This stock has fallen 43% in 12 months. But is it really as bad as it seems?

Mineral Resources (ASX: MIN) released its FY24 on Wednesday night, and the market really didn't like it. Its share price fell north of 11% on the open, before recovering to around an 8% loss during the day.

Over the past 12 months, Mineral Resources is now 42.58% in the red - although things only really started to get dire in May. For shareholders, of which I am one, this is a painful pill to swallow, given the company had been on what had seemed like an unstoppable trajectory for a good few years.

Caught in the crosshairs of plummeting lithium and weakening iron ore prices, Mineral Resources reported an underlying NPAT of $158 million, 24% below the consensus analyst estimate of $207.7 million.

Revenues ($5.2 billion) and adjusted EBITDA ($1.06 billion) beat analyst estimates, but the company suspended its dividend. And to make matters worse, the company's outlook statement left a lot to be desired.

So, should investors be selling like the rest of the market? Or is it time to be brave and dive on in?

Livewire sat down with Katana Asset Management's Romano Sala Tenna to find out.

MIN FY24 Key Results

- FY underlying NPAT $158 million vs FactSet estimates of $207.7 million

- Revenue of $5.28 billion vs FactSet estimates of $4.85 billion

- Adjusted EBITDA $1.06 billion vs FactSet estimates of $1.03 billion

- Final dividend nil; total FY dividend $0.20/share vs year-ago $1.90/share

- Outlook: FY25 CAPEX of $1.945 billion vs $3.355 billion in FY24

What was the key takeaway from this result?

I think the result was well-telegraphed. So, there were no surprises per se. I think the surprises come when we look out into FY25.

Were there any surprises in this result that you think investors need to be aware of?

I think the market reaction today is based on the outlook statements and there are a couple of things to say about that.

Firstly, the market is nervous about the high CAPEX - it was above where the market was anticipating and a big chunk of that is in mining services. They haven't alluded as to what that is. That might be a new contract win, I'm not quite sure there, but it's likely to be positive. In any event, it was higher CAPEX, which investors weren't forecasting and with a balance sheet which is perceived to be stressed.

I think the second thing was lower forecast spodumene production from Mt Marion. That was unsurprising, as spot prices for 6% grade spodumene have plummeted to US$740/tonne.

Chris Ellison opened his comments at the Mineral Resources briefing this morning stating that no one is making money at US$740/tonne. So we know that we're crawling along the bottom now. We need to see a bit of the high-cost supply burnt out, and then we'll see a recovery in the price.

But, certainly dropping 100,000 tonnes per annum off from Mt Marion was a surprise to the market. But it is a smart thing to do. Why would you be spinning supply into the system at depressed prices? Better to leave it in the ground and sell it in a better market.

