Travel is back on a roll but the best could be behind these two companies

After a challenging few years for Australia’s travel and tourism industry, profits are well and truly back, surprising expectations. Reports indicate flight numbers and bookings are close to 2019 pre-covid levels (if not higher in some cases) and the companies in this sector are reaping the rewards.

Qantas (ASX: QAN) announced a bumper return to profit, while Flight Centre (ASX: FLT) even announced a dividend today. This was a far cry from expectations earlier this year.

Of course, these results have been quickly overshadowed by the controversial relationship between Australia’s national carrier and the government, seeing the government block Qatar Air from flights and even denying additional funding to the ACCC for its continued monitoring. It raises a number of concerns over the travel sector as a whole, let alone what it may have meant for local competitors like Virgin. (You can read more in this wire by Roger Montgomery.)

Outside of all this, there's been concerning indications that consumers are starting to tighten their belts on the retail front. Jun Bei Liu, lead portfolio manager for Tribeca Investment Management, believes the travel industry could be the next to feel the pinch and that the best times are behind Qantas and Flight Centre.

In this wire, Liu discusses the challenging environment ahead, what the Qantas controversy might mean for share prices and competitors and where she sees bright spots on the ASX.

Note: This interview took place on 30 August 2023.

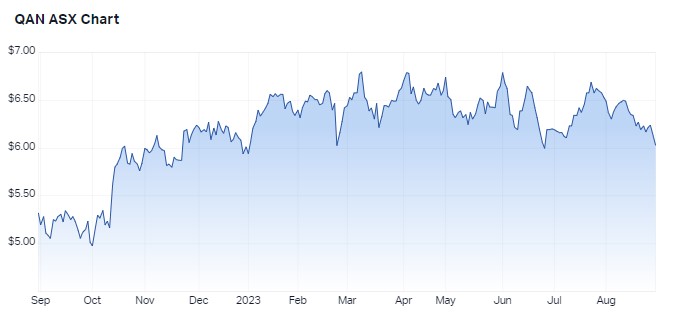

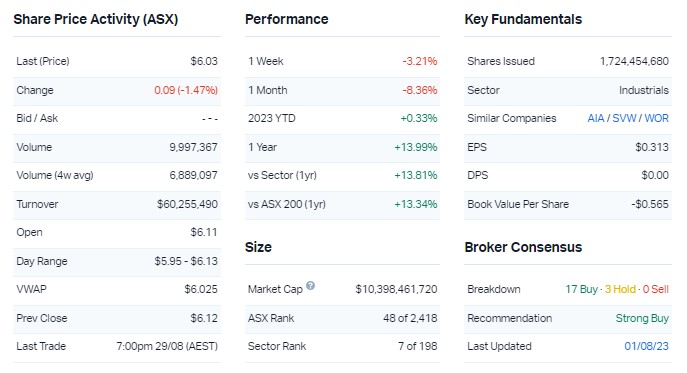

Qantas (ASX: QAN) FY23 results

- Underlying profit before tax $2.47bn

- Revenue and other income $19.8bn (up over 100%)

- Return on invested capital 103.6%

- Group unit revenue 12.29c/available seat kilometres (up 30%)

- Total aircraft fleet 336 aircraft

- Basic earnings per share 96c

- On-market share buyback of up to $500million

Key company data

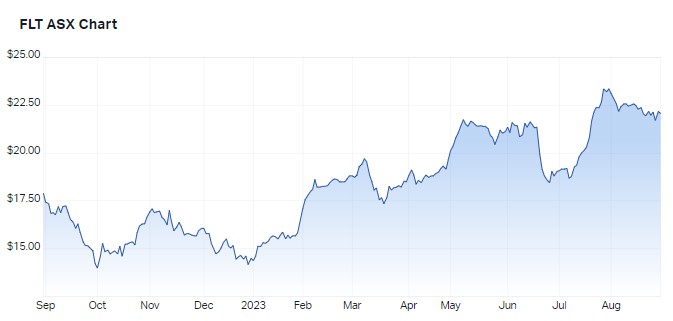

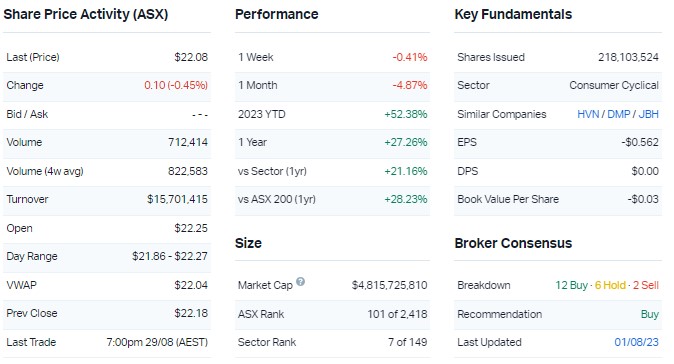

Flight Centre (ASX: FLT) FY23 results

- Total transaction value $21.9bn (up 115% yoy)

