISC-V, and graphics processing units (GPUs) taking over this market in the years to come. Over the next 10 years, they see GPUs dominating the data centre market, growing at 21% p.a. out to 2030.

Intel, the traditional category leader, appears to have stalled in its development. Since 2014, Intel has made little inroads in upgrading its architecture. This has allowed other manufacturers and architectures to catch up, and then surpass Intel’s capability. For an everyday example, one needs to look no further than the new MacBook Air, powered by Apple’s M1 “system on a chip”. The M1 is ARM-based and offers a significant performance boost over older Intel (x86) products.

Accelerators, such as GPUs, are set for significant growth too. They can perform some of the most resource-intensive tasks such as artificial intelligence (AI), and spending on this category is expected to expand from US$6 billion in 2020, to US$41 billion in 2030 (21% CAGR).

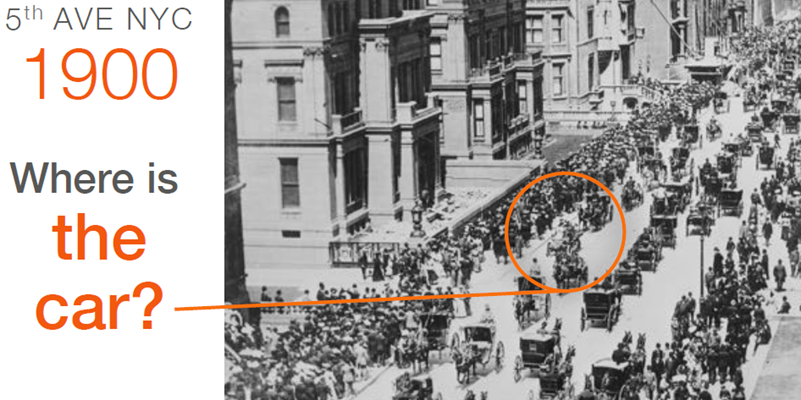

Electric vehicles: Where’d all the horses go?

Ever since seeing the two images below in a presentation six years ago, the idea of electric and autonomous vehicles has burned in my mind. After several false starts, it seems the EV movement is now building major momentum.

