This profitable tech company is only getting started...Hansen Technologies FY23 result

Hansen Technologies (ASX: HSN)

Why Hansen Technologies?

The share price of Hansen Technologies (ASX: HSN) has rallied in recent months in-line with global technology stocks and after delivering a strong FY23 result. Hansen specialises in providing enterprise billing software capability for the telecommunications and utilities sectors. The business high barriers to entry with a sticky customer base (<2% churn) due to significant investment in implementation and customization with long-term contracted revenue growth supported by high customer satisfaction, new customer wins and strategic software upgrades. Hansens technology assists its customers improve operational efficiency in an ever more complicated software and billing environment.

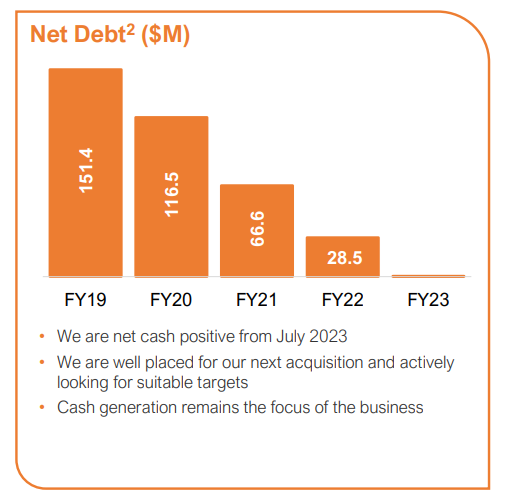

Hansen has long history of strong cash generation with a healthy balance sheet (net cash currently) which supports further acquisition opportunities to compliment an improving organic growth outlook. The company is founder led with Managing Director Andrew Hansen owning >17% of the company ensuring strong shareholder alignment.

LSN Capital has owned Hansen since the inception of our fund in 2021.

What you need to know off the back of Hansen’s result:

The numbers:

FY23 result was ahead of guidance and expectations.

- Revenue $312m (+5.2% pcp).

- EBITDA $100m (flat).

- Operating cashflow of $79m and since 2019 Hansen has returned ~$212m to shareholders and banks.

- Balance sheet now net cash.

- Strong 2H momentum saw +9% revenue growth and 33.5% EBITDA margins.

Increased reporting disclosure around end customers, revenue segments and R&D costs was good news.

- Highly diversified customer base with top 10 customers making up 33% of revenue.

- Revenue consists of materially higher recurring and repeatable revenue (86%) than many have given it credit for across Support and Maintenance services.

The outlook:

FY24 Outlook

- Accelerating organic revenue growth of +5-7%.

- Underlying EBITDA margin +30% which appears conservative post 33.5% 2H23.

- R&D spend 5-7% of revenue.

Key focus areas for FY24

- Hansen enters FY24 with strong operating momentum and several software upgrades.

- Plateauing CAPEX will see strong cashflow conversion and profit growth.

- Staff churn and wage pressure have stabilised so pressure on the cost base is abating.

M&A opportunity:

- M&A should be a feature in FY24 with the company holding a robust pipeline of opportunities and exploring acquisitions in the $30-$500m range.

- Balance sheet has $300m capacity which could be materially accretive if deployed on the right targets whilst management are open to a 3rd pilar to complement its telecommunications and utilities sectors.

- As a founder led business, Hansen treats shareholder capital very carefully and patience will likely be rewarded with tech valuations having come back over the last 2 years.

- With organic growth becoming more challenging globally having the capacity to add to growth via M&A is highly attractive and the company has had a strong track record for M&A execution.

Artificial Intelligence (AI)

- Software is mission critical and leveraged to growing complexity in its defensive end markets undergoing digital transformation.

- Hansen expect to see compounding productivity gains from its utilisation of AI.

- Hansen invests in its products to ensure our clients remain agile, responsive & relevant to their customers and believe AI will start another cycle where customer demand for AI innovation will drive R&D and ultimately further embed Hansen with its client base.

Valuation

- Attractive financial metrics – Price to earnings (PE) 20x, EV/EBITDA 10x, Net Cash on balance sheet and Return on Invested Capital (ROIC) >20%.

- We forecast Hansen to deliver >8%+ EPS growth pa for the next 2 years with potential significant upside potential as its balance sheet is deployed into accretive acquisitions.

We are happy owners of HSN on the back of this result and think the outlook for FY24 and beyond is highly attractive.

1 topic

1 stock mentioned