Three global stocks with sustainable earnings, delivering sustainable change

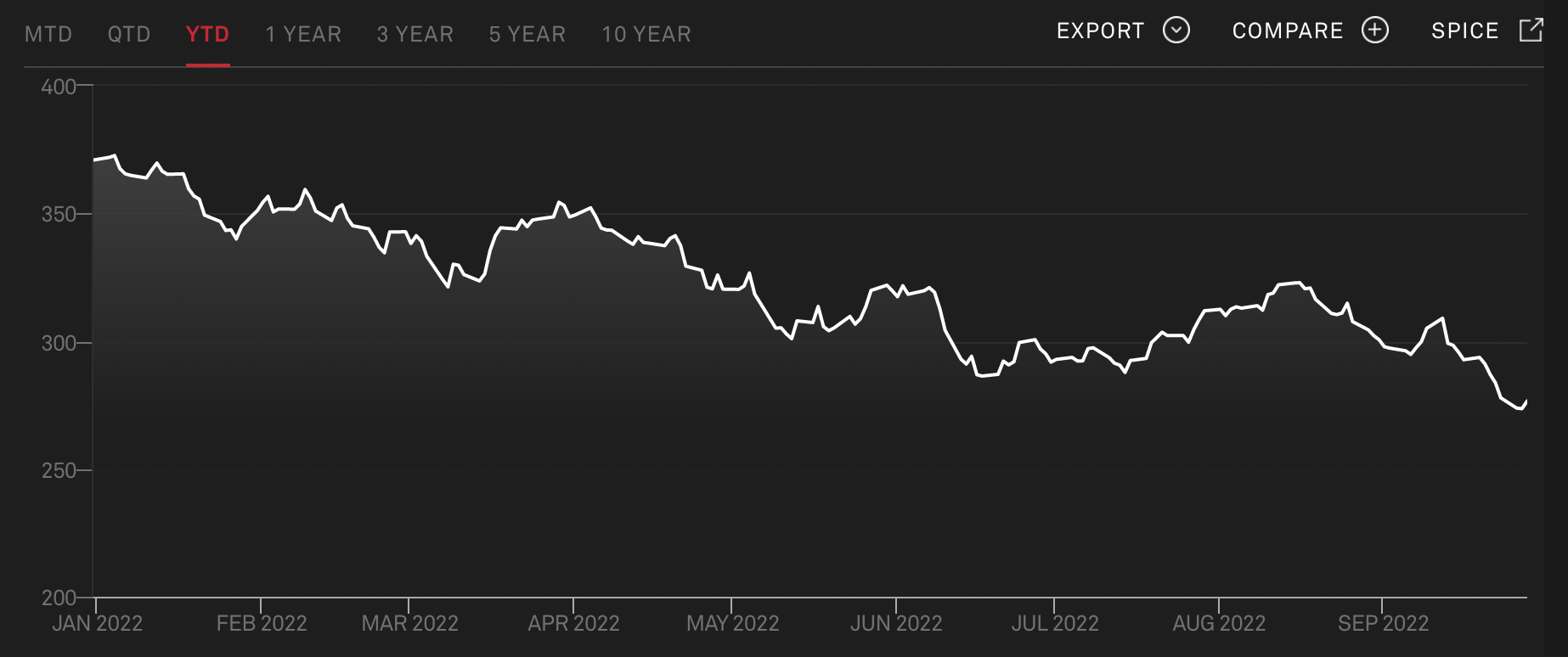

Global equities have had a rough year - and no market or sector has been spared. The S&P Global Broad Market Index is down 25%+ year-to-date while every US FAANG stock is officially in a bear market.

What started as a list of uncertainties around the lengths central banks will go to keep the easy money around has culminated in a race against time to hike interest rates and taper the trillions in quantitative easing which has flooded the market since March 2020.

The war in Ukraine exacerbated all these uncertainties even further, sending commodity prices to the moon before eventually receding. And in spite of all this, ESG investing continues to earn its fans as well as its critics. Lithium stocks are regularly in (and out of) fashion and institutional investors continue to back them. Analysis from Deloitte suggests global ESG-related assets under management will grow to US$80 trillion by as soon as 2024.

But returns also don't lie. The S&P 500's ESG Index is down 23.6% year-to-date, with its trend line possessing something of an eerie coincidence to the S&P Global Broad Market Index.

So if the trend is downward, the hikes are still coming, and the returns on sustainability-linked stocks continue to fall, why would a sustainability-centric fund launch as an active ETF now?

