This heavily sold-off darling just became earnings positive

Over the past year, locally-listed tech darlings have been punished as interest rates lifted at their fastest rate, well, ever. Unfortunately for both these companies and consumers alike, the period of free money is over, and growth companies - many still in the cash burn phase (read: unprofitable) - are having to pivot.

Overseas, we've seen companies like Amazon, Meta, Microsoft, Salesforce, Google and Uber announce heavy staff layoffs in a bid to shore up capital. And locally, it's no different.

"We're now seeing that domestically," abrdn's Camille Simeon said.

"Management teams are showing signs of capital discipline. They're cutting hiring intentions, and bringing forward free cash flow intentions as well. And we really need to see that persist now we're moving into either a soft landing or a hard landing."

Similarly, heavily sold-off tech darling Megaport (ASX: MP1) has announced it too would be running a cost-cutting program, one which would save it $8-$10 million across seven of its workstreams.

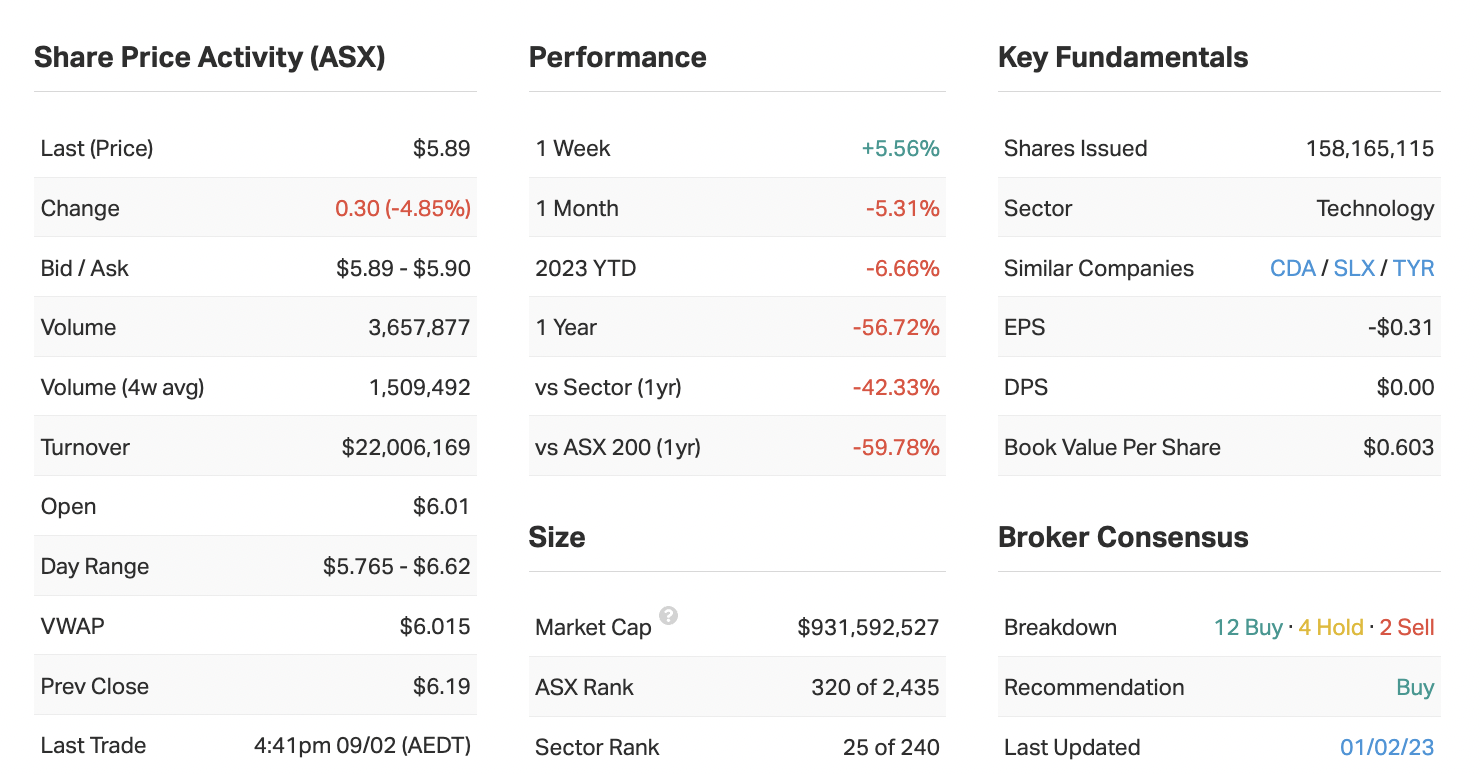

In its half-year results yesterday, Megaport also delivered a key profitability measure of EBITDA positive for the half, up 147% from the first half a year ago. And with its share price down nearly 60% over the past 12 months, the stock is now the cheapest its been in years (see chart below).

