This is a once-in-a-generation opportunity to generate alpha

With the Reserve Bank of Australia announcing its 11th rate hike earlier this month, and the US Federal Reserve its 10th, the era of cheap money is well and truly behind us.

Only a few years ago, NFTs, cryptocurrencies and low-quality growth stocks had taken the market by storm, as central banks and governments pumped liquidity into the global economy. Today's market is far more sobering.

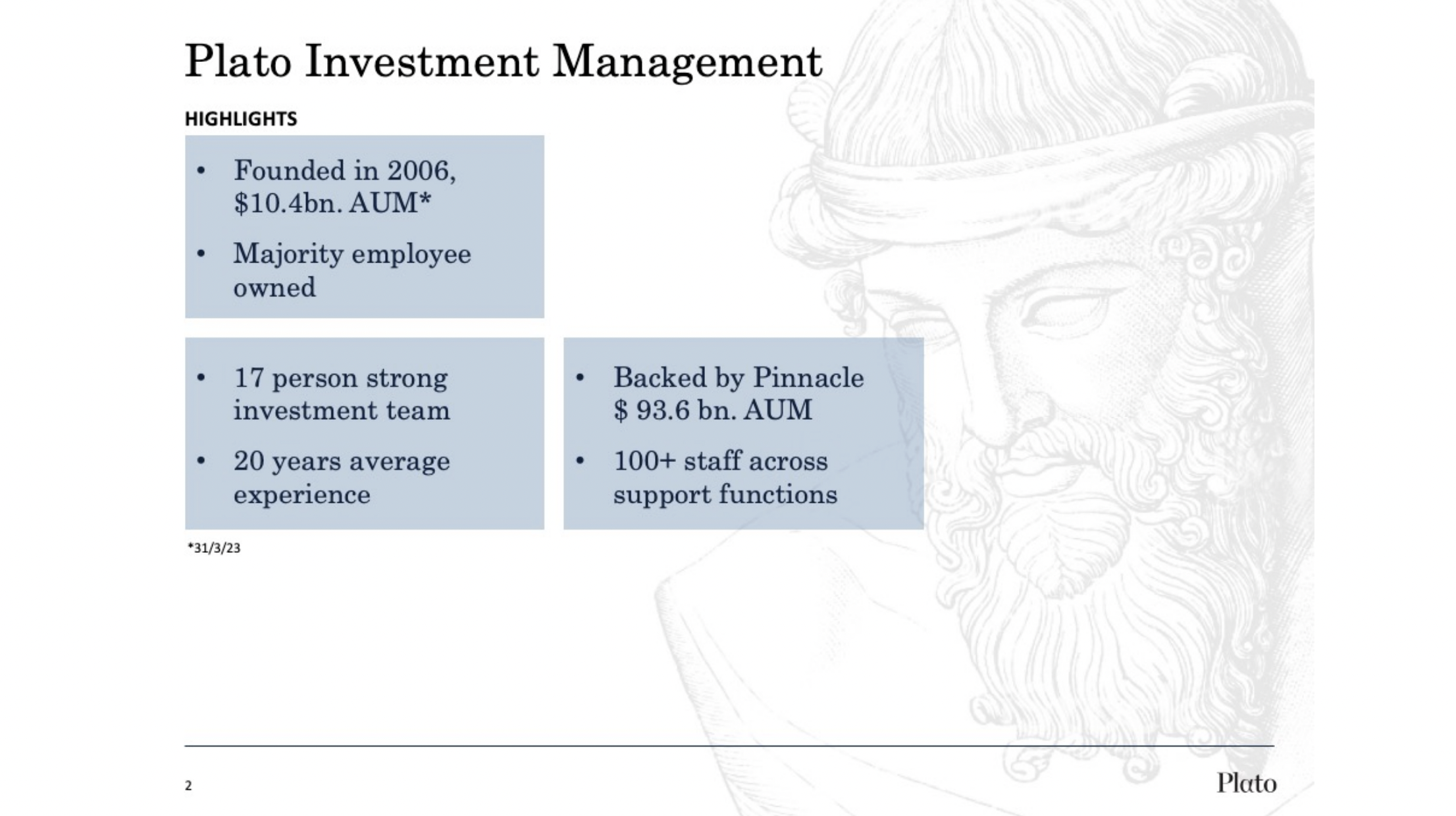

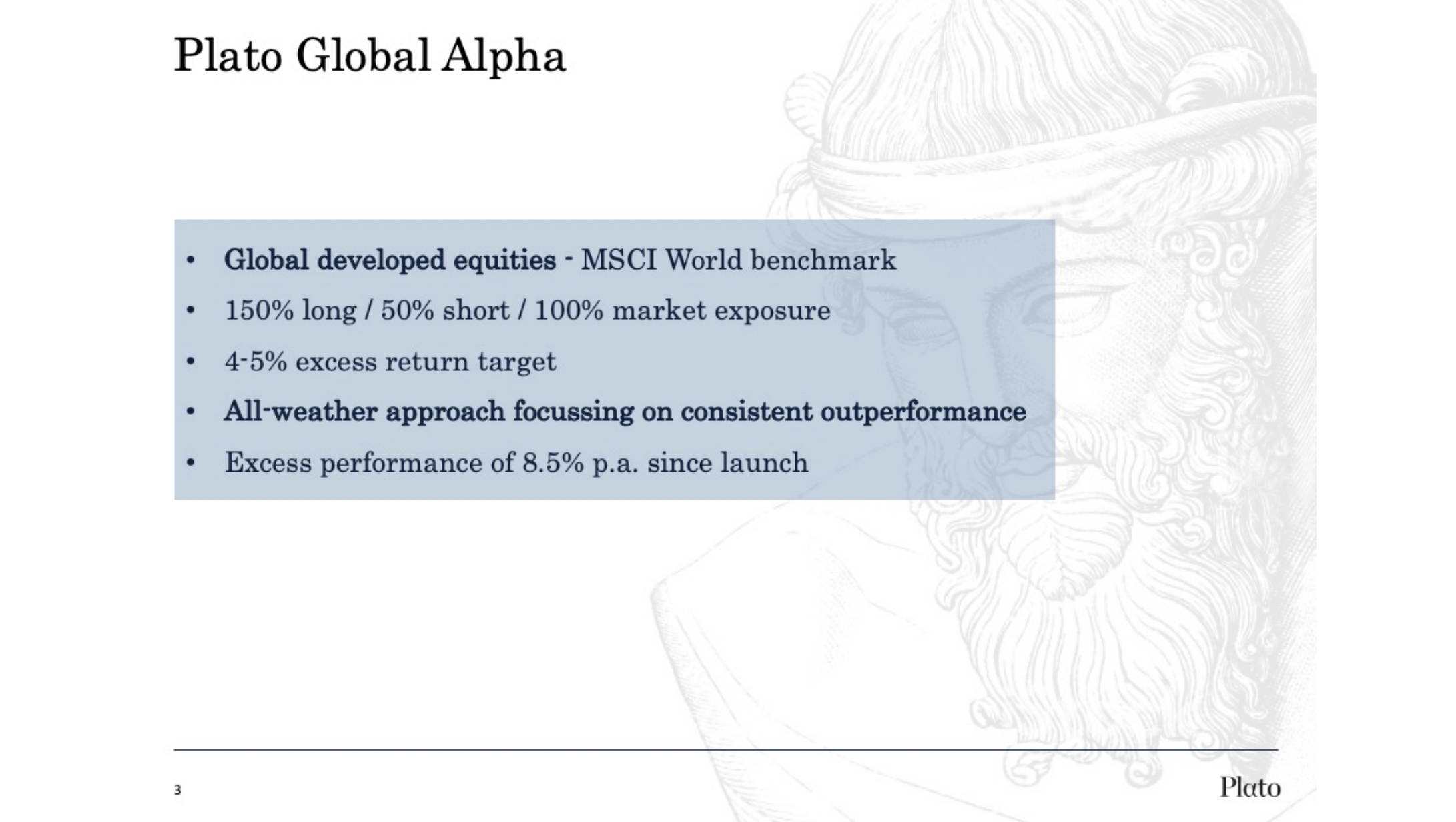

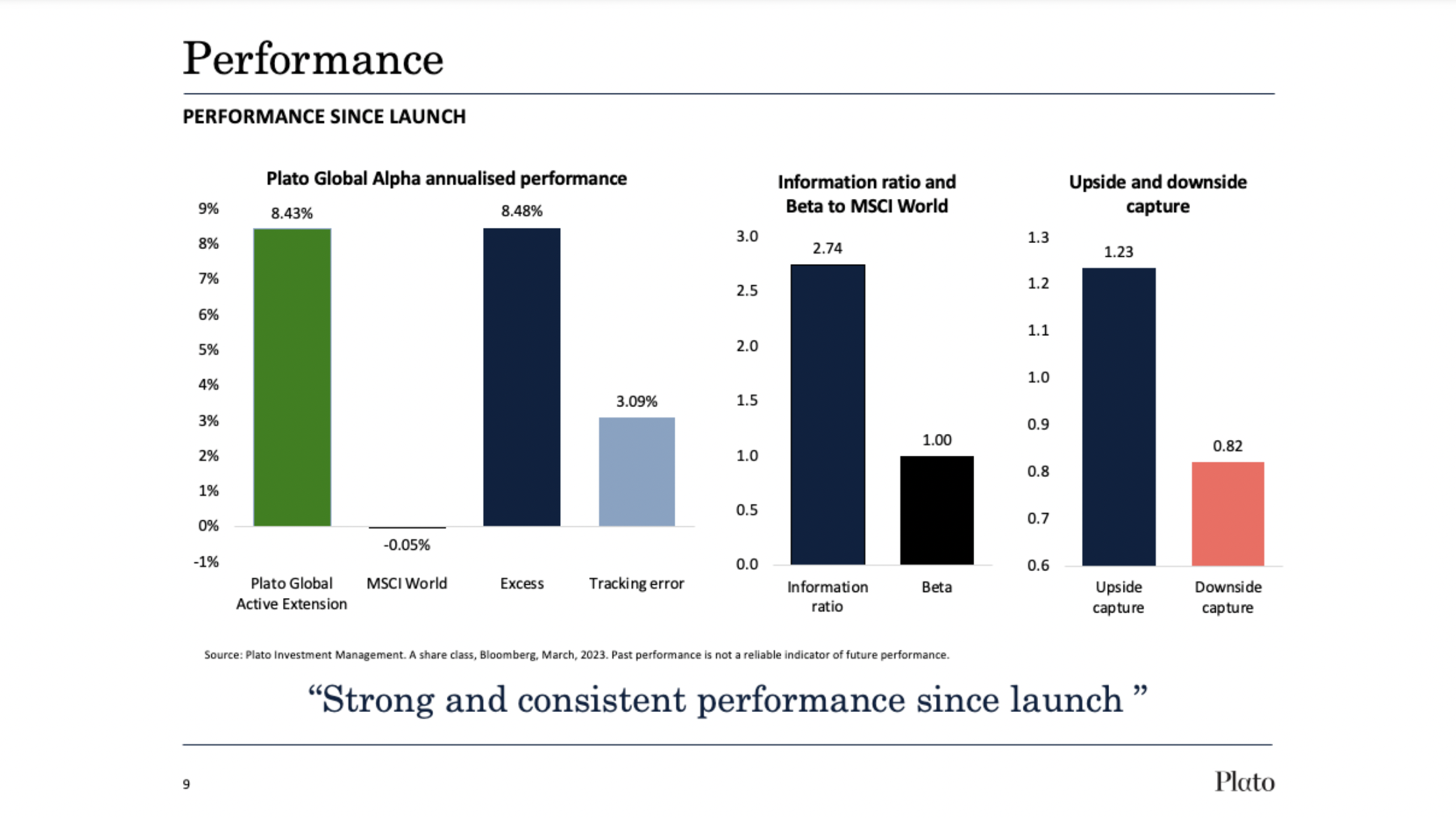

