This ASX gold miner just paid out a record dividend. But does it really matter?

If there's any metal that shines (or should shine) during periods of market uncertainty, it's gold. Over the last year, the gold price has returned 8.8% with the current price tracking near its 52-week high. But selling the gold is only part of the story. Before it ever reaches the end consumer, companies go through a long journey of finding the best assets and keeping as many black swans at bay as possible. From cost to currency headwinds and labour shortages, it's never a dull time being a miner.

No company knows this better than Newcrest Mining (ASX: NCM). The world's sixth-largest gold miner (and Australia's largest) has operations in Canada, Papua New Guinea, New South Wales, and Western Australia.

In 2010, the company was the subject of many headlines when it merged with PNG-domiciled Lihir Gold. Fast forward 13 years and it's once again the subject of M&A talk. Only this time, it's the one being bought out. Its former parent, Newmont Corporation (NYSE: NEM), is working on a near-US$29 billion deal that will make the world's largest gold miner even larger.

To discuss the Newcrest full-year result and most importantly, what happens now for shareholders, I spoke to Brad Potter at Tyndall Asset Management.

Note: Newcrest Mining is not a holding in the Tyndall Australian Share Wholesale Fund.

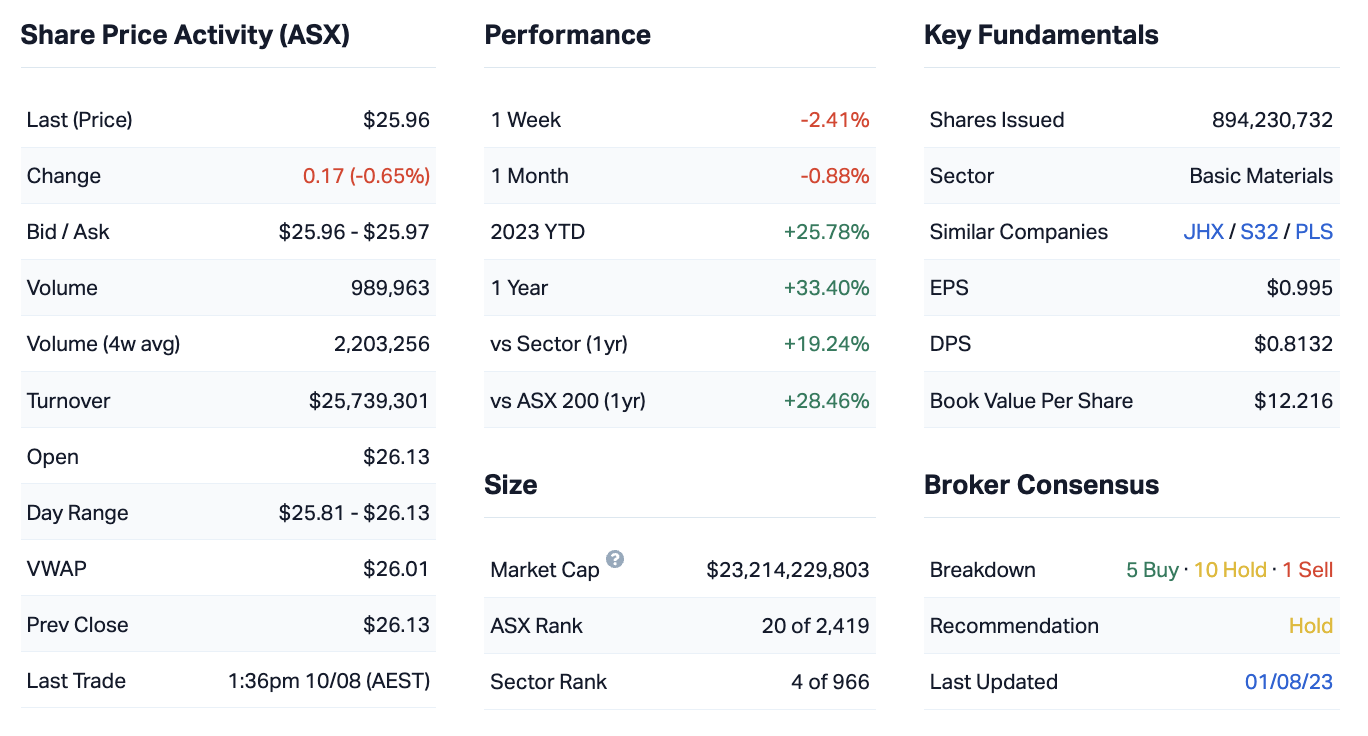

Newcrest Mining Chart

Newcrest Mining Full Year Key Results

- NPAT of US$778 million vs US$676 million (FactSet estimate)

- EBITDA of US$2.06 billion vs US$1.99 billion (estimate)

- Revenues of US$4.51 billion vs US$4.52 billion (estimate)

- Final dividend of US20 cents/share, taking the total payout to US55 cents a share (an all-time record for the company)

- FY24 AISC guidance of US$2.2-2.6 billion, gold production guidance of 2,000-2,300koz

Key Company Data

In one sentence, what was the key takeaway from this result?

The result was in-line on an EBITDA basis, which is understandable given its recent quarterly cash flow and production report. But it's a largely irrelevant result given the Newmont takeover that is expected to be completed by November 2023.

