Top telehealth stock plays for a post-COVID world

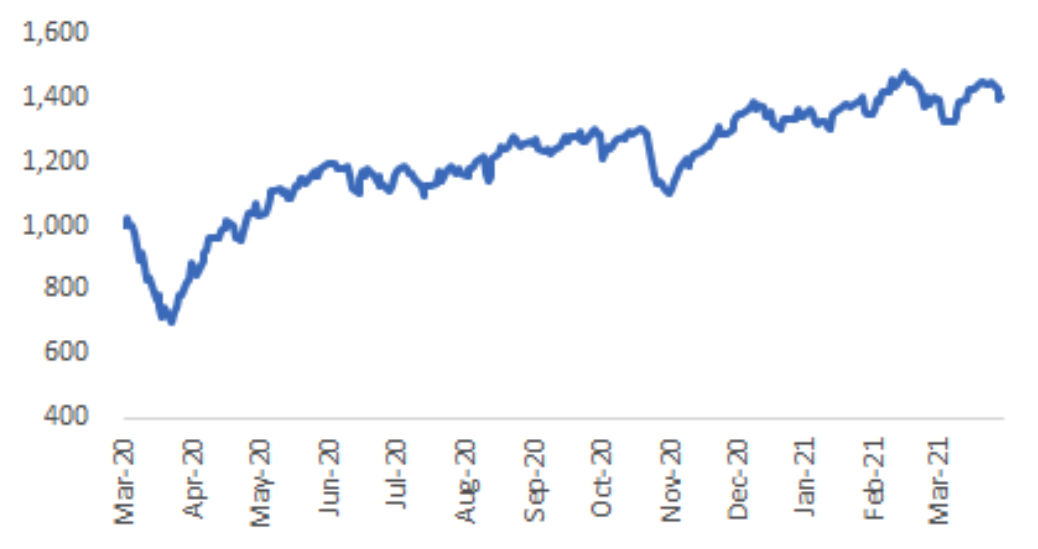

The IIR Pharma & Biotech Index increased

slightly in March, up 1.3%. The index has performed strongly since the lows

resulting from the pandemic, up 67.4% over the 12-months to 31 March 2021. This

compares to the broader market (ASX All Ordinaries Accumulation Index) which

was up 41.1%.

IIR Pharma & Biotech Index*

*The IIR Pharma & Biotech Index is a market capitalisation weighted index and currently includes 139 stocks across the Pharmaceutical, Biotech, Health Care Suppliers, Health Care and Equipment, Health Care Technology and Life Sciences GICs sectors. The index excludes the five largest companies in these sectors being ANN, COH, CSL, FPH and RMD. Source: Supplied.

Opthea Limited (ASX: OPT) fell out of the top 10 in March, with Mayne Pharma Group (ASX: MYX) moving into the top 10 after the share price increased 27.3% for the month. The share price was buoyed by the release of positive data regarding NEXTSTELLIS, a novel, investigational combined oral contraceptive. The positive momentum has continued in early April with the stock nearing its 52 week high. MSB continued to weaken, down 11.8% in March to be trading at $2.17 per share at March-end. This is down from the high of $5.70 per share in September 2020.

Over the 12-months to 31 March 2021, of the top 10 constituents in the index, IMU has been the best performer with the share price increasing 500%. TLX has been the second best performer, up 330.2%. SPL and PME have also performed strongly over the 12-month period, up 149.4% and 112.7%, respectively.

Telehealth Market Landscape

Advancement of the telehealth segment (which includes telemedicines for the purposes of this report) has accelerated significantly on the back of the COVID-19 pandemic, with these technologies becoming an essential component in health care delivery, seemingly overnight. The pandemic provided the impetus for the removal of regulatory, behavioural and financial barriers to the use of telehealth services providing it with the backdrop for its sustained use when the world returns to normal.

The acceleration of the use of telehealth has resulted in a number of companies operating in this space performing well over the last twelve months and has seen some companies take advantage of the momentum in the market to list on the ASX, with Intelicare Holdings Limited (ASX: ICR) and Doctor Care Anywhere Group PLC (ASX: DOC) both coming to market in 2020. ICR raised $5.5m through the IPO while DOC raised $102m.

Looking outside Australia, there were three major telehealth listings in 2020 - CloudMD; Amwell; and GoodRX, which raised a combined US$1.8 billion through the IPO’s.

There are wide ranging forecasts with respect to

the size of the telehealth market. According to Signify Research, the global

telehealth market was worth ~US$5.3 billion in 2019 and is expected to grow to

US$14.9 billion by 2024. While the forecast amounts vary, the overarching

outcome is that the market is expected to grow significantly over the

short-and-medium term.

There are numerous benefits to the use of telehealth, including cost, choice and convenience. In 2013-2014, an Australian study that involved nearly 300 telehealth patients not only found a reduction in hospital admissions but an improvement in the participants' health literacy and health behaviours.

While telehealth tools don’t replace face-to-face care, it is an important tool to facilitate access to healthcare, particularly for those in remote or rural areas. As the Minister for Regional Health, Regional Communications and Local Government, Mark Coulton, stated in a press release in November 2020, “Telehealth is here to stay. The Government is working with the health sector to consider a broader and permanent range of telehealth services in developing our Primary Care plan.”

Below provides a selection of ASX-listed companies that provide exposure to the telehealth market. The products and services provided by the below companies include technologies for virtual services and visitations, health care provider directories, applications for remote diagnostics and monitoring and applications for accessing client records and clinical data remotely.

Alcidion was the largest company by market cap

as at 31 March 2021 of the below group. From a share price performance

perspective, ONE has been the best performer, with the share price increasing

by more than 1,000% over the last 12-months. A large portion of this share

price rise has been in the last two months. The catalyst for the increase was

the company signing a distribution agreement with Samsung SDS America, Inc. for

a bundled solution for bedside digital services for patients in the US.

