Trending On Livewire: Weekend Edition - Saturday 7th Sept

As the reporting season fades away into the distance like a Grecian yacht, the market’s attention returns to the macro. Weak US manufacturing data from earlier in the week and the US jobs report are both weighing on sentiment.

The ASX 200’s 2% fall earlier this week was attributed to the earlier data point and BCA Research says that a US recession is now locked in for Q4 2024. We’ll see about that. Stock-by-stock, Mineral Resources (ASX: MIN) and Woodside (ASX: WDS) shares slumped while Star Entertainment Group shares were actually suspended for not releasing its results on time. But it’s all okay because CBA (ASX: CBA) hit another record high, leaving bank analysts scratching their heads. Again.

Hans Lee, Senior Editor, Livewire Markets

Buy Hold Sell: 3 stocks that have been smashed (and 2 big buys)

If you feel like your portfolio has taken a hit over the last month, spare a thought for shareholders in stocks like Johns Lyng Group (ASX: JLG), Audinate (ASX: AD8), Tabcorp (ASX: TAH), Megaport (ASX: MP1), and A2 Milk (ASX: A2M). All in all, 117 companies in the All Ords shed more than 10% during the month, 29 saw their share prices fall more than 20%, and eight tumbled more than 30%.

So, in this episode, host Matthew Kidman from Centennial Asset Management was joined by First Sentier Investors' David Wilson and Medallion Financial's Michael Wayne for their analysis of three stocks that have recently been smashed. Plus, they also name two stocks with serious upside potential.

Signal or Noise: The 4 investments to buy in the next pullback

The overwhelming consensus we are hearing from our guests is that August 5th was not a scare but a gift for patient investors. But just because there has not been more downside to this story hitherto does not mean there aren't lessons to glean from this experience. In this episode of Signal or Noise, we are looking at these lessons with the help of three experienced investors: T. Rowe Price's Thomas Poullaouec, Schroders Australias' Kellie Wood, and Magellan's Arvid Streimann. Tune in to also hear about how these investors handled the spike - and what they would love to buy in the next volatility bout.

Rules of Investing: Australia has all the ingredients to become a superpower in this space

Despite the rising cost of living and surging house prices, Australia really is the lucky country. Our economy has enjoyed an unprecedented run of growth, we’re highly educated, we’re resource-rich, and we have opportunities – one of which lies in energy creation. As Darren Brown, Co-Managing Director, Renewables Australia at Octopus Investments tells it, there is “a really unique opportunity for Australia to become a superpower in renewable energy”.

Livewire’s Chris Conway sat down with Brown to understand the transformative changes taking place in the energy sector, the strategic initiatives underway, and the opportunities for investors.

Top 3 Wires this Week

.png)

Our Experts

Some of the best wires from our Contributors this week.

.png)

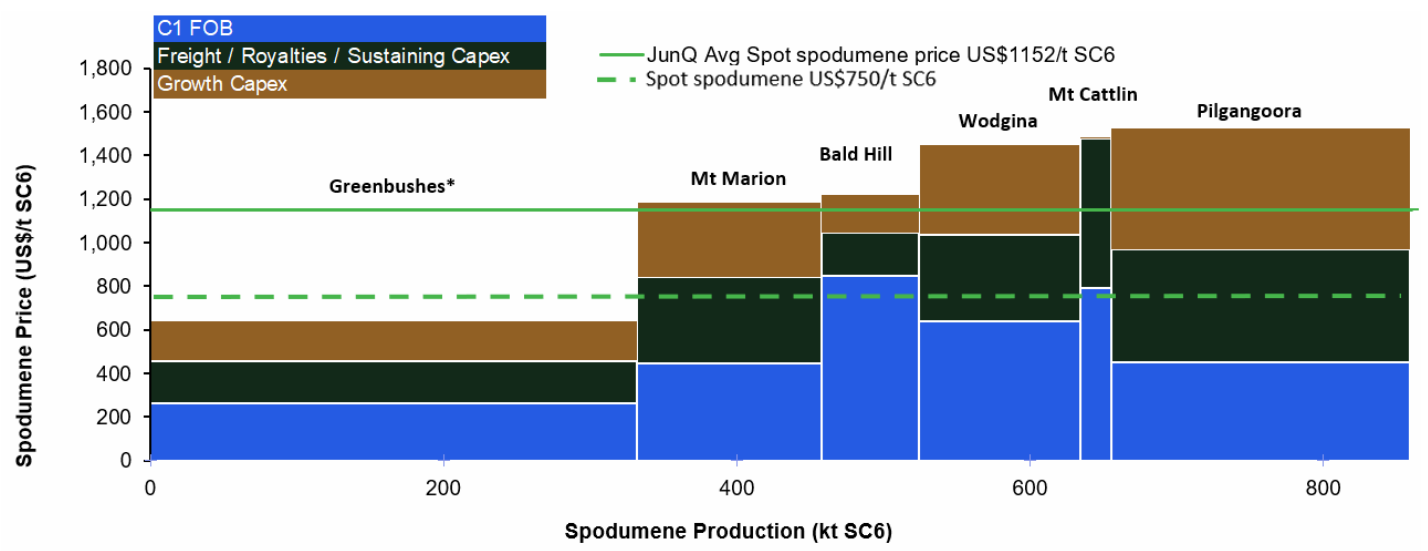

Carl’s Chart of the Week: Real production costs at ASX lithium miners will shock you: Just one mine is profitable

The prices of most lithium minerals are down nearly 90% since 2022, as a glut of supply has hit the market at the same time demand growth from the EV industry has slowed.

Many analysts have been trying to calculate the point at which lithium minerals producers respond to prevailing lower prices by reducing their supply, and therefore potentially rebalancing the market and prices.

The figure above, equates to Citi’s best estimate for AISCs across the major Australian lithium producers. The broker notes that after accounting for growth capex, its coverage is “break-even to loss-making on spot spodumene of US$740-780/t”.

Carl Capolingua, Livewire Markets

Weekly Poll

One of the longest-standing copper bulls, Goldman Sachs, has cut its 2025 price target by a third. Copper prices have fallen 20% from their peak, joining its compatriots nickel, lithium, and iron ore.

What is your sentiment towards Copper over the next 12 months?

- Bullish

- Bearish

- Neutral

Last Weeks Poll results

We asked "How has your portfolio performed during this reporting season?"

The recent ASX reporting season has produced mixed results for investors, with 61% experiencing a balanced portfolio performance and 34% reporting good to excellent outcomes. Only 17% found their results disappointing, and notably, no respondents reported terrible performance.

This distribution suggests a resilient yet unpredictable market, characterised by sector-specific variations and opportunities. The overall sentiment appears cautiously optimistic, highlighting the importance of careful stock selection and portfolio diversification in navigating the current economic landscape.

Meme of the Week

We'd love your feedback

How would you rate this Weekend's Trending On Livewire overall? Choose an emoji to share your thoughts:

😡 😞 😐 🙂 😀

After selecting, you'll have the option to provide more detailed feedback in our quick survey.

Get the Weekend Edition straight to your inbox

Popular and exclusive content from the week sent every Saturday morning

SUBSCRIBE TO TRENDING ON LIVEWIRE - IT'S FREE

Other Newsletters across our network

- Trending on Livewire Daily: Get the best of Livewire by signing up to our popular daily newsletter

- Market Wraps: Concise market recaps of the ASX's most critical events 2x daily

- Weekly Wrap: A summary of market highlights from the week, sent each weekend

5 topics

8 stocks mentioned

10 contributors mentioned