Too expensive and unreliable: why Kate McClure believes the critics of this theme are wrong

The green transition is one of the biggest investment themes of our time. It’s possibly also the most divisive. Critics of renewable energy and the green transition argue that its too expensive and unreliable and that it is also responsible for huge jobs displacement. And that’s before you get into the arguments about climate change itself.

But making significant changes does take time and money. And it’s never going to look perfect from the start. But if we’re talking reliability, the number of blackouts that Australia has experienced in various states, or the longer government blackouts in China, suggests that the traditional energy forms are not necessarily reaching the gold standard either.

There’s extraordinary spend coming in this space, with governments and private organisations being committed to the change. In fact, the International Renewable Energy Agency argues that yearly investments need to reach US$35 trillion by 2030 to be successful.

When it comes to successful investing, there’s something to be said for watching where governments and other organisations are focusing policy and spend. It’s an opportunity and one that Octopus Investments is grabbing with both hands. It is one of the largest owners of renewable energy projects in Australia and Europe and is focused on building a bespoke portfolio of renewables assets across locations and technologies.

In this edition of Rapid Fire, Kate McClure, senior portfolio manager for Octopus Investments, shares where she sees the opportunities in this space, how to think about valuations and earnings and debunks some common criticisms of renewable energy. She also discusses where Australia is positioned in the transition race and why we are still positioned favourably.

How has the more uncertain market environment affected investment into the green transition?

Uncertainty in markets generally slows investment across asset classes and alternatives/infrastructure aren’t immune to that. More specifically, volatility in equities makes planning for deployment in real assets a trickier especially when trying to target strategic asset allocations.

In saying that, Octopus have found traction with investors who recognised the macro opportunity in Australia’s energy transition and have partnered with a number of them to secure a $10bn pipeline of projects to be built over the coming 5 years.

How has the renewable energy investment space changed in the past 5 years? What are the key opportunities and challenges you are seeing?

Globally, renewable investment is moving towards backing ‘platforms’ – teams with a track record of development and exclusive pipeline origination. We’re seeing this here in Australia with the recent consolidations such as Tilt, Meridian, Wirsol and Spark.

The opportunity for investors will be in gaining access to the right renewable energy platform with a team that can deliver sustainable returns. The challenge, however, is that many of the platforms that have transacted were acquired by institutional and international investors, effectively locking out the wholesale markets. We have sought to open up this opportunity through the OASIS and OREO products.

There’s been some concerns – including those voiced by the ACTU – that Australia is falling behind in the energy transition race. What is your view on this and our position compared to other nations?

Despite Australia’s energy transition efforts being slower than some other nations, there are certain advantages and characteristics that position us favourably in the global energy transition.

Australia has the opportunity to be a renewable energy superpower with the right support in policy developments, technological advancements and market dynamics. There is a $320bn opportunity in new energy and infrastructure investment to replace retiring coal generation in Australia, and $2.5tr opportunity to support ammonia and hydrogen as energy sources.

Some of the advantages include:

- Abundant natural resources: our land area and climate conditions are well suited for large-scale energy generation, especially solar and wind power.

- State-level initiatives: some regions, like South Australia, have already achieved 100% renewable energy for their electricity needs. There is also growing public support putting pressure on government.

Australia is also advanced in some areas for renewable energy generation. For example:

- It has one of the highest rates of rooftop solar installation per capita in the world.

- It is 3rd in the world (behind China and the US) in deploying utility scale battery storage.

Octopus Investments invests in a number of large-scale renewable projects. Can you discuss one of these projects and what makes it a valuable investment?

Dulacca Wind Farm is Octopus Australia’s first wind project in Australia. The site is fully constructed and operational with the largest capacity turbines ever installed in Australia. It’s a large-scale wind farm (180MW) which had its official opening on 19 October with the QLD premier Annastacia Palaszczuk. The site is expected to power ~124k homes.

The project secured a high-quality Power-Purchase-Agreement (PPA) with the Queensland Government’s Energy Retailer – CleanCo. They are an ideal offtake partner with extremely strong credit risk.

We also partnered with two of the most experienced developers and EPC contractors in the Australian market (RES and Vestas), leveraging our long-standing relationships globally. RES and Vestas bring deep wind farm and grid experience in Australia.

We’re extremely excited about this asset due to its exposure to attractive wind profile in Queensland, that captures more of the morning and evening peak periods. This is when energy prices are highest.

How should investors in renewable energy think about valuation and timing for earnings?

Valuations in renewable energy infrastructure have been relatively steady since launching the strategy in July last year. Of course, rising rates have had an impact, as have increasing capex through supply chain issues. With that being said, wholesale spot energy prices and PPAs have also risen which has netted the effect.

Regarding timing of earnings, we invest in the entire lifecycle of renewable infrastructure – Development, Constructions and ongoing Operations. We’re long-term owners so don’t try to time earnings. We try to optimise the assets through our in-house asset management team, thus maximising lifetime earnings for these assets.

