Unlocking the opportunity of 'special situations' in Australian equities

Successful investing is nuanced. It’s more than chasing share price gains, and you often have to take the paths others avoid in order to find the most unique opportunities. The following “special situations” may help achieve superior returns from Australian equities.

Special situations, as explained in a recent webinar hosted by Rob Hay and Michael Goldberg of Collins Street Asset Management, are classified as:

- Off-market buybacks

- Special dividends

- Capital raising

- Takeover arbitrage

- Convertible notes.

So for example, a couple of miners and a bank – Bluescope (ASX: BSL), Rio Tinto (ASX: RIO) and Suncorp (ASX: SUN) – alone paid out more than $1 billion in "special dividends" – that is, on top of their ordinary dividends.

In the video and the transcript below, Goldberg and Hay elaborate on the pros and cons of this and other special situations. They also explain where an over-the-counter convertible note – essentially a customised slice of corporate debt – fits into the “special” mix for certain fundies and their clients.

The discussion includes the following topics:

- "Asymmetric return profiles" (which even Goldberg concedes is “a fancy way of saying "very one-sided deals")

- Recent examples of OTC convertibles they negotiated and hint at some imminent takeover arbitrage opportunities they’re eyeing

- The role of “small-A” activism in sweetening investors' returns, and eking out more shareholder value when a company is either targeted – or targeting someone else – in an M&A deal (“takeover arbitrage).

Edited transcript

Rob Hay, head of distribution and investor relations, Collins St Asset Management

Special situations isn't necessarily available in the mandate of many funds in the Australian marketplace. The starting point of course must be explaining what the term “special situation” refers to.

Off-market buybacks

The first one is an off-market buyback. Now for many investors, this won't be particularly new. They will have been familiar with the idea of off-market buybacks most recently with the banks by way of example.

However, they do have their own nuances associated with them. For example, understanding and analysing a balance sheet. Seeing if there are, for example, excess franking credits on the balance sheet, which might give rise to an off-market buyback at some point in the future and transacting around that.

Also, it takes into account and certainly, investors would be prudent to think about the likelihood of scale backs, the range of pricing options and so forth as to how they're structured.

Special dividends

Secondly, we have a special dividend and again, for many investors that will be familiar with the idea of receiving these. However, there are opportunities for fund managers to influence these outcomes in what we would call small "a" activism.

And this may be working with other shareholders to lobby management, particularly if there's excess cash on the balance sheet of the company, or if the company is not trading at its net asset value, and there's a way to unlock or realise that value.

And so rather than simply being a passive shareholder and waiting for management to do something, we are able to lobby, influence and share insights into how the market might respond or react to various outcomes with special dividends.

Capital raisings

And again, while many investors will be familiar with these, there are particular nuances that can create new opportunities. For example, during COVID-19 and the market sell-off last year, there were many capital raisings available and within the Collins St Value Fund at that time, we had 35% of our portfolio sitting in cash. Which meant that we were a very attractive counterparty for those companies looking to recapitalise their businesses quickly.

And a good example of that was the Decmil Group. We were able to work very closely with management in order to provide that money in a reasonable timeframe. And because of that, there wasn't the same level of competitive tension in terms of pricing. And we were able to be very much a price maker there. It was also an opportunity for us to build that relationship and get closer to management and further our due diligence into the company.

Takeover arbitrage

Fourthly, we have takeover arbitrage, and this is simply where a company is looking to take over another company. And perhaps there's an opportunity to pick up a nice profit between what the company is currently trading at and what the potential suitor is prepared to pay.

Now, naturally, this can have its own complications because shareholders may have to vote on this and not all shareholders may share the same view. Similarly, not all offers to buy out the company might be equally as genuine and there could be opportunities for price increases and bidding and other people to come in as well. That can have its own complexities to it.

Convertible notes

And then finally, we have a convertible note. Historically, these have been available on the ASX in a very standardised form where companies are issuing them and setting their own terms. Within the Collins St Value Fund,

we have the ability to approach companies and negotiate, originate, and execute our own convertible notes on what is known as an over-the-counter basis. And that's simply where we provide our own insight into what terms we would like, how we would see it structured and having something made up specifically for us.

