Two Aussie coal plays. One suffered a $271 million loss; the other returned $2.67 billion profit

Commodities companies often walk in general lockstep, as they ride the commodity cycle up and down. If they sell the same stuff, with the same spot prices, the narratives should be broadly aligned.

Sometimes that's the case, but not always.

This can be seen in the results of South32 (ASX: S32) and Whitehaven Coal (ASX: WHC). The former posted a loss of $271 million, while the latter posted a profit of $2.67 billion.

There's a lot more to these results than meets the eye, as underscored by the market response. Both companies sold off. What's even more interesting is that Whitehaven suffered roughly twice the selloff as South32, despite having a far healthier bottom line in FY23.

It just goes to show that there's more to a stock than the bottom line. As you'll learn in this wire, capital management and return on equity are front of mind for investors.

To make sense of it all, I reached out to Emanuel Datt from Datt Capital. He doesn't own either company, but he is bullish on one of them - with one important caveat.

S32 Key Results

- Statutory loss of US$173 million vs profit of US$2.67 billion a year ago

- Revenue of US$9.05 billion vs consensus of US$8.34 billion

- Adjusted EBITDA US$2.53 billion vs consensus of US$2.42 billion

- Final dividend of US$0.032 per share fully franked

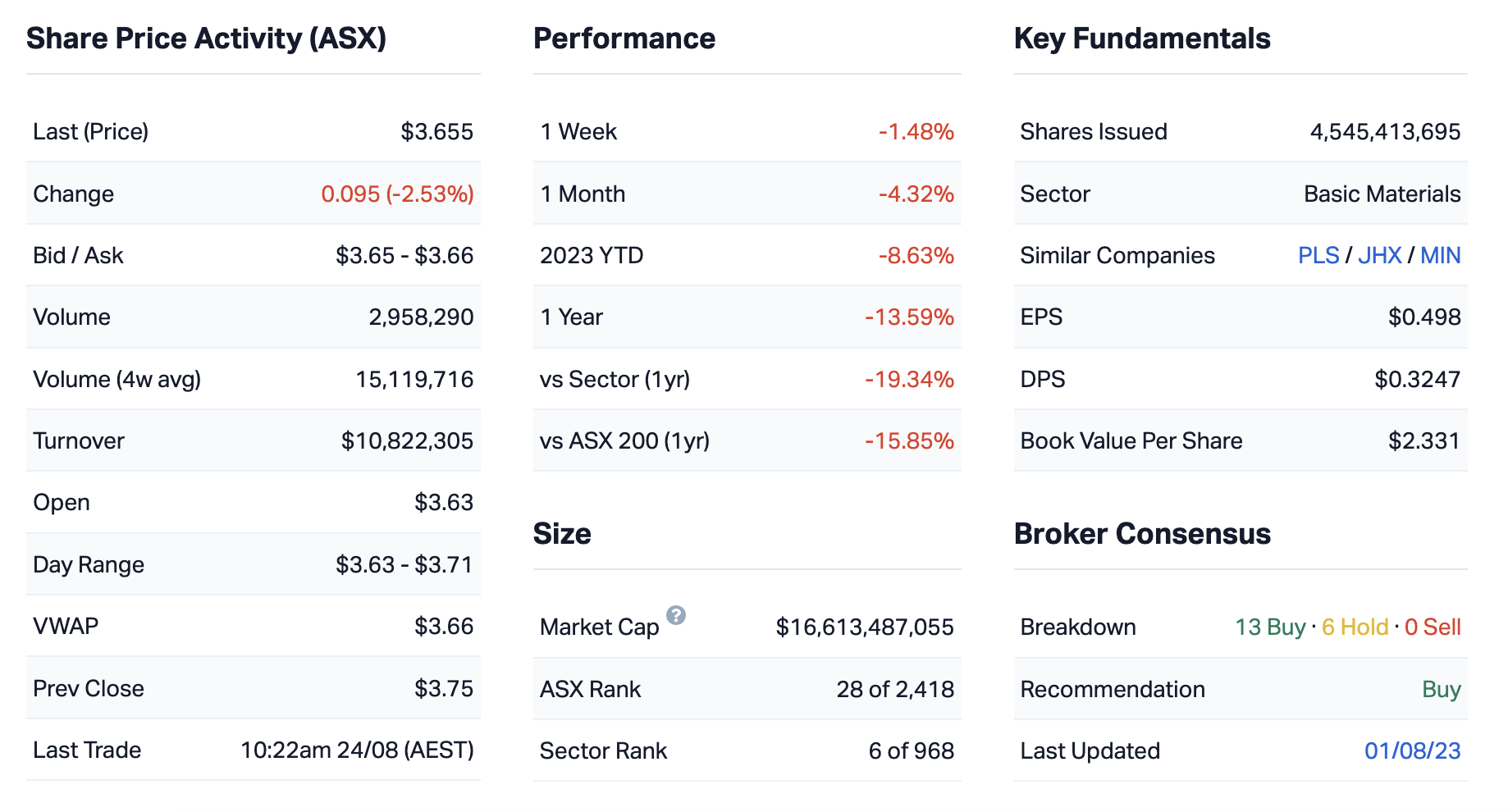

S32 Chart

S32 Key Company Data

Whitehaven Coal Key Results

- Net profit of $2.67 billion (+37%)

