Two tech trends soaring in Asia

Mirae Asset Management

Asia is currently undergoing rapid levels of industrialisation and urbanisation, as well as income growth, wealth accumulation, population growth and favourable demographics. This is leading to the emergence of a new consumer class, whose greater disposable income and purchasing power is leading to a dramatic increase in consumption activities across the region. Here are two technology trends set to benefit from a push in demand.

School’s out, e-Learning shines

Schools in China had been closed since the Chinese New Year until May, and most students had to stay home and took various online courses instead. Leading online After-school Tutoring (AST) players have been actively providing free online courses, leveraging this opportunity and engaging with students to expand their user base and increase market penetration. Thus, we believe online education can meaningfully take off in China after the COVID-19 pandemic.

Online Learning sees a surge in demand

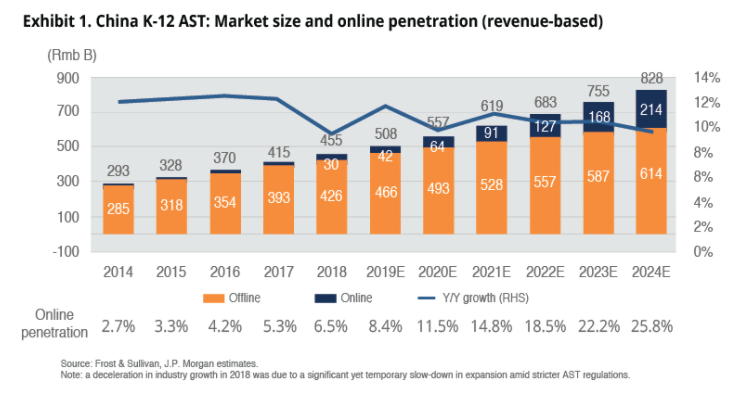

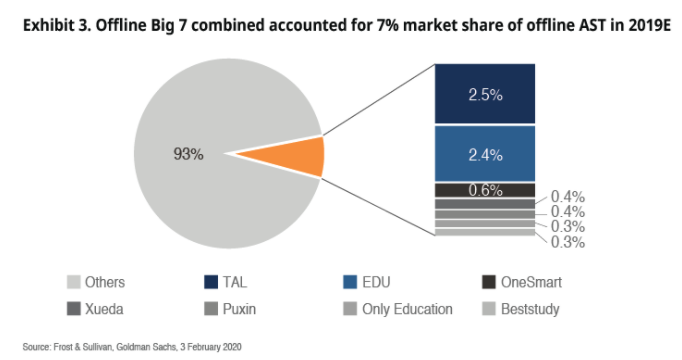

Online education is the most effective and efficient way to penetrate low-tier cities in China, where 70% of the K-12 population resides (1). AST industry is vast and fragmented by the nature of the business. Albeit leading players like TAL and EDU have been aggressively opening offline new learning centres in the past several years, they only have less than mid-single-digit market shares combined in the total offline AST market. However, online education has no physical constraint that will be a scalable business, through enhancing its content quality and services.

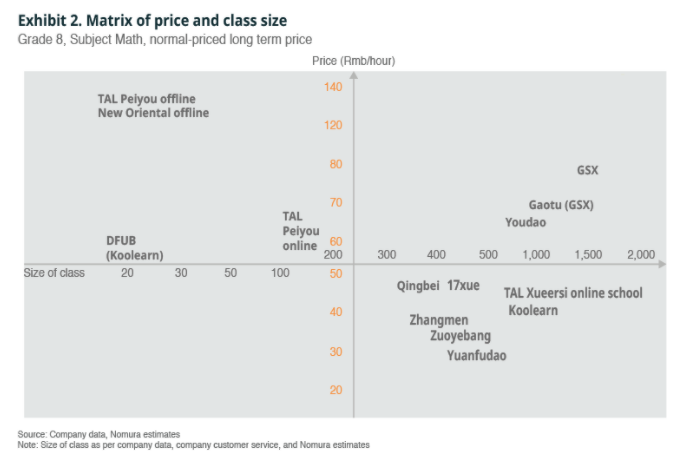

Additionally, parents find online education learning easily affordable because it costs only around 40% of offline courses. This preferential price opens the door to students in both low and top-tier cities that online education providers expand the addressable market through low entry price points.

According to TAL, offline courses are priced at around RMB 3,000-4,000 per subject each semester, which translates into roughly RMB 10,000 per subject every year. In Beijing, the average salaries for single and double-income families are RMB 8,000 and RMB 16,000 per month (before tax). Even though there are many affluent families in top-tier cities in China, there is a large portion of low, and middle-income households in top tier cities that can’t afford those AST classes.

Moreover, students today are tech-savvy and inclined to use digital formats, comparing to their parent generation. Most K-12 students are born after the invention of smartphones and they find convenient and straightforward to take courses at home without spending hours in traffic.

