Trending On Livewire: Weekend Edition - Saturday 2nd November

Since mid-April this year, the Aussie market has been on a@ steady grind higher. The index moved from around 7600 up to a recent high near 8400 in a fairly linear fashion. The last two weeks, however, have seen selloffs and there have been a few signs of cracks in the façade.

First and foremost, the VIX index in the US has spiked from a low around 18 in mid-October, up to 22. The inflation print in Australia this week, whilst moving in the right direction, all but guarantees we won’t see a rate cut this year.

Meanwhile, inflation in Europe this week unexpectedly rose, highlighting the decoupling of the global economy and subsequent central bank policy. On the US earnings front, the market hasn’t been particularly impressed with big tech earnings so far, with RBC labelling the whole season to this point as "mildly disappointing". This is to say nothing of the US election next week, which continues to be a meaningful overhang on risk sentiment. And while markets don’t typically care who sits in the White House, they will care if there is an inconclusive and protracted election process.

There’s always a lot to play for in markets, but it feels like we’re approaching the inflexion point for a couple of major factors that could determine whether the party continues, and we get the fabled Santa Claus rally into the end of the year, or we end 2024 with a whimper. A certain election outcome with a clear result will go a long way to ensuring the bull run continues.

Chris Conway, Managing Editor, Livewire Markets

Worried about a downturn? Here are 7 ASX companies with resilient earnings

Whether you’ve been watching earnings downgrades or feeling the pinch at the checkout, we’re facing a tougher environment. Data from the RBA showed that GDP grew 0.2% in the June quarter – and only 1% across 2023. Ignoring COVID, that’s the slowest growth since the early 1990s. Meanwhile, Franklin Templeton's Pulse Survey for October revealed that two of the top four concerns of CIOs are disappointing earnings and a recession. The time has potentially come to bolster portfolios with companies that have resilient earnings. To help uncover such companies, we pulled a list of ASX names that have exhibited earnings resilience and put the results to IML’s Daniel Moore, Merlon Capital’s Julian McCormack.

Ben Griffiths: The one thing that needs to happen to confirm a new major bull market

.jpg)

Top 3 Wires this Week

Our Experts

Some of the best wires from our Contributors this week:

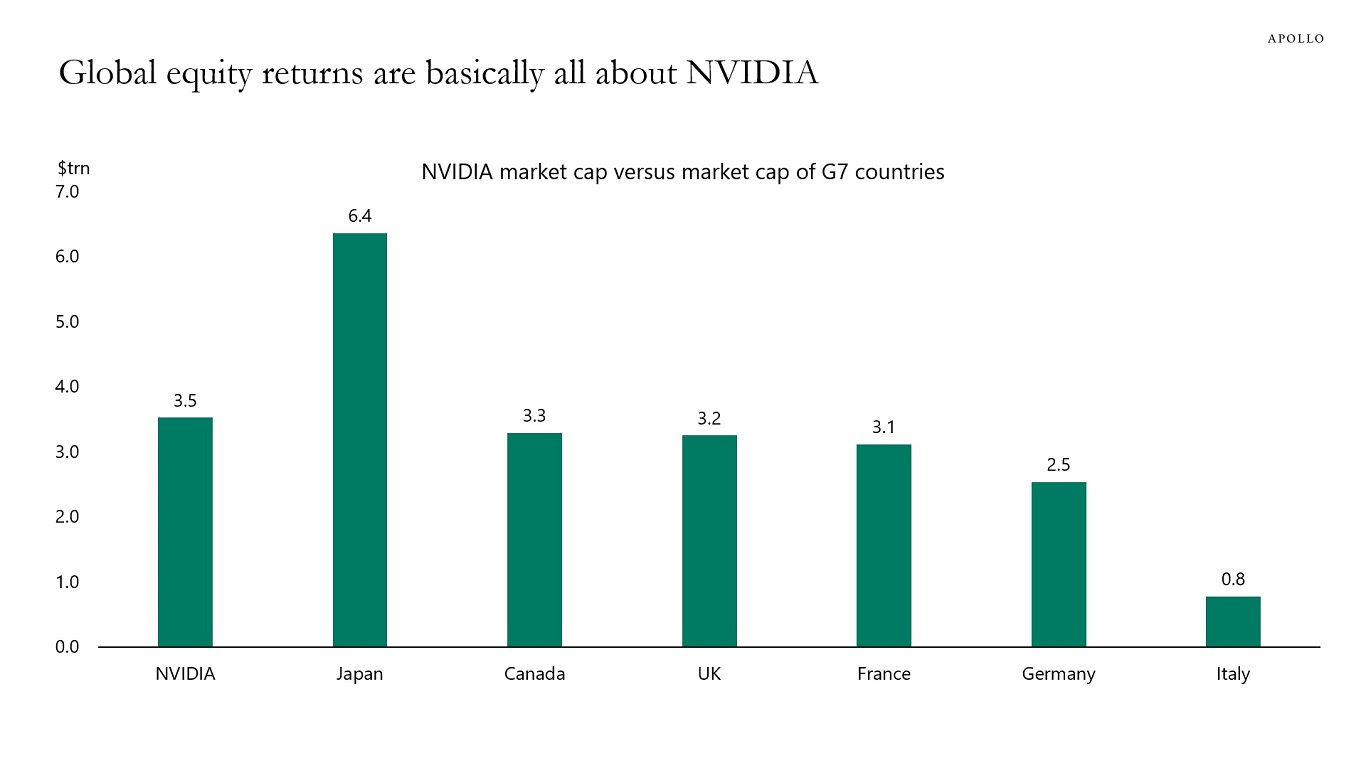

Global equity returns are basically all about NVIDIA

Weekly Poll

Gold prices and Australian gold miners were the subject of this wire during the week - until a sharp reversal Thursday night saw the precious metal plunge nearly US$50 per ounce in US trading.

While gold prices are still up 33% year-to-date, do you think the rally is coming to an end?

a) Yes, this is as good as it gets with all positive factors priced in

b) No, there is plenty more to come for gold bulls, particularly given macro/election uncertainty

c) Too early to tell at this stage. More evidence is required

LAST WEEKS POLL RESULTS

We asked "How do you feel about investing in founder led stocks?"

The poll results show that 72% find founder-led stocks appealing despite the risks, while 22% are unconvinced of their returns, and a small minority are unaware or avoid them due to risks.

How do you rate this Weekend's Trending On Livewire?

After selecting, you'll have the option to provide more detailed feedback in our quick survey.

Get the Weekend Edition straight to your inbox

Popular and exclusive content from the week sent every Saturday morning

SUBSCRIBE TO TRENDING ON LIVEWIRE - IT'S FREE

Other Newsletters across our network

- Trending on Livewire Daily: Get the best of Livewire by signing up to our popular daily newsletter

- Market Wraps: Concise market recaps of the ASX's most critical events 2x daily

- Weekly Wrap: A summary of market highlights from the week, sent each weekend

4 topics

2 contributors mentioned