Recently, I posed that very question to Anthony Doyle, head of investment strategy at Firetrail Investments. Doyle is also on the leadership team of the S3 Global Opportunities Fund - a fund designed to make its investors sustainable earnings, as well as a sustainable impact on our world. Listen in for why he believes ESG investing deserves the criticism it's getting right now, how the team handles sustainability stock picking, and why it remains fully invested when others are sitting on a cash pile instead.

Note: This interview was taped on September 30th, 2022.

Topics covered

0:49 - Why investors shouldn't be scared of investing in global equities

1:57 - The challenges of a fully invested fund + why they're launching an ETF

4:19 - Digging into the sustainable mandate

7:15 - Discussing the macro headwinds facing global investing

10:16 - Fund in focus: Screening, selecting, and scrutinising the fund

11:42 - Three top holdings analysed

EDITED SUMMARY

Why investors shouldn't be scared of investing in global equities

This year, Doyle says, has been a painful reminder that global equities are at the mercy of central banks in every sense of the word. As quickly as the "Fed put" arrived, so did the "Fed call" - the idea that the world's largest central bank was not coming to save the valuations of risk assets after all. But that doesn't mean there aren't opportunities across the spectrum.

"So, we're likely to see and experience heightened levels of volatility and risk assets. We acknowledge that but undeniably we're finding fantastic opportunities across the global equity landscape," Doyle says.

The challenges of a fully invested fund and why they're launching an ETF

Fund and money managers across the world have been cautious about the valuations of equities. Recently, Katana Asset Management's Romano Sala Tenna told our very own Ally Selby that the flagship Australian equity fund has a 34% allocation to cash. The Munro Global Growth Fund, run by Nick Griffin, has a similar amount on the sidelines.

Not so Doyle, who runs a fund that only ever holds up to 10% cash at any one time. Why? He says it's all about not missing the upside days when they arrive.

"We will be fully invested throughout the cycle to capture those turning points in markets when they do occur. We don't want to miss those best days that can often represent the most meaningful performance over the life cycle of a long-term investment," Doyle tells me.

When asked about the rationale behind launching the fund in ETF form, Doyle said it's all about democratising access and providing retail investors with the access they crave at a lower cost.

Digging into the sustainable mandate

Let's not mince words. It's been a rough year for investing in global equities, and the year has been even rougher if you have not had decent exposure to old-world energy stocks (crude oil, coal in particular). Of course, all of this was exacerbated by the war in Ukraine. So does Anthony feel the sustainability-centric mandate attached to his fund is a hindrance in these times? Yes and no.

"We think that ESG sustainable investing is right to come under criticism right now," Doyle says before adding "we don't think that you are constrained in any way by identifying companies that will be the sustainability future leaders or current leaders of tomorrow."

"Companies that are contributing to positive change ... may not exist in Australia," Doyle adds.

Discussing the macro headwinds facing global investing

If the war in Ukraine compounded by the cost-of-living crisis both in the UK and on the continent has proven anything, it's that digesting macro noise into signal has become harder than ever. But Doyle is not deterred by that, arguing the weaker single currency has actually been a tailwind for the companies the fund invests in.

"When you look at our exposures to Europe, the majority of their revenues and earnings are offshore. So, the decline in the Euro, for example, has actually acted as a bit of a tailwind for many of these businesses," Doyle says.

Similarly, the US Dollar has been a source of opportunity as a hedge for the fund. They will not predict what the terminal rate of the Federal Reserve will be, but they will use the US Dollar as a proxy for investments that may have their earnings significantly impacted by it.

Screening the best in global equities

Doyle estimates that there are over 20,000 publicly-listed equities based all over the world. So how do you get 20,000 companies down to the best 25? A whole lot of numbers.

"We have to implement screens in order to get that down to what we describe as positive change opportunities. We use those screens to get it down to around 800 companies and we use over 350 financial metrics in order to do that," Doyle says.

Among some of their best ideas is a timber REIT, an air-conditioning giant, and one of the world's most well-known automotive brands.

A high-conviction portfolio with a sustainable edge

The Firetrail S3 Global Opportunities Fund (Managed Fund) (‘S3GO’)1 will be available from 11th October 20222 as an Active ETF, allowing investors to buy and sell units on the ASX. This means you can now access Firetrail’s best global equity ideas via one trade. For further information, please visit Firetrail's website: (VIEW LINK)

4 topics

2 stocks mentioned

1 fund mentioned

3 contributors mentioned