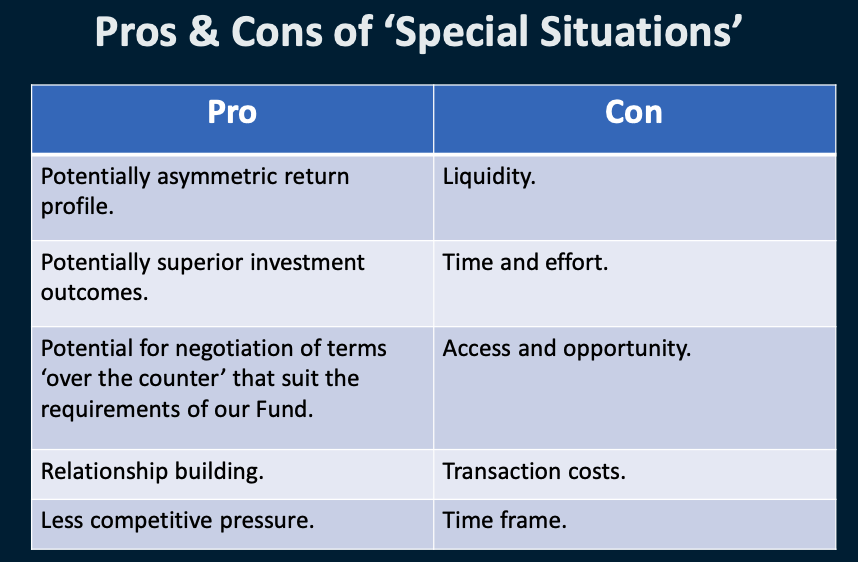

The pros and cons of special situations

Now there's a range of pros and cons for special situations in the portfolio. And certainly, Michael Goldberg will be giving some insights into how they're used from a portfolio management context, but I'd call out here the main pros as being the potential for what's known as an asymmetric return profile.

And this is a fancy way of saying a very one-sided deal where the upside opportunity is far greater than the downside. For example, in a convertible note, you might find that you have a debt-like risk for equity-like upside.

You can see there is the potential for superior investment outcomes. And this may be as a result of a convertible note being exercised well above where it sits today. It may involve interest or lending charges as part of a convertible note, or even with takeover arbitrage opportunities, it can provide, particularly if timed well, a very attractive return over a short period of time.

Source: Collins St Asset Management

There is the potential for the negotiation of terms that suit the requirements of the fund. And this comes into the idea of capital raisings, for example, where cash balances can be used to move quickly with a company.

Convertible notes as I mentioned before, and also not necessarily over-the-counter, but where we're engaging with a company around special dividends, what that special dividend might look like and how it might play out. Certainly, the pro around relationship building is an important one. And this is something that Michael will be touching on as well.

Being a repeat player with these types of transactions in the industry and having a reputation that proceeds you as being a counterparty that has the knowledge, experience and investment mandate to actually execute upon this is really key.

And as I mentioned earlier, having a lesser amount of competitive pressure in some types of Special Situations can also provide some very powerful opportunities to get good pricing on terms that are very favourable to our investors. And from there build out the return profile.

Naturally, there are cons that come with all of this, the first one being liquidity. It may be that you see a really wonderful takeover arbitrage opportunity popping up, but if it's at the smaller end of the market and you're not able to get set and pick up the allocation you want, that can be an issue.

Equally, if you have an unlisted convertible note that you can't sell off to anyone else, that can also be a liquidity issue. A lot of time and effort goes into these types of deals and as Michael will allude to not every convertible note that you propose to management will necessarily be approved. You have to spend a lot of time researching them, pitching them in the right way. And also when one is offered to you to spend a lot of time researching and making sure you understand it as well.

Access and opportunity are not something that is afforded equally in the marketplace and for that reason, the relationships with the board and management are absolutely key. Transaction costs can be quite high, particularly if there are legal or accounting matters that you have to take into account. And then timeframe is important too.

Things don't always happen in the time and space in which you might prefer. And particularly with the takeover arbitrage, it might be the case that multiple bidders come in, make offers, withdraw offers, new people come on board.

And what looked like a particularly attractive opportunity on day one might take months or possibly even a matter of years for it to come to fruition. And so for that reason, we have to balance our enthusiasm for any particular idea against what these risks might look like.

On that footing, I'd like to hand over to Michael Goldberg, who's now going to share his insights into three different Special Situations that we've adopted within the Collins St Value Fund in recent years.

Michael Goldberg, executive director, Collins St Asset Management

It's worth noting that when we're looking at originating a convertible note, it's the networking that we've done over the years that really drives our ability to come to terms and agree on terms. Certainly, sometimes companies will approach us to discuss the issuance of some sort of raising or convertible note, but more often than not, we tend to instigate the conversation. So it's not just that management needs to know us; they also need to be able to trust us.