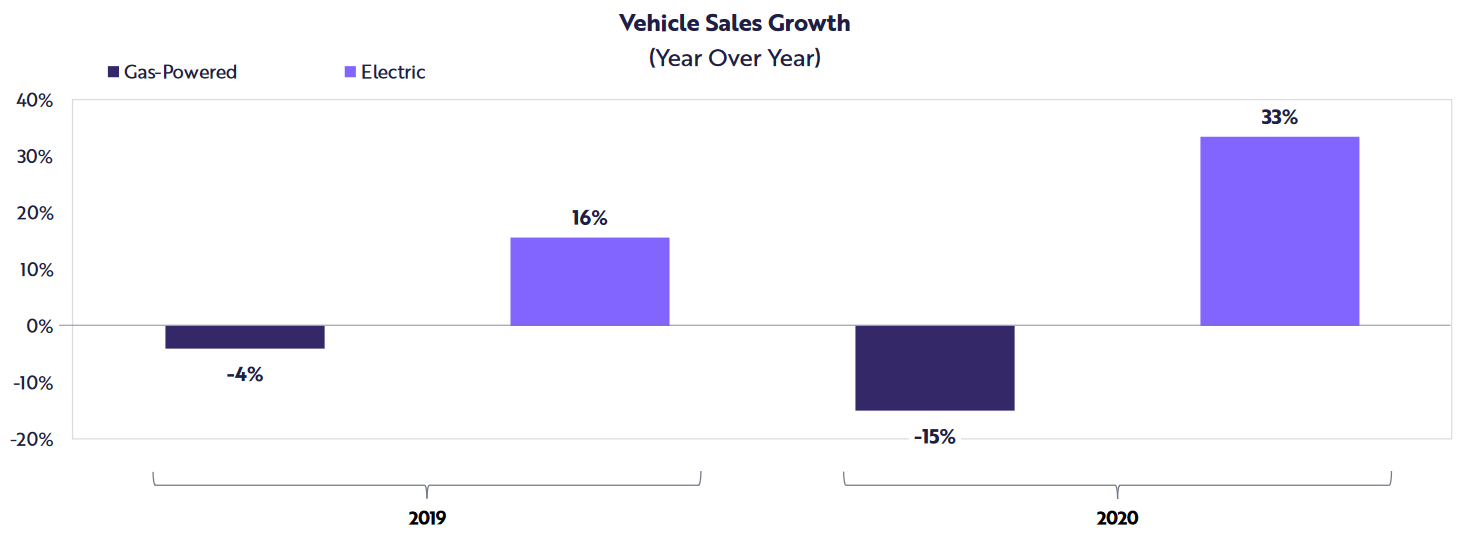

With EVs now able to compete on price with internal combustion engine (ICE) powered cars, we could be nearing a major tipping point. Ark estimates that EV sales should rise “roughly 20-fold from ~2.2 million in 2020 to 40 million units in 2025.” (emphasis mine) Growth at this scale might be hard to imagine, but it’s far from unprecedented – just look at penetration of smartphones for a recent example.

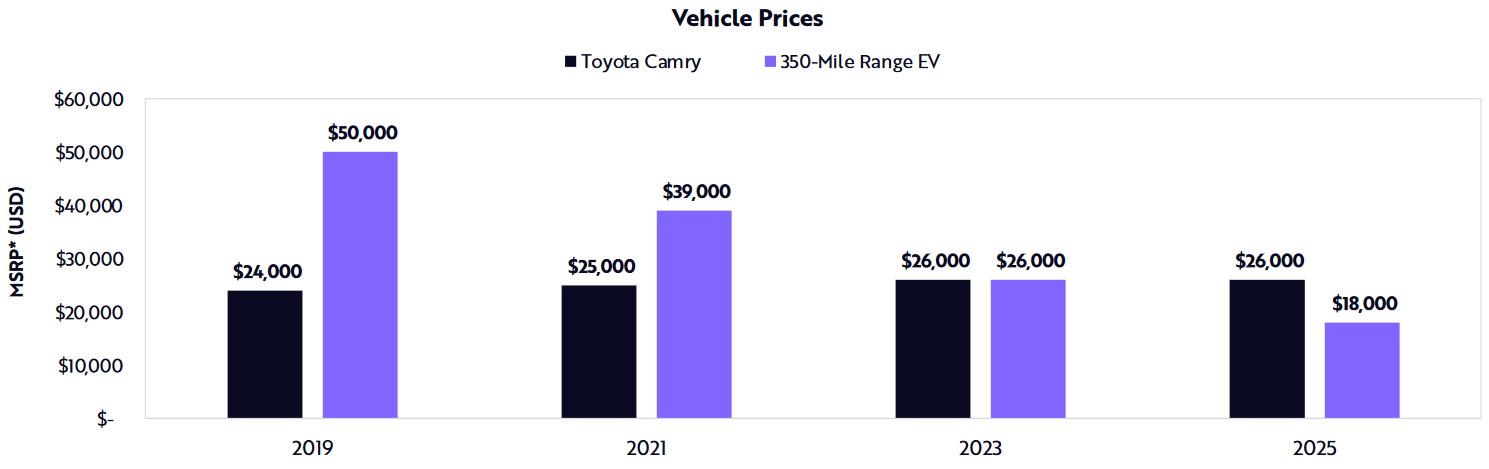

While sticker prices for EVs remain above those of comparable ICE-powered cars, the total cost of ownership (which includes petrol, maintenance, insurance, and resale value) for a comparable EV has now dropped below that of a Toyota Camry. With significant further price drops expected as battery costs fall, even the sticker price will soon be more attractive.

