“Unbelievable moats” in reasonably priced US tech, says Bob Desmond

You could be forgiven for thinking technology stocks are in a death spiral. While researching this topic, my Google searches were almost always accompanied by terms such as “plummet” or “crash”. It's not that simple, though.

The technology-dominated Nasdaq 100 declined by almost one-third in the year to 30 June. Some of the biggest winners of the early pandemic period – streaming giant Netflix, telemedicine company Teladoc and video platform Zoom – became the worst performers, as reported by Bloomberg.

“At this rate, the Nasdaq 100 would finish the year down 50%, the biggest annual collapse in the almost four decades the Bloomberg has tracked the benchmark,” writes the finance media company.

But generalisations are fraught with danger – even this one (to paraphrase French writer Alexander Dumas). Perhaps the term “technology” was once a useful catch-all, but now many companies’ business models are intertwined with software, artificial intelligence or other technology.

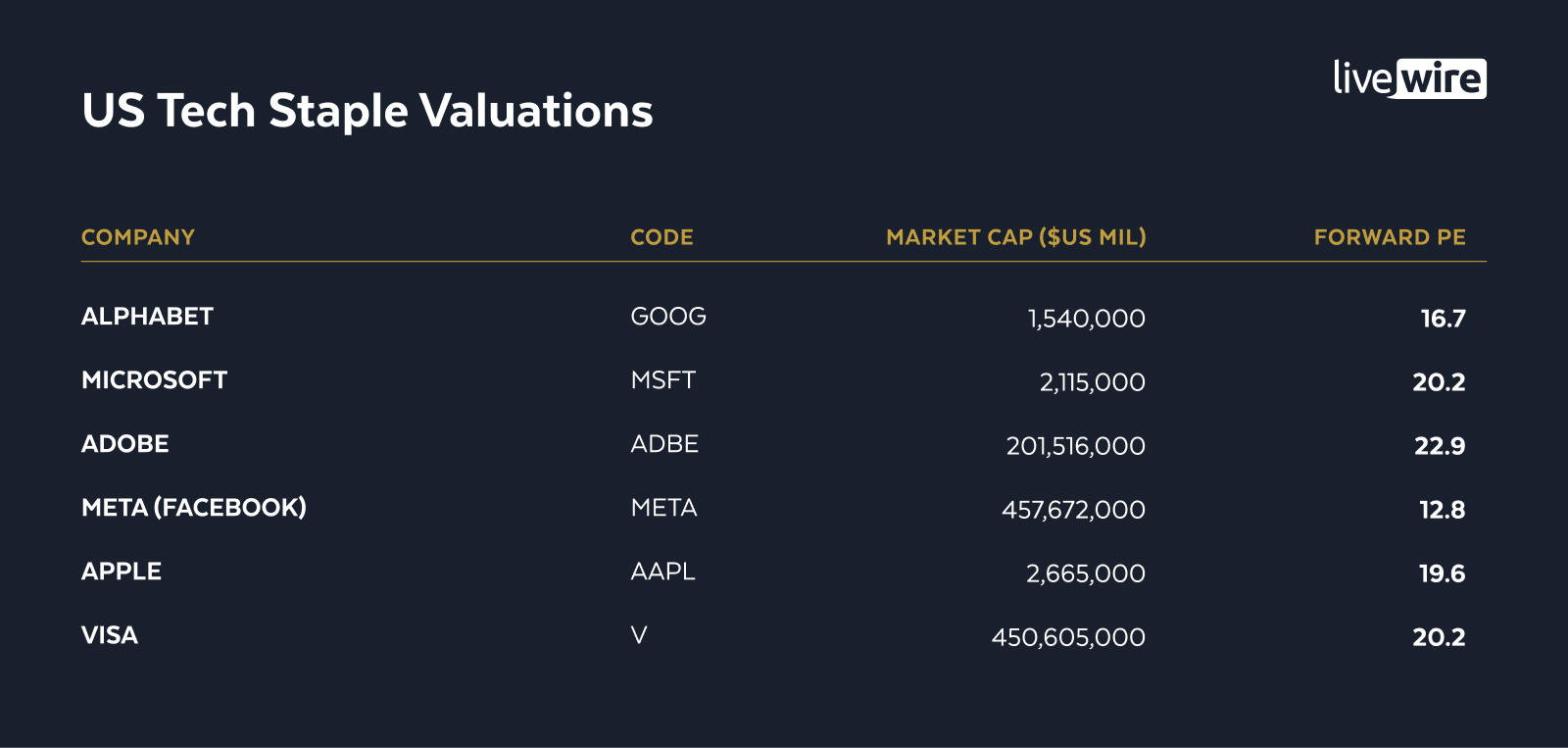

Bob Desmond, head of Claremont Global, prefers to use the term “technology staples” to describe some of the firms he’s most excited about.