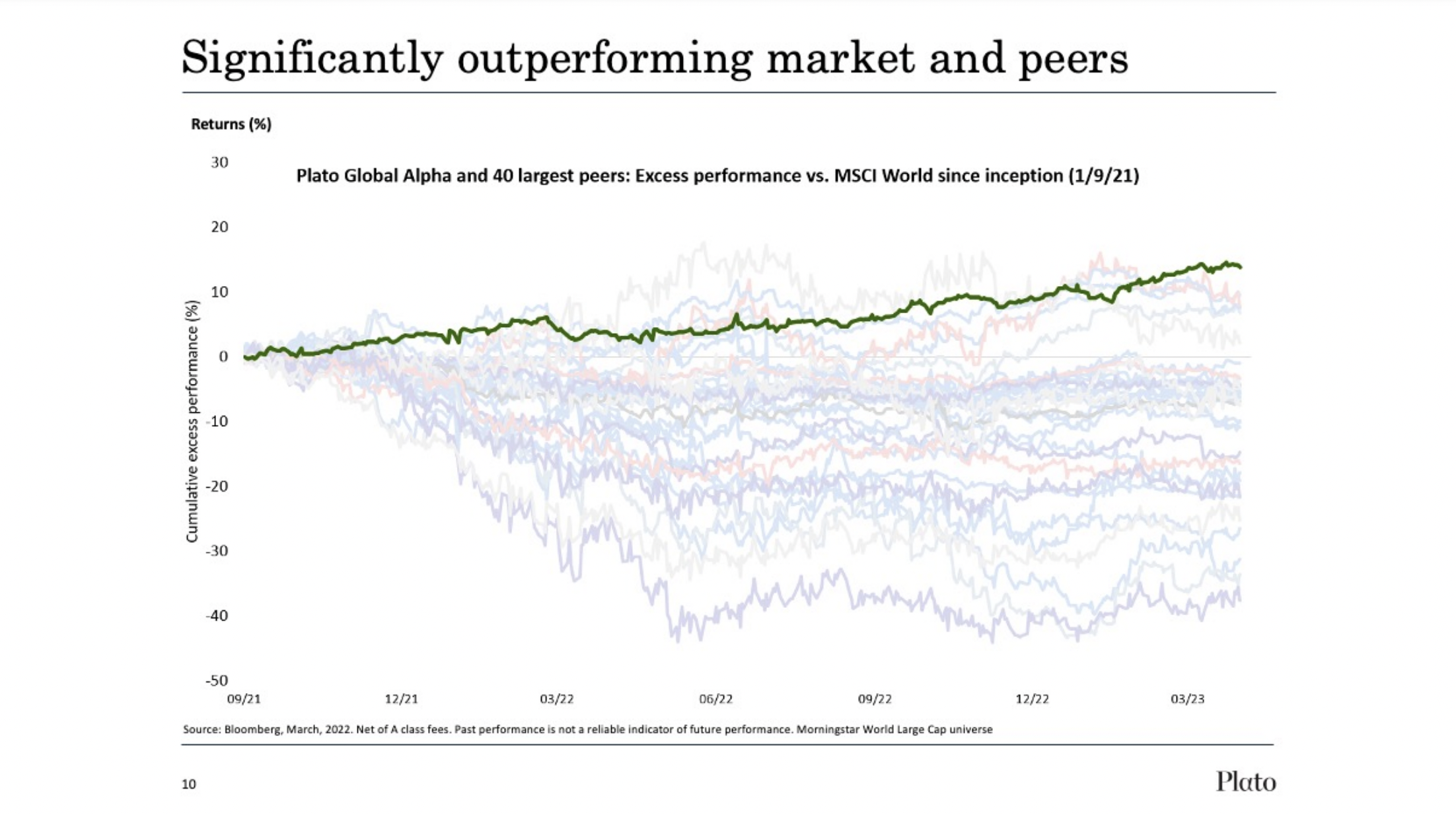

We believe this has created a once-in-a-generation opportunity to generate alpha. In fact, since launching in late 2021, we've been able to generate returns of 8.5% in excess of the MSCI World Index through our unique approach.