My final point is that a well-diversified portfolio of assets should provide stable income to investors as a mix of wind/solar/storage will balance intermittency and bring consistency to cashflows. Octopus targets 6-monthly distributions for its products.

What area of this investment space are you most excited about and why?

The growth of Battery Energy Storage Systems (BESS) is an exciting area!

Advancements in battery technology coupled with declining costs, are making energy storage more economically viable. They will play a critical role in grid stability, renewable energy integration and supporting the transition to a more reliable and resilient energy system, alongside renewable sources like wind and solar.

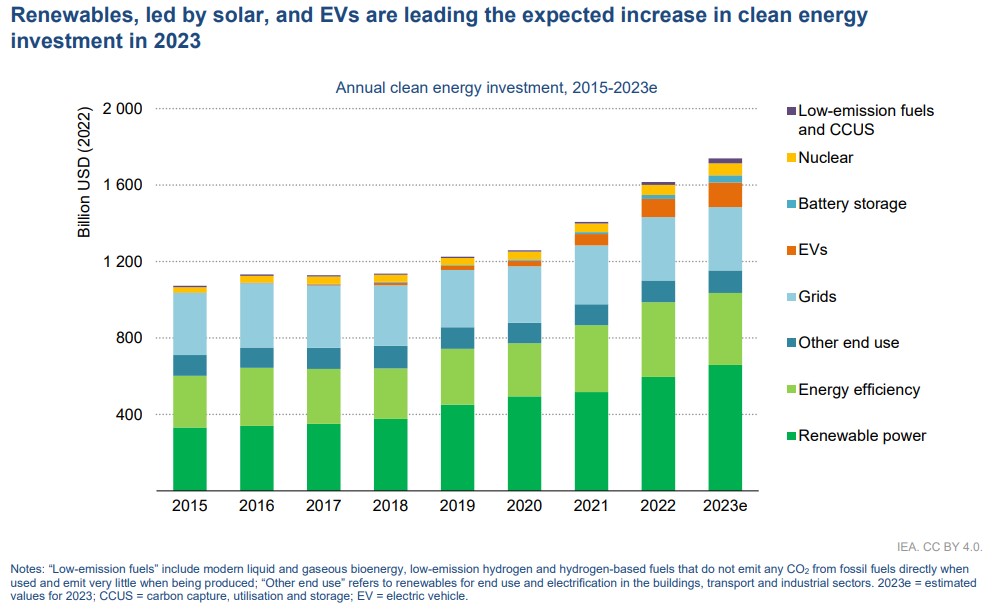

The chart: how does the below compare to continued investment in older forms of energy? Where do you anticipate the biggest growth in investment in coming years?

Older forms of energy such as coal which were historically dominant source of energy in Australia’s energy are declining, with the retirement of 80% of coal power plants over the next 10 years. This has been and will continue to be replaced by increases in renewable energy sources, such as solar and wind.

In the transition to renewable generation, natural gas will still play a role as baseload energy as we move to further advances in battery storage. However, there is a growing shift away from natural gas due to emissions and environmental concerns. With an increase in renewable energy to the energy mix, the deployment of energy storage solutions, including battery storage is anticipated to grow substantially. This is crucial for managing the intermittency of renewable energy sources and stabilising the grid. Hydrogen, especially green hydrogen using renewable energy sources, is also expected to see substantial growth.

Lastly, I anticipate the development of hybrid projects that combine renewable energy generation with complementary technologies, such as energy storage or green hydrogen project, will become more common.

Fun question: what are the top 3 silliest criticisms you’ve heard about investing in renewable energy?

-

“Renewable Energy is Too Expensive”

Some critics claim renewable technologies are too expensive compared to fossil fuels. While the initial investment in renewable energy infrastructure may be high, the long-term operational and maintenance costs are often lower. Additionally, the costs of technologies such as solar and wind have significantly decreased over the years and in many cases are the most cost- competitive sources of electricity. -

"Renewable Energy Is Unreliable"

A common criticism is that renewable energy sources like solar and wind are unreliable because they are dependent on weather conditions. Critics argue that the intermittent nature of renewables can lead to grid instability and blackouts. In reality, modern renewable energy systems are designed with energy storage solutions (like batteries) to ensure reliability and stabilise the grid. -

"Renewable Energy Leads to Job Losses"

Some critics claim that transitioning to renewable energy will lead to job losses, particularly in the fossil fuel industry, arguing that renewable energy will result in the displacement of workers in sectors like coal mining. However, the renewable energy sector has been a significant source of job creation in Australia, offering opportunities in construction, manufacturing, installation, operations and maintenance.

Leading Australia's drive towards a cleaner future

Octopus invests directly into the Australian renewable energy sector, helping to provide the innovative solutions it needs during its transition to a clean energy future. Visit our website for more information, or the OREO fund profile below.

3 topics

1 fund mentioned

1 contributor mentioned