I think it's also worth pointing out that although today's conversation is specifically about special situations, it is important to note that they represent just a part of our broader portfolio.

And even though convertible notes are something that's very attractive to us and I'd be happy to have as many of these things as I can get my hands on, we are cognizant from a portfolio management perspective of remaining a liquid fund, which means we do need to limit the amount of exposure that we do have to these sorts of ideas so that we can maintain liquidity for our investors who might be coming in or going out.

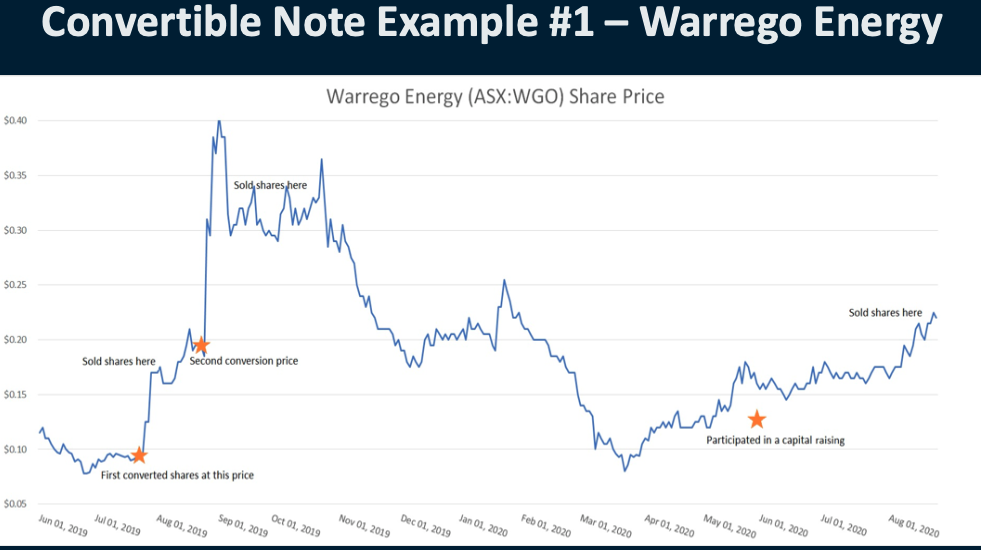

Example 1: Warrego Energy

That's it - we'll have a good chat now about the first idea, which is Warrego Energy (ASX: WGO). This particular transaction starts to generate a total return of about 125% over six months.

The opportunity was identified based on some existing relationships that we had with some of the members of the board and management. And when the team came to us and told us that they were looking to arrange a back door listing and would need some early financing, we proposed the idea of a convertible note to help them progress with both that listing and also some of the early drilling works they were going to have to undertake.

The note was to provide finance for the team early, obviously, and it has to be on objective enough terms that Warrego was willing to engage with us.

And from our perspective, we gained really attractive equity exposure to an exciting upside of the prospects of Warrego without taking on board all of the risks of an equity investment in let's be honest, what was at the time, and probably still is, an oil exploration company.

On that basis, we came to terms on the convertible note.

Source: Collins St Asset Management

Interestingly, in this particular case, the conversion price was not at a fixed exercise price instead, what we ended up agreeing on, was a conversion that would be made on the basis of the previous 10-day, volume-weighted average price of the stock.

So essentially what that means translated into English is we would get a chance to see what the share price did today. And we'd be able to convert our notes into equity based on yesterday's unit price.

And that meant obviously if things didn't play out as we'd quite hoped then we'd be able to gradually sell out of our position without really taking on any meaningful loss because we'd be able to convert our notes at the lower price.

But it also meant that if drill results went well, we can convert our holdings after new news had already impacted the share price, but we could get in at that pre-result, pre-news price. As fortune would have it, the results were good.

It wasn't super surprising given we had some degree of confidence in what we were expecting in it before we actually got involved. And just a couple of months after our initial investment, we decided to convert about half of our notes at nine cents per share as you can see there on the graph on the screen.

We were then able to immediately start selling those at about 18 cents into the market. The other half of our notes we held on to for about another month, we were waiting for the second set of additional drilling results.

We thought there was more to be had from the company, as it turns out we were right. The second set of results came out about a month later. And at that point, we were able to convert our notes at 19 cents. And then over the next couple of weeks, we're able to sell our holdings at between 30 and 35 cents per share.