Will E-Learning go viral?

The online education market is more consolidate and easy to control and regulate. According to the Ministry of Education, there are 718 registered online AST institutions in China compared to 401 thousand reported offline AST institutions under the Ministry of Education investigation in 2018-19.

The top four players account for 20-25% of the total online AST market, and we expect they will grow at a rigorous pace by its nature of business. Online education currently accounts for 7% of the total AST market (USD 7bn), and is expected to take up 22-23% of the AST market by 2025E (USD 50bn) (2).

The COVID-19 pandemic has become a trigger point of online education growth in China, given the growth characteristics for this segment of the market it will be an exciting area to follow in the coming years

The rise of Telemedicine

Telemedicine is the use of modern telecommunications technology that enables a patient to reach medical consultation through an app using artificial intelligence. The process involves a symptom brief then in real-time exchanging the information with a live doctor where diagnosis and recommendation are approved with professional feedback. This new technology integrates with a one-stop-shop where the patient’s prescription is registered, and medication is then delivered to the patient’s door. All of this is achievable within the comfort of one’s home.

Digital Healthcare transformation

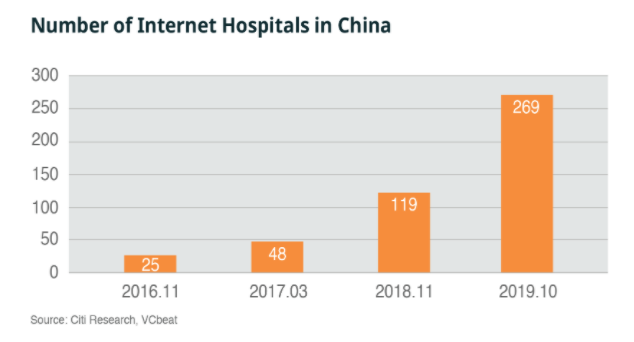

Online medical consultation platforms have attracted more users during the COVID-19 crisis. We believe this is a perfect storm to shift offline consumer behaviour to an online platform. To facilitate physical isolation and reduce cross-infection, the Chinese government has further supported its adoption, encouraging the utilisation of online healthcare services.

We have seen unprecedented demands for telehealth in the wake of online solutions in healthcare services. For example, China’s largest healthcare platform, Ping An Good Doctor, from late-Jan 2020 to early-Feb 2020, witnessed (3):

- 1.11 billion accumulated visits on the platform

- 10 times the number of accumulated new registered users

- 9 times the daily consultations by newly registered users on App

Chinese Government Support

Earlier in April 2020, the NDRC (National Development and Reform Commission), in conjunction with the Cyberspace Administration, issued a document proposing the development of new digital industries “Internet Plus Healthcare.”

The promotion adopts medical insurance services during the prevention and control of COVID-19, supporting the reimbursement of qualified online medical consultations services of common diseases, chronic diseases, and the e-prescription filings for re-visit patients. The guidance urges cooperation between the Provincial Healthcare Security Administration and internet hospitals on the direct online settlement by medical insurance.

Some pilot cities, such as Yinchuan, Guizhou, and Inner Mongolia, have already started promoting internet-related treatments alongside price guidance. More provinces are now joining the bandwagon. The reimbursement rate for online diagnosis lies in the range of RMB6-50 per consultation.

To further promote telehealth, Fuzhou’s Municipal Health Commission signed a new agreement with Ping An Good Doctor in October 2019, establishing a centralised internet hospital platform. It was made compulsory for all bricks-and-mortar hospitals in Fuzhou to join.

With an accelerated application on country and city level, we have seen an increase in the usage of online hospitals over the past few months.

In addition to China, digital health platforms in other Asian countries such as Indonesia and India are reporting a surge in activities too.

The pandemic has accelerated trends and generated new investment opportunities. Telemedicine is a paradigm.

The post-COVID new normal

Even though the business may face challenges in the post-COVID world, they may also bring into being new normalcy. We believe that telemedicine has the potential to be the new norm of the fast-changing medical landscape.

Seize the opportunity

Mirae Asset seek to capitalise on the growth in the middle-class consumption across Asia and focus on high-quality companies with solid long-term growth prospects. Click the 'FOLLOW' button below for more insights.

Footnotes

- Mirae Asset Asia Pacific Research, Goldman Sachs Global Investment Research, 3 February 2020.

- Mirae Asset Asia Pacific Research, Nomura, 15 April 2020

- Mirae Asset Asia Pacific Research, as of March 31 2020

3 topics

It's an exciting time to invest in Asia. Over the last 14 years, I've experienced first hand the growth and evolution of equity markets across the region. We're seeing a shift in global production and consumption. In Asia, Consumption Growth...