Using our 100+ Red Flags process, we are able to avoid the landmines potentially hiding within global indices. But we can additionally benefit from these same businesses through our short book.

In this Fund in Focus, I discuss the Plato Global Alpha Fund's process in detail, as well as how it has enabled us to generate outsized returns since the Fund's inception. Plus, I also discuss some of the long and short positions that are helping us deliver alpha for our investors today.

Edited Transcript

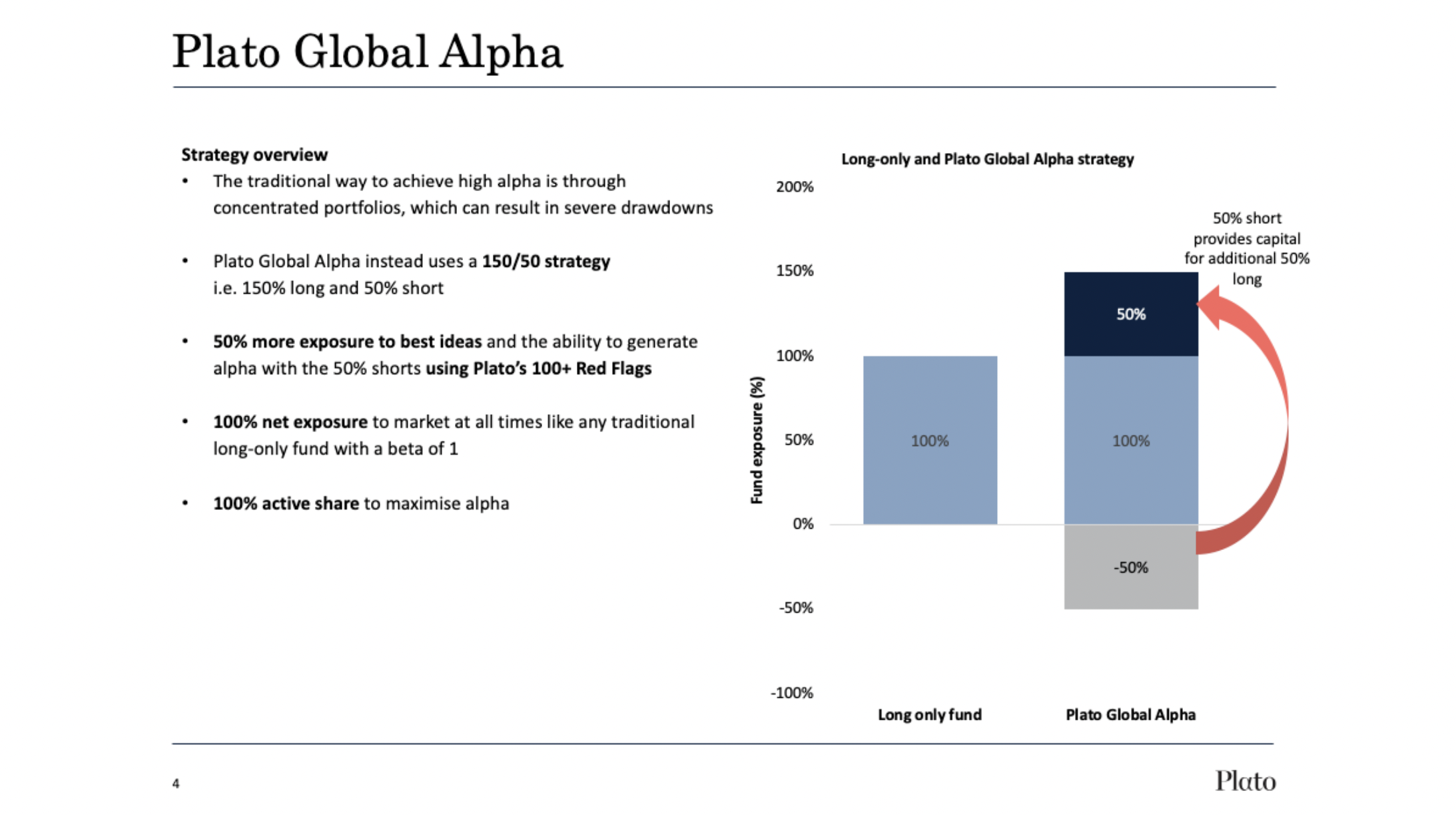

Dr David Allen: My name is Dr David Allen from Plato Investment Management. Today I'm going to speak about the Plato Global Alpha Fund. This is a fund that's for accumulators, looking to outperform the MSCI World Global Benchmark, but without the extreme feast and famines that you have with highly concentrated managers.

The unique feature of this fund is it's a 150:50 fund. What does that mean? Well, we're 150% long, which means that we have 50% more firepower, and 50% more invested in our very best ideas. But we are also 50% short at all times. We've generated the majority of the strong alpha so far from our shorts and it is this unique 150:50 structure that enables us to really turbocharge the returns that we can generate.