- Operating revenue $2.28bn (up 127%)

- Underlying EBITDA $301.6m (up 265% - nearly 70% generated in 6 months to 30 June 2023)

- Total cash $1.2bn (up 69%)

- International air traffic 90% of pre-covid levels

- Outbound capacity increased 85% in June 2023

- Earnings per share 23.1c (up 116% yoy)

- Final dividend 18c

Key company data

In one sentence, what was the key takeaway from these results?

What was the market’s reaction to these results? In your view, was it an overreaction, an under-reaction or appropriate?

I think the market reaction has been appropriate. Both share prices drifted down on the day of their results and then stayed flat. There are two reasons for this. One is that the results are in line with expectations because both companies had a lot of earnings upgrades in the lead up so it’s well anticipated. We know people are still travelling from anecdotal evidence.

The other reason is that I think investors are getting a bit more cautious given what we’ve heard from other sectors, such as retail, that July started to get tougher. There’s a lot of anticipation that in the next six months, travel will be the next to be hit by the slowdown in consumer sentiment.

Do you think the controversy over the Australian government’s support of Qantas in terms of blocking Qatar Air from increasing flights and ACCC funding has affected the Qantas share price?

I think the share price has been quite muted but it is reflecting that investors are reluctant to rush back into Qantas because of the controversy and what might happen with Qatar in the future. That could be a meaningful impact to Qantas. The reluctance of investors to support the share price at this level is reflective of what’s happening.

Were there any major surprises in these results that you think investors should be aware of?

Would you buy, hold or sell Qantas and Flight Centre on the back of these results?

I’m sitting in the camp that the best is behind them. I’m a seller of those businesses. I think they’ve had an incredible run and they’ve benefitted a lot from the catch-up in travel. Things will get harder for the domestic and international market in the next 12 months.

In the case of Qantas, we’ve seen the ticket prices coming off, and that’s aside from the potential for competition, like Qatar coming in.

What’s your outlook on Qantas and Flight Centre and the travel sector over the year ahead? Are there any risks to these companies and their sector that investors should be aware of?

The risk is how quickly consumers tighten their belts, particularly domestically. Within Australia, we are seeing indications that it is getting tighter. While travel is strong at this point, people tend to book their travel between six and 12 months ahead. Forward booking is going to look a bit harder. Businesses have talked to that for the next six months.

Qantas is actually very different in terms of their drivers. More travellers coming through may not actually benefit them due to ticket prices coming off and international capacity coming back.

Qantas has had a fantastic run. It’s just not sustainable to have sky-high ticket prices internationally. With competition coming in and the government having to step back, it certainly should drive a more reasonable price outlook.

Qantas is also at a point where they need to spend a lot of capital. They have to refresh their fleet and that is going to be billions of dollars in the next few years. It will also need to increase its operating expenditure to restore some of the reputational damage it has had over the last couple of years. It is going to get harder for them.

What could the controversy over the Australian government's support of Qantas mean for competitors like Virgin?

From 1 to 5 where one is cheap and five is expensive, how much value are you seeing on the ASX right now? Are you excited or are you cautious about the market in general?

I think the market is reasonably valued, but the value varies significantly from sector to sector. If we look at the best-performing sector, technology, they look incredibly expensive. There are amazing winners and companies, but relatively technology is sitting at around 4-5.

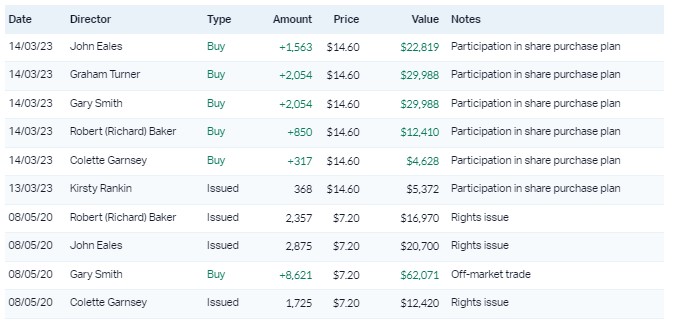

The 10 most recent director trades for Qantas

The 10 most recent director trades for Flight Centre

3 topics

3 stocks mentioned

1 contributor mentioned