This stock market is screaming an "invest now" opportunity

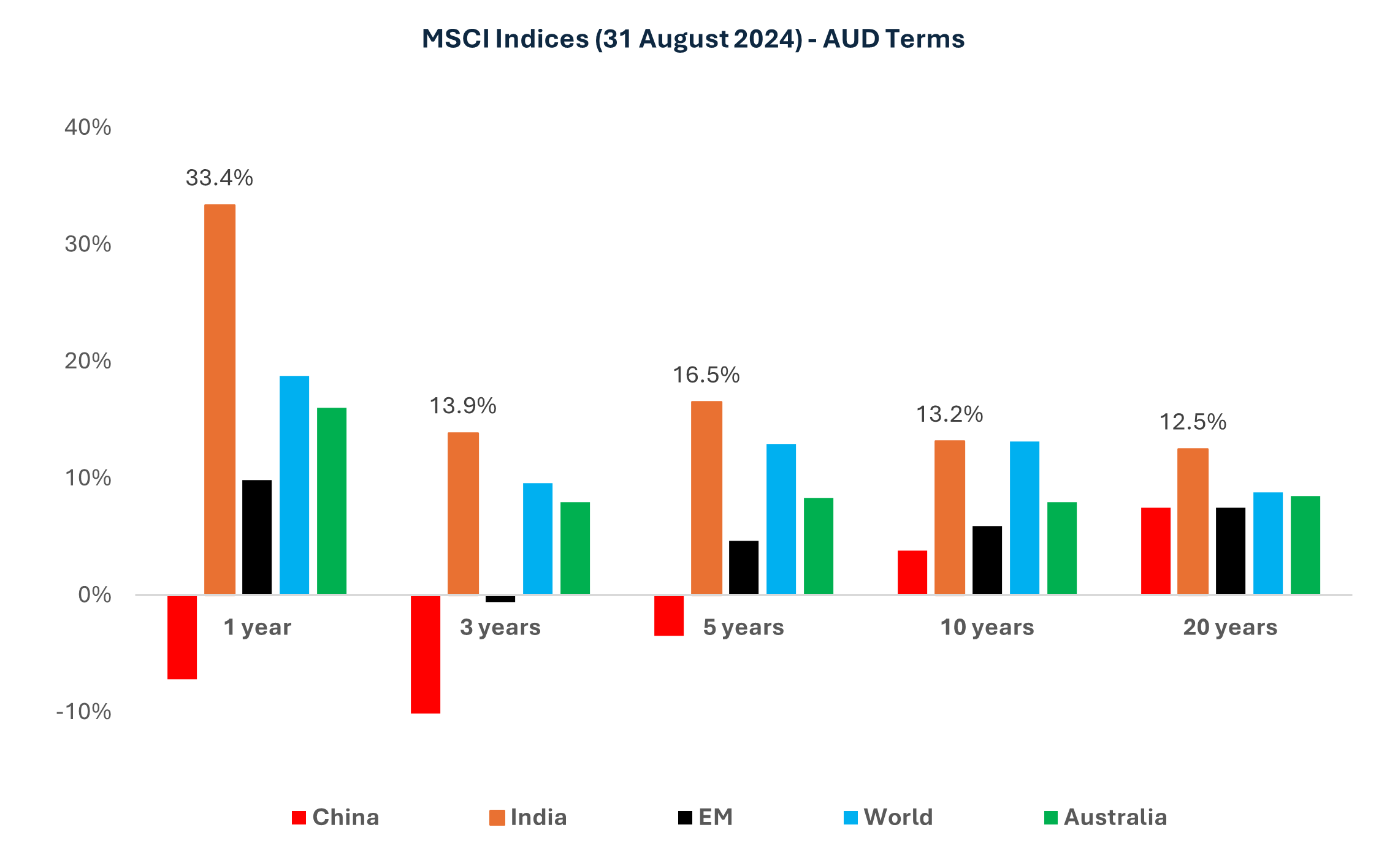

Australian returns over the past year have been nothing to sniff at. The ASX 200 even hit record highs - multiple times. So, if I were to tell you there is another market that has consistently done better over the long term as well, you might assume I’m talking about the US. You aren’t wrong, but this is not a story about the US.