The environment that we're coming out of - this period of incredibly cheap and easy money, which is almost unprecedented in 200 years of economic history, has inflated the valuations of everything from NFTs to cryptocurrency to low-quality growth companies that have never made a profit and likely never will.

This has really created a once in a generational opportunity to generate alpha from taking short positions in these companies with unsustainable business models.

Critically, the fund has 100% net exposure to the market at all times, identical to a long-only fund. So this fund will rise and fall with equity markets but with that targeted alpha on top through that additional 50% long and that 50% short.

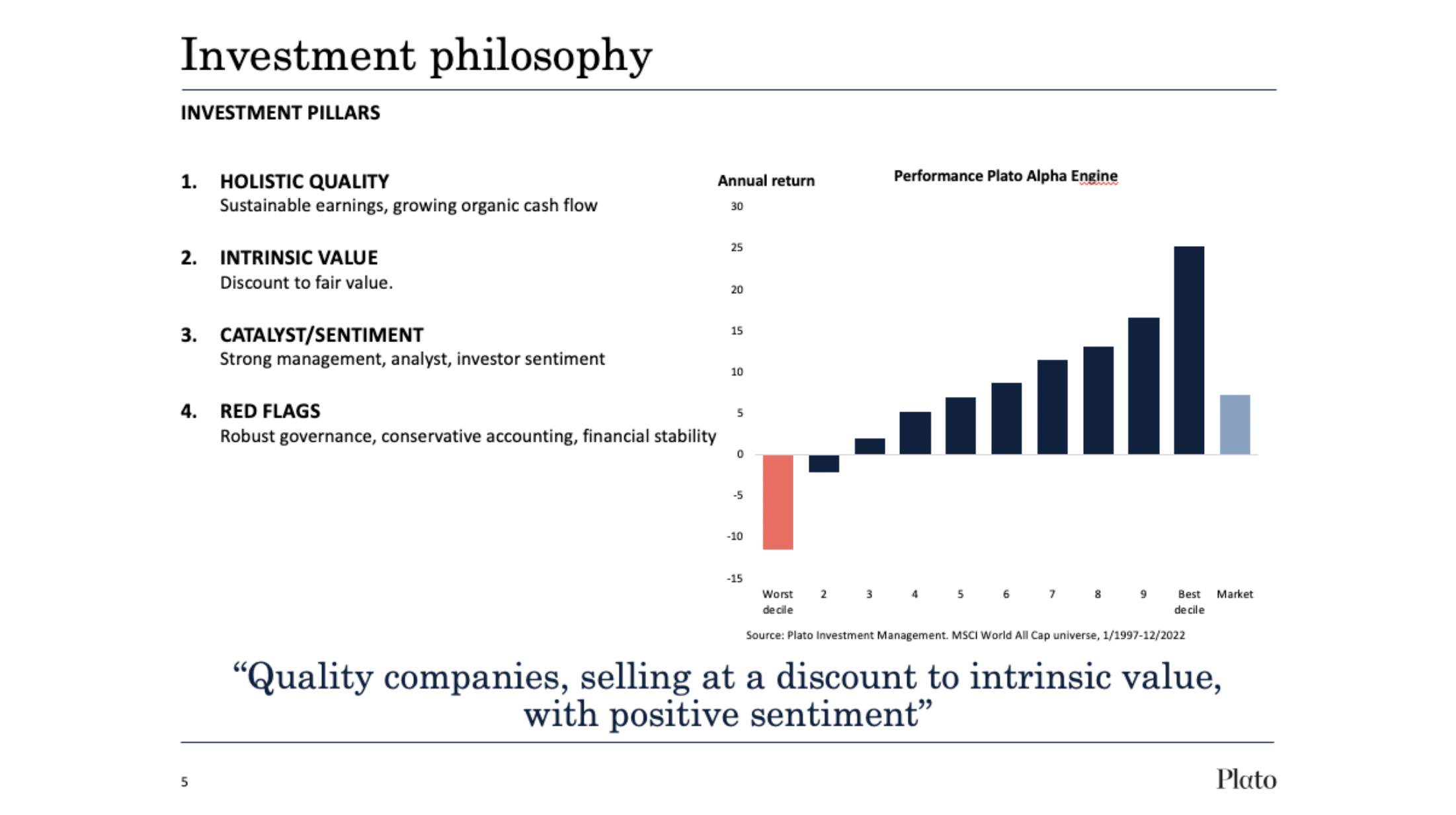

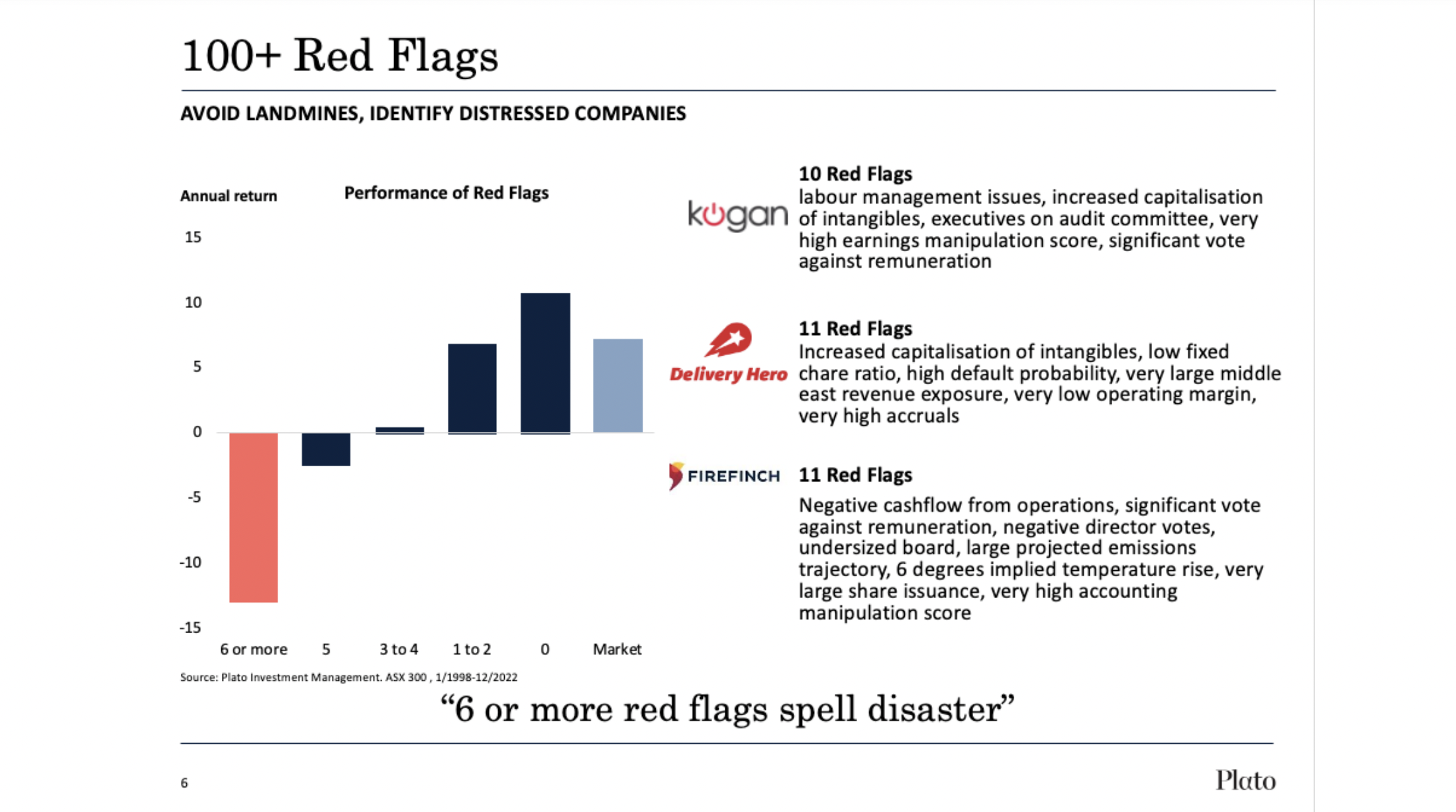

One of the most unique features of Plato's Investment Toolkit is our 100+ red flags. This has been built up over many years and is designed to really do two things:

1) Identify landmines that we need to sidestep on the long side of the portfolio; and

2) Identify great short ideas.

The great Warren Buffett is very fond of saying that there are only two things you need to know in investing. Rule number one, don't lose money. Rule number two, don't forget rule number one. And that's very much what the red flags are all about, ensuring that we sidestep those landmines but also generate great alpha on the short side.

So what are these red flags that have been built up over the years? It may be as simple as the CEO suddenly divesting all their stock. It may be that directors in the firm have been involved in corporate failures or bankruptcies in the past. It may be issues with governance where there are executives that are sitting on the audit committee consistently. There may be extremely aggressive revenue recognition or deferral of recognising expenses.

The fascinating thing is each of these red flags in isolation is not actually that powerful. They might give you a 51% edge, not much better than a coin toss. But when you put them all together, the whole is much, much greater than the sum of its parts.

And you get an incredibly potent way of identifying names that you should not be long, but in fact, be short. If a company has six or more red flags, then on average over the next 12 months, that company will underperform by almost 15%. So a very, very significant number.

