Tribeca pushing for change at underperforming Glencore

Tribeca published an investor letter yesterday, pushing for change at global commodities powerhouse, Glencore.

The following wire outlines the four major recommendations from the letter, leaning heavily on its content coupled with commentary stemming from an interview conducted with the author of the letter, Ben Cleary, Portfolio Manager of the Tribeca Global Natural Resources Fund.

The full, 17-page letter can be accessed at the bottom of the wire.

Tribeca's Letter to Glencore's Board of Directors

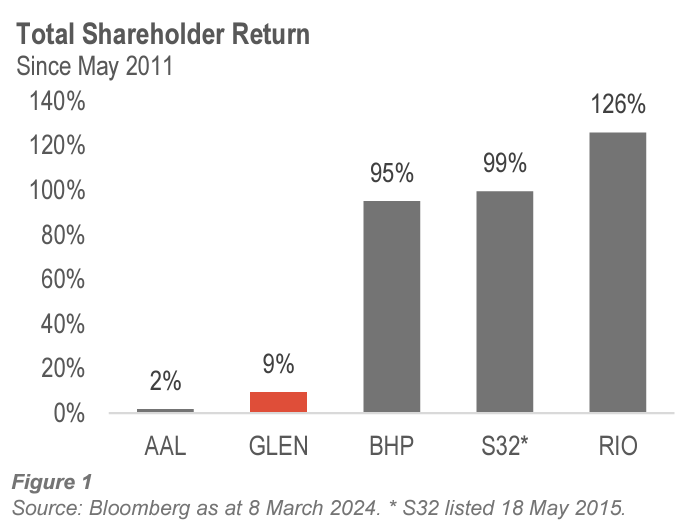

The Tribeca Global Natural Resources Fund has been a long-term shareholder of Glencore plc (hereafter Glencore or the Company). We are invested to gain exposure to the Company’s best-in-class management, world-leading commodity trading business and tier-one coal, copper, and zinc assets. Despite its core asset quality and strong fiscal position, Glencore’s share price has underperformed its peers (see figure 1). We believe that change, as outlined in this letter, can unlock the Company’s intrinsic value.

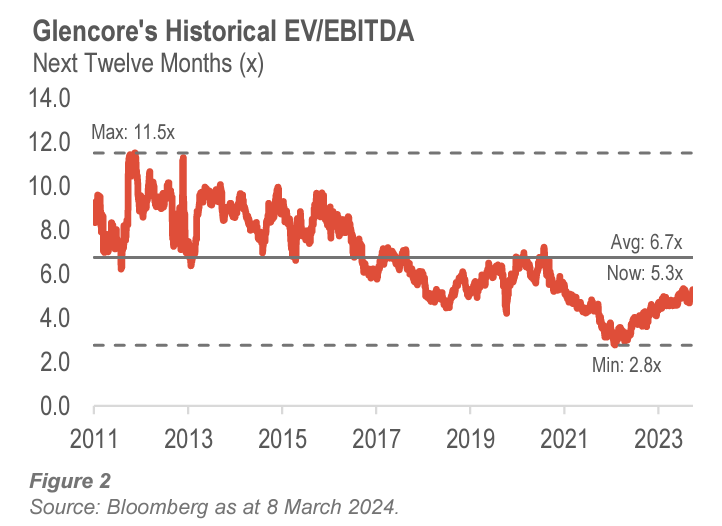

Asset rationalisation, bourse adjustment and the optimisation of capital returns are all suggestions we have made to BHP and Teck Resources. Having largely followed these, BHP subsequently reaffirmed its position as the world’s premier mining company and Teck delivered shareholder returns of 371%. Since listing on the London Stock Exchange (LSE) in May 2011, the total return Glencore has provided to shareholders, including buybacks and dividends, has been 9%. Over the same period, returns delivered by peers such as BHP (+95%), South32 (+99%) and Rio Tinto (+126%) have been multiple times higher. This disparity is a result of continued de-rating (see figure 2) illustrated by the fact that, despite having quadrupled EBITDA, Glencore’s enterprise value has risen by only 15% pursuant to its initial public offering (IPO).

This letter makes four recommendations for Glencore to consider and implement in order to realise the material upside that we present in our valuation.

1. ESG 3.0 IS Here

Retain the combined coal business in accordance with industry leading practices to drive shareholder returns through stable and diversified earnings streams.

Comment from an interview with Cleary:

"Things have changed dramatically in the ESG space in recent years, so much so that BHP, with their Mt Arthur thermal coal mine and decision not to close it, are now being lauded for their responsible stewardship of assets.

Glencore is one of the only companies that didn't bow down to pressure [when ESG reached fever pitch] to sell these assets and were one of the only companies globally that committed to being responsible for these emitting assets and running them off appropriately... and now the debate is now coming to them."

2. London is No Longer the Home of Mining:

Transfer the primary listing to the ASX to attract a structurally higher valuation, long-term net inflows and optionality for potential corporate activity.

Comment from Cleary:

"Mining is just far bigger and more relevant in Australia"

"With coal, for example, while multiples are probably a bit higher in the US (where Glencore is also considering re-listing) than Australia, on the other hand, metal has a much better multiple in Australia - very few people don't love copper and want more exposure to the electrification of thematic.

Some of these IPOs, recently whether it's Mac or Capstone, they're coming on at higher multiples than Glencore, where a third of the value is in the trading company that should be on much higher multiple."

3. Dividends are King:

Discontinue buybacks and pay an increased, fully franked dividend to attract strong buying from Australian retail and superannuation investors.

Comment from Cleary:

"The taxes that [Glencore] have paid over the last five financial years in Australia, would have been sufficient to frank 100% of their capital returns.

There is still significant [if they listed in Australia] franking potential for them to pay into Australia, depending on the structure - whether its a CDR or a full listing".

4. Trading Business Undervalued:

Divest a minority stake in the trading business to unlock latent value, supercharge capital returns and support upstream investment.

Timeline for recommendations

To wrap up, I asked Cleary about the timeline for these recommendations being implemented. He noted that, as laid out above, they would likely happen chronologically.

Cleary references similar previous campaigns in answering the question, acknowledging that while it took a few years for the recommendations to be fully implemented, "commitments were within the first 12 months". Cleary is even more ambitious with the Glencore campaign, however, and concerning the listing he hopes "to see a commitment within six months of sending the letter".

At the very least, Cleary is confident that there will be an advisor appointed to review the merits of listing in either Australia or the US.

If the value release and share price upside Cleary envisages can become a reality, one would imagine that Glencore shareholders will hope that the wheels start turning sooner rather than later.

3 topics

1 contributor mentioned