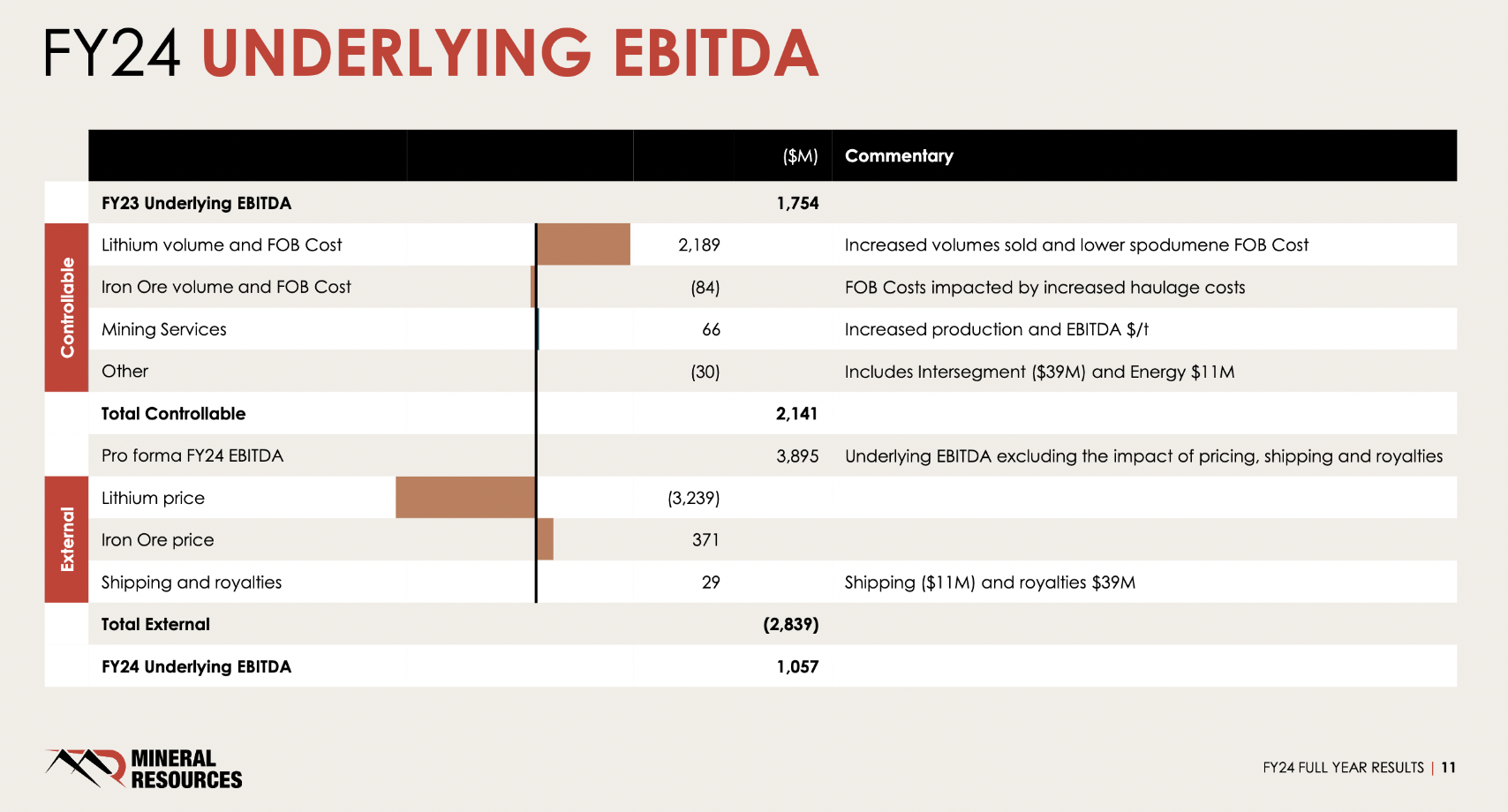

I think the third reason the Mineral Resources share price is down is because lithium prices are down 76% in FY24. In the last four weeks, they've fallen a further 18%. To put that in perspective, if you look at the slide below, you'll see that $3.2 billion of EBITDA was taken off from the price decline in lithium. So, EBITDA would have been over $4 billion if we still had like-for-like pricing.

The final piece of the puzzle is the fact that the iron ore price has been testing US$90/tonne. It's back through US$100/tonne at the moment, but I don't think there is a lot of confidence that it is going to hold at these levels.

So, throw those factors into the mix with the perception of a stressed balance sheet, and you've got a recipe for a perfect storm.

Would you buy, hold or sell MIN off the back of this result?

Rating: HOLD

Even though the price has fallen 60% from its peak, we would be holding right at the moment, simply because you have to allow this price cycle in iron ore and lithium to wash through.

Are there any risks investors need to be aware of?

I think the two main risks are commodity prices because they're outside of Mineral Resources' control. And then, secondly, the balance sheet.

Now, we're very confident they won't do a capital raise. They've been to market once since listing 18 years ago, and that was a very small cap raise. So we're pretty confident it won't need to come to market.

I think the balance sheet is the main reason why the share price is here today. But, there are a few reasons why we are more confident than the market on the balance sheet. I think the first thing is there are no debt repayments before 2027 - they've got a three-year runway to build cashflow ahead of those repayments.

The second thing is that they have sold the haul road for $1.3 billion. The bulk of those proceeds, $1.1 billion, will be received this half. So, by December 31, $1.1 billion will be added to the balance sheet. That's a big chunk of cash.

Part of their debt has been misunderstood - which is loans they've lent their JV partner to build the project. So, there's $400-600 million, depending on how you gauge it, that will come back onto the balance sheet as they start producing more iron ore.

In the very worst case, if iron ore and lithium remain depressed, there is still their mining services business, which is their annuity income business. For this business alone, the EBITDA/interest cover is 1.3 times FY24 and 2.4 times FY25. So that business alone covers their interest liabilities and can be used to pay down the debt.

And then there is Onslow, which could almost be considered a world-class iron ore project. It's going to be producing 35 million tonnes per annum at an annualised run rate by 30 June this financial year. So we're not too far away now and they're already spitting out more and more tonnes every day. 60% of 35 million tonnes per annum is 21 million tonnes, which is their attributable amount. At A$55 a tonne FOB, plus royalty and shipping, their landed cost is likely to be close to A$70/tonne in China, give or take.

At the current spot, that's over a billion dollars of free cash flow that'll generate a year. Plus on top of that, they're getting about A$400 million in mining services each year. So it's about A$1.5 billion in free cash flow.

It pays off the project in 0.9 years, and it could pay off its total debt pile, at US$100/tonne in two and a half years. The risk, of course, is that we see the iron ore price head down to US$80-$85/tonne.

So, it's built a phenomenal iron ore business for a company of this size. We just now need to wait 6-12 months to see all of that wash through.

From 1 to 5, where 1 is cheap and 5 is expensive, how much value are you seeing on the ASX today?

You can't ask that question, in my mind, because it's a market of two halves. The large-cap growth momentum companies would be a 4.5 out of 5 expensive. And then the rest of the ASX, outside of the top 20, would probably be a 2.5-3.

5 topics

1 stock mentioned

1 contributor mentioned