Tribeca's radical new carbon play (and 6 stocks to see you to 2022)

What's the trick to investing in decarbonisation? Do you go all-in with battery metals? Do you mix in some intangible services like software, IT, and a basket of EVs? Do you make a hesitant commitment to an ESG or clean-energy ETF, and keep a weather eye out for greenwashing?

All of the above? None? Well, whatever your answer, you might well benefit from reading on as Tribeca Global Natural Resources (ASX:TGF) may have an answer.

At a recent investor update, cohosted by CIO and portfolio manager, Ben Cleary, and Head of Research, Todd Warren, the company laid out what they believe is not only a compelling decarbonisation strategy but also “one of the most exciting investment opportunities we have seen in some years.”

They also talked through six of their highest conviction positions to the end of the year.

In this wire, I’ll provide details on both and summarise Tribeca’s take on their recent performance and near-term outlook.

One of the most exciting investment opportunities we have seen in some years.

What is Tribeca’s decarbonisation strategy? It involves key metals – it has to. It involves good timing, with catalysts imminent, which helps. It involves careful selection of the highest quality projects and certification from peak bodies. Sounds good. It also involves exponential demand.

Which sounds very appealing indeed.

Mostly though it involves carbon credits - or as Tribeca put it: A “high quality diversified portfolio of carbon credits which we believe offers asymmetric return potential as the market evolves and demand for carbon credits increases exponentially.”

“The increasing emission of carbon has led to increasing demand to offset the emissions,” Warren said . “As we move to 2050 and the net-zero target, players like Goldman Sachs who have estimated we’re going to see some 175 times the need for carbon credits."

"The natural pointy end to this ... is the fact the Resources sector will be needed for decarbonisation: you can’t decarbonise without key metals like copper, lithium, uranium, rare earths, and nickel. And you don’t just need corporates you also need governments to step in and buy carbon credits.”

Hang on - What is a carbon credit and how does it work?

As Tribeca explained in their update, a carbon credit is a tradeable unit representing the reduction or removal of one tonne of carbon dioxide equivalent from the atmosphere. The credits enable business, government, or an individual to pay someone else to cut or remove a given quantity of greenhouse gases from the atmosphere.

They can be taken in the form of projects such as developing countries that reduce deforestation for firewood to financing wind turbines to displace fossil fuels.

It can also come as credit for restoring or preserving forest that takes in carbon from the atmosphere. When an individual or company offset their emissions the equivalent volume of credits is retired from the market. Companies celebrities cities countries and organizations have all made commitments to curb if not eliminate their contributions to climate change by buying carbon offsets.

Tribeca's carbon credit thesis settled around these four key points

- Commodities such as copper, lithium, uranium, rare earths, and nickel are key beneficiaries of decarbonization

- Carbon credits as a compelling emerging asset class which, as above, will grow 175x over coming decades according to Goldman Sachs estimates with the world’s largest companies AAPL and MSFT announcing quite considerable carbon credit plans

- There are ways to buy into the theme with diversified, nature-based and renewable energy projects developed by blue-chip groups such as Wildlife Works and verified by the leading certification body, VERA

- There are upcoming key catalysts such as the UN Climate Change Conference COP26 which will focus on the need the more investment into carbon projects; and the Singapore carbon Exchange Climate Impact X) will starts in the coming weeks boosting trading volumes and market access.