“Technology is such a broad term, so you have to be careful with that definition,” Desmond says.

“We invest in tech staples like Microsoft and Alphabet and they’ve never been expensive to us. There’s this view that they are – Alphabet has hit 35 times PE, but its earnings are growing at 20% plus.”

He draws comparisons between a company like this and some of Australia’s largest companies, such as CSL ASX:CSL . The biotech firm is currently trading on a PE valuation of around 35 times and industry peer, hearing aid manufacturer Cochlear, is on a multiple of 46 times.

In explaining why technology has been so heavily sold down, Desmond argues the aggressive selling was in pockets of the sector with “questionable business models, that weren’t generating any cash flow.”

“They were being funded by capital markets that were completely open. Now, suddenly the capital markets are closed, and now people are questioning the valuations,” he says.

Instead, he emphasises the need to assess companies on an individual basis rather than trying to use shortcuts to group stocks together and make sweeping judgements. This is particularly important in his fund, the Claremont Global strategy, which holds a concentrated portfolio of between 10 and 15 stocks.

Some of the big Growth names in the US market have undoubtedly suffered, Desmond singling out social media company Facebook – now trading as Meta Platforms – and Netflix as examples. Both companies’ business models are under threat. From high profile regulatory and privacy challenges to competition from the likes of TikTok, Facebook’s struggles are well-known, reflected in its 45% share price decline since the start of 2022.

“Netflix has been hammered for the same reason. It got really expensive and investors overlooked the fact that growth attracts competition,” Desmond says.

In this instance, the Disney+ streaming platform highlighted the absence of strong competitive advantages for the incumbent as it went head-to-head with Netflix.

“That’s why we’ve never invested in Netflix. They’re competing with these really big players like Amazon, Alphabet and Disney. At the end of the day, it’s all just content, and we believe there’s no competitive advantage there.”

On the other side of the equation, Desmond points to Microsoft as a company with an almost unassailable competitive advantage.

“This is based on a huge network effect that’s completely embedded in almost every business in the world. The switching costs are massive,” he says.

“And in the fastest growing part of the business, Azure, there might only be three players and you need to have scale and deep pockets if you want to compete in cloud computing.”

Desmond believes Alphabet holds a comparably strong competitive advantage in the online search and advertising behemoth Google.

This isn’t the tech wreck

While many have sought to compare the selloff in parts of the Growth universe to the tech wreck of the late 1990s, the differences outweigh the similarities.

“In the late 90s you had that exogenous shock, capital management imploding, Greenspan dropped interest rates, and then you had Y2K – even though it turned out to be a furphy,” says Desmond.

“You had all these ‘story’ stocks – people were just buying a story and hope. But back then, the big stocks were also very expensive.”

He argues that this time around, some of the tech behemoths are reasonably priced.

“Even Adobe, which was trading on 50 to 60 times earnings, and is now on 30 times. The business is just as good as it was but the valuation has come off…that’s an example of something good that’s also been thrown out,” Desmond says.

How do you find quality tech staples?

Desmond is quick to emphasise there’s no special sauce when it comes to identifying good tech firms – it’s the same process his team uses to sift all stocks.

Referencing a stock that has been bid up as a company of the future, Tesla, he says the financial ratios appear “amazing.”

“It’s getting better, it’s making money but I have no idea what they’re going to be earning in five years. The competitive advantage is not immediately obvious with a gross margin of only 25%, while there is a lot of future growth priced into their valuation," Desmond says.

“The knowledge barrier is so much higher, so if you’re going to be in those types of businesses, you might consider 50 or 100 positions in your portfolio.”

Simplifying the process of some funds, such as venture capital investors, he says they might have 100 holdings. “Maybe 90 will go nowhere, five will be okay and the rest will be the Microsoft's that carry the rest of the portfolio.”

In this stage of the market, Desmond believes there are definitely more opportunities out there within global technology.

A stock the market is underestimating

“I still think there’s upside in Visa, because I think the market is underestimating the recovery in cross-border transactions as travel comes back,” Desmond says.

“Travel is up 4% on pre-pandemic levels. The normal trend in growth here has been roughly 10% per annum, so they’re under-earning on travel. I think there’s potential upside in those numbers for Visa because we’re only just getting back to where we were pre-pandemic and business travel is still coming back.”

Access to high conviction investing

This interview was conducted on 11th August 2022. Claremont Global Fund holds Adobe, Alphabet, Microsoft and Visa. Claremont Global is a high conviction portfolio of value-creating businesses at reasonable prices. To learn more about how Bob and the team approach markets, please visit the Claremont website.

2 topics

5 stocks mentioned

1 fund mentioned

1 contributor mentioned