While it’s true that Uncle Sam has outdone us, their stock market is highly concentrated in the Magnificent Seven and valuations are looking expensive. A much more appealing story is also much closer to home: India.

India has outperformed Australia by 17.4% in the last year alone.

There are a lot of misconceptions around India, and it can be challenging for investors to invest, but just because something can be hard doesn’t mean we should ignore it.

After all, some of the world’s biggest companies are Indian – and we use them locally. Think names like Infosys, Tata Consulting or HCL Technologies.

In light of this, I spoke to India Avenue Investment Management’s Mugunthan Siva and Ellerston Capital’s Ashok Jacob for their views on the opportunities and challenges in the market and some of the companies they like.

India is not the next China

If you’ve been in the industry long enough, you’ve heard the catch cry “India is the next China” and probably read countless think pieces on why it hasn’t gotten there yet.

Both Siva and Jacob think it’s the wrong descriptor and it’s not fair to compare the two.

“India will never be the next China,” says Jacob, pointing out that China uses a centralised approach and defined targets, compared to India’s democratic framework.

“This moderates India’s vibrant demographic and economic tailwinds leading to a slower albeit more stable and secular growth trajectory,” he says.

Siva notes that the tendency to compare India and China often comes back to their large populations and GDP growth, but they are very different markets.

“One thing is for certain. India has taken leadership from China as the fastest-growing major economy in the world. The IMF today forecasts India to grow its GDP at an average of 6.5% real growth over the next five years, in comparison to China’s 3.6%,” says Siva.

India’s contribution to world GDP is growing at a point when China’s is falling. That’s not to say China doesn’t still hold excellent opportunities, but it is moderating.

Built for economic growth

There are a range of factors driving growth in India. One of the biggest drivers is its population. India has the world’s largest working-age population between 15-65 years which should support its productivity. It is also seeing movement into the middle class.

“This youthful population will have rising demand for consumer products, infrastructure, banking and financial services, and healthcare as the shift towards an expanded number of people moving into the middle class occurs,” says Siva.

This is also linked to mass urbanisation – and India’s digitisation is also supporting accessibility and economic growth in the population.

Global businesses are recognising the growth potential of exposure to India, and off the back of Indian President Modi’s reforms to the business environment, many have successfully opened up operations locally (or bought into local businesses) – such as Macquarie Bank and Findi.

The themes to watch

Jacob highlights that there are a range of policy tailwinds or transitions occurring in India, including:

-

Manufacturing

Both Siva and Jacob point to manufacturing as a key theme in the Indian market, with India benefitting from the diversification of supply chains during and following the COVID pandemic. -

Urbanisation

Jacob notes that urbanisation is driving infrastructure development across metros, roads, railways, airports, ports, sanitation, irrigation and more. It is also seeing a real estate up-cycle benefitting auxiliary industries. -

Energy and power generation

There is a strong push for renewables in India with a focus on batteries, EVs and hydrogen power. -

Digital transformation

There is a push to build a strong digital infrastructure to ease living in India. The Digital India Initiative has been an important driver in this, and regulatory reforms have also supported the transformation of financial and lending standards. -

Rural development

Technical upgradation and development have been important factors in rural India. That said, the rural recovery post-Covid has been weak. A slight uptick in 2-wheel sales and FMCG demand is a positive for the Indian rural economy.

Speaking about this list, Siva sees tremendous opportunity in India’s pharmaceuticals industry and he has significant exposure to it in his portfolio.

“India is the largest exporter of generic drugs in the world. They have more FDA-approved facilities than any other country (apart from the US) and can produce generic drugs and approved ingredients at far due to their scale and expertise,” he says.

“The industry is expected to grow from close to US$50 billion to around US$130 billion by 2030,” he adds.

