Two big Aussie themes and 4 stocks on Regal's radar

Livewire Markets

There's definitely a giddy feeling you get when you stumble across your dream investment. Perhaps you've developed a "type" over the years, whether that's companies with a good PE ratio, a strong moat, or maybe you're drawn in by a good founder or an unbelievable growth story?

Regardless of the allure, here's a tip: you must try not to fall in love.

Phil King, CIO and founder of Regal Funds Management, spoke at an investor briefing last week, saying financials have fallen from his good graces in favour of a mining bull run.

Regal is the quintessential stock-picking manager. With performance like 116% return since ASX:RF1 inception in 2019, it's no wonder investors sit up and pay attention to King's next moves.

King believes the much-beloved Aussie financials sector is headed for the doldrums and is dragging down market performance.

As a precursor to his sage advice, King and the team at Regal provided key insights into the fund's positioning, including where the next opportunities lie and what headwinds will buffet the Aussie market.

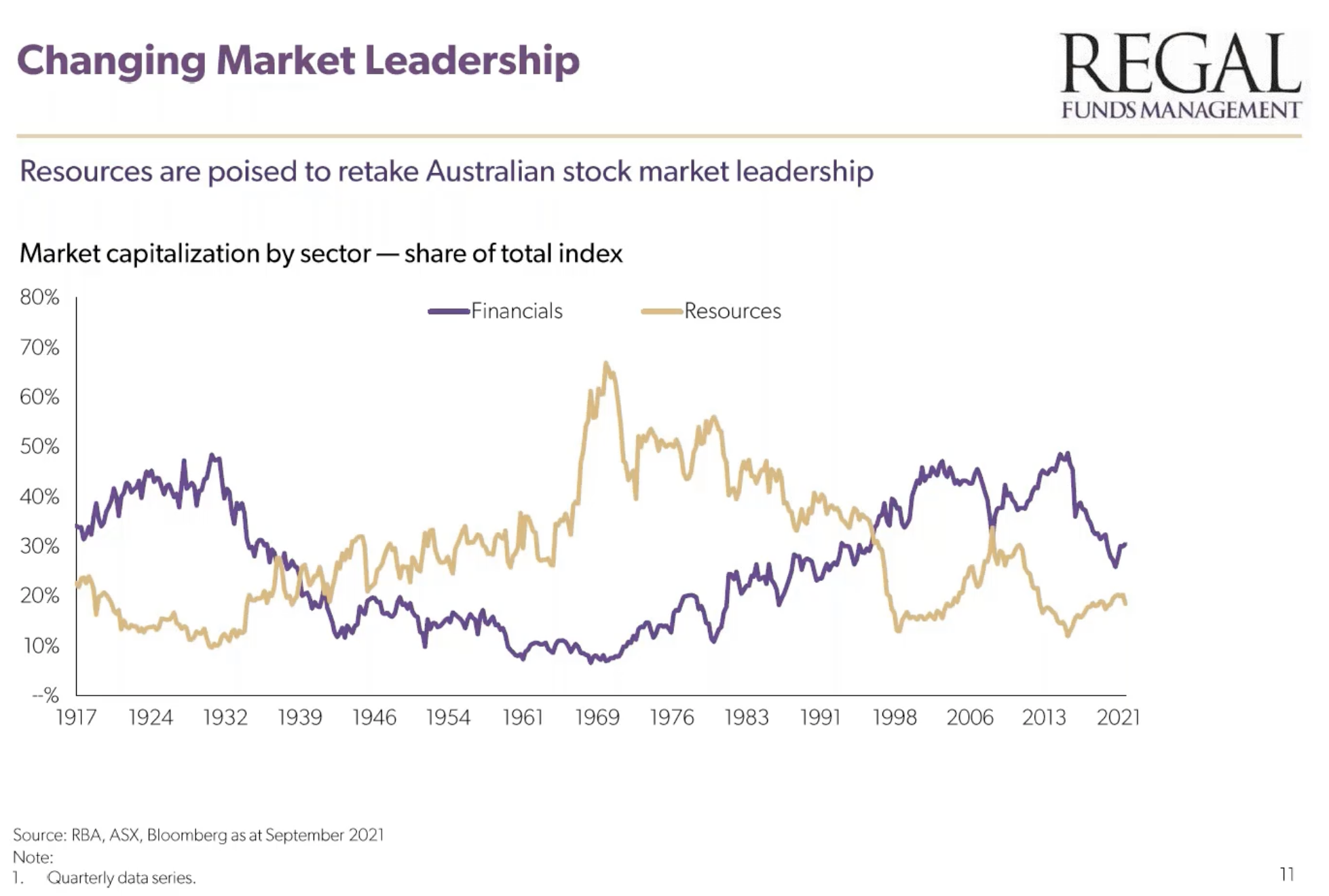

"One of the reasons we think the Australian stock market has underperformed global indices, over the last 10 years is just the dominance of the financial sector. At times, it's been over half our Australian stock market," King said.

Source: Regal Investment Management.

"This is in contrast to overseas markets where financials represent a much smaller proportion of the broader market, and where faster-growing sectors like technology, are much more important.

With banks deviating from their traditional roles as the custodian of cash, King said "the financial sector will shrink".

Instead, Regal is backing these two major themes:

- Mining bull market taking off

- Green metals, especially batteries

#1 Iron ore price collapse won't take the shine off Aussie resources sector: Phil King

