UK claimant count change soared 20.4k in Sept, Australia’s CPI y/y rose to 5.6%

Let’s hop straight into five of the biggest developments this week.

1. UK claimant count change soared 20.4k in September

The UK labour market took a turn for the worse with a much worse than expected growth in jobless claims. Unemployment numbers ballooned to 20.4k after a convincing August report where claims had fallen to 9k. The report was a shocker to markets that had bet on an improvement figure of just 2.3k. Once again this demonstrates that the effects of higher interest rates are slowly working their way through the economy.

2. Australia’s CPI y/y rose to 5.6%

Inflation in Australia is becoming endemic, accelerating far much faster than expected. Prices elevated in the twelve months to September 5.6%, a significant rise from the previous 5.2% and the 5.3% expected by market participants. This rise was notable and shocked markets. Based on the RBA’s recent communication, they should be compelled to raise rates in November.

3. Bank of Canada held interest rates steady at 5%

The BOC sat in its hands to leave interest rates unchanged at 5% for the second successive sitting. The central bank remained hawkish, pointing to elevated inflationary risks in the short term. Markets considered the tone to effectively leave the door open to further tightening interventions in the future.

4. German flash manufacturing PMI marginally improved to 40.7

German manufacturing remained in contraction according to PMI surveys, despite a marginal improvement in October. The 40.7 reported was a measly improvement from the 39.6 recorded last month, as well as the 40.1 forecasted by market participants. While this marks the third straight month of uptick, the weakness in the German economy is far from over.

5. ECB left interest rates unchanged at 4.5%

The ECB paused its aggressive monetary policy tightening regime for the first time since June 2022. The main refining rate remained static at 4.5% after ten successive rate hikes. Incessant inflationary pressure and improving economic data have markets betting on this being a temporary hold with additional hikes expected.

Below shows the performance of a range of futures markets we track. Some of these are included within the universe of our multi-strategy hedge fund.

The best performer in commodity markets was Natural Gas, as it rose after weather reports outside of North America indicated it could be a colder than expected winter. Oats, Cocoa and Orange Juice continued their recent ascent due to shortages. US fixed-income markets rebounded as investors started allocating into this space due to yield vs equity market yield. The Nasdaq had the worst equity market performance, which was down -4.62%. Oil markets reverted from profit-taking as market participants repriced the effect of the Israeli war on energy markets.

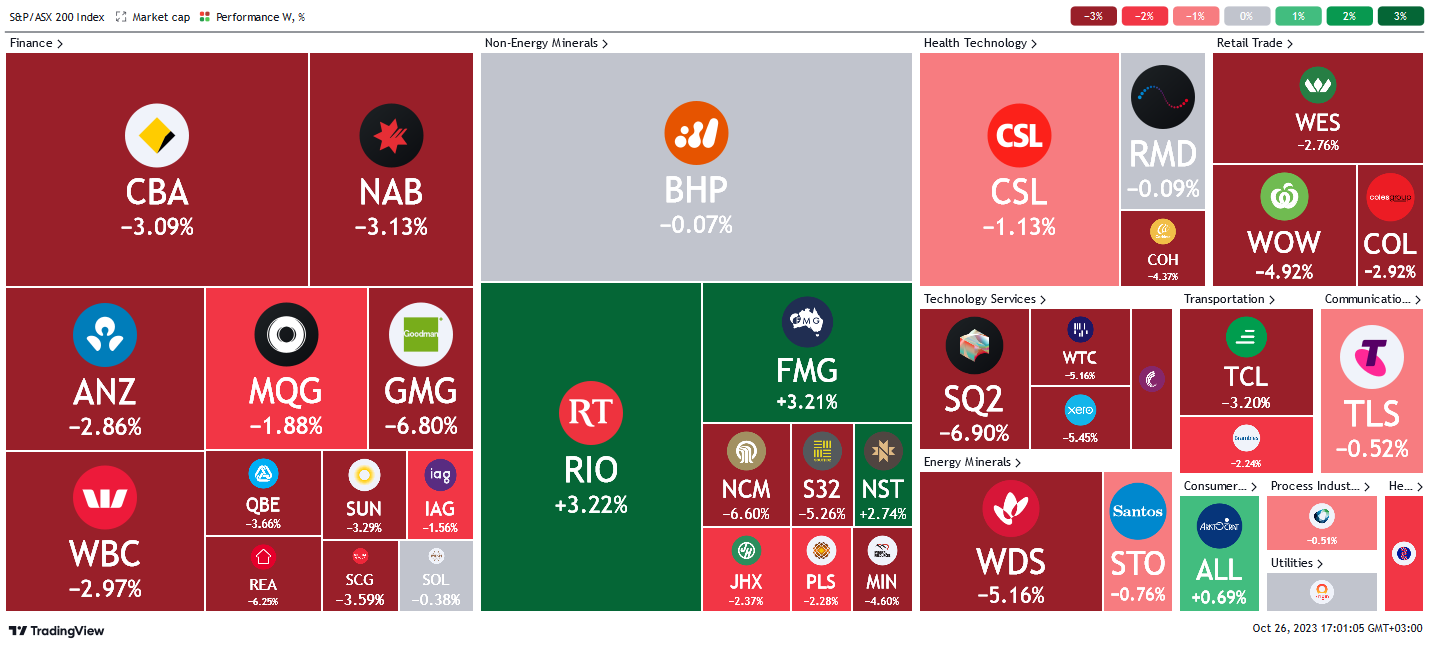

Here is the week's heatmap for the largest companies in the ASX.

A gloomy week for the ASX with virtually all sectors in the red. Financials were the worst hit with nearly all stocks closing lower as GMG and NAB were the worst. CBA, ANZ, and WBC all sold off around -3%. Non-energy minors were equally down but with rare islands of green in a sea of red. FMG, RIO, and NST depicted relative strength to close with solid gains in a tough week. The selling continued in CSL, RMD, and COH, as these names continued to hit multi-year lows. On the other hand, technology, energy miners, retailers, transporters, and communication stocks were a total bloodbath as fears of geopolitical tensions in the Middle East and the South China Sea remained high.

Below shows our proprietary trend-following barometer which captures the number of futures contracts within our universe hitting new short and long-term trends.

5 topics

5 stocks mentioned