Below we take a look at the revenue generated for CY2020 and the growth from CY2019 to see if the companies exposed to the telehealth segment benefited from a revenue perspective. Over the 12-months to 31 December 2020, ALC generated the greatest revenue amount of AUD$21.5m. DOC was the only other company to generate revenue in excess of AUD$20m for CY2020. A number of companies were able to capitalise on the momentum in the market. ICR, DOC and MDR all reported an increase in revenue of 80%+. We note that ICR reported the greatest revenue increase, however, there was only one half of revenue reported in CY2019 and the revenue is coming off a very low base, therefore small movements result in large percentage increases.

ONE’s revenue was largely unchanged over the CY20 period but the recent share price movement suggests the market is expecting recent announcements to result in revenue growth in CY2021.

A number of the below companies are in the early

stages of growth and 2021 will be pivotal from a developmental perspective.

There has already been significant movement in the sector in the early part of

the year. We expect this to continue for the remainder of the year.

The global telehealth market is expected to experience significant growth in the coming years. We expect competition in the market to continue to grow, as is typically the case in a fast growing market. While most agree that telehealth products and services are here to stay beyond the COVID-19 pandemic, whether the momentum that was realised during the pandemic can be sustained is yet to be known. Without a doubt, the value of telehealth has been highlighted in recent times.

Company News

Below we look at stocks in the IIR Pharma & Biotech Index that made notable announcements during the month that were received well by the market. These include: Oneview Healthcare PLC (ASX: ONE), IDT Australia Limited (ASX: IDT), Actinogen Medical Limited (ASX: ACW), Anteris Technologies Ltd (ASX: AVR); and Mayne Pharma Group Limited (ASX: MYX).

Oneview Healthcare PLC (ASX: ONE)

ONE’s share price was up 348.9% in March taking the 12-month return to in excess of 1,000%. The catalyst for the share price in March was the announcement of an investor awareness agreement and placement with StocksDigital. During the month, the company also launched the CXP Cloud Enterprise, the world’s first and only cloud-based care experience platform. The platform enables health systems to quickly adapt technology for engaging patients, reducing non-clinical demands on care teams and optimising clinical and operational effectiveness.

The launch of the CXP Cloud Enterprise comes after the company announced in February an agreement with Samsung SDS America to distribute ONE’s Cloud Start product to healthcare-focused resellers in the US.

IDT Australia Limited (ASX: IDT)

IDT’s share price rocketed in March after the company announced it was undertaking a feasibility assessment to assess the possibility of utilising it’s sterile manufacturing facility to supplement the production capability for a COVID-19 vaccine at the request of the Australian Government.

IDT’s share price increased 123% on the day of and the day after the announcement and finished the month up 140.5%. The market is waiting for further information regarding the assessment and we expect if the facility were to be suitable for COVID-19 vaccine production this would be a further catalyst for the share price.

Actinogen Medical Limited (ASX: ACW)

ACW’s share price was up 85.7%. The market responded favourably to the appointment of Dr. Steven Gourlay as CEO and MD during the month. Dr. Gourlay replaced Dr. Bill Ketelbery, who resigned from the position in February 2021.

Dr. Gourlay has more than 30 years’ experience in the development of novel therapeutics and brings considerable skills and experience to the company. Dr. Gourlay has been acting as a consultant CMO to the company since December 2020 and has been actively involved in the review of the full dataset on ACW’s lead compound, Xanamem.

In February 2020, the company received Rare Paediatric Disease Designation from the FDA for the company’s lead drug candidate, Xanamem, for the treatment of Fragile X Syndrome (FXS), a rare and serious genetic disorder characterised by a range of neurological developmental problems.

In late 2020, the company raised $7.4 million to fund the development of the lead drug candidate with Phase II clinical trials in the treatment of Alzheimer’s and FXS set to commence in 2021.

Anteris Technologies Ltd (ASX: AVR)

AVR’s share price has been on an upward trajectory since the announcement of a $20m funding package for the company’s TAVR research and development from the Mercer Street Global Opportunity Fund. Since the date of the announcement of the funding package on 6 January 2021, the share price had increased 215% to March-end.

AVR is a structural heart company focused on developing next generation technologies that help healthcare professionals create life-changing outcomes for patients. During the month, the company reported the results from its anti-clarification study indicating its ADAPT treated tissue has superior anti-clarification attributes compared with tissues used in competitor valves. Results showed the ADAPT treated tissue used in the DurAVR 3D single-piece aortic valve, had ~38% less calcium concentration compared with the Medtronic AOA porcine arm (the tissue used in commercially available TAVR valves) and 26% less calcium in the bovine arm (used in some of the Medtronic SAVR valves).

Mayne Pharma Group Limited (ASX: MYX)

MYX was up 27.3% in March. The key catalyst for the share price increase was the positive data from NEXTSTELLIS, a novel investigational combined oral contraceptive (COC). NEXTSTELLIS resulted in limited changes in endocrine markers, including lower increases in hormone binding globulins compared with COCs based on ethinyl-estradiol (the synthetic estrogen used in all but one of the marketed COCs).

The results add to the growing body of evidence that NEXTSTELLIS may be a promising novel oral contraceptive for women. The company is seeking FDA approval. If NEXTSTELLIS is approved, it would be the first new estrogen introduced in the US for contraceptive use in approximately 50 years. In the 1H’FY21 Investor Presentation released in February, the company stated it was targeting a 2% market share by volume for NEXTSTELLIS with peak net sales potential to exceed $200m per annum.

Not already a Livewire member?

Sign up today to get free access to investment ideas and strategies from Australia’s leading investors.