Three good companies in one good stock

Seven Group (ASX: SVW) is a diversified operating and investment group with holdings that sit across the mining, industrial, energy and media sectors. Some of Seven Group’s key businesses include:

- WesTrac, an authorised Caterpillar dealer;

- Coates, an equipment rental provider; and

- Boral, an Australian construction materials business.

Seven Group also has investments in listed and unlisted energy assets and a shareholding in Seven West Media.

We think the market discounts the quality of Seven Group’s key holdings because of the sectors it operates in, and because Seven Group is a conglomerate. Conglomerates have a reputation for diluting returns through a bloated corporate structure, but in our view, the Seven Group corporate overhead is relatively lean. Furthermore, management has a strong track record of capital allocation and driving improved returns in the businesses they own.

At Airlie we look to invest in quality businesses that we believe are undervalued by the market. In our view, each of WesTrac, Coates and Boral are attractive investments in their own right, and through SVW we are able to get exposure to all three for a price we believe is more than fair.

How is WesTrac different from other mining services companies?

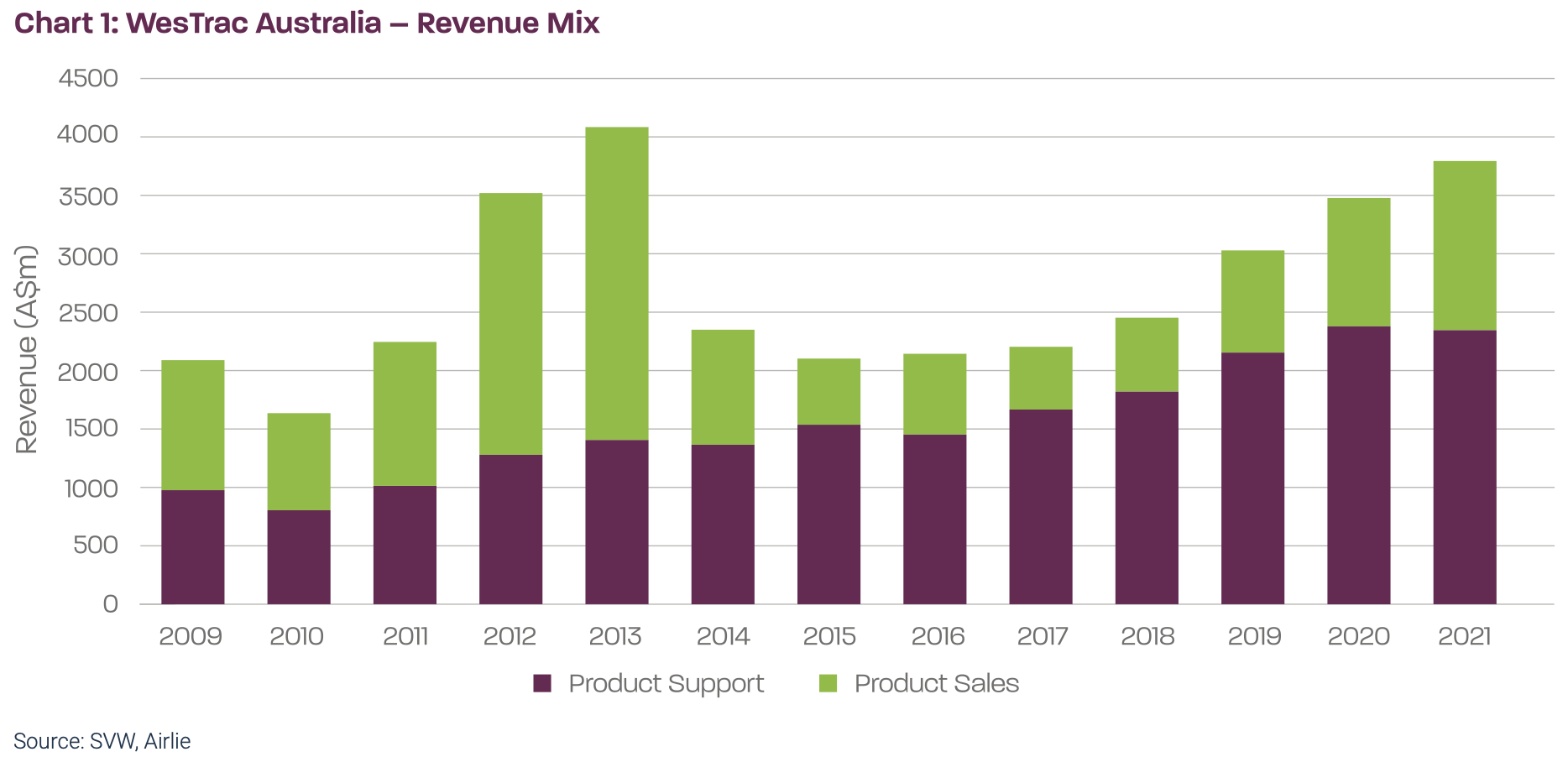

WesTrac is the exclusive dealer of Caterpillar yellow gear in WA, NSW and the ACT. Revenue and earnings for WesTrac come from two sources – new vehicles sales and product support, which includes parts sales and servicing. Effectively, customers use WesTrac to purchase new CAT vehicles, but then also to maintain their existing CAT fleet. As customers grow their installed fleet and their fleet ages, they naturally grow their demand for parts and services.

“WesTrac, Coates and Boral are attractive investments in their own right, and through SVW we are able to get exposure to all three for a price we believe is more than fair.”

Since the last mining boom sales from product support have grown steadily even as commodity prices have fluctuated over the same period (Chart 1). Most mining services businesses generate revenue from lumpy contracts that are competitively bid and for which the returns on capital are relatively low. WesTrac on the other hand now generates the majority of its business from the maintenance of its customers’ Caterpillar fleets, which is effectively recurring, non-discretionary spend for customers to maintain production volumes. More importantly, WesTrac basically has a monopoly over this spend.

In our view, the shift in sales and earnings mix towards product support over new vehicles has greatly improved the quality of the WesTrac business overall. Not only are the earnings more stable, but the mid-cycle earnings of the business are now higher given the larger installed fleet base, even as new vehicle sales oscillate. It’s the earnings visibility of WesTrac alongside the strong returns that come as a function of its privileged competitive position that make the business a standout for us in the mining services sector.

What makes Coates a good business?