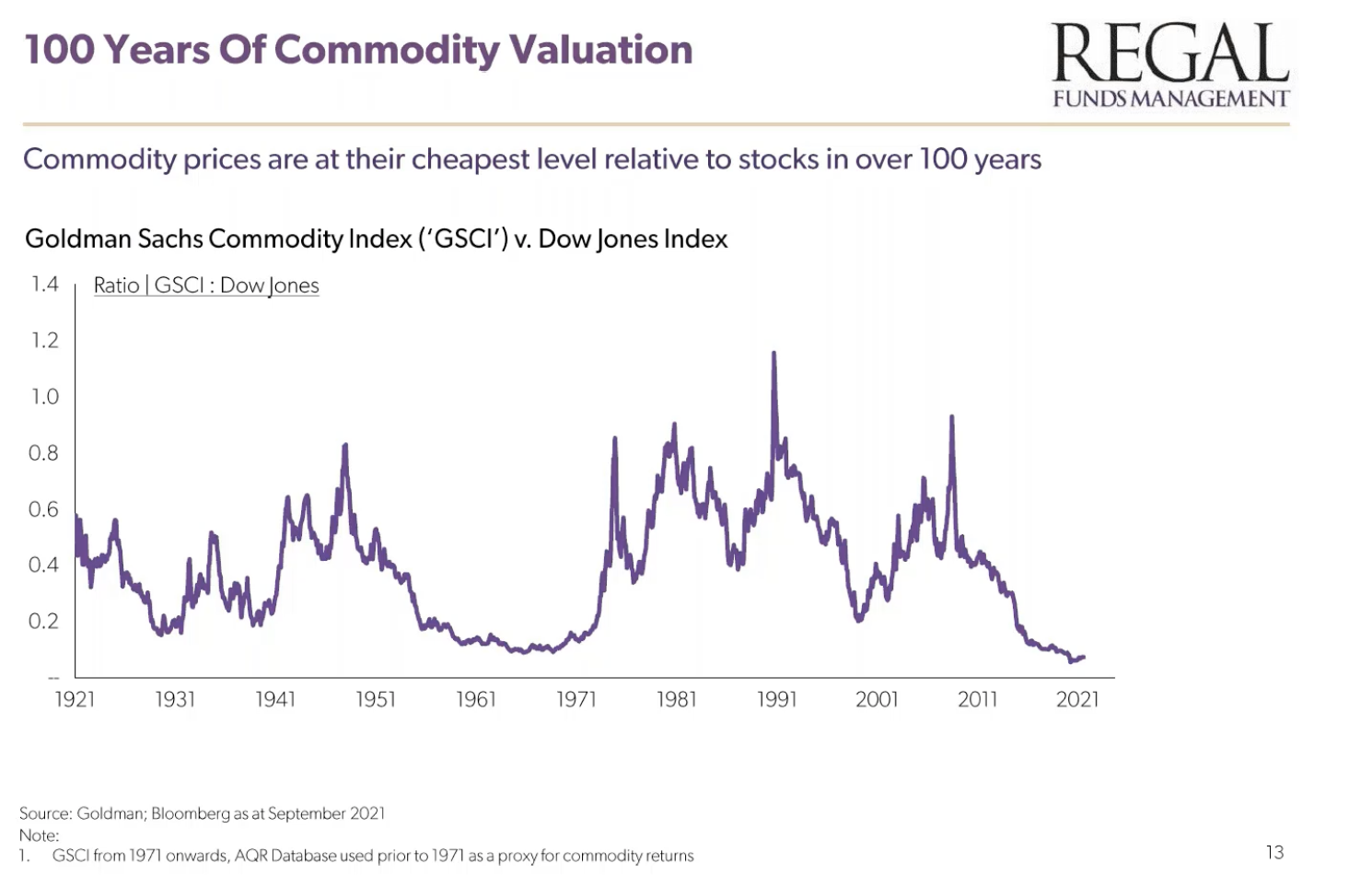

"We think the current period is very much like the 1960s that ultimately led to a huge increase in inflation. And mining stocks performed extremely well on the Australian stock market," said King.

"However, the bull market that we think is starting in resources is not apparent to everyone, because the Australian resource index is dominated by iron ore and gold, which have been under pressure," said King.

Instead, he points to early signs of rising prices in uranium, lithium and gas.

#2 Don't fall in love with a good stock story: Campbell Chambers

Head of Australian trading at Regal Campbell Chambers is homing in on electrification, especially battery technology.

