Trending On Livewire: Weekend Edition - Saturday 1st March

Reporting season has just wrapped up, with the bulk of ASX-listed companies giving investors a glimpse of how they're travelling. The ASX 200 has given up almost all the gains from a strong start and is effectively back to where we started the year. The pressure is coming from all angles as the euphoria from the US election fades, rate cut expectations are being tempered, and investors receive a reality check on valuations.

The ASX 200 Banks Index (XBK) is a good place to start, as it shed close to 4% for the month. Clearly, when the biggest sector is in the red, it is hard for the market to move higher. Beneath the surface, there have been some wild moves with small misses from high-flyers causing professional investors to seek haven in some of the unloved parts of the market. But it hasn't been top-line growth causing most of the issues. Rather, persistent cost inflation has hampered companies’ ability to grow earnings. Perhaps this is a telling sign for rate cuts, but keep in mind that these are last year's numbers.

It hasn't been all bad news, as more than a handful of stocks, including Domain Group, PointsBet and Mayne Pharma, received offers from cashed-up bidders. The weak Aussie dollar appears to be waving the 'sale' sign on the ASX shopfront.

FNArena's comprehensive Reporting Season Monitor (link below) shows that beats (33.3%) marginally outstripped misses (31.2%) while the broking community issued more ratings downgrades than upgrades. If you want to get a quick download on your top holdings or some potential new ideas to research, the FNArena Monitor is a cracking resource.

James Marlay, Co-Founder, Livewire Markets

Steve Johnson: Two small caps on a run and the uncovered gems that could be next

The allure of small-cap investing is undeniable. The chance to find an overlooked gem that can skyrocket is real, but the risks are just as high. Illiquidity, limited analyst coverage, and varying investor strategies create opportunities—but also traps. Success stories like Pro Medicus and Netwealth prove the potential, yet the volatility can be brutal.

Steve Johnson, CIO at Forager Funds, knows this world well. In the latest episode of The Rules of Investing, he shares his journey from investment newsletters to funds management and reveals the small caps he's backing for future growth.

FNArena reporting season monitor: February 2025 - Week 4 (324 stocks covered)

Welcome to the fourth weekly report for the February 2025 results season. The FNArena Reporting Season Monitor reports ratings, consensus price target changes, and brief summaries of the collective responses from FNArena's database of brokers for each of the stocks covered. The latest update is now available for download, with coverage of the 324 stocks that have reported results in February. You can access the full PDF in the attachment at the bottom of this wire. Readers should be aware that it doesn't matter what profit or loss has resulted from a company. What's important is how the stock fared against consensus forecasts – whether management delivered a "miss" or a "beat".

Top 3 Wires this Week

Here are the weeks top viewed or liked wires by our subscribers:

Our Experts

Some of the best wires from our Contributors this week

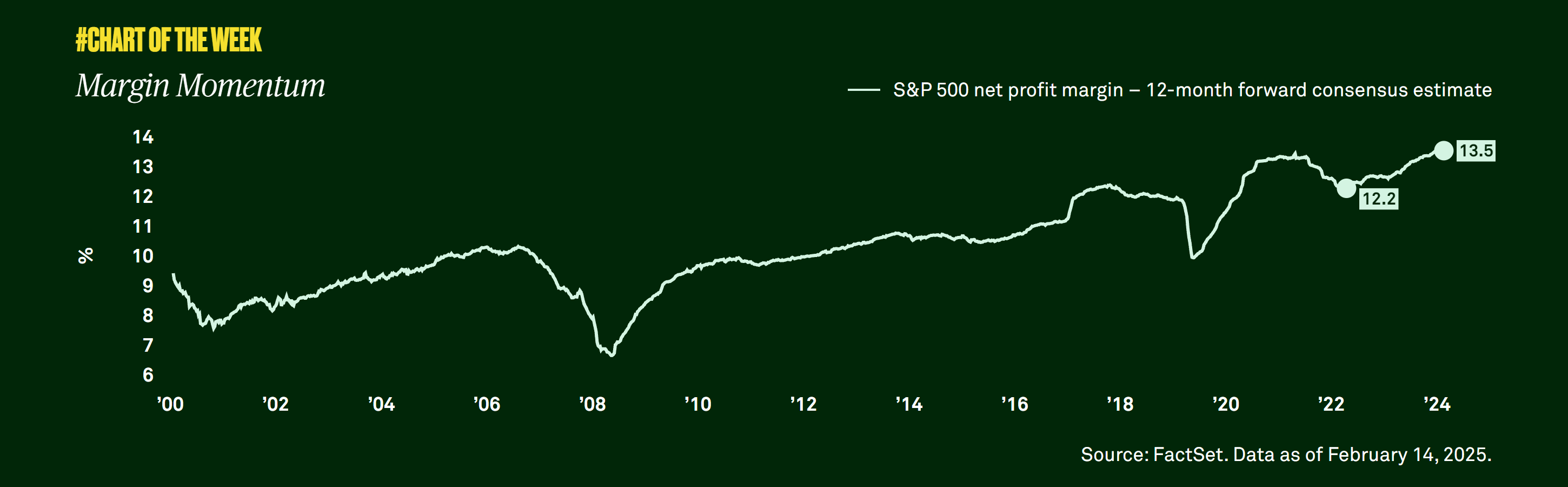

Chart of the Week: BNY Improving margins to support US stock prices

This week's chart of the week comes from The Bank of New York Mellon (BNY), showing that though volatility looks to be on the rise, improving profit margins and earnings support the bank's constructive outlook. As per BNY:

Profit margins continue to climb, and are expected to reach all-time highs over the next 12 months. Because they indicate how much profit a company earns for every dollar of revenue it generates, margins directly impact earnings, which for S&P 500 companies are expected to grow a noteworthy 12.3% this year compared to a still impressive 9.7% in 2024.

Although we expect equity market volatility to persist as new policies roll out and investors monitor fresh inflation and consumer spending data, we remain optimistic given that market fundamentals remain intact, reinforcing our constructive outlook for U.S. equities.

Chris Conway, Managing Editor, Livewire Markets

Weekly Poll

Recent data suggests investors see market-cap-weighted ETFs as risky due to their increasing concentration. For example, tech now makes up 30% of the S&P 500, while banks and miners account for over 50% of the ASX. Do you agree?

a) Yes – I’m exploring alternatives like equal-weighted and factor-based ETFs.

b) No – The index is doing its job by allocating more to the best-performing stocks.

c) Neutral – I see pros and cons to both approaches.

LAST WEEKS POLL RESULTS

We asked "What have you made of reporting season so far and how is your portfolio faring?"

The poll shows 69% see mixed results, 20% report heavy losses, 7% have had strong gains, and 5% say it’s too early to tell.

How do you rate this Weekend's Trending On Livewire?

After selecting, you'll have the option to provide more detailed feedback in our quick survey.

Get the Weekend Edition straight to your inbox

Popular and exclusive content from the week sent every Saturday morning

SUBSCRIBE TO TRENDING ON LIVEWIRE - IT'S FREE

Other Newsletters across our network

- Trending on Livewire Daily: Get the best of Livewire by signing up to our popular daily newsletter

- Market Wraps: Concise market recaps of the ASX's most critical events 2x daily

- Weekly Wrap: A summary of market highlights from the week, sent each weekend

2 contributors mentioned