What was the market’s reaction to this result? In your view, was it an overreaction, an under-reaction or appropriate?

Rating: Appropriate

The market reaction suggested it was a well-known and uneventful result. It's trading in-line with Newmont given how close it is to the vote. It's going as one would have expected.

Assuming the vote goes ahead, it will be the last Newcrest result and it goes back to its parent! But there will be a Newmont listing and it will be a decent listing because most people will just accept the scrip and continue owning it.

Would you buy, hold or sell Newcrest Mining on the back of these results?

Rating: SELL

I'm not a big believer in buying size for the sake of getting larger. In many ways, this feels like what it is from a Newmont perspective. They will now be the largest gold producer in the world with a very significant copper credit as well. I'm much more constructive on the copper side of the business than gold. Gold's always been a difficult commodity in the sense that supply and demand is meaningless unlike most other commodities.

At this stage, I'm not a buyer of the stock. I don't hold it and I wouldn't be holding it at this stage.

What’s your outlook on the wider commodities sector? Are there any risks to this company and its sector that investors should be aware of?

Copper is one of the key commodities for the net zero process. Demand for copper will continue to rise over time. There is much more difficulty in finding new copper resources out there. My expectation is that long-term copper prices will remain elevated for a long time. That's arguably the most attractive part of the combined Newmont/Newcrest business.

From 1-5, where 1 is cheap and 5 is expensive, how much value are you seeing on the ASX right now? Are you excited or are you cautious about the market in general?

Rating: 3

In aggregate, I'd give it a three. That always hides the opportunities and the excesses in the market. Parts of the market are extremely expensive like those high growth areas while those cyclical areas remain extremely cheap at this stage. There's plenty of opportunities out there, particularly for a value manager looking long-term.

There's plenty of value in the cyclical end of the market and I'm a true believer in the critical minerals super-cycle. Insurance remains attractive, as do the oil and energy players. And in the consumer discretionary sector, it feels a little bit early right now but there will be a time when those stocks will look interesting and look closer to the bottom.

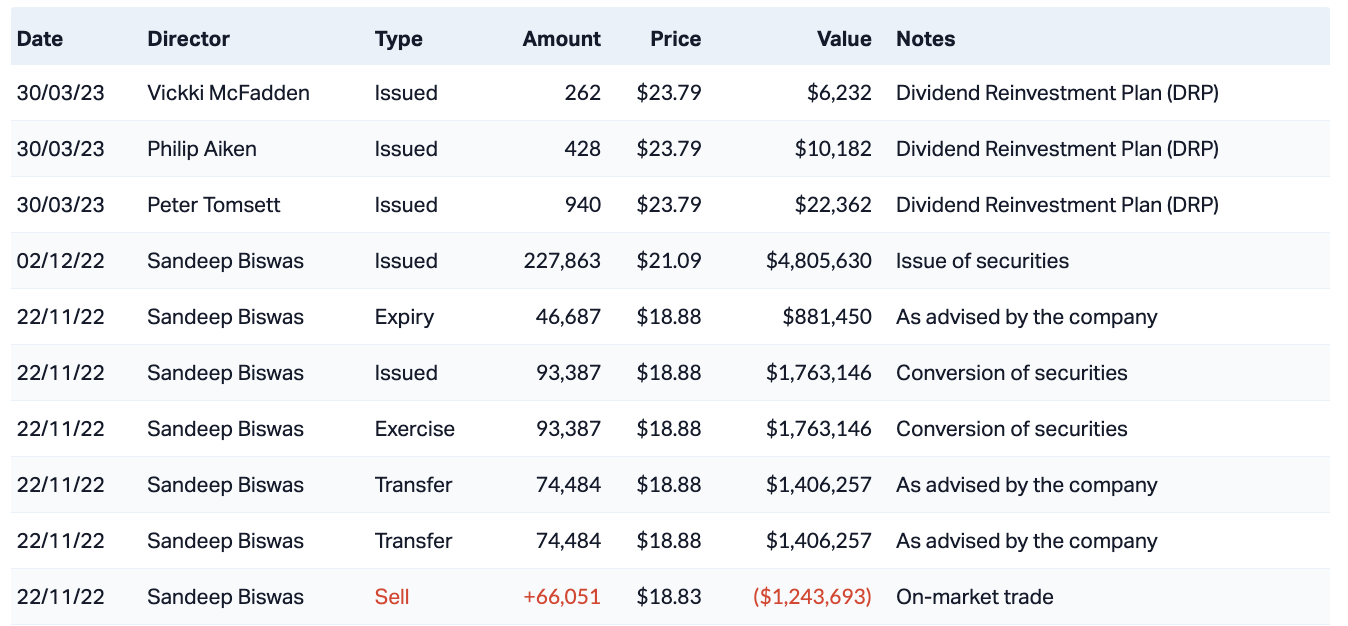

10 most recent director transactions

Catch all of our August 2023 Reporting Season coverage

The Livewire Team is working with our contributors to provide coverage of a selection of stocks this reporting season. You can access all of our reporting season content by clicking here.

4 topics

2 stocks mentioned

1 fund mentioned

1 contributor mentioned