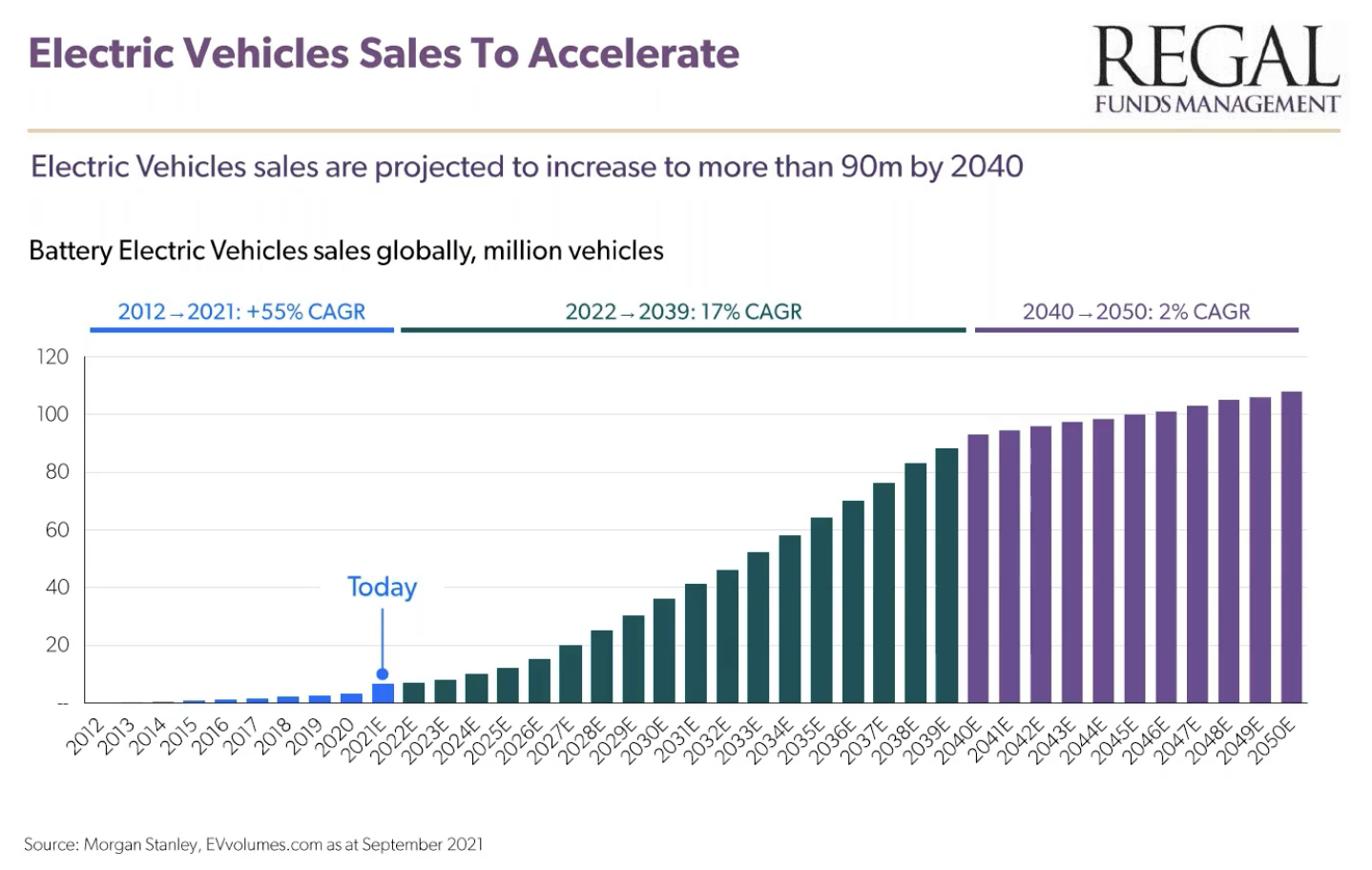

"The global battery market is expected to more than triple over the next 10 years to north of US$130 billion a year," said Chambers. And not just for EVs, but for on and off grid storage as well.

But stock picking in this sector is extremely challenging, said Chambers.

"We aim to maintain a disciplined approach to valuation. In such a hot sector, stocks inevitably get overbought and valuations can become stretched. So, we do our best not to fall in love with stocks, or with a good story, but I must admit, this is never that easy."

That said, the electrification story is incredibly compelling. Chambers points to Morgan Stanley research showing EV sales rising at a projected compound annual growth rate of 17% per annum -- moving from 6.4 million EVs sold this year to nearly 20 million vehicles by 2040.

"What took Tesla, eight years to achieve in terms of production volumes will likely take Toyota, Volkswagen, General Motors and others, a significantly shorter time, maybe by as much as a factor of 10," said Chambers.

4 ways Regal is playing this theme:

- Chalice ASX: CHN "(Chalice), we believe, has discovered a new tier-one green metals province, remarkably, only 60 kilometres east of Perth, which has the potential to become the most significant polymetallic discovery in Australia," he said.

- Novonix ASX:NVX "(Novonix) is engaged in a diverse range of battery-related technologies, and is a global leader in producing high-quality synthetic graphite for battery anodes." It also has a collaboration with Tesla.