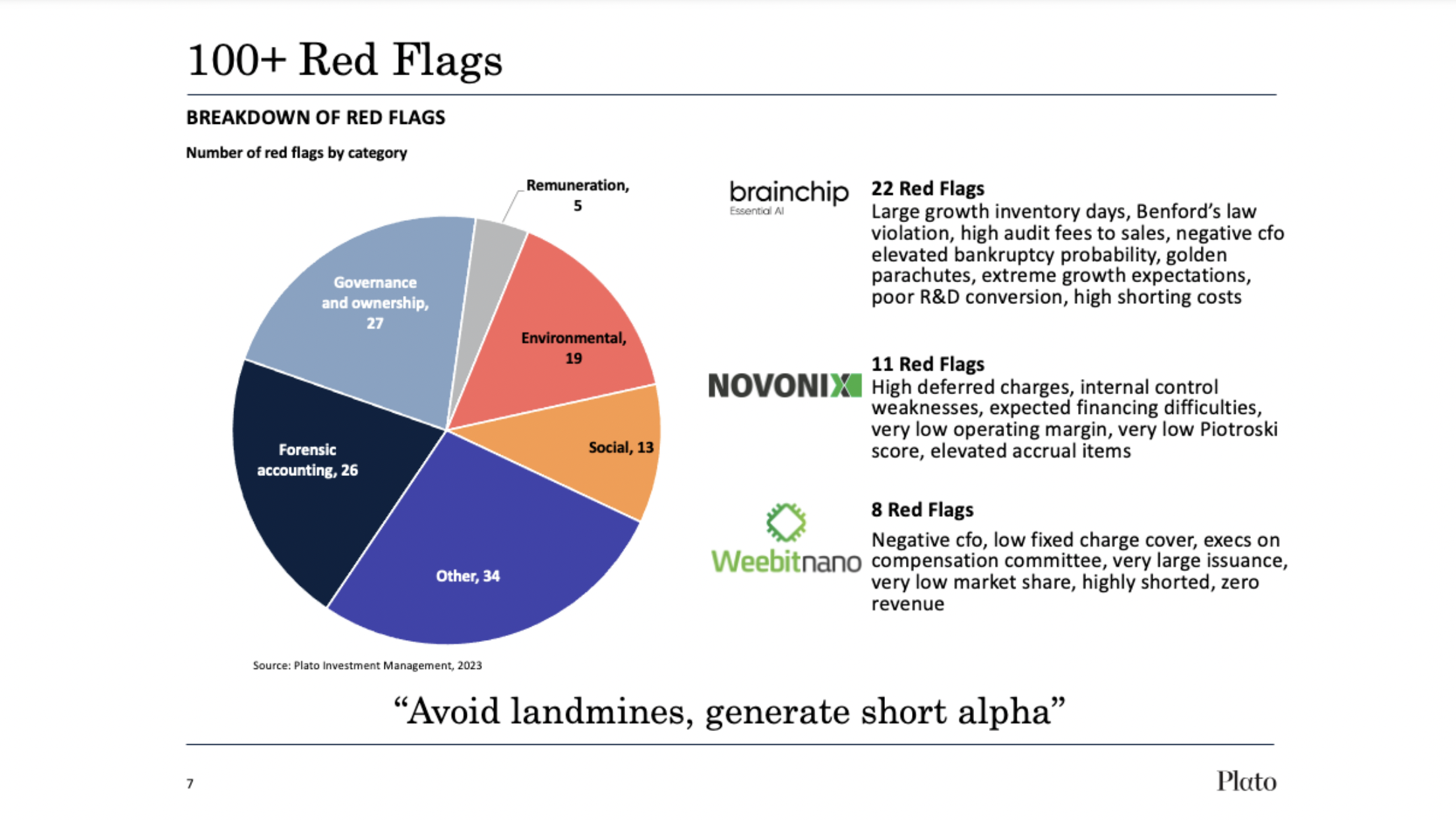

If you look at some names domestically that we've had short positions in, BrainChip (ASX: BRN) is a name that out of the 10,000 stock investible universe we look at globally, actually has the second largest number of red flags out of any - 22 red flags in all.

It's a company that, up until quite recently, had a valuation of well over $3 billion. And it's a company that has less revenue than some cafes. Weebit Nano (ASX: WBT) had a valuation of over $1 billion and it's a company with zero revenue. So I think this is a great environment, and there are many of these companies that have a high number of red flags that are likely to come unstuck sooner rather than later.