- Revenue $6.06 billion vs consensus of $6.09 billion

- Adjusted EBITDA of $3.99 billion vs consensus of $3.98 billion

- Final dividend of 42 cents per share

- $2.65 billion of net cash

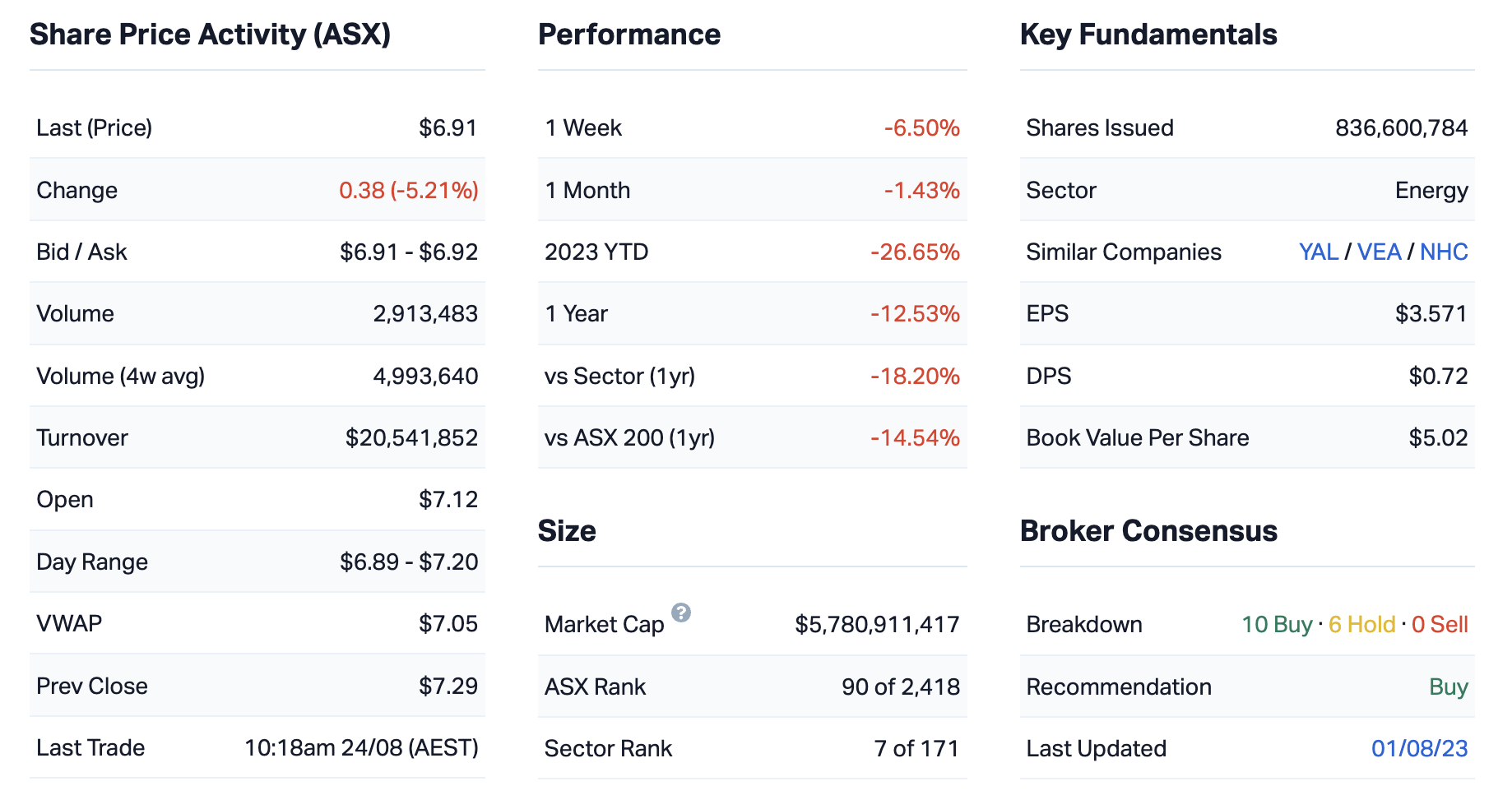

Whitehaven Coal Chart

Whitehaven Coal key Company Data

In one sentence, what was the key takeaway from this result?

For S32, the key takeaway would be poor performance driven by lower commodity prices.

WHC’s performance on the other hand was exceptional. We had NPAT of $2.7 billion, up 37% from the previous corresponding period despite softer volumes overall.

What was the market’s reaction to this result? In your view, was it an overreaction, an under-reaction or appropriate?

S32: Appropriate.

To a degree this result was priced in given there wasn’t a huge move.

WHC: Appropriate.

The market reacted negatively to WHC, it’s down about 6%. I believe that’s because the market was perhaps expecting a greater return of capital (or dividend). They’re holding about $2.6 billion on their balance sheet and half of that could potentially be distributed. There has been a lot of talk about BHP mines for sale, and WHC looks to be a frontrunner for that. Given the conservative dividend, there’s a good probability WHC is successful in buying that asset.

Were there any major surprises in this result that you think investors should be aware of?

S32 took a $1.3 billion impairment for a development asset they had purchased a few years back, called the Hermosa project, and that had always been pitched as a big growth opportunity for the company in the past.