- PPK Group ASX:PPK "(PPK) has made significant progress this year" in research and development. "PPK's subsidiary Li-S Energy, which is developing lithium-sulphur batteries ... a competing technology to the well accepted lithium-ion batteries."

- Li-S Energy ASX:LIS launched its IPO this week.

- The list of income focused ETFs, LICs and funds.

- Detailed fund profile pages, with data powered by Morningstar.

- Exclusive interviews with leading fund managers.

- Videos and articles to help you perfect your income strategy.

Never miss an insight

Enjoy this wire? Hit the ‘like’ button to let us know. Stay up to date with my content by hitting the ‘follow’ button below and you’ll be notified every time I post a wire. Not already a Livewire member? Sign up today to get free access to investment ideas and strategies from Australia’s leading investors.

Why you can't miss Livewire’s Income Series:

The Livewire 2021 Income Series gives investors best in class education and premium content to build a bulletproof income portfolio.

Click here to view the dedicated website, which will include:

2 stocks mentioned

Mia Kwok is a former content editor at Livewire Markets. Mia has extensive experience in media and communications for business, financial services and policy. Mia has written for and edited several business and finance publications, such as...

Expertise

Mia Kwok is a former content editor at Livewire Markets. Mia has extensive experience in media and communications for business, financial services and policy. Mia has written for and edited several business and finance publications, such as...