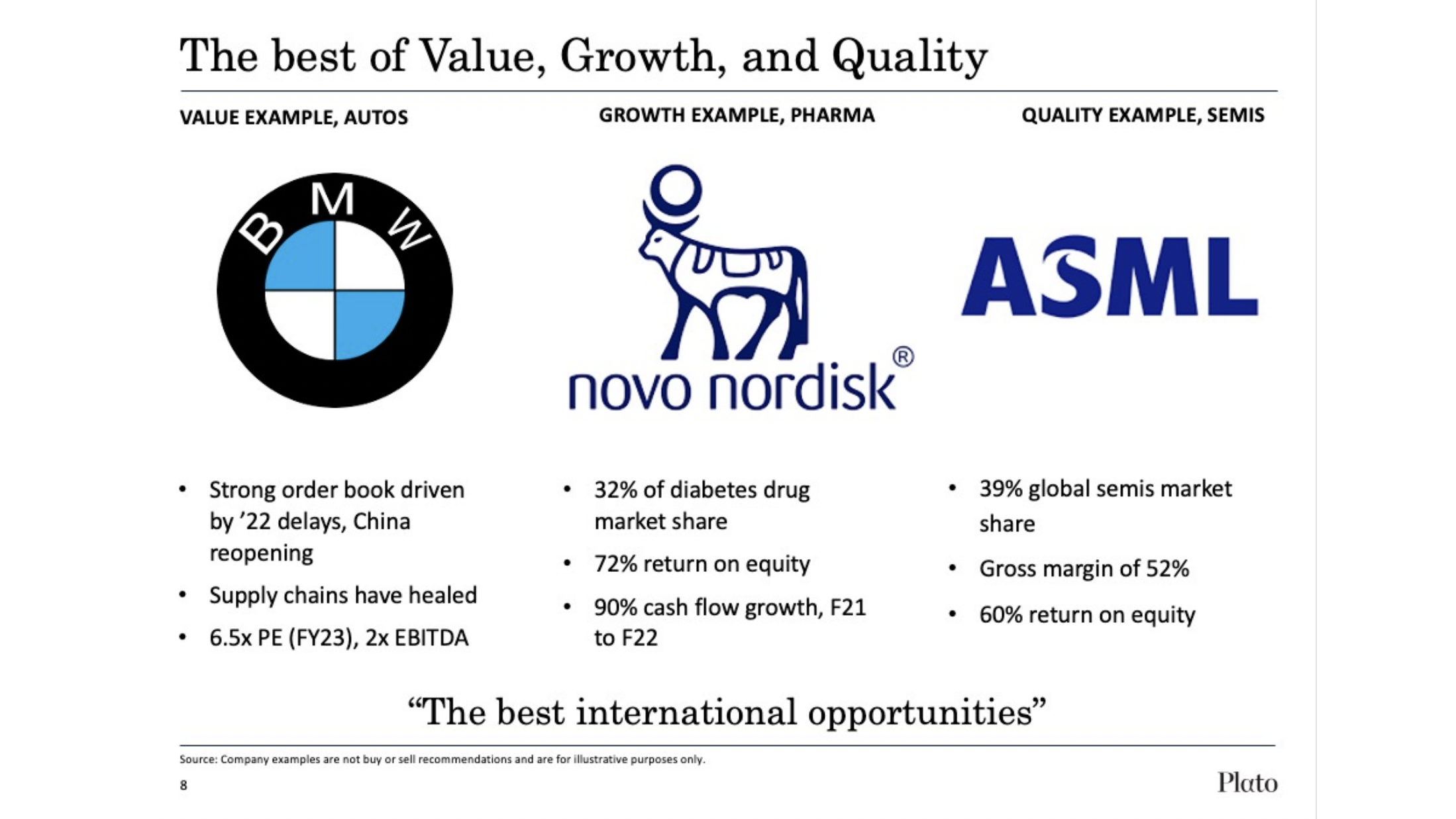

On the long side, how do we look to create all-weather, really consistent returns? Well, we do it by creating or investing in the very best value, the very best growth, and the very best quality opportunities anywhere in the world. So a few examples of that. If you look at BMW (ETR: BMW). BMW is a company with a storied history, and they've got this huge pent-up demand.

Now, supply chains have healed that backlog is being unlocked, and they trade at a valuation if you can believe it, of just 6.5 times FY 23 earnings. So it's an absolute bargain. You might say, well, are they growing as fast as other companies in the EV space? Well, they're actually growing in electric vehicles at 35% a year, which is the same as Tesla (NASDAQ: TSLA).

I think that's an incredible, almost once-in-a-generation investing opportunity to pick up a company like BMW.

Novo Nordisk (NYSE: NVO) is another name that we really like on the long side. You know, if you ask people what are the biggest names in pharma, people will talk about AstraZeneca (LON: AZN), they'll talk about Merck & Co (NYSE: MRK), they'll talk about Eli Lilly And Co (NYSE: LLY).

Novo Nordisk is actually the third-largest pharma company in the world at present. What is their story? Well, this Danish company is at the forefront of anti-obesity research and has a virtual monopoly of drugs in that space. And I think it's fair to say, just as immuno- oncology drugs have been the great blockbuster story of the last decade, anti-obesity drugs are likely the great story over the next 10 years. Obesity rates have tripled since 1975. By 2050, it's forecast that 50% of the Western world will be obese, and that's associated with 200 different co-morbidities. So a name like Novo Nordisk has such market power in this space and is really going to be a name to watch.

ASML Holding (NASDAQ: ASML). This is an AI enabler and it's the way that we play the AI space. If you were to ask who the eventual winners in the AI race are going to be, I think the answer can really change from month to month and year to year. Most people hadn't even heard of ChatGPT until November last year. But what all of the different AI technologies have in common is they all use the highly evolved chips that are made by the machines created by ASML. ASML has an 80% market share of the deep ultraviolet lithography machines that are required to make all of these chips. So it's a picks-and-shovels approach of investing right at the top of the supply chain. I think that's an incredibly exciting name for the future. And by combining these value, growth, and quality names, we can generate very consistent alpha through the cycle that's not going to be tied to a growth period or any one thematic.

If you look at performance, the proof is in the pudding, as they say. The fund performance has been very, very strong since launch. So after fees, the fund has beaten the MSCI World by 8.5%, but it's also done so in a very smooth fashion. The tracking error, that people talk about, your active risk relative to the benchmark, has been exceptionally low. It's only been 3%. So that means that the risk-adjusted returns of this strategy compared to all other funds in the Morningstar large cap universe actually has the highest risk-adjusted returns on that basis. The up market capture is very strong at 1.23. So we're doing better in up markets. And then the down market capture is 0.82. So we're doing better in down markets as well.

So in conclusion, what are the key takeaways for the Plato Global Alpha Fund? We're looking to deliver that high alpha without the high concentration that can lead to feasts and famines in return. There's a focus on all-weather returns with the best value, growth, and quality opportunities. Identifying shorts through our 100+ red flags, it's a great environment to be doing that. And all of that has culminated to deliver some very strong performance since launch.

Thank you very much for listening today. I really hope that you enjoyed that. If you're interested in learning more about the fund, then please make contact with our distribution staff. Thanks so much.

Learn more

The Plato Global Alpha Fund uses an all-weather investment style that seeks to deliver consistent alpha over the cycle.

2 topics

7 stocks mentioned

1 fund mentioned

1 contributor mentioned