So really on both occasions, we were able to take advantage of the special situation that we'd orchestrated for ourselves months earlier. And much as Rob previously touched on the endpoint about we were able to create an asymmetric risk-reward imbalance and take advantage of that misbalance.

It worked out well when all is said and done for the company because they needed capital early, and we provided that capital to them. And of course, it was attractive to us due to the significant downside protection that we received from the inherent protection of a convertible note in general.

And I suppose you may ask why not just buy the shares outright at 9 cents to start off with, because after all, if you look at the journey of the share price, certainly from the time we first converted until the time we sold our first set of notes, we would have come out with broadly the same outcome.

And I think that assumption may be true with the benefit of hindsight, but of course, we were concerned about the capital preservation aspect of things. We're concerned about the protection that we receive as part of the convertible note.

So, in the event that let's say the drill results had been poorer than expected, it's entirely possible that had we taken an equity position at nine cents, we might've suddenly found our holdings halving in value, but of course, with a convertible note, we could make that conversion at a later date, post the negative announcement, post the lower price and avoid taking the loss.

And that really does illustrate why the idea of convertible notes are so attractive to us. And as Rob pointed out you really do get much of if not all of the equity upside from an investment of this type, but at the same time, you significantly protect your downside risk.

Naturally, we remain on good terms with the board. And we actually participated in a regular equity raising later on, at a substantial discount to the prevailing share price at the time. But our thinking is that the people who sit on this board will sit on other boards and we're keen to nurture those relationships so that when the next raising comes up on the table, it's Collin St that they think about when they're looking for a partner.

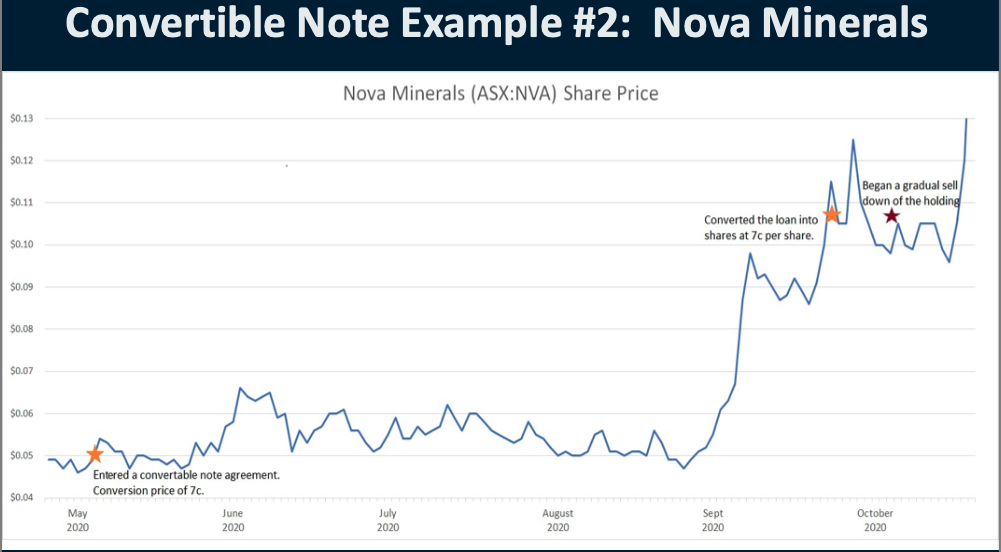

Example 2: Nova Minerals

This brings us to our second example for today, which is Nova Minerals (ASX: NVA). Once again, this investment played out over about the same six months and generated a better than 120% return when all was said and done.

Again much like Warrego, it was our existing relationships with the board and management and their recognition that we have capital available and were able to move quickly around a convertible note that drove them to our door when they were looking for some financing in 2020.

Source: Collins Street Asset Management

The company Nova still owns some spectacular gold prospects in Alaska. The potential of those are quite exciting, but of course, the cost of drilling and prospecting can be quite costly.

So when management approached us in 2020 with an invitation to negotiate a short-term convertible note, we were quite interested. I think it's worth pointing out that even though an early-stage mining company might be the type of business that we tend to naturally gravitate to, I think there were some exceptions, there were some interesting things about Nova that provided a very unique situation.

Specifically, when we engaged in our conversation, they had approximately $13 million worth of "in the money" options that were maturing shortly after we were to lend them the money and the term was to settle.