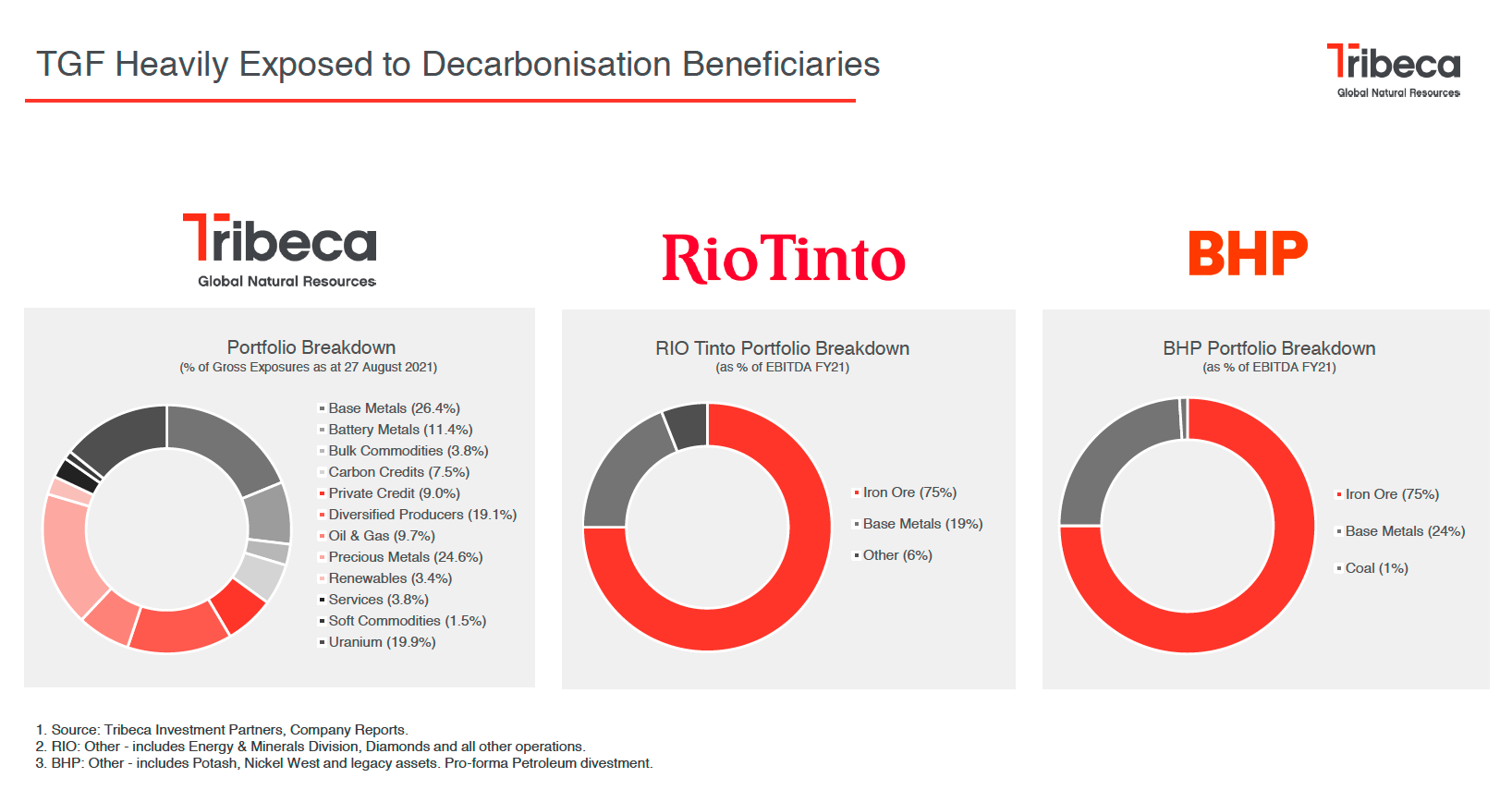

Some extra context: BHP, RIO and Tribeca

Tribeca recently exited the BHP dual-listed spread trade after BHP recently announced its intention to collapse the London listing, exiting with 16% profit on the position, and sees itself as having much better exposure to decarbonisation beneficiaries (see below) than Rio and BHP, both of which are much more heavily skewed to iron ore (see chart below).

- Base Metals (26.4%)

- Battery Metals (11.4%)

- Bulk Commodities (3.8%)

- Carbon Credits (7.5%)

- Private Credit (9.0%)

- Diversified Producers (19.1%)

- Oil & Gas (9.7%)

- Precious Metals (24.6%)

- Renewables (3.4%)

- Services (3.8%)

- Soft Commodities (1.5%) Uranium (19.9%)

(Source: Company presentation)

So how did we get here? What’s changed?