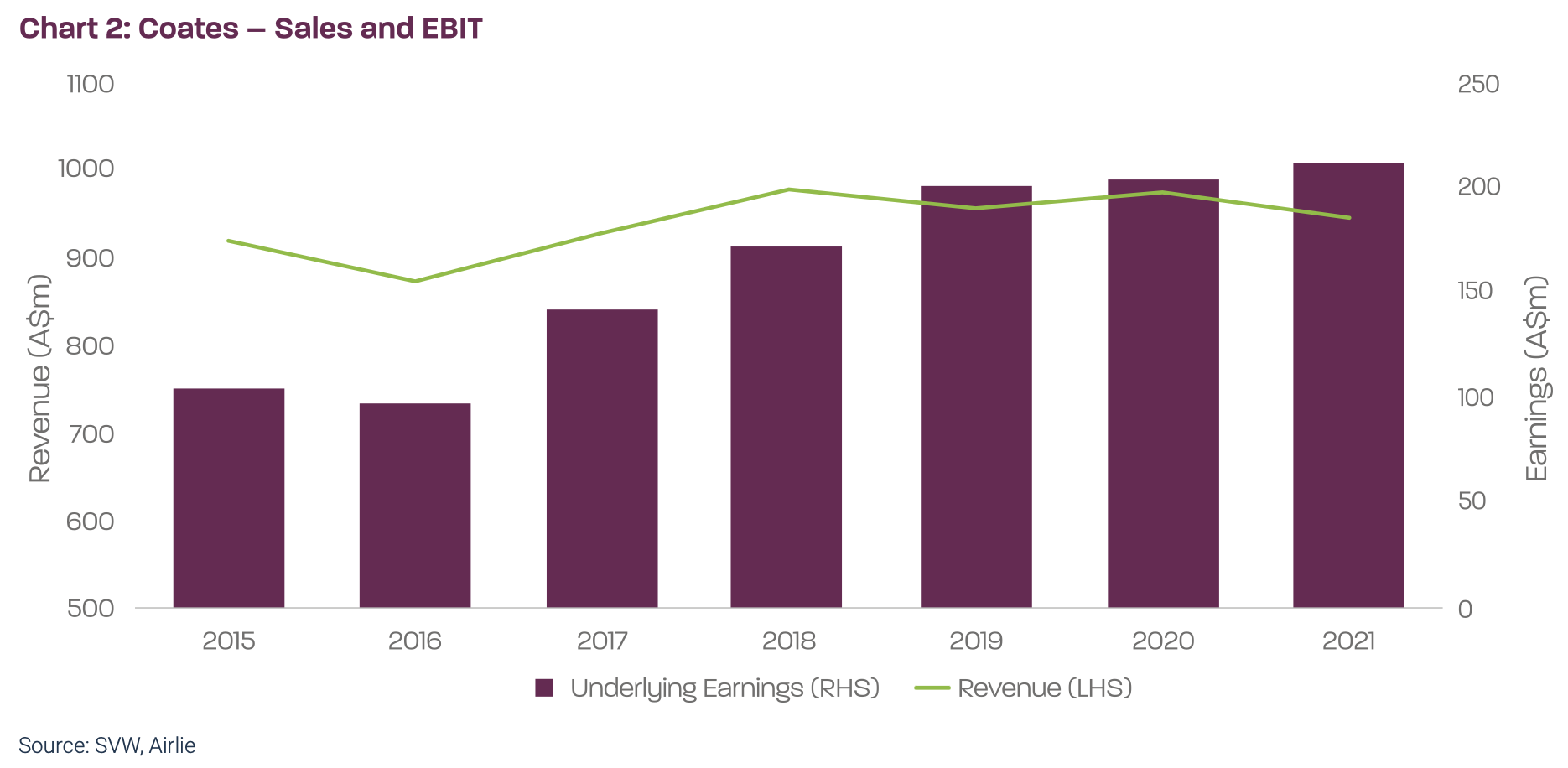

Coates is an equipment hire provider that owns Australia’s largest fleet of rental equipment and has a 20% share of the national market. Coates provides a range of equipment to large, medium and trade customers predominantly for use in infrastructure, mining and residential construction projects.

Equipment hire businesses aren’t generally thought of as particularly high quality, given the barriers to entry are low and they can be quite capital intensive, which means the returns are often mediocre. We think Coates is an exception here for a few reasons:

- Coates has scale and is a trusted national brand

- Operating metrics like asset utilisation and earnings margin are top quartile versus global peers

- Management has an exceptional track record of delivering earnings growth and market share gains, without simply acquiring competitors

From 2015 to 2021 Coates was able to more than double earnings from around $100 million to $212 million, while only growing sales $25 million over the same period (Chart 2). The pipeline of upcoming infrastructure projects is healthy, which we think should see Coates grow revenue at a faster clip over the next five years than the previous, and earning leverage flow-through as a result. Internally management focuses the business towards what they call the “Team25 targets” – 25% margins on $1.25 billion of revenue by 2025. Hitting these targets would imply earnings of over $300 million, or an additional $100 million over the 2021 reported result. It’s the strong track record of management, the market-leading position and a robust earnings outlook that makes Coates attractive to us as at Airlie.

What is the opportunity for Seven Group in acquiring Boral?

Boral is a national integrated construction materials and building products business, with a network of assets that support the production and sale of concrete, asphalt, and cement. Boral has operated in Australia for over 75 years and the brand is synonymous with Australian construction.