In this wire, Simeon outlines some of the highlights (and lowlights) from Megaport's latest result and shares why she rates the stock a hold in the near-term, and a buy for the long term.

Note: The interview took place on Thursday 9 February 2022.

Megaport First Half FY23 Key Results

- Global revenue of $70.7 million, up 38% from the pcp (1HFY22).

- Total number of customers lifted by 4% to 2,739.

- Net loss of $13.5 million, improving by 33% from the pcp.

- Normalised EBITDA of $3.4 million, up 147% from the pcp.

- OPEX of $43.1 million, up 13% on the pcp. CAPEX of $19 million, improving by 11% from the pcp.

- Announced a major "Cost Out" program initiated in FYQ2 - $8-$10 million in cash savings identified across seven workstreams.

- Cash on the balance sheet of $57.5 million, down from $82.5 million in June 2022.

Key company data for Megaport

In one sentence, what was the key takeaway from this result?

Megaport grew at a very healthy top-line growth rate and delivered a key profitability measure of EBITDA positive for the half, but the focus is on the near-term outlook, where there is some uncertainty.

What was the market’s reaction to this result? In your view, was it an overreaction, an under-reaction or appropriate?

We view it as an overreaction, but we need to break that down. The market has punished the stock, selling it off 25% since its quarterly result at the end of last month. It has materially underperformed the sector (which has been broadly flat over that same time period).

Near-term growth uncertainty is the key driver of that, so while operating leverage is being demonstrated and going forward management is focused on profitable growth, the market's confidence in the demand outlook is weaker.

There’s also the focus on cash burn and what that means for the balance sheet, particularly in the case if there is a risk of a capital raise, though we expect cash burn to improve.

The sales multiple that it's trading on is one of the cheapest it's been in recent years. And when you take a longer-term view of the underlying fundamentals of the market and the structural tailwinds, Megaport's market position and scalability make the current share price, in our view, look like an overreaction. But we need to be mindful of the near-term uncertainty and balance sheet.

Were there any major surprises in this result that you think investors should be aware of?

The results were largely pre-announced in the quarterly just the other week, but if we look at the positives from this result - the top line grew at a very healthy rate of 38%, customer quality has improved, and there are green shoots with the revenue impact from additional product uptake and partner channel engagement. Cash burn is expected to reduce with the Cost Out program, and that's especially important in de-risking the financial position.

The surprise based on the market reaction is that there is still some near-term uncertainty on the demand outlook. There are questions about its sales trajectory on the back of weaker-than-expected operational KPIs in the period. Management has begun a strategic review and go-to-market, looking at where they can drive efficiency. And then, of course, you've got the macro backdrop in the near term, which is a headwind, though management has commented that the pipeline is solid.

Would you buy, hold or sell MP1 on the back of these results?

Rating: HOLD (for now)

On a near-term timeframe, in our view, it's a hold (given the macro backdrop and the uncertainty around demand). But if you take into account a longer-dated timeframe, in our view, it's a buy.

What’s your outlook on MP1 and its sector over the year ahead? Are there any risks to this company and its sector that investors should be aware of?

Over the next 12 months, a key driver is interest rates. They've been a headwind to Megaport and the broader sector and you've seen the de-rate of these longer-duration growth stocks. That said, we're potentially near the peak of interest rates and this could provide support for these names, but inflation remains elevated. And we are seeing disinflation, which is what we've heard from the Fed's Jerome Powell just recently, but we really need to see this broaden out to be confident that inflation will slow and in turn, interest rates peak.

The sector is having to prove its mettle. A number of companies are in the cash burn phase - they're unprofitable, and the period of cheap capital is gone. Management teams are responding to this.

We've seen that offshore and we're now seeing that domestically, where management teams are showing signs of capital discipline. They're cutting hiring intentions, and bringing forward free cash flow intentions as well. And we really need to see that persist now we're moving into either a soft landing or a hard landing (aka recessionary concerns and questions on top-line growth), and that's obviously a concern for the sector if they're unprofitable and free cashflow negative.

That's no different for Megaport. And certainly, that's the strategy for management there as well - shore up capital, demonstrate operating leverage and bring forward free cash flow.

From 1-5, where 1 is cheap and 5 is expensive, how much value are you seeing in the market right now? Are you excited or are you cautious about the market in general?