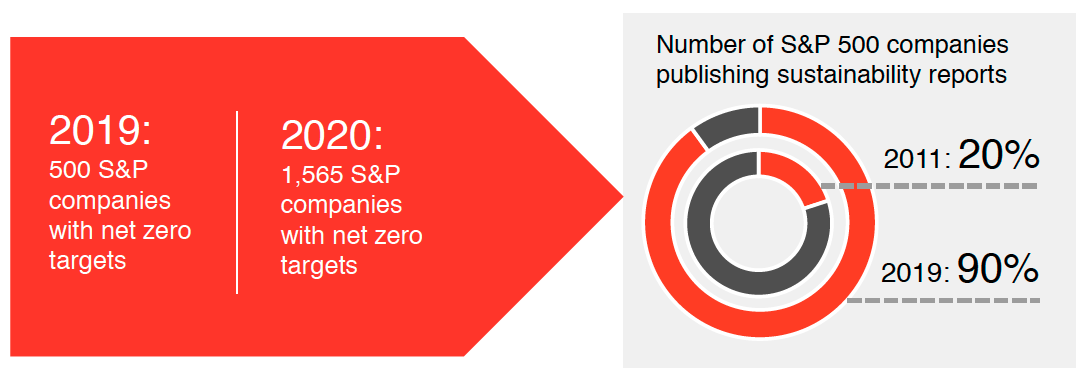

Key to Tribeca’s analysis is the recognition that much has changed in the past ten years, and, indeed, the past two years.

It’s not just that over 1500 companies have announced plans to be net-zero by 2050, but that carbon credits are anticipated to be integral to meet these targets especially in hard-to-abate sectors such as oil, aviation, steel, and cement. Additionally:

- The Net Zero Asset Managers initiative, which includes Blackrock, Vanguard, and 126 others, managing $43 trillion of assets, is targeting net-zero emission across their holdings by 2050

- Climate change is the #1 ESG issue for asset managers in the US

- Climate-related disclosures will encourage the purchase of carbon credits for those emissions that cannot yet be eliminated so companies can avoid reputational risk

- In 2019, only 500 S&P companies had net-zero targets. By 2020 it was 1565.

(Source: Company presentation)

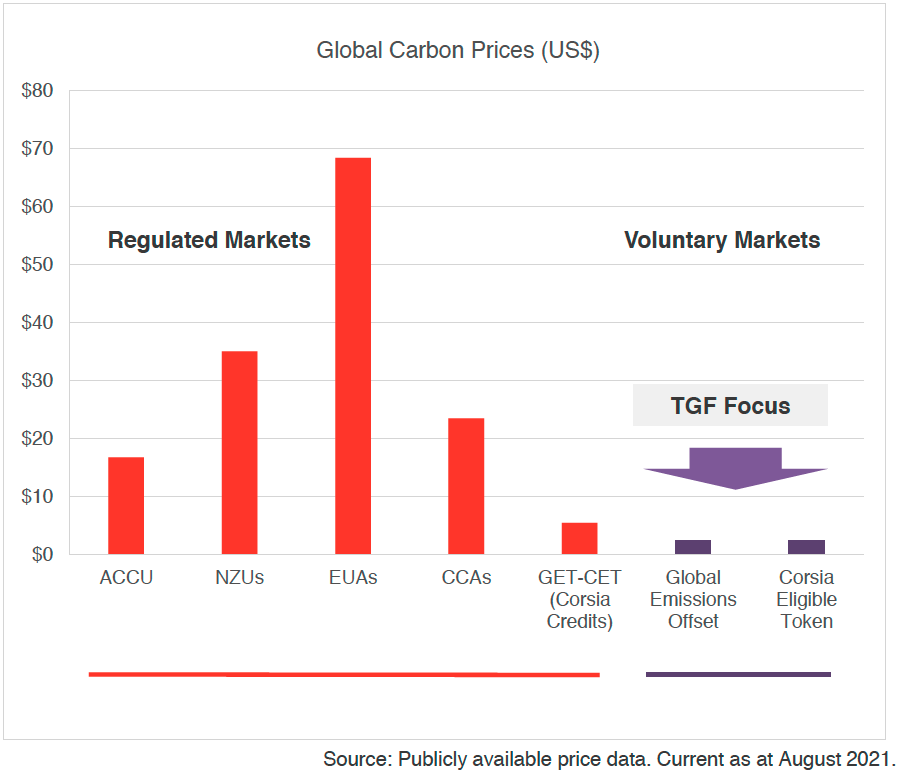

At the heart of the opportunity: carbon pricing

"Carbon pricing is set to rise to an estimated $100 a tonne by 2030. Existing prices are a fraction of that. This presents a considerable opportunity," Warren told investors.