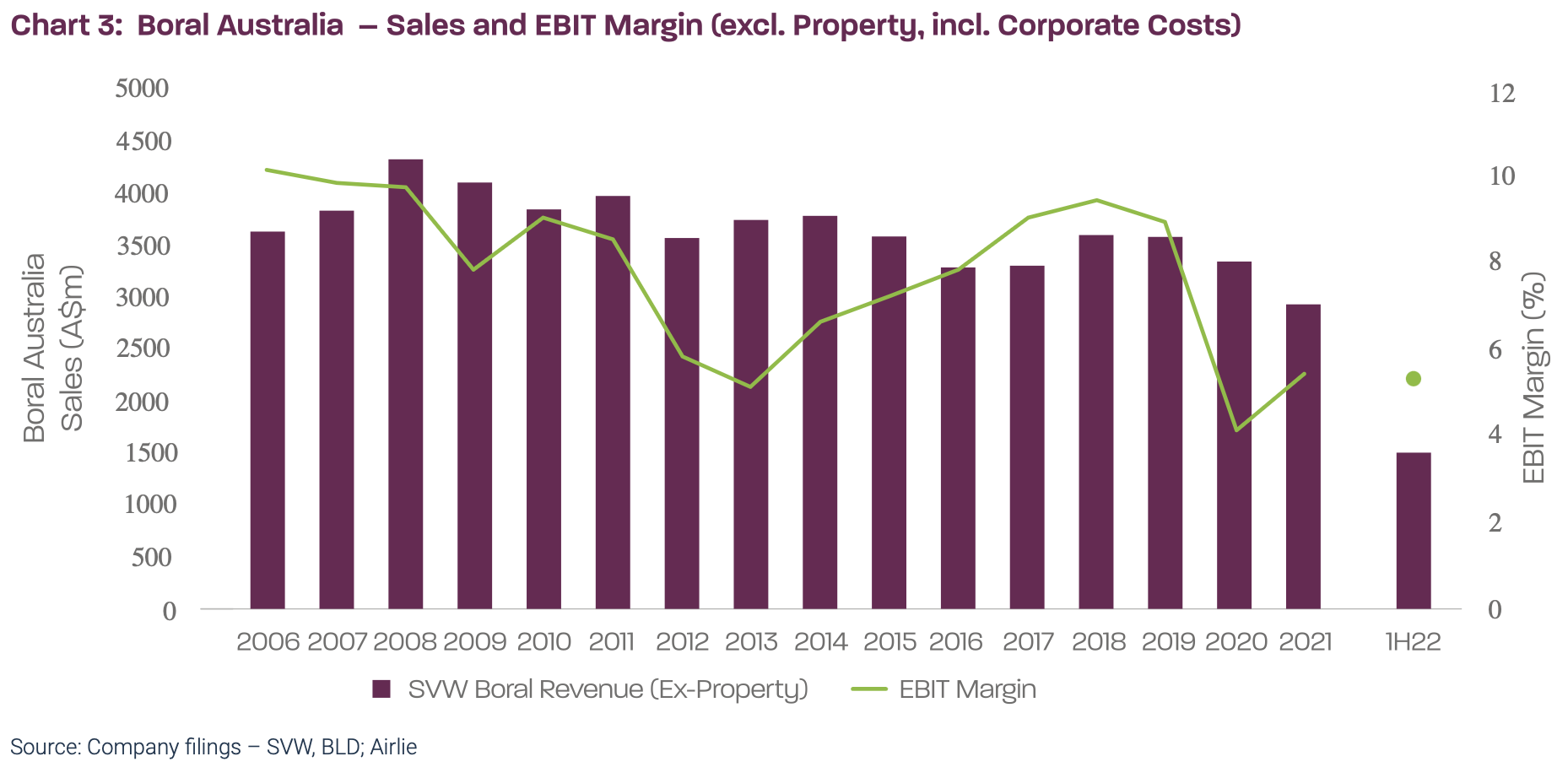

The past decade has been pretty disappointing for Boral – we think returns fell away for a couple of reasons:

- The competitive position of the Australian business weakened as imported products gained share, and

- Management overpaid for acquisitions in North America.

Internally Seven Group had long flagged the Boral Australian construction materials business as one of interest for the right price. To Seven’s credit, it was effectively able to buy its position on market, initially entering the stock during the March 2020 downturn, without paying a takeover premium. The company then sold Boral’s North American assets at fair prices to fund the transaction debt.

Now as 70% owners of Boral, we consider the opportunity for Seven Group is two-fold.

First, if Boral can reset its cost base and start pushing price now that the competitiveness of imported products is starting to reduce, earning margins should lift back in line with peers and returns should rise to a level that better reflects the quality of the asset base. While revenue can be cyclical, it’s really margin that’s been the issue for Boral, and so simply put a restructuring of the cost base should drive earnings leverage to the upside reasonably quickly (Chart 3).

Second, Boral has an extensive portfolio of surplus property that has basically been used to plug earnings holes in the business for the past fifteen years. We think there are opportunities to create value over the long term through development of non-core assets and by rationalising the operating network.

In our opinion, the recent earning downgrades from Boral are more one-off in nature than structural, and don’t change the long-term turnaround opportunity in Boral’s Australian business. At Airlie, we believe a successful turnaround requires proven management teams, quality assets and balance sheet optionality, all of which Boral now has.

WesTrac, Coates and Seven Group’s 70% shareholding in Boral (BLD) form the majority of our Seven Group valuation. Each in isolation has qualities that align with the Airlie investment process, whether it’s the privileged competitive position of WesTrac, the high-calibre management team at Coates or the asset base and turnaround opportunity at Boral. Overlay the impressive track record of Seven Group’s management team, and a valuation below market multiples, and to us the stock looks incredibly compelling.

Access more insights from Airlie's latest InReview

This year’s collection of investment perspectives features our experienced and proven team of portfolio managers and analysts. We share our advice on investing in today’s ‘extreme’ market conditions, explain why most owner-managed businesses succeed in the long term, and unpack a number of companies that we believe are strongly positioned for the year ahead. Learn more here.

2 topics

2 stocks mentioned