Rating if we are headed for a recession: 4

Rating if we are headed for a soft landing: 2.5

The market has rallied since the start of the year. And it rallied from what we would have viewed as cheap to a somewhat fairer valuation. But where we go from here is really dependent on the macro data and central bank policy reactions, and it's not clear yet whether we're heading towards a soft landing or a recession.

The tight labour market points to a soft landing, but then central bank reactions and the potential for a policy mistake could point to recessionary outcomes. And that's going to have very different impacts on sectors, stocks and the market.

So, in that environment where the market is near to a fair valuation on a long-term historical metric, but there remains a very high probability of a recession, then, in my view, we're probably more on the expensive side.

Again, if we're heading towards a soft landing, and what the market thinks about that changes on a weekly basis, then, in my view, we're probably closer to a fair valuation. So you need to be really selective in terms of where you allocate capital in equity markets right now. I am cautiously optimistic.

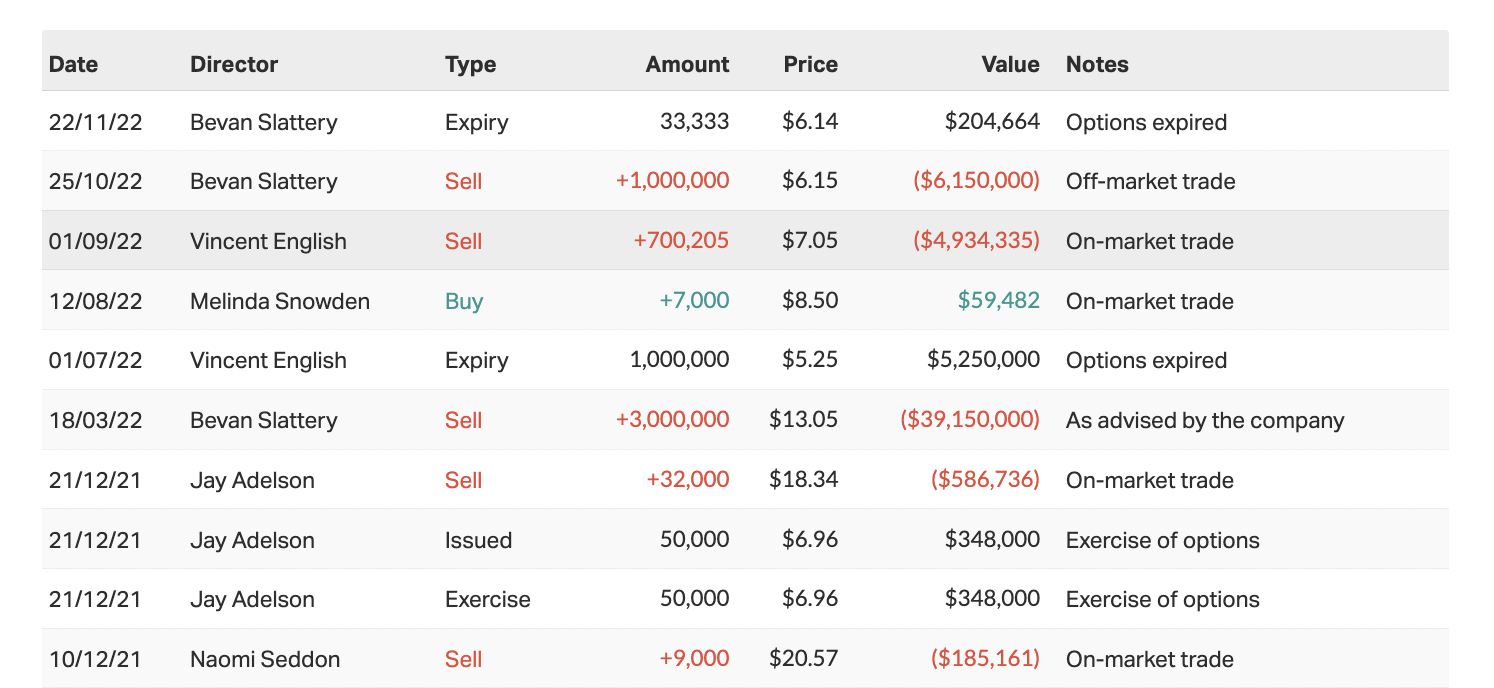

10 most recent director transactions

Catch all of our February 2023 Reporting Season coverage

The Livewire Team is working with our contributors to provide coverage of a selection of stocks this reporting season. You can access all of our reporting season content by clicking here.

2 topics

1 stock mentioned

1 contributor mentioned