On WHC, we were surprised how much production costs have risen. They’re up about 22% on a per tonne basis. But we also have the potential for coal royalties to increase in the budget that’s being released in September. It’s hard to evaluate.

Would you buy, hold or sell on the back of these results?

S32: HOLD

I would HOLD S32 given these results. I think they’ve obviously cleared decks as much as possibly, given they’ve taken a conservative approach to impairments. But they’ve also returned quite a bit of capital to shareholders – US1.2 billion through dividends and buybacks in FY23. So I think they are disciplined on the capital allocation front, but they also have strong exposure to base metals going forward.

WHC: BUY (contingent)

I would say BUY once we have more certainly around royalty rates. It’s hard to evaluate right before the budget’s released.

What’s your outlook on S32 and its sector over the year ahead? Are there any risks to this company and its sector that investors should be aware of?

The outlook is very much dependent on a commodity price recovery. S32’s main businesses are aluminium, coking coal, nickel and manganese. Those last 3 are highly correlated with steel production. So the outlook very much depends on your view on steel production, and the Chinese housing crash may put some fear in investors.

The outlook on WHC is positive, especially once there’s certainty around the political environment.

From 1-5, where 1 is cheap and 5 is expensive, how much value are you seeing on the ASX right now? Are you excited or are you cautious on the market in general?

Rating: 3

At the smaller end of town there’s good value. But the larger caps are overvalued.