Identifying stocks in India

For investors looking at India, it helps to start with the caveat – it’s not about value, it’s about growth.

“It is about finding growth stocks before others do. Several addressable markets are yet to grow to scale and size,” says Siva, who aims to find market leaders in growth segments with a moat comprising a low-cost competitive advantage and strong distribution networks.

Jacob similarly looks for opportunities with higher growth that may be under-appreciated.

“These opportunities are currently more prevalent in the less discovered mid and small-cap sectors,” he says.

He is looking for companies in manufacturing, chemicals, EMS [Electronic Manufacturing Services], real estate, infrastructure, healthcare and discretionary spending.

The stocks to watch

3 stocks Jacob invests in

1. Brigade Enterprise (NSE: BRIGADE): “a mixed-use real estate developer that is focused on South India. They provide an excellent mix of annuity portfolios across offices, malls and hotels, complete with burgeoning residential developments.”

2. Syrma SGS (NSE: SYRMA): “One of the key EMS players in India. The company is growing revenue at 40% over the mid-term and benefits from policy tailwinds for job creation and increased local manufacturing.”

3. Titagarh Railway Systems (NSE: TITAGARH): designs, manufactures, supplies, commissions and services rolling stock and metro coaches for Indian Railways and Indian Metros.

“It is a market leader and one of the key manufacturers helping Indian railways meet their rolling stock demand. Titagarh has massive growth visibility, running a multi-year order book and struggling to meet demand on an expanding asset base.

3 stocks Siva invests in

1. Hero MotoCorp (NSE: HEROMOTOCO) is India’s largest bike and motorbike manufacturer – over 70% of Indian transport is two-wheeled.

“Over the last two years, this stock has moved from being a cheap, low-risk company to a more innovative company, expanding capacity and product lines to a broader set of customers. As a result, the stock has performed exceptionally and is set to continue as rural India makes a recovery.”

2. Marksans Pharma (NSE: MARKSANS): an exporter of generic pharmaceuticals that supplies the likes of Coles, Woolworths and Aldi.

“A cheap, “undiscovered” company with little or no institutional ownership became more significant given the niche the company operates in. Almost all of the company’s products are sold via exports to the rest of the world.”

3. Amara Raja Energy & Mobility (NSE: AMRJ): holds a leading share in lead acid battery manufacture and its product range includes energy storage solutions, lithium-ion cell manufacturing, EV chargers, Li-ion battery pack assembly, automotive and industrial lubricants and exploration of new chemistries.

“The company’s batteries are exported to over 50 countries and they supply the likes of Ford, Honda, Hyundai, Maruti Suzuki, Mahindra & Mahindra and Tata Motors.”

Tips for investors in India

There is no ‘right’ time to invest in India

Traditionally investors aimed to invest in India at market peaks and sell-downs. However this is suboptimal.

“India does not suffer significantly from earnings drawdowns due to its underlying demographics. Our tip would be to dollar-cost average over time, without worrying about share prices in the short-term, until you are happy with the allocation in your portfolio,” says Siva.

India isn’t as expensive as you think

“In the context of substantial growth opportunities and the secularity of growth, it is not expensive compared to other large markets. We believe India is an “invest now” market and should be included in the most diversified portfolios. It has been the best-performing market of this decade, and that compounding engine shows no signs of slowing down,” says Jacob.

Deep understanding is important

“Indian companies have an average of 40% ownership by the founding family. Unless you have a deep understanding of how these owners think and behave over time, it is difficult to add value and you resort to exclusively holding large, liquid and expensive companies,” says Siva.

He advocates co-investing with top-tier investors within India’s corporate ecosystem who have networks across suppliers, consumers, competitors, employees and the supply chain.

Finally, it's worth noting that India is generally difficult for retail investors to access directly, meaning exposure needs to be via a fund. Investors can look at passive or active options, both listed and unlisted in Australia. Both Jacob and Siva manage active funds of Indian equities.

2 topics

1 contributor mentioned