"Indeed the price disparity depends on whether you’re looking at regulated or voluntary markets.

"The massive growth in regulated carbon prices and the underlying growth in demand for carbon offsets are yet to be reflected in internationally traded credits. This provides an opportunity for investors as all markets rise and prices begin to converge."

On the chart below, on the left, in regulated markets the prices vary and are not fungible. The opportunity, Warren explained, is in the voluntary market.

“Why? As you can see the pricing is much lower. It’s more difficult to get, as most of these are off-market, so liquidity can be difficult to get if you don’t know where to access these offsets.

"But it’s also where, because of the pricing today, you see the most upside and why we are so excited about this nascent angle here."

Six high conviction positions across three key investment themes

Ben Cleary also took investors through six portfolio positions Tribeca had added to during the recent pullback in the natural resources sector, all of which he said fit into three key investment themes:

- Green policy-driven demand

- Infrastructure and fiscal stimulus

- Money supply and inflation

(The quotes below have been edited for clarity)

#1 Teck Resources (TECK:NYSE)

"A mainstay for two years, the stock has almost tripled over 18 months but we feel it has 100% upside ... it has the best copper production growth of the major diversified mining companies And it's able to fund copper production by incredible high steelmaking coal prices at $200 plus a tonne, with generating significant cashflow funding its base-metal production growth."

#2 Glencore (GLEN:LON)

Cleary said Glencore is a business with some of the best battery metal mines globally and the number one producer of cobalt - and some of the best copper growth along with Teck. It’s funding green metal production with its energy coal business benefiting from much higher prices.

#3 Chalco (92500:HK)

"A stock we were buying last year, close to $2 now close to $6. We think it has a lot further to go." Cleary said Chalco, one of the largest aluminium producers in China, as

"One of the best-managed businesses we’ve met over the past 20 years (with) a very good track record of dividend-paying. We do feel it is a stock that can double from current levels. given the tightness of the aluminum markets and the quality of these assets."

#4 Neo Performance (NEO:CA)

Neo Performance is a Canadian-listed company Tribeca added recently after a strong result. The business is strategic in nature. It's the only rare earth-processing and magnetic material business in the northern hemisphere. Cleary argued it would be a major beneficiary for demand in:

- LED lighting

- Medical imaging

- Hybrids and electricals.

Bottom line? As Cleary put it succintly: It's a sub $1 billion dollar business with $100m profit, and $60M in cash.

#5 Energy Fuels (UUUU:US)

The largest capacity Vanadium and Uranium producer in the US, with $80million in cash. “The uranium potential of this business alone justifies its market cap, let alone vanadium and rare earths upside," Cleary said

#6 DDH1 (DDH:AU)

The company with the largest drilling fleet in Australia with aligned management with significant share ownership. Also a track record of strong returns through the cycle, and "tremendous leverage to one of the big themes: increased cost of services across the sector." Also, the company has no debt and a very strong outlook. "We see the company doubling over the next 12 months."

Conclusion

After a good reporting season where the “vast majority of the portfolio emerged with strong earnings, increasing dividends and strong outlook and results”, and where the pullback in the resources sector was viewed as a buying opportunity, the real news for Tribeca was the unearthing of a new carbon credit play, discussed above.

They’re backing it to deliver long-term “asymmetric return potential as the market evolves and demand for carbon credits increases exponentially.”

The Tribeca team are willing to back their views with a recent ASX lodgement showing Cleary has purchased an additional 19,999 TGF shares for a consideration of $47,970.01

“We do think there's going to be a very strong finish to the year which is why we've been buying stock in the company and increasing our own exposure ourselves.”

Access the full presentation

A copy of the slides is attached and a video of the presentation is available here.

Never miss an insight

Enjoy this wire? Hit the ‘like’ button to let us know. Stay up to date with my content by hitting the ‘follow’ button below and you’ll be notified every time I post a wire. Not already a Livewire member? Sign up today to get free access to investment ideas and strategies from Australia’s leading investors.

2 topics

4 stocks mentioned

Matt Buchanan is a former Head of Content at Livewire Markets. Matt is an avid investor and a big fan of the Livewire community, which he first joined in 2017.

Expertise

Matt Buchanan is a former Head of Content at Livewire Markets. Matt is an avid investor and a big fan of the Livewire community, which he first joined in 2017.