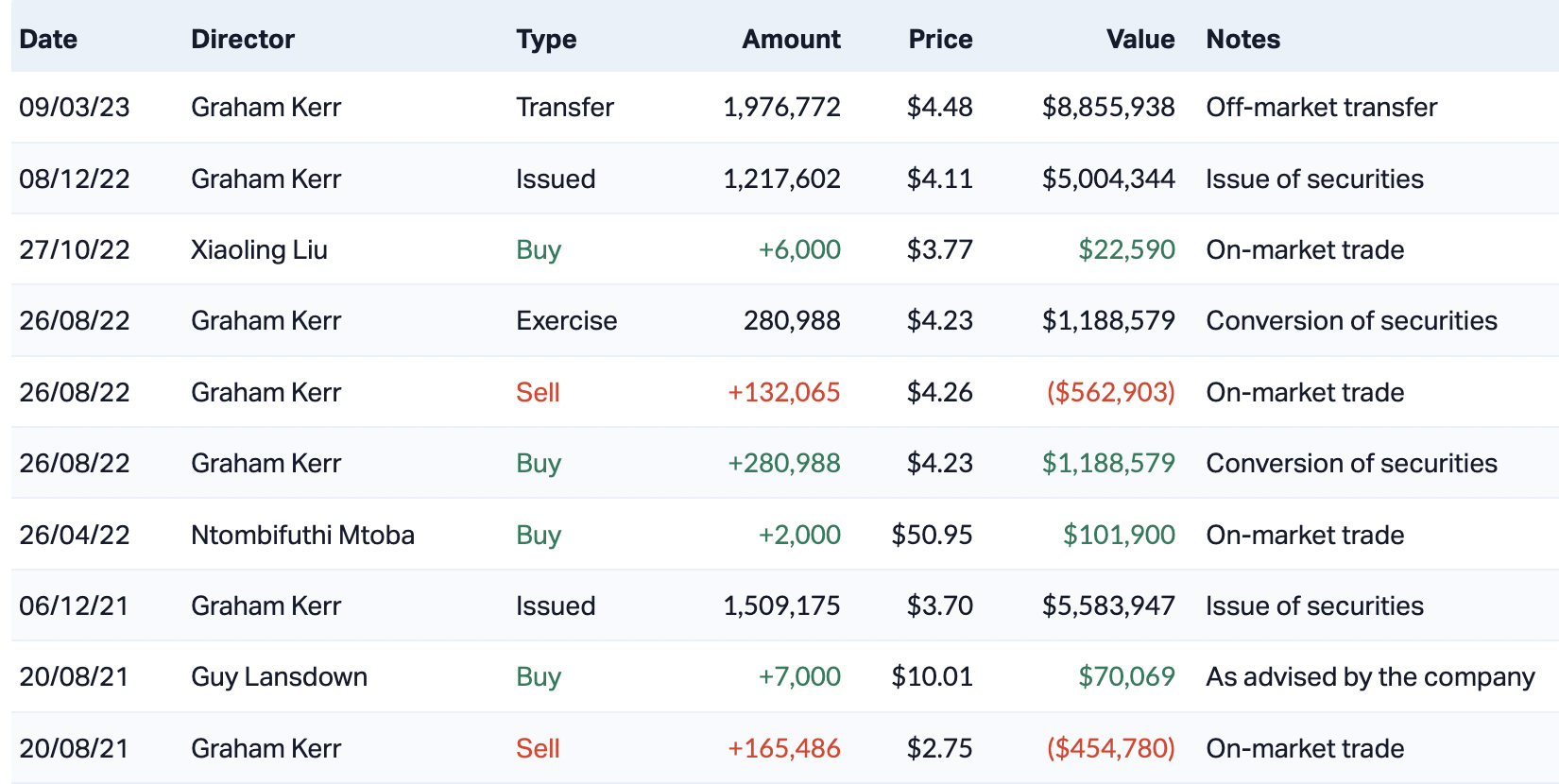

S32's last 10 director transactions

2 topics

2 stocks mentioned

1 contributor mentioned