The rev-heads among us need not fear either. Range-anxiety will soon be a thing of the past, and the performance of EVs is already meeting or exceeding that of ICE-powered performance cars.

Drone delivery

As we all suffered through lockdowns and movement restrictions in 2020, many of us (myself included) turned to online shopping for an increasingly wide array of products. But there are few things more frustrating than sitting around for days, waiting for your shiny new toy to arrive.

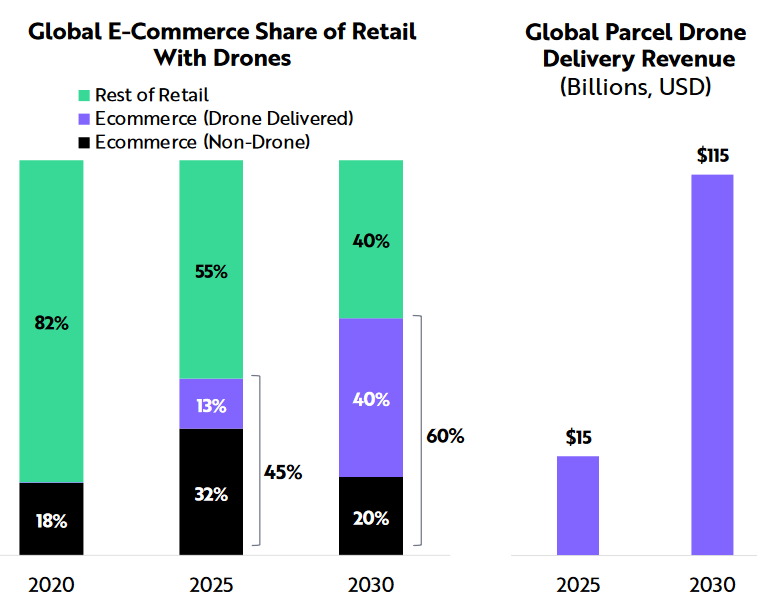

While logistics chains are well suited for getting products to people’s suburb, it’s the ‘last-mile’ delivery that presents the biggest challenge. Enter: autonomous aerial drones. Without the need to pay a driver or wade through traffic, drones will soon be able to deliver more quickly and cheaply than traditional services.

“ARK believes that drone delivery platforms will generate roughly US$275 billion in delivery revenues, US$50 billion in hardware sales, and US$12 billion in mapping revenue by 2030.”

While the idea of delivering packages by drone might sound appealing, what about delivering a person? This might sound like science fiction, but the first passenger drone ‘vertiport’ (an airport for aircraft that take off and land vertically) is being built in Florida, and it plans to be in operation by 2025!

Food delivery is another major opportunity, with its share of the ‘Food Away From Home’ market expected to rise from 2% globally in 2020, to 41% by 2030 with the implementation of autonomous drone delivery.

Think big

This article covers just three of the 15 big ideas outlined in this year’s report. While the 112-page report might look intimidating at first, it’s easy to consume, comes with myriad supporting images and data, and most importantly, contains plenty of Big Ideas! Other topics covered include:

- Deep Learning

- Virtual Worlds

- Digital Wallets

- Bitcoin

- Automation

- Autonomous Ride-Hailing

- Orbital Aerospace

- 3D Printing

- Various developing areas of biotechnology

Access the full version of ARK's Big Ideas 2021

Hear more from Ark

ARK Invests CEO, Cathie Wood, will soon be appearing on Livewire's Rules of Investing. Hit the "FOLLOW" button below to be notified when the episode is available.

You can gain exposure to ARK’s big ideas via the Nikko AM ARK Global Disruptive Innovation Fund.

Not already a Livewire member? Sign up today to get free access to investment ideas and strategies from Australia’s leading investors.

Disclaimer: Forecasts are inherently limited and cannot be relied upon. For informational purposes only and should not be considered investment advice, or a recommendation to buy, sell or hold any particular security.

1 topic

3 stocks mentioned

1 fund mentioned

1 contributor mentioned