Three ASX retailers copping five broker downgrades

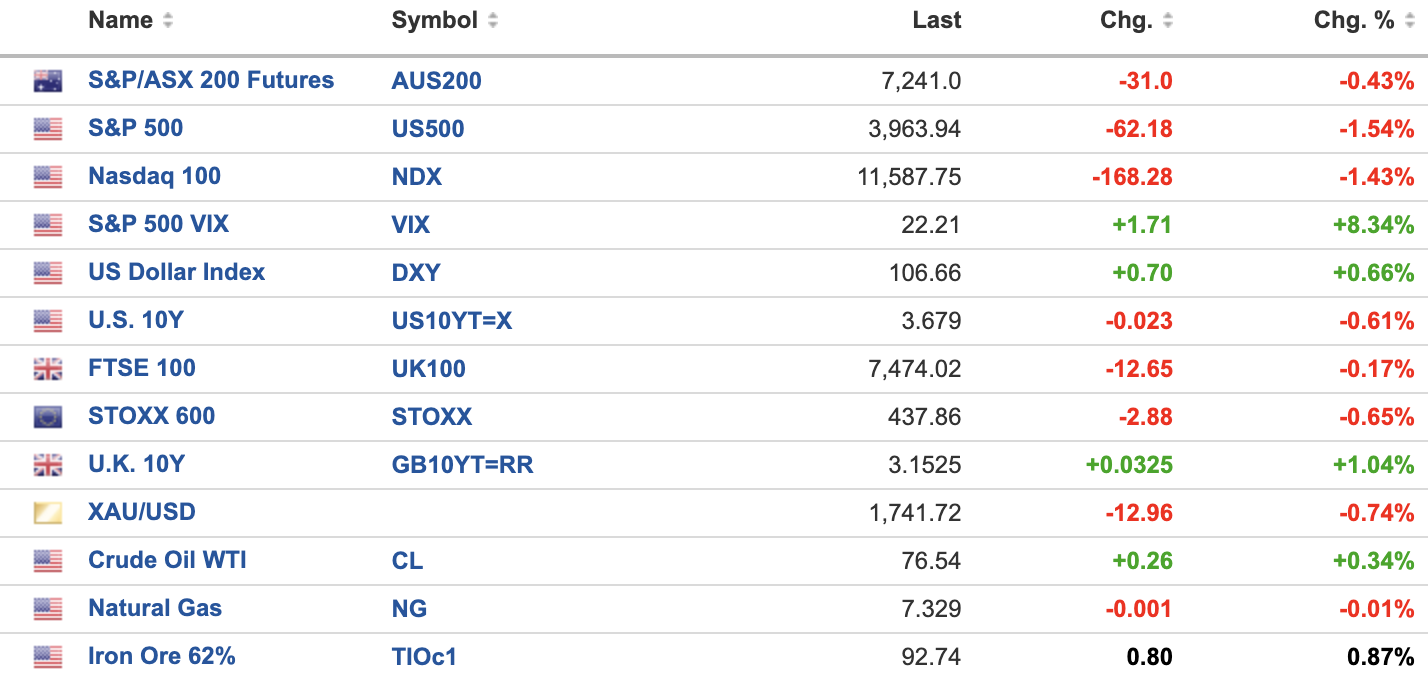

MARKETS WRAP

S&P 500 TECHNICALS

THE CALENDAR

A light amount of central bank speak is the warm-up act to a huge week of macro data. The new ABS monthly inflation indicator and a slew of partial data which goes into Q3 GDP all hit the wires on Wednesday morning.

And speaking of local data, ANZ recently pushed out its first rate cut in this cycle out to November 2024 (yes, you read that right.) Its head of Australian economics David Plank summed up the change in call this way:

"We have upgraded our wage growth forecast and now expect it will accelerate to a peak of 4.3% y/y by late 2023 and remain at or above 4.0% y/y over 2024."

"All else equal, this will make inflation a bit stickier, ending 2024 at 3.0% y/y rather than in the high-2s ... the higher-for-longer outlook for inflation and wages means we’ve pushed our forecast for the first rate cut out to the end of 2024."

If GDP comes in softer than expected next week and inflation remains high on a month-to-month and year-to-year basis, market action could still get very ugly.

THE QUOTE

"So that’s regrettable. I’m sorry that that happened. I’m certainly sorry if people listen to what we’d said and then acted on that."

You rarely see a central banker so contrite in his messaging, but RBA Governor Philip Lowe was exactly that when he addressed the Senate economics committee yesterday. He apologised for the lack of clarity in its messaging and the fact it didn't get all those economic caveats across to the end consumer in plain English. And they're really paying for it now.

THE CHART

SECTORS TO WATCH

If Goldman Sachs' economics team is so optimistic that the US economy can avoid a recession, their sector choices sure don't reflect a US economic rebound/recovery. The team are still overweight in US healthcare, utilities and consumer staples stocks. In contrast, they are bearish on the semiconductors and parts of the big tech trade.

Let's see how much this changes throughout 2023.

STOCKS TO WATCH

Following a trading update that shocked the market, City Chic Collective (ASX: CCX) has been dealt one of the most brutal slew of downgrades I can remember since we started this report six months ago. Not one but four brokers have downgraded the company, over concerns about a slump in its American business and warnings on margin compression and inventories.

Here's what some of the sell-side analysts have been saying:

- Ord Minnett downgrades the stock to a HOLD from BUY, with the price target slashed by more than 60% to $1.10/share.

- Morgan Stanley also downgrades to a HOLD from BUY, with the price target slashed by a similar magnitude to $1.20/share.

- And... Macquarie is so concerned about the company's supply chain and inventory levels that it said "limited risk to the upside exists in the near term". Now a NEUTRAL, with a price target of just $1/share (it was $2.60/share).

And finally, speaking of retail, Australian giants Myer (ASX: MYR) and Premier Investments (ASX: PMV) have both been downgraded to UNDERPERFORM from neutral at CLSA. I guess you know where they stand on the Christmas trade.

Hans Lee wrote today's report.

GET THE WRAP

If you've enjoyed this edition, hit follow on this profile to know when we post new content and click the like button so we know what you enjoy reading.

If you have a chart and/or a stat that you would like to see featured in a future edition of the newsletter, drop us a note at content@livewiremarkets.com.

4 topics

3 stocks mentioned

1 contributor mentioned