And of course, our financing was simply to allow the company to invest right now at that time in a second drilling program, without having to wait for those options to mature to provide them that capital or without them having to go back into the market and raise capital at a discount to the share price.

Now, unlike Warrego, Nova wanted to set a conversion price above the prevailing share price. I think at the time it was a 40% premium to the share price. And we were actually happy to accept those terms because they were supplemented by an upfront fee of 10%. And we also received a number of options for free as part of the deal as well.

Obviously, these agreements always have to suit both parties, but from Nova's perspective, they were able to raise money quickly and they were able to avoid unnecessary dilution from a discounted capital raising. And of course, they were able to progress their drilling programme now instead of having to wait for the conversion of those options, or again, raising that money through the markets.

For us, our view was if drilling results disappointed, then we'd be satisfied with the coupon, that 10% fee that we received upfront. We'd obviously also still have those options, which were longer-dated, but on the flip side of things went well and our funds were able to help drive the company forward, and the results are strong.

Then we would of course benefit quite substantially from it. Once again, as fortune would have it and as you can see on the graph in front of us, the results were impressive. Our capital did help move the company forward and with it so too did the share price.

As maturity date arrived, not only did the share reach that seven set conversion price, but once again, as you can see on the graph, it actually surged into the double digits. At that point, over the following weeks, we were able to convert our notes into actual regular equity. And then over the weeks after that, we were able to gradually sell down our position at around about 11 or 12 cents.

Now, I suppose if we wanted to play devil's advocate, although we can't see it on the chart right here. But if you find the time to have a look later and you do a bit of research into Nova you'll note that the share price actually did go considerably higher after we sold.

So, if you wanted to play devil's advocate, you could point out that after we sold the share price raised to, I think it was as high as 24 cents, then the question could be wouldn't we have been better off just holding our position for the long-term in what was quite an exciting company to start off with. And in light of what the share price did, you could make that case, but we're looking to invest in businesses and not speculate on share prices.

While we maintain the security provided to us by the convertible note we were happy, more than happy to enjoy the potential upside, but without that security, we just felt that there were too many moving parts outside of our control, that would dictate the outcome.

And what we're not keen to start doing is speculating on things like spot gold prices, which is obviously going to have a material impact on what a gold company is going to do. When the investment worked out well for both parties, our view has always been when the deal is done and completed, it's time to take our capital off the table and go find the next great idea, which is obviously what we did do.

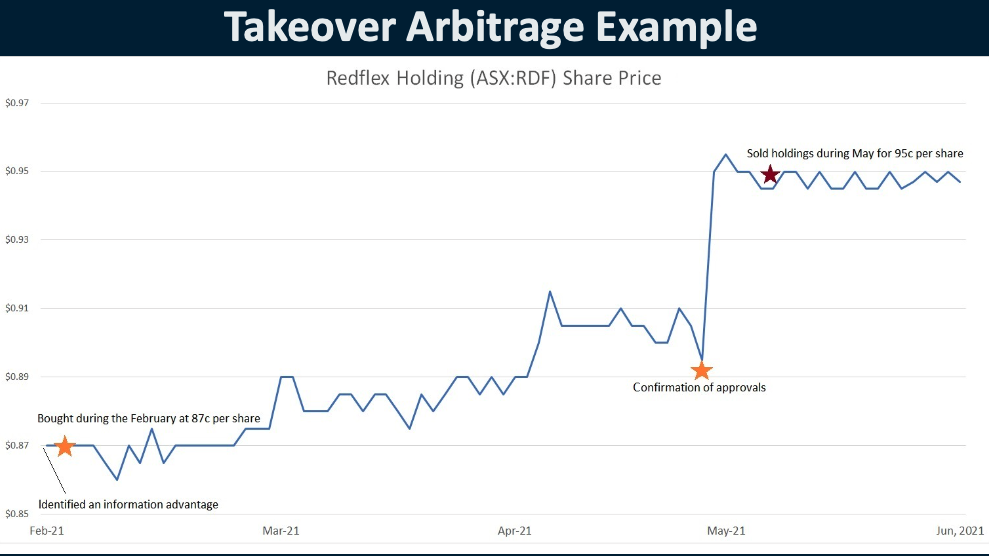

Example 3: Redflex

This brings us to the third and final example for today. This one was a takeover arbitrage of Redflex (ASX: RDF).

Source: Collins Street Asset Management

This investment only lasted about four months and generated a return of 9% for us. Now, I think what sets this example apart from our previous two is that this one was actually available to anybody who wanted to participate and really investors could participate with just about as much capital as they wanted.

Just to rewind the clock and give you a bit of context, in early 2021, it was announced that Redflex, which is a company that installs and manages red light cameras predominantly in Australia, but also more recently in the United States that they were being taken over at 96 cents per share.

But when we were looking at this company, despite it being recommended by the board and unlikely to face any significant local regulatory challenges, the share price language did around about 87 cents, which basically left 10% on the table for that form of arbitrage, which is quite attractive.

We were trying to understand in the office why it was that this discount was prevalent and we did some pretty simple investigation and we determined that the reason for the gap was that investors were unsure if major shareholders would all vote in favour of a takeover when it came time to actually have that vote.

And I think that's a fair enough concern. An earlier offer had actually been blocked by major shareholders, I think around about 12 months prior. It was a reasonable matter to tap in to pay consideration to. I suppose the question for us became what do we do? How do we get comfortable that we're not going to have a repeat of the last effort? How can we be comfortable that this takeover offer will go ahead and this 10% is actually on offer?

That's when I decided that we'd track down all the major shareholders and just strike up a chat with them. Obviously, we couldn't expect answers and we certainly couldn't expect definitive ones, but our thought was we'll never know unless you try.

So we reached out to a number of contacts, we spoke to our brokers, we spoke to the management of the company. We tapped a few of our other existing networks. And by and large, we were able to get phone numbers and get in touch with, we’ll all but one of the major shareholders. There was one that we couldn't track down. We actually managed to find a company where they were a director and so we found a residential address for the individual, but we weren't able to find a phone number for that particular person.

I suppose most normal people would just satisfy themselves with the fact that we've done the best job that we can do and there's one guy that we can't contact, but we don't like to settle for incomplete jobs and we're not often called normal and we're happy to challenge the status quo. And as Rob pointed out earlier, where we feel it's important to get comfortable being uncomfortable. And sometimes we've got to do things that are a little bit outside of the box and a little bit uncomfortable to get superior results.

So, we committed that we wanted to speak to everybody before we were prepared to risk our capital, which I think is a reasonable thing, given that we're looking after other people's capital as well.

We decided that if we can't call this person, we're just going to have to go and visit them in person. So that's what we did, unannounced and uninvited, we paid the final investor a visit literally at their doorstep. Unsurprisingly they were at first a little bit weirded out by the fact they had two strangers on their front door unexpectedly visiting them.

But after we introduced ourselves and let them know that we were interested in this particular company and wanted to get a sense of what their thoughts were about the takeover and the thoughts of the company in general, we actually became fast friends, and it was a lovely conversation.

When all of our running around was said and done, and we became confident that shareholder approval would be achieved. At that point, we were happy to invest in the company for that 10% take of arbitrage.

We'd identified this particular information advantage. We'd taken the extra effort to go and speak to all the major shareholders to make sure or to get comfortable at least that we thought it was going to go ahead and in getting that advantage over the market, we essentially de-risked this investment opportunity and that 10% profit was open and available to us.

Now for those eagle-eyed participants, you might've noticed that on the first slide relating to this example, we noted a 9% return. Whereas I've just explained that there was in fact a 10% return on offer.

So the question is, I suppose, where did that 1% go and it's a fair question.

The answer actually came out of left-field. It turned out that Redflex had one small division based out of Saudi Arabia. It was by no means a major part of the business, but they did have one business division there. And so the Saudi Arabian regulator actually needed to approve the transaction.

To our view, not knowing all that much about Saudi regulators or the propensity to delay deals in Australia, that's when I decided that we would exit the position a couple of weeks earlier, as you can see by the red star on the chart there, leaving that 1% to people who are smarter than us.

Now at the end of the day, we look for what we call an information advantage or an information edge. And once we've got that edge, we look to take advantage of that edge. But at the point that that edge is dissipated and translated hopefully into an excellent return, we're happy to move on to the next idea and leave that last 1% or leave that last squeeze of the rock or lemon again to people who are far smarter than us.

And finally, I think it's worth pointing out that we’re currently involved in a couple of Special Situations. I think there are three on the boil that are live right now, where we are in the early stages of investing or are negotiating. Hopefully one of those will pan out and we can perhaps talk about it even as early as the next week or two.

3 topics

6 